- United States

- /

- Personal Products

- /

- NYSE:YSG

March 2025's Top Penny Stocks To Watch

Reviewed by Simply Wall St

As of March 2025, the U.S. stock market has experienced a surge, driven by positive developments such as a temporary reprieve from tariffs impacting automakers, which led to gains in major indices like the Dow Jones Industrial Average and S&P 500. For investors seeking opportunities beyond well-known companies, penny stocks remain an intriguing option. Despite their vintage label, these stocks can offer significant growth potential when backed by strong financials and sound fundamentals. In this article, we explore several promising penny stocks that stand out for their balance sheet resilience and potential for impressive returns.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.860025 | $6.53M | ★★★★★★ |

| Safe Bulkers (NYSE:SB) | $3.71 | $400.14M | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $121.65M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.38 | $73.1M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.52 | $48.18M | ★★★★★★ |

| Tuya (NYSE:TUYA) | $3.52 | $1.95B | ★★★★★★ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.88 | $76.36M | ★★★★★☆ |

| PHX Minerals (NYSE:PHX) | $3.77 | $141.68M | ★★★★★☆ |

| TETRA Technologies (NYSE:TTI) | $3.39 | $454.11M | ★★★★☆☆ |

Click here to see the full list of 749 stocks from our US Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Amylyx Pharmaceuticals (NasdaqGS:AMLX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Amylyx Pharmaceuticals, Inc. is a commercial-stage biotechnology company focused on developing treatments for amyotrophic lateral sclerosis (ALS) and other neurodegenerative diseases, with a market cap of approximately $204.93 million.

Operations: Amylyx Pharmaceuticals, Inc. currently does not report any distinct revenue segments.

Market Cap: $204.93M

Amylyx Pharmaceuticals, Inc., with a market cap of approximately US$204.93 million, has been navigating financial challenges as it remains pre-revenue and unprofitable. Despite a net loss of US$301.74 million for 2024, the company maintains a cash runway for about 10 months and is debt-free, which provides some financial stability. Recent developments include the lifting of an FDA clinical hold on its ALS treatment trial and new leadership appointments to bolster commercialization efforts. The company filed shelf registrations totaling over US$312 million to potentially enhance liquidity and support ongoing R&D initiatives in neurodegenerative diseases.

- Click to explore a detailed breakdown of our findings in Amylyx Pharmaceuticals' financial health report.

- Assess Amylyx Pharmaceuticals' future earnings estimates with our detailed growth reports.

Yatsen Holding (NYSE:YSG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Yatsen Holding Limited, with a market cap of $345.02 million, develops and sells beauty products under various brands including Perfect Diary and Little Ondine in the People’s Republic of China.

Operations: The company's revenue primarily comes from the People's Republic of China, totaling CN¥3.39 billion.

Market Cap: $345.02M

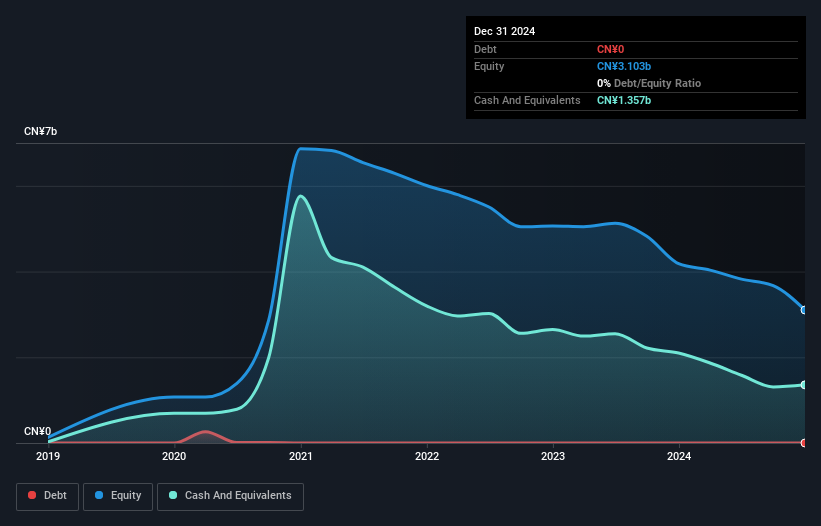

Yatsen Holding Limited, with a market cap of US$345.02 million, faces financial challenges as it remains unprofitable despite generating CN¥3.39 billion in revenue primarily from China. The company reported a net loss of CN¥708.17 million for 2024 and recently impaired goodwill by US$55.2 million in Q4 2024. Despite these setbacks, Yatsen is debt-free and has short-term assets of CN¥2.3 billion exceeding its liabilities, offering some financial flexibility. The management team is experienced with an average tenure of four years, and the stock trades at a significant discount to estimated fair value compared to peers.

- Jump into the full analysis health report here for a deeper understanding of Yatsen Holding.

- Learn about Yatsen Holding's future growth trajectory here.

Zevia PBC (NYSE:ZVIA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zevia PBC is a beverage company that develops, markets, sells, and distributes various carbonated beverages in the United States and Canada, with a market cap of $174.22 million.

Operations: The company's revenue comes entirely from its non-alcoholic beverage segment, totaling $155.05 million.

Market Cap: $174.22M

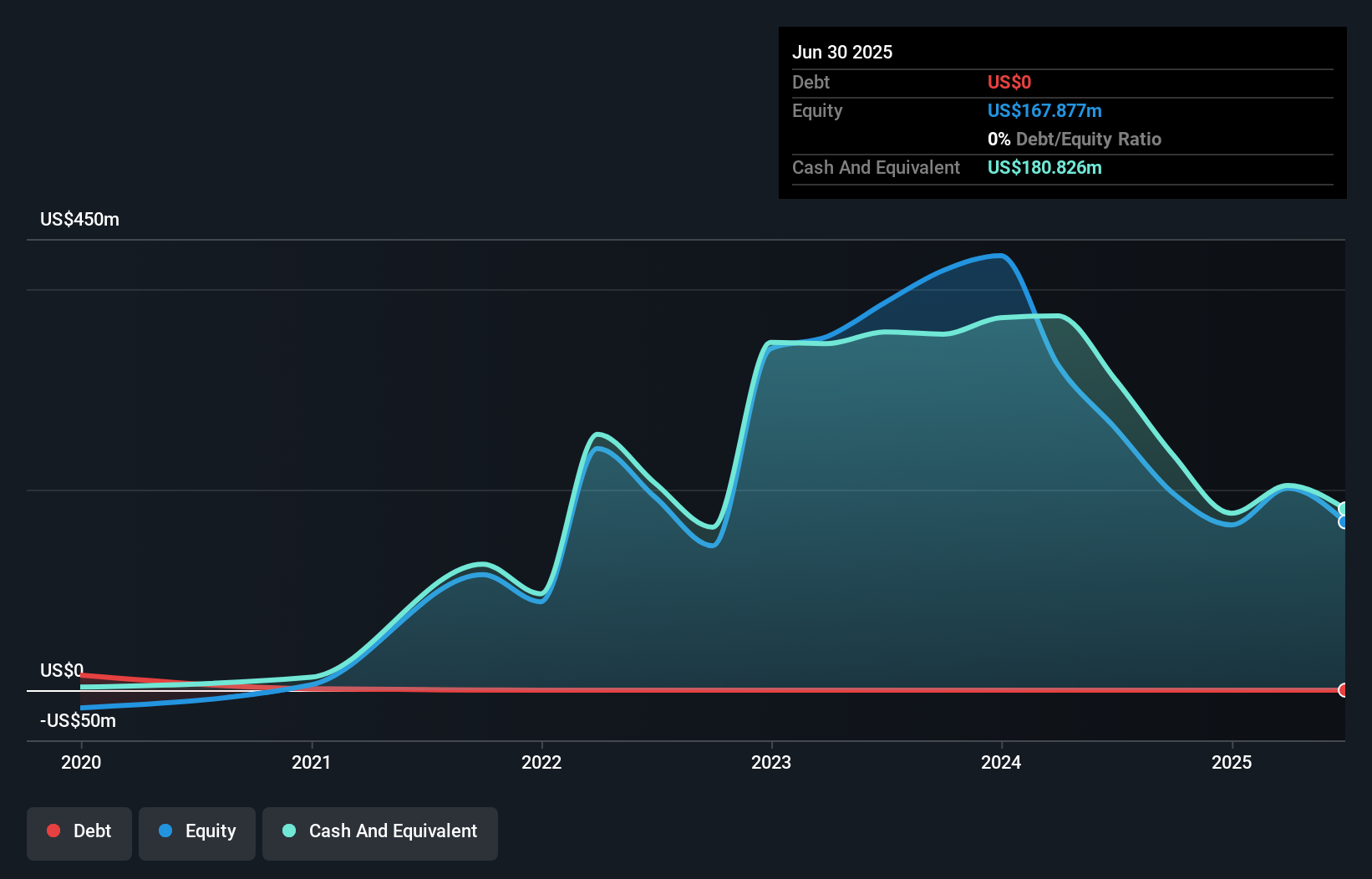

Zevia PBC, with a market cap of US$174.22 million, reported sales of US$155.05 million for 2024, reflecting a decline from the previous year. Despite being debt-free and having short-term assets of US$61.9 million that exceed both its short- and long-term liabilities, the company remains unprofitable with net losses slightly reduced to US$20.01 million for 2024. The management team is relatively new with an average tenure under two years, and insider selling has been significant recently. Zevia's stock is highly volatile but trades at a good value compared to industry peers.

- Take a closer look at Zevia PBC's potential here in our financial health report.

- Evaluate Zevia PBC's prospects by accessing our earnings growth report.

Summing It All Up

- Unlock more gems! Our US Penny Stocks screener has unearthed 746 more companies for you to explore.Click here to unveil our expertly curated list of 749 US Penny Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YSG

Yatsen Holding

Engages in the development and sale of beauty products under the Perfect Diary, Little Ondine, Pink Bear, Abby’s Choice, GalÃnic, DR.WU, Eve Lom, and EANTiM brands in the People’s Republic of China.

Undervalued with adequate balance sheet.