- United States

- /

- Personal Products

- /

- NYSE:KVUE

Kenvue (NYSE:KVUE) Launches Drug-Free TYLENOL Proactive Support For Joint Health

Reviewed by Simply Wall St

Kenvue (NYSE:KVUE) has launched a new TYLENOL® product, *Proactive Support*, which aims to improve joint health and promote an active lifestyle for older adults. The introduction of this innovative product, supported by a high-profile marketing campaign featuring actress Molly Shannon, coincided with a 1.92% price increase last quarter. This modest rise aligned closely with overall market trends, where the S&P 500 saw gains despite global trade tensions. In tandem, Kenvue's Q1 2025 results demonstrated stable earnings growth and were complemented by the appointment of a new CFO and a strategic collaboration with Microsoft, reflecting a phase of positive corporate activity.

Be aware that Kenvue is showing 3 risks in our investment analysis and 1 of those is significant.

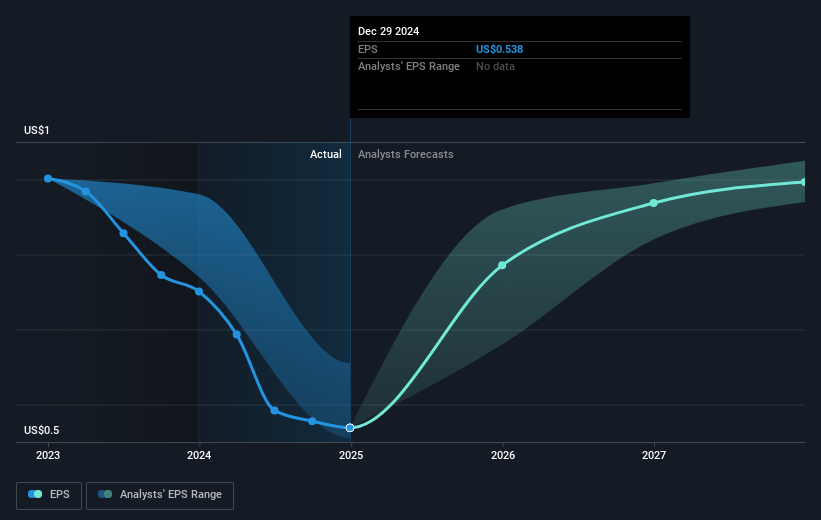

Kenvue's recent introduction of TYLENOL® *Proactive Support* and the ensuing promotional efforts featuring Molly Shannon appear poised to enhance consumer engagement and contribute positively to revenue and earnings outlooks. The modest 1.92% share price increase following the launch is a reflection of the market's initial response, aligning with the S&P 500's concurrent upward movement despite global trade tensions. Over the past year, Kenvue achieved a total return of 28.73%, both from share price gains and dividends, indicating a favorable performance compared to the previous 12-month span.

Relative to the broader market and its peers in the US Personal Products industry, Kenvue's share price movement over the past year has been strong, surpassing the industry's decline of 17.8% and the overall US market's return of 11.5%. The company's strategic initiatives in cost-cutting and product innovation are expected to bolster future revenue streams. Analysts maintain a cautious yet optimistic outlook, forecasting annual revenue growth of 3.4%. The current share price of US$23.57 is close to the analyst consensus price target of US$24.27, suggesting that the stock is near a perceived fair value. Revenue and earnings forecasts may be positively influenced by innovative product launches, though economic challenges and supply chain issues could present hurdles.

Learn about Kenvue's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Kenvue might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KVUE

Kenvue

Operates as a consumer health company in the United States, Europe, the Middle East, Africa, Asia-Pacific, and Latin America.

Proven track record and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)