- United States

- /

- Banks

- /

- NasdaqGS:SHBI

Undiscovered Gems In The US Market Nature's Sunshine Products And Two More Promising Small Caps

Reviewed by Simply Wall St

The United States market has remained flat over the last week but is up 30% over the past year, with earnings forecast to grow by 15% annually. In such a dynamic environment, identifying promising small-cap stocks like Nature's Sunshine Products can offer unique opportunities for investors seeking growth potential beyond the well-trodden paths of larger companies.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Nature's Sunshine Products (NasdaqCM:NATR)

Simply Wall St Value Rating: ★★★★★★

Overview: Nature's Sunshine Products, Inc. is a natural health and wellness company that manufactures and sells nutritional and personal care products across various regions including Asia, Europe, North America, Latin America, and internationally, with a market cap of $296.53 million.

Operations: The company generates revenue primarily from Asia ($199.31 million), North America ($139.43 million), and Europe ($83.20 million).

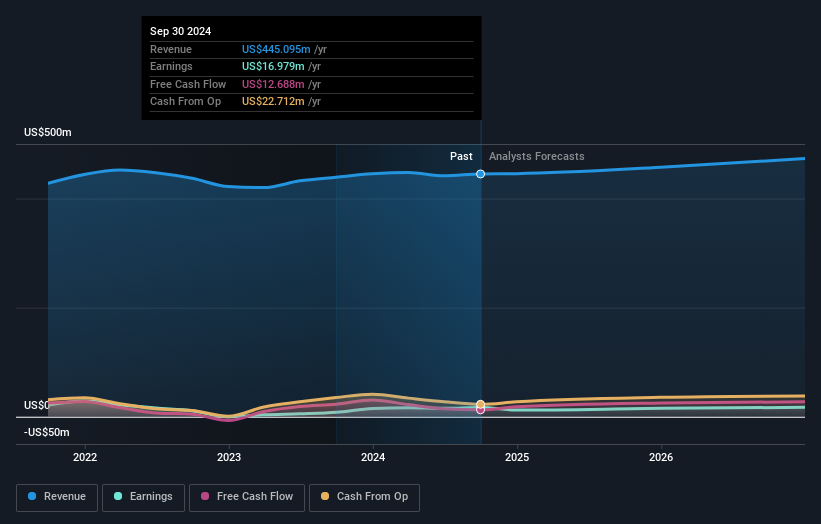

Nature's Sunshine Products, a natural health and wellness company, has made impressive strides with earnings growing 110% over the past year, outpacing the personal products industry. The firm is trading at 55% below its fair value estimate and remains debt-free, offering a strong financial position. Recent strategic efforts include a partnership with Cirque Series to enhance brand visibility and digital initiatives aimed at increasing sales in Asia. Despite macroeconomic headwinds causing revenue drops in China (23%) and North America (3%), Nature's Sunshine repurchased shares worth US$0.71 million recently, reflecting confidence in its growth trajectory.

Shore Bancshares (NasdaqGS:SHBI)

Simply Wall St Value Rating: ★★★★★★

Overview: Shore Bancshares, Inc. operates as a bank holding company for Shore United Bank, N.A., with a market cap of $569.89 million.

Operations: Shore Bancshares generates revenue primarily from its community banking segment, totaling $193.05 million. The company's net profit margin is a key financial metric to consider when evaluating its profitability and efficiency.

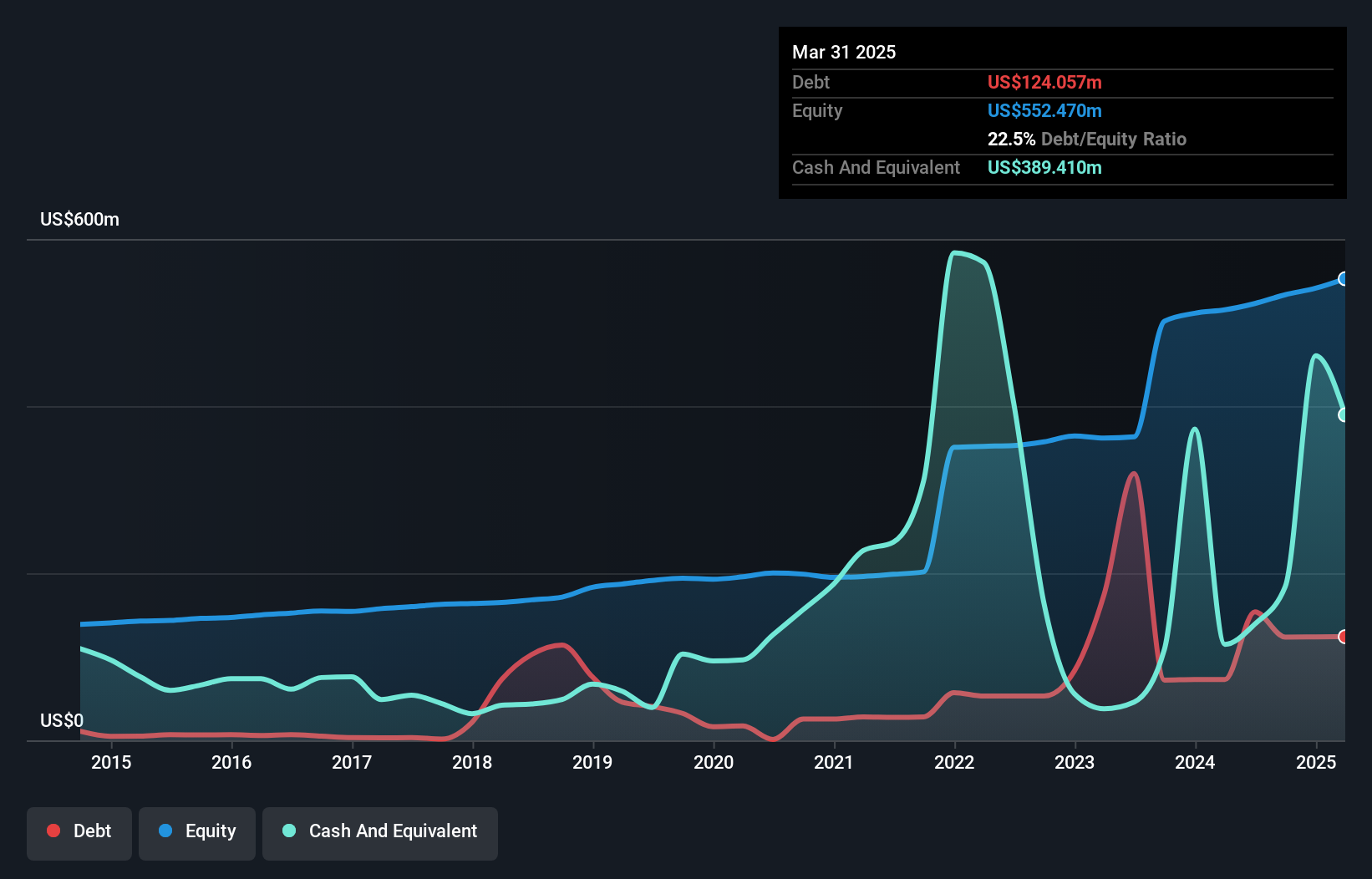

Shore Bancshares, with assets totaling $5.9 billion and equity at $533.3 million, presents a solid financial footing with deposits of $5.2 billion and loans amounting to $4.7 billion. The company boasts an impressive allowance for bad loans at 384%, well above the necessary threshold, while maintaining non-performing loans at just 0.3%. Its price-to-earnings ratio of 13.9x is attractively below the US market average of 19.4x, suggesting potential value for investors seeking opportunities in smaller financial institutions. Recent earnings growth of 349% highlights its robust performance compared to the broader industry trend of -12%.

- Click here to discover the nuances of Shore Bancshares with our detailed analytical health report.

Gain insights into Shore Bancshares' past trends and performance with our Past report.

General American Investors Company (NYSE:GAM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: General American Investors Company, Inc. is a publicly owned investment manager with a market cap of approximately $1.21 billion.

Operations: The company's revenue is primarily derived from its financial services, specifically closed-end funds, totaling approximately $26.75 million.

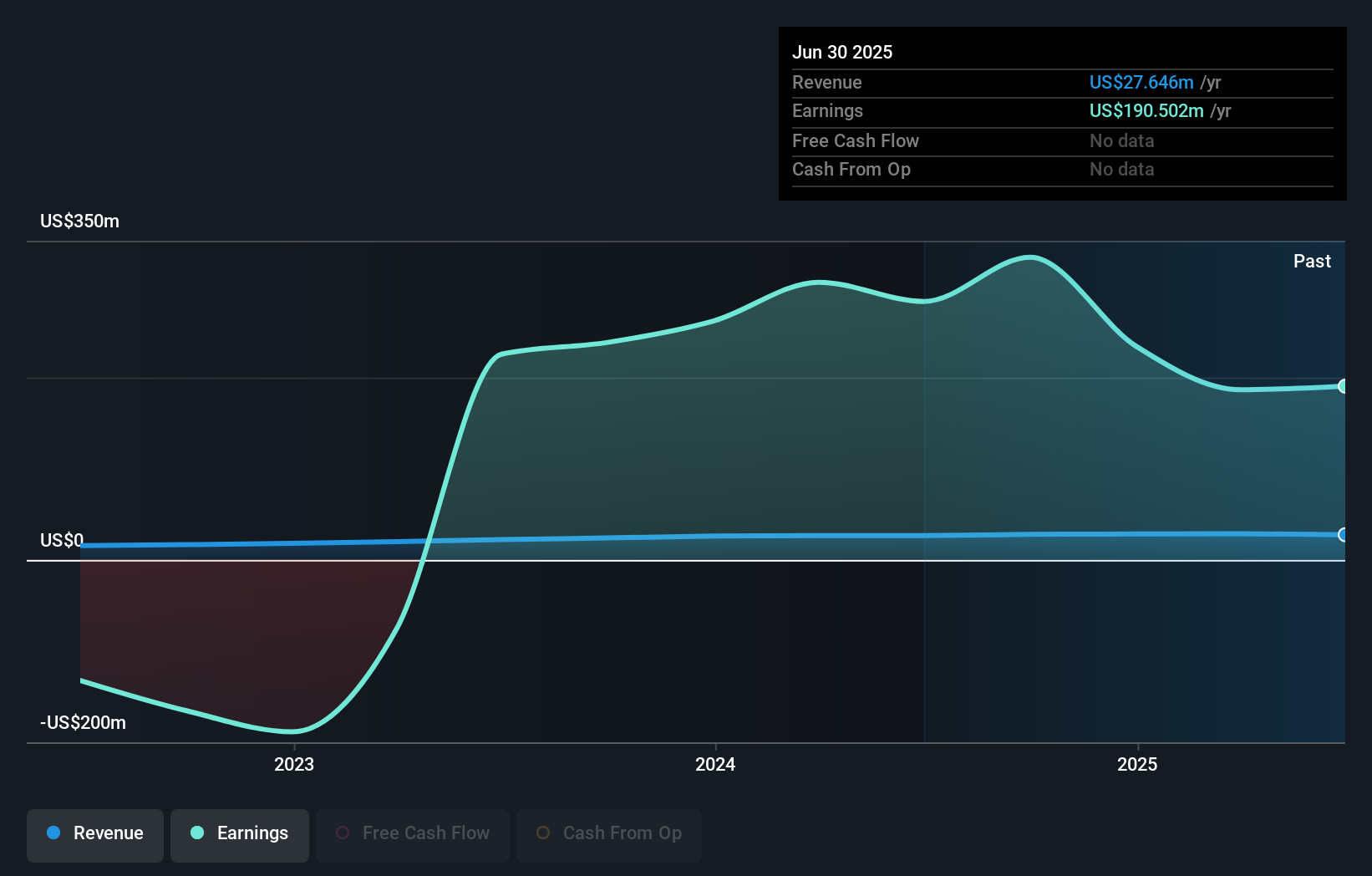

General American Investors Company, a small cap player in the capital markets sector, shows promising potential with its debt-free status over the past five years and earnings growth of 25.7% last year, outpacing the industry average of 12.9%. The company recently declared a combined dividend and distribution of US$4.50 per share, including US$4.05 from long-term capital gains and US$0.45 from net investment income for 2024. Despite benefiting from a one-off gain of $285 million impacting recent results, it trades at an attractive 63% below estimated fair value, suggesting significant upside potential for investors seeking undervalued opportunities.

- Get an in-depth perspective on General American Investors Company's performance by reading our health report here.

Understand General American Investors Company's track record by examining our Past report.

Seize The Opportunity

- Navigate through the entire inventory of 235 US Undiscovered Gems With Strong Fundamentals here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Shore Bancshares, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SHBI

Shore Bancshares

Operates as a bank holding company for the Shore United Bank, N.A.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives