- United States

- /

- Personal Products

- /

- NasdaqGM:ODD

Oddity Tech (NasdaqGM:ODD) Raises Full-Year Earnings Guidance

Reviewed by Simply Wall St

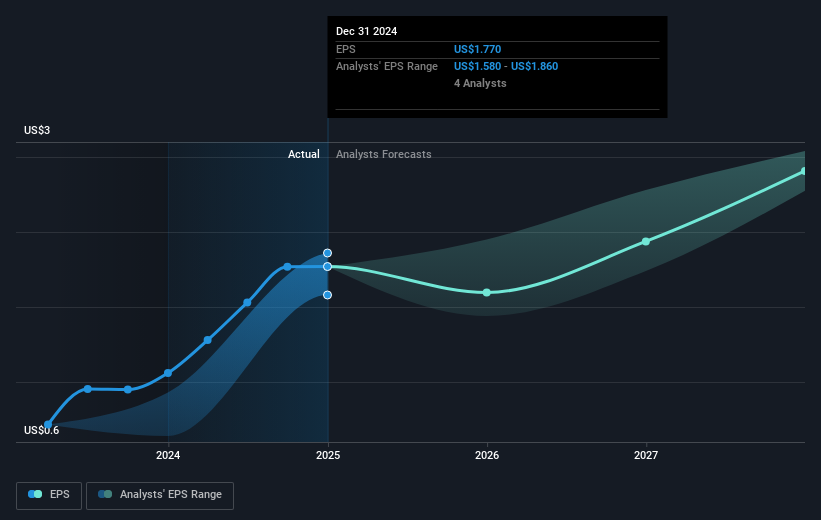

Oddity Tech (NasdaqGM:ODD) recently announced impressive first-quarter earnings and raised its full-year earnings guidance, projecting higher net revenue than previously anticipated. These positive developments likely played a significant role in the company's 56% share price increase over the past month, markedly outperforming the broader market's 5% rise over the same period. Oddity's strengthened financial outlook, with anticipated annual growth surpassing long-term expectations, underscores investor confidence in its potential. This robust performance, coupled with market trends, places Oddity Tech in a favorable position as it exceeds both its own benchmarks and broader economic projections.

Find companies with promising cash flow potential yet trading below their fair value.

The recent first-quarter earnings announcement and full-year guidance upgrade for Oddity Tech have had a positive impact on the company's narratives around growth and innovation. These developments highlight the potential for increased revenue through strategic international expansion and the upcoming launch of Brand 3 aimed at high-margin sales. This aligns with the company's focus on tech-driven customization and product development, which is expected to enhance customer experience and support future earnings growth.

Long-term performance for Oddity Tech's shares has been strong, with a total return of 48.69% over the past year, substantially higher than the US Personal Products industry, which experienced a decline. This robust return underscores the market's confidence in Oddity Tech's ability to outperform its sector amid challenging conditions. Additionally, the company's earnings growth over the past year has far exceeded industry averages, supporting the view that it is well-positioned in its market.

Despite the impressive share price increase of 56% in the past month due to recent developments, the current share price of US$47.13 remains below the consensus analyst price target of US$53.44. This suggests there may still be room for appreciation if Oddity Tech achieves its ambitious revenue and earnings forecasts. Analysts expect revenue growth to reach approximately 700 million and earnings to rise significantly, which could further drive investor confidence. This paints a positive trajectory for Oddity Tech, from its strengthened financial outlook to its targeted market positioning.

Review our historical performance report to gain insights into Oddity Tech's track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ODD

Oddity Tech

Operates as a consumer tech company that builds digital-first brands for the beauty and wellness industries in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)