- United States

- /

- Personal Products

- /

- NasdaqCM:NATR

Nature's Sunshine Products, Inc.'s (NASDAQ:NATR) Price Is Right But Growth Is Lacking

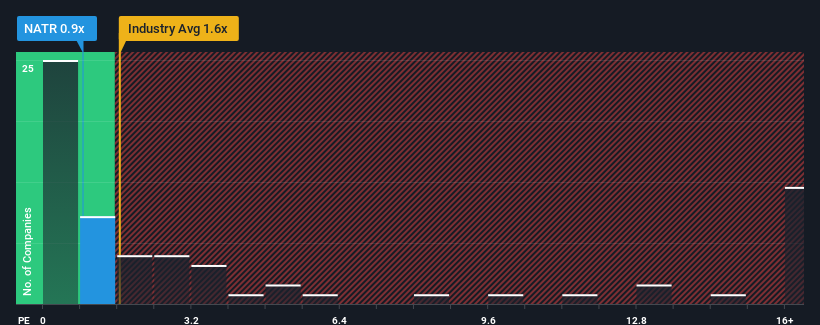

With a price-to-sales (or "P/S") ratio of 0.9x Nature's Sunshine Products, Inc. (NASDAQ:NATR) may be sending bullish signals at the moment, given that almost half of all the Personal Products companies in the United States have P/S ratios greater than 1.6x and even P/S higher than 6x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Nature's Sunshine Products

What Does Nature's Sunshine Products' Recent Performance Look Like?

Nature's Sunshine Products could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Nature's Sunshine Products' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Nature's Sunshine Products would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 5.5% last year. Revenue has also lifted 16% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 5.1% over the next year. Meanwhile, the rest of the industry is forecast to expand by 8.6%, which is noticeably more attractive.

With this in consideration, its clear as to why Nature's Sunshine Products' P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Nature's Sunshine Products' P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Nature's Sunshine Products maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Nature's Sunshine Products you should know about.

If you're unsure about the strength of Nature's Sunshine Products' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Nature's Sunshine Products might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:NATR

Nature's Sunshine Products

A natural health and wellness company, manufactures and sells nutritional and personal care products in Asia, Europe, North America, Latin America, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives