- United States

- /

- Software

- /

- NYSE:TUYA

3 US Penny Stocks With Market Caps Under $900M

Reviewed by Simply Wall St

As of October 22, 2024, the U.S. stock market has shown mixed results following a wave of earnings reports, with the Nasdaq Composite rising for its fifth consecutive session while other indices experienced slight declines. For investors eyeing opportunities beyond large-cap stocks, penny stocks—though an older term—remain relevant as they often represent smaller or emerging companies with potential value. This article explores several U.S. penny stocks that exhibit strong financial foundations and could offer both stability and growth potential in today’s market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.786075 | $5.8M | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.33 | $517.9M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.63 | $2.06B | ★★★★★★ |

| ARC Document Solutions (NYSE:ARC) | $3.42 | $147.91M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.57 | $51.81M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $3.75 | $114.35M | ★★★★★★ |

| Better Choice (NYSEAM:BTTR) | $1.96 | $3.11M | ★★★★★★ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.07 | $98.03M | ★★★★★☆ |

Click here to see the full list of 755 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Niu Technologies (NasdaqGM:NIU)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Niu Technologies designs, manufactures, and sells electric scooters in China, Europe, and internationally with a market cap of $200.20 million.

Operations: The company's revenue segment is primarily from Auto Manufacturers, amounting to CN¥2.85 billion.

Market Cap: $200.2M

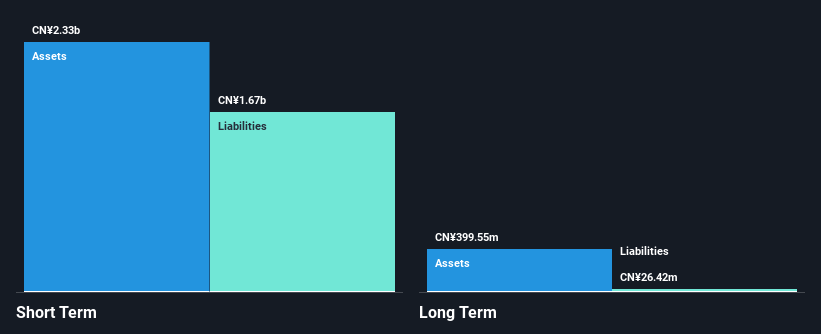

Niu Technologies, with a market cap of US$200.20 million, has been expanding its product line and geographic reach, recently launching the KQi 100F kick scooter in the U.S., which will be available at major retailers like Best Buy and Amazon. Despite reporting increased sales volumes—312,405 units for Q3 2024 compared to 265,923 units a year ago—the company remains unprofitable with growing losses over five years. Niu's financial health shows more cash than debt and short-term assets exceeding liabilities; however, its share price is highly volatile. The company's earnings are forecasted to grow significantly annually.

- Dive into the specifics of Niu Technologies here with our thorough balance sheet health report.

- Gain insights into Niu Technologies' outlook and expected performance with our report on the company's earnings estimates.

Tuya (NYSE:TUYA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tuya Inc. operates as a provider of an Internet of Things (IoT) cloud development platform both in China and globally, with a market cap of approximately $884.58 million.

Operations: The company generates revenue primarily through its Internet Software & Services segment, amounting to $260.44 million.

Market Cap: $884.58M

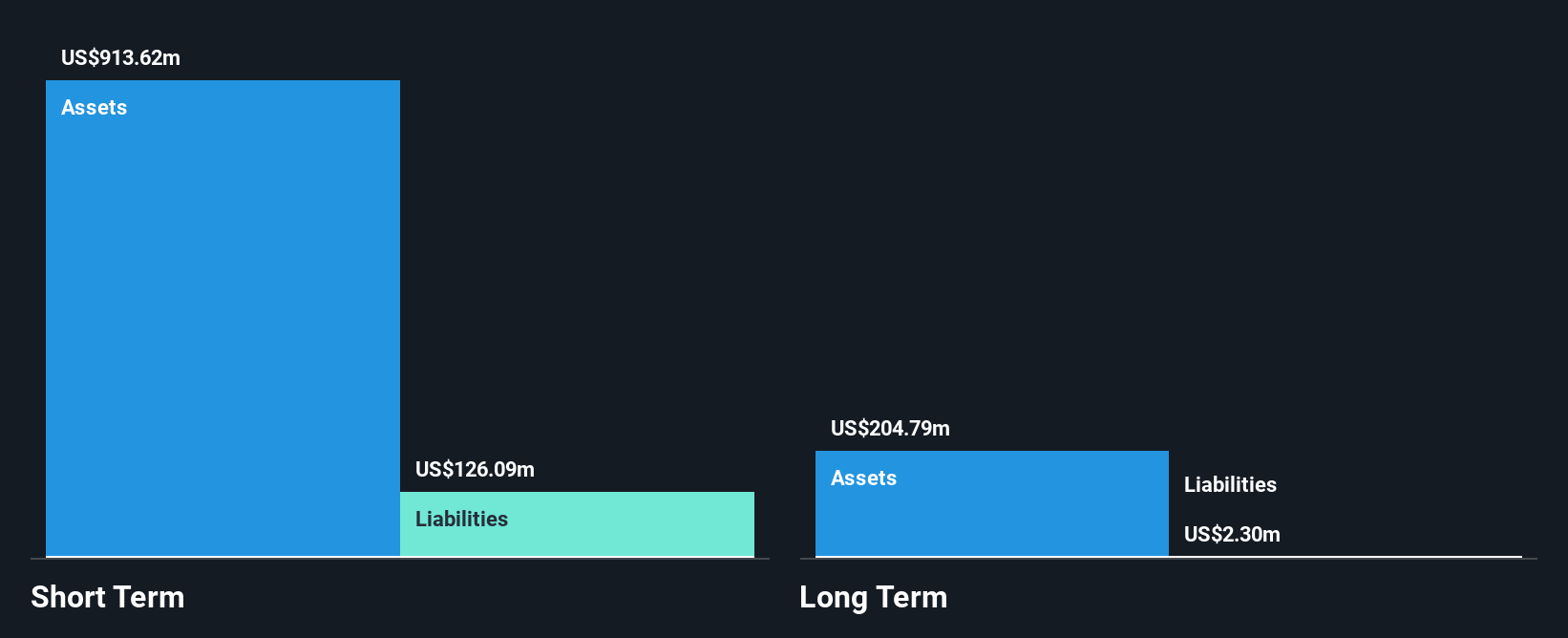

Tuya Inc., with a market cap of US$884.58 million, has shown significant revenue growth in its Internet Software & Services segment, reaching US$73.28 million for Q2 2024, up from US$57 million the previous year. Despite being unprofitable, Tuya has reduced losses over five years and achieved positive net income recently. The company benefits from a seasoned management team and no debt, with short-term assets significantly exceeding liabilities. However, recent changes in leadership and its removal from the FTSE All-World Index could pose challenges. A special dividend was announced to be distributed in October 2024.

- Jump into the full analysis health report here for a deeper understanding of Tuya.

- Understand Tuya's earnings outlook by examining our growth report.

Yatsen Holding (NYSE:YSG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Yatsen Holding Limited, with a market cap of $366.68 million, develops and sells beauty products under various brands such as Perfect Diary and Little Ondine in the People’s Republic of China.

Operations: The company's revenue from the People's Republic of China amounts to CN¥3.36 billion.

Market Cap: $366.68M

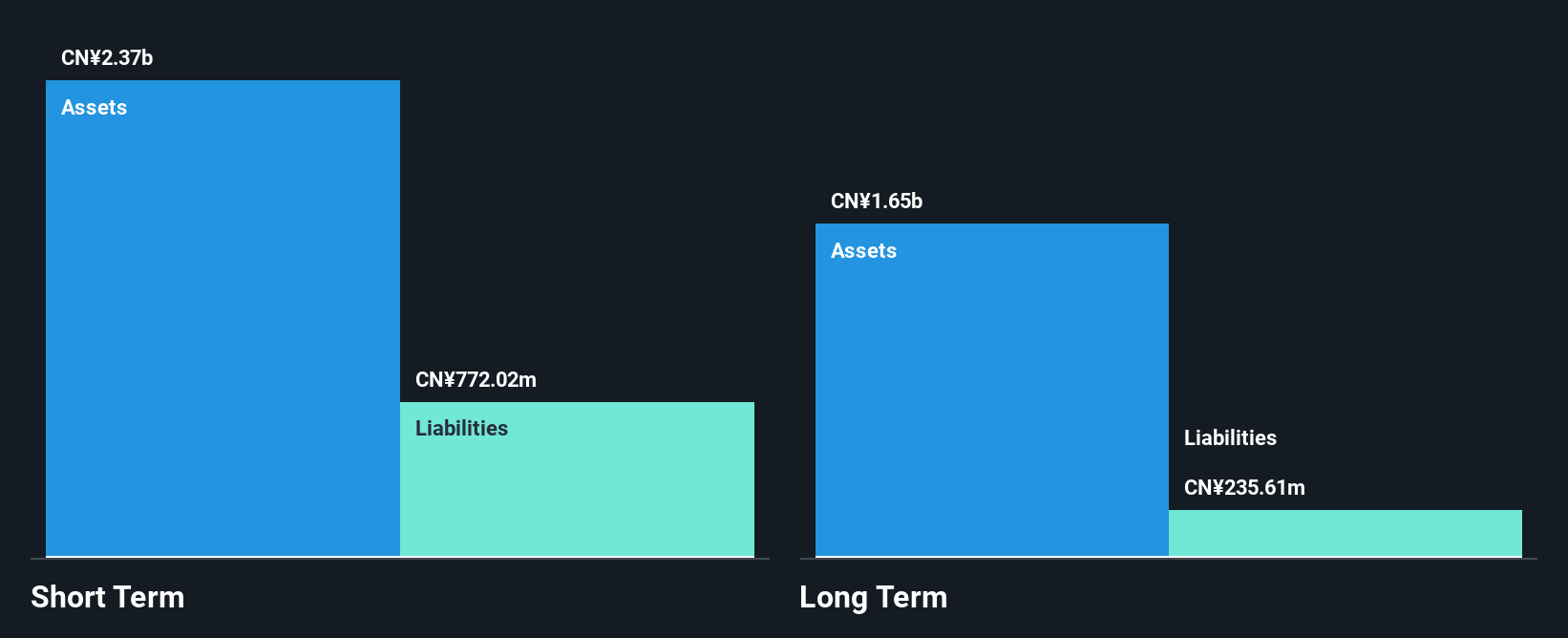

Yatsen Holding Limited, with a market cap of $366.68 million, is currently unprofitable but has managed to reduce its losses by 23.1% annually over the past five years. The company holds significant short-term assets (CN¥2.5 billion) that exceed both its short and long-term liabilities, indicating strong financial stability without any debt burden. Despite trading at a substantial discount to estimated fair value, Yatsen's profitability remains elusive with no forecasted profits in the near term. Recent filings for a $419 million shelf registration and guidance suggesting stable revenue reflect ongoing strategic adjustments amidst challenging market conditions in China’s beauty sector.

- Click here to discover the nuances of Yatsen Holding with our detailed analytical financial health report.

- Explore Yatsen Holding's analyst forecasts in our growth report.

Key Takeaways

- Reveal the 755 hidden gems among our US Penny Stocks screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tuya might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TUYA

Tuya

Offers purpose-built Internet of Things (IoT) cloud development platform in the People’s Republic of China and internationally.

Flawless balance sheet and good value.