- United States

- /

- Medical Equipment

- /

- NYSE:ITGR

Integer Holdings (NYSE:ITGR) shareholders notch a 12% CAGR over 5 years, yet earnings have been shrinking

Integer Holdings Corporation (NYSE:ITGR) shareholders might be concerned after seeing the share price drop 15% in the last quarter. But the silver lining is the stock is up over five years. In that time, it is up 75%, which isn't bad, but is below the market return of 106%.

The past week has proven to be lucrative for Integer Holdings investors, so let's see if fundamentals drove the company's five-year performance.

Our free stock report includes 2 warning signs investors should be aware of before investing in Integer Holdings. Read for free now.While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During five years of share price growth, Integer Holdings actually saw its EPS drop 6.3% per year.

Essentially, it doesn't seem likely that investors are focused on EPS. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

On the other hand, Integer Holdings' revenue is growing nicely, at a compound rate of 10% over the last five years. It's quite possible that management are prioritizing revenue growth over EPS growth at the moment.

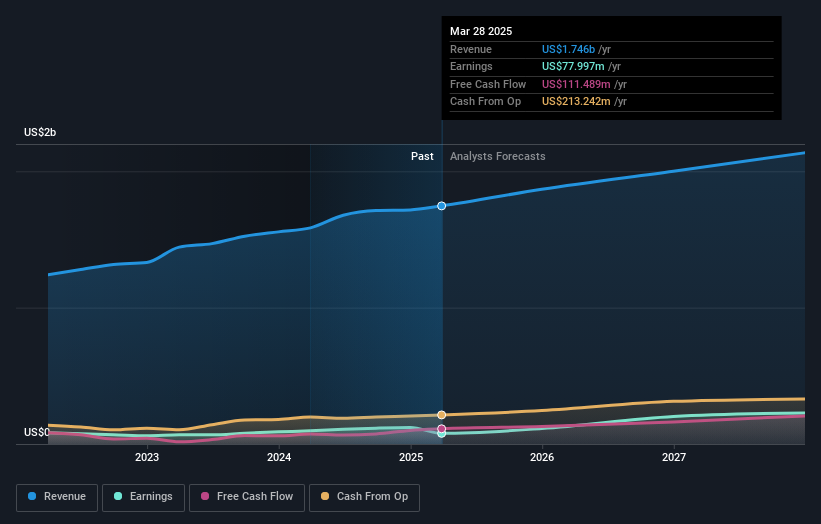

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Integer Holdings stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Integer Holdings shareholders gained a total return of 7.7% during the year. But that was short of the market average. On the bright side, the longer term returns (running at about 12% a year, over half a decade) look better. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. It's always interesting to track share price performance over the longer term. But to understand Integer Holdings better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for Integer Holdings (of which 1 makes us a bit uncomfortable!) you should know about.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ITGR

Integer Holdings

Operates as a medical device contract development and manufacturing company in the United States, Puerto Rico, Costa Rica, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives