- United States

- /

- Personal Products

- /

- NYSE:USNA

USANA Health Sciences (NYSE:USNA) stock falls 5.5% in past week as three-year earnings and shareholder returns continue downward trend

If you love investing in stocks you're bound to buy some losers. Long term USANA Health Sciences, Inc. (NYSE:USNA) shareholders know that all too well, since the share price is down considerably over three years. Unfortunately, they have held through a 55% decline in the share price in that time. The more recent news is of little comfort, with the share price down 25% in a year.

If the past week is anything to go by, investor sentiment for USANA Health Sciences isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Check out our latest analysis for USANA Health Sciences

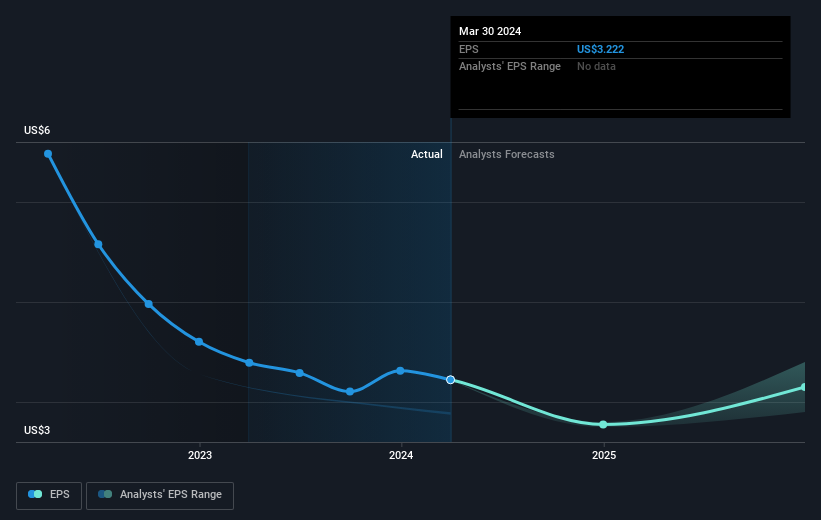

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the three years that the share price fell, USANA Health Sciences' earnings per share (EPS) dropped by 19% each year. This change in EPS is reasonably close to the 24% average annual decrease in the share price. So it seems that investor expectations of the company are staying pretty steady, despite the disappointment. Rather, the share price has approximately tracked EPS growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

This free interactive report on USANA Health Sciences' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market gained around 24% in the last year, USANA Health Sciences shareholders lost 25%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 6% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand USANA Health Sciences better, we need to consider many other factors. For example, we've discovered 2 warning signs for USANA Health Sciences (1 is a bit unpleasant!) that you should be aware of before investing here.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:USNA

USANA Health Sciences

Develops, manufactures, and sells science-based nutritional, personal care, and skincare products in the Asia Pacific, the Americas, and Europe.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives