- United States

- /

- Personal Products

- /

- NasdaqGM:NAII

Is Natural Alternatives International (NASDAQ:NAII) A Risky Investment?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Natural Alternatives International, Inc. (NASDAQ:NAII) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Natural Alternatives International

What Is Natural Alternatives International's Net Debt?

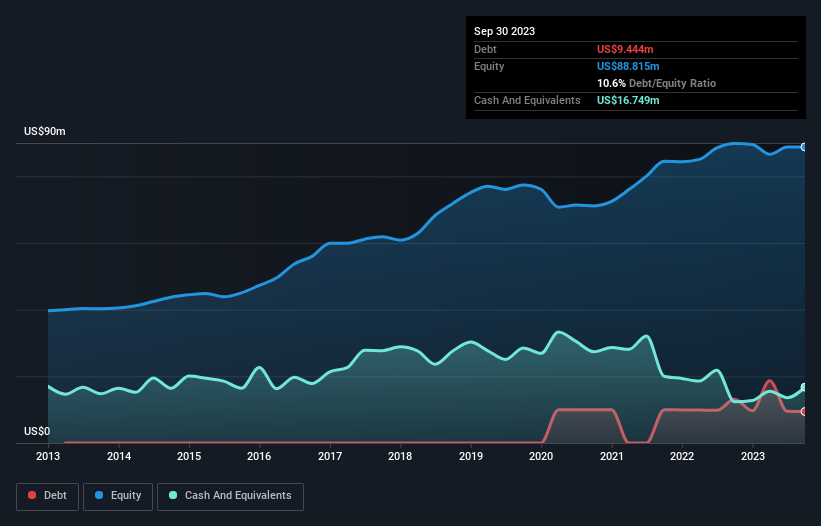

You can click the graphic below for the historical numbers, but it shows that Natural Alternatives International had US$9.44m of debt in September 2023, down from US$13.1m, one year before. However, it does have US$16.7m in cash offsetting this, leading to net cash of US$7.31m.

How Strong Is Natural Alternatives International's Balance Sheet?

We can see from the most recent balance sheet that Natural Alternatives International had liabilities of US$15.4m falling due within a year, and liabilities of US$56.0m due beyond that. On the other hand, it had cash of US$16.7m and US$10.1m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$44.6m.

Given this deficit is actually higher than the company's market capitalization of US$43.9m, we think shareholders really should watch Natural Alternatives International's debt levels, like a parent watching their child ride a bike for the first time. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution. Given that Natural Alternatives International has more cash than debt, we're pretty confident it can handle its debt, despite the fact that it has a lot of liabilities in total.

The modesty of its debt load may become crucial for Natural Alternatives International if management cannot prevent a repeat of the 76% cut to EBIT over the last year. When it comes to paying off debt, falling earnings are no more useful than sugary sodas are for your health. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Natural Alternatives International will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While Natural Alternatives International has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, Natural Alternatives International recorded negative free cash flow, in total. Debt is usually more expensive, and almost always more risky in the hands of a company with negative free cash flow. Shareholders ought to hope for an improvement.

Summing Up

Although Natural Alternatives International's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of US$7.31m. Despite its cash we think that Natural Alternatives International seems to struggle to grow its EBIT, so we are wary of the stock. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example - Natural Alternatives International has 2 warning signs we think you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if Natural Alternatives International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:NAII

Natural Alternatives International

Engages in formulating, manufacturing, and marketing nutritional supplements in the United States and internationally.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives