- United States

- /

- Insurance

- /

- NasdaqGS:CINF

Does Cincinnati Financial’s Rally Still Have Room to Run After 137% Five-Year Surge?

Reviewed by Bailey Pemberton

If you are weighing what to do with Cincinnati Financial stock, you are not alone. After all, the past few years have been nothing short of impressive, with the stock up 26.7% over the past year, 85.6% in three years, and more than doubling in five years with a stellar 137.4% gain. Just this year, the trend has continued, climbing 16.3% year to date and delivering an 8.0% jump in the past month. Those kinds of numbers are enough to make anyone stop and consider whether there is more growth ahead or if the easy money has already been made.

Much of this price momentum has matched broader positive sentiment in the insurance sector, as investors react to steady market developments and better risk management across the industry. Yet, as shares move higher, the nagging question is whether the current price still offers attractive value or if risk is quietly creeping in.

So, what does valuation say about Cincinnati Financial right now? According to our valuation checklist, where each of six factors gets a point if the stock is undervalued, Cincinnati Financial only checks one box, landing a score of 1. That number does not tell the whole story, however. In the next section, we will break down the different approaches to valuing the company, while highlighting a perspective that goes beyond the usual methods to help you make a smarter call on the stock.

Cincinnati Financial scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Cincinnati Financial Excess Returns Analysis

The Excess Returns model offers a focused way to value a company by analyzing the return it generates above and beyond its cost of equity. In simple terms, it asks how efficiently Cincinnati Financial turns shareholders’ capital into profit, after accounting for the minimum required return investors expect.

For Cincinnati Financial, this model highlights the following figures:

- Book Value: $91.50 per share

- Stable EPS: $7.59 per share (Source: Weighted future Return on Equity estimates from 5 analysts.)

- Cost of Equity: $6.58 per share

- Excess Return: $1.01 per share

- Average Return on Equity: 7.82%

- Stable Book Value: $97.12 per share (Source: Weighted future Book Value estimates from 5 analysts.)

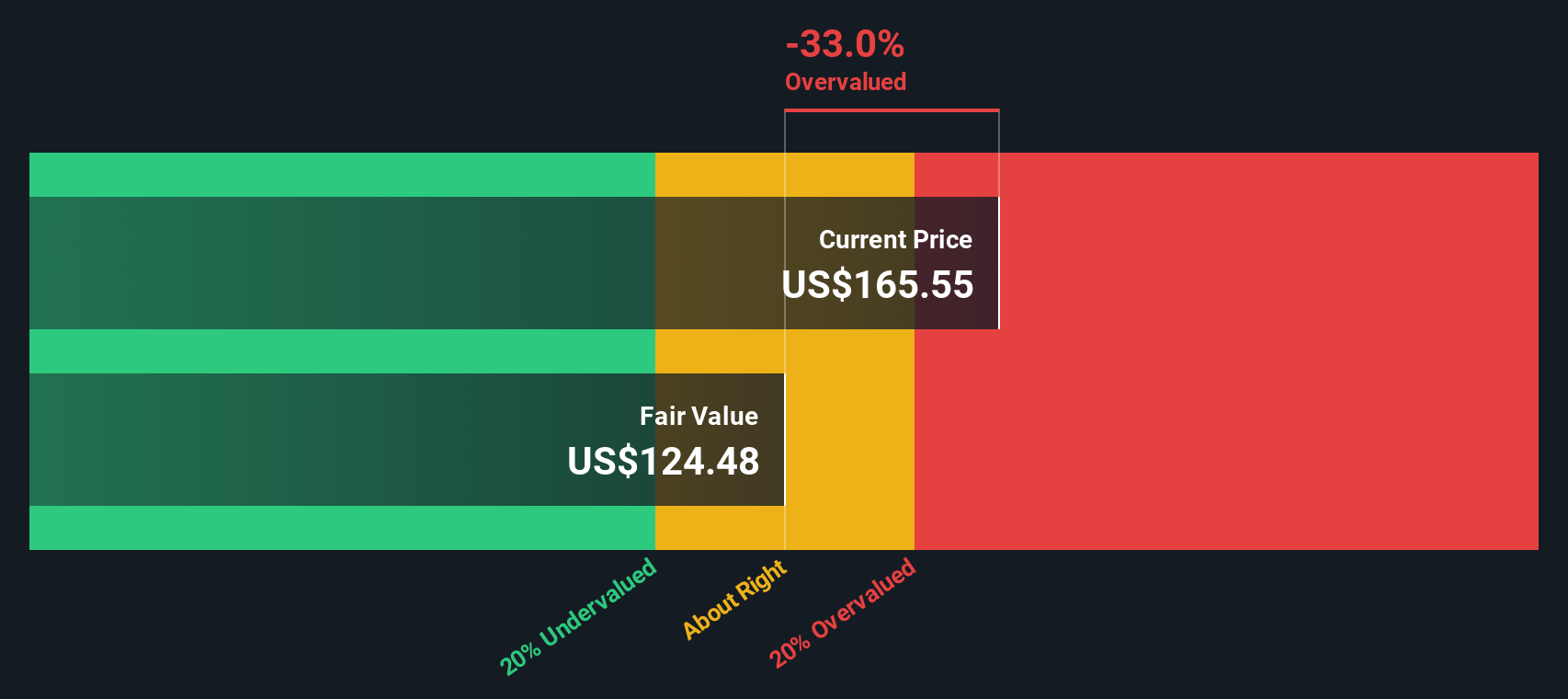

Applying the Excess Returns methodology to these numbers yields an estimated intrinsic value of $124.48 per share. With the stock currently trading 33.1% above this level, the model indicates Cincinnati Financial is significantly overvalued based on its ability to generate returns above its cost of equity.

Result: OVERVALUED

Our Excess Returns analysis suggests Cincinnati Financial may be overvalued by 33.1%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Cincinnati Financial Price vs Earnings

The Price-to-Earnings (PE) ratio is a time-tested metric for valuing profitable companies such as Cincinnati Financial, because it directly relates a company’s share price to its annual earnings. Investors often use the PE ratio as a shorthand for what they are willing to pay today for a dollar of future profits. Higher growth prospects and lower perceived risk tend to push a company’s “fair” PE ratio up, while slower growth or higher risks generally lower it.

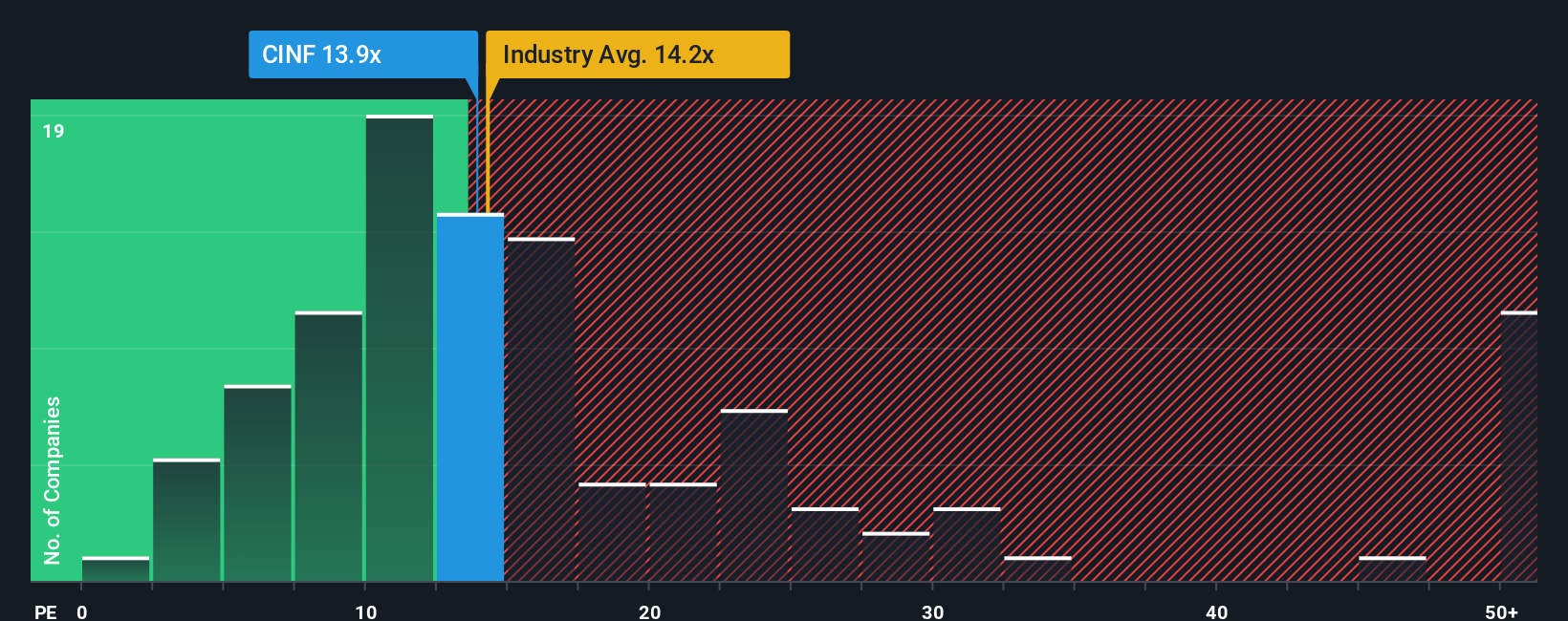

Cincinnati Financial currently trades at a PE ratio of 14.24x. This is virtually identical to the insurance industry average of 14.24x, and just above the peer average of 13.41x. On the surface, the stock appears to be in line with its sector and closest competitors, suggesting the valuation is not extreme by broad industry standards.

To get a more tailored reading, Simply Wall St’s proprietary “Fair Ratio” comes into play. This Fair PE ratio, at 7.91x, is calculated by weighing company-specific factors such as expected earnings growth, profit margins, market capitalization, and risk profile, alongside industry influences. Unlike blunt industry or peer comparisons, this approach allows investors to assess valuation with a perspective tailored to the company’s fundamentals and prospects.

Comparing Cincinnati Financial’s current PE of 14.24x to its Fair Ratio of 7.91x, the stock is valued at a notably higher multiple than its fundamentals would warrant according to this custom benchmark. This indicates that, on a PE basis, the company is trading at a significant premium to its fair value.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Cincinnati Financial Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your story behind the numbers. It connects why you think Cincinnati Financial will perform the way it will, to a financial forecast and ultimately to your best estimate of fair value.

Rather than relying solely on rigid formulas or metrics like PE ratios, Narratives let you layer your knowledge about business trends, risks, and opportunities on top of the raw numbers, then see the outcome reflected as a fair value. This approach helps you move beyond just comparing share prices by allowing you to articulate and justify your assumptions for future growth or challenges, all within a straightforward framework.

On Simply Wall St’s Community page, used by millions of investors, Narratives are an accessible tool you can use to create, update, or follow perspectives tailored to your own research. When analysts or community members update revenue forecasts, earnings, or margin estimates based on fresh news or results, the Narrative’s fair value updates instantly, letting you see in real-time whether the stock is trading at a level that matches your view and if it is a buy, hold, or sell.

For Cincinnati Financial, one Narrative might warn about “overvaluation and rising catastrophe and technology risks” with a price target of $145, while another sees long-term earnings stability driving value as high as $175.

Do you think there's more to the story for Cincinnati Financial? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CINF

Cincinnati Financial

Provides property casualty insurance products in the United States.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives