- United States

- /

- Auto

- /

- NYSE:XPEV

Insiders Favor These 3 High Growth Companies

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 5.1%, contributing to an overall increase of 11% over the past year, with earnings expected to grow by 14% annually in the coming years. In this favorable environment, companies that combine high growth potential with significant insider ownership often stand out as compelling opportunities due to their alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (NasdaqGS:SMCI) | 14.1% | 37.4% |

| Duolingo (NasdaqGS:DUOL) | 14.3% | 39.9% |

| AST SpaceMobile (NasdaqGS:ASTS) | 13.4% | 68.3% |

| FTC Solar (NasdaqCM:FTCI) | 32.2% | 61.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 12.1% | 65.1% |

| Astera Labs (NasdaqGS:ALAB) | 15.3% | 44.8% |

| Red Cat Holdings (NasdaqCM:RCAT) | 14.8% | 123% |

| Niu Technologies (NasdaqGM:NIU) | 36% | 82.8% |

| BBB Foods (NYSE:TBBB) | 16.2% | 30.1% |

| Upstart Holdings (NasdaqGS:UPST) | 12.5% | 102.6% |

Here's a peek at a few of the choices from the screener.

Futu Holdings (NasdaqGM:FUTU)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Futu Holdings Limited offers digitalized securities brokerage and wealth management product distribution services in Hong Kong and internationally, with a market cap of approximately $15.64 billion.

Operations: The company generates revenue of HK$11.97 billion from its online brokerage services and margin financing services.

Insider Ownership: 36.3%

Futu Holdings has demonstrated strong growth, with recent earnings showing significant increases in both revenue and net income. Despite no insider buying or selling activity reported recently, the company's high insider ownership aligns with its robust financial performance. Analysts expect Futu's revenue to grow faster than the US market average and project a 23.8% stock price increase, while its earnings are forecast to outpace the market at 19.1% annually, reflecting solid growth potential.

- Click here and access our complete growth analysis report to understand the dynamics of Futu Holdings.

- The valuation report we've compiled suggests that Futu Holdings' current price could be quite moderate.

Hims & Hers Health (NYSE:HIMS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hims & Hers Health, Inc. operates a telehealth platform connecting consumers to licensed healthcare professionals in the United States, the United Kingdom, and internationally, with a market cap of approximately $14.33 billion.

Operations: The company generates revenue through its online retail segment, amounting to approximately $1.78 billion.

Insider Ownership: 13%

Hims & Hers Health is experiencing strong growth, with recent earnings showing substantial increases in both revenue and net income. The company has a high forecasted return on equity of 32.5% over three years and expects annual profit growth of 22.5%, outpacing the US market average. Although insider activity shows significant selling recently, Hims & Hers continues to innovate through strategic leadership appointments and collaborations, such as its partnership with Novo Nordisk for obesity care solutions.

- Navigate through the intricacies of Hims & Hers Health with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that Hims & Hers Health is trading beyond its estimated value.

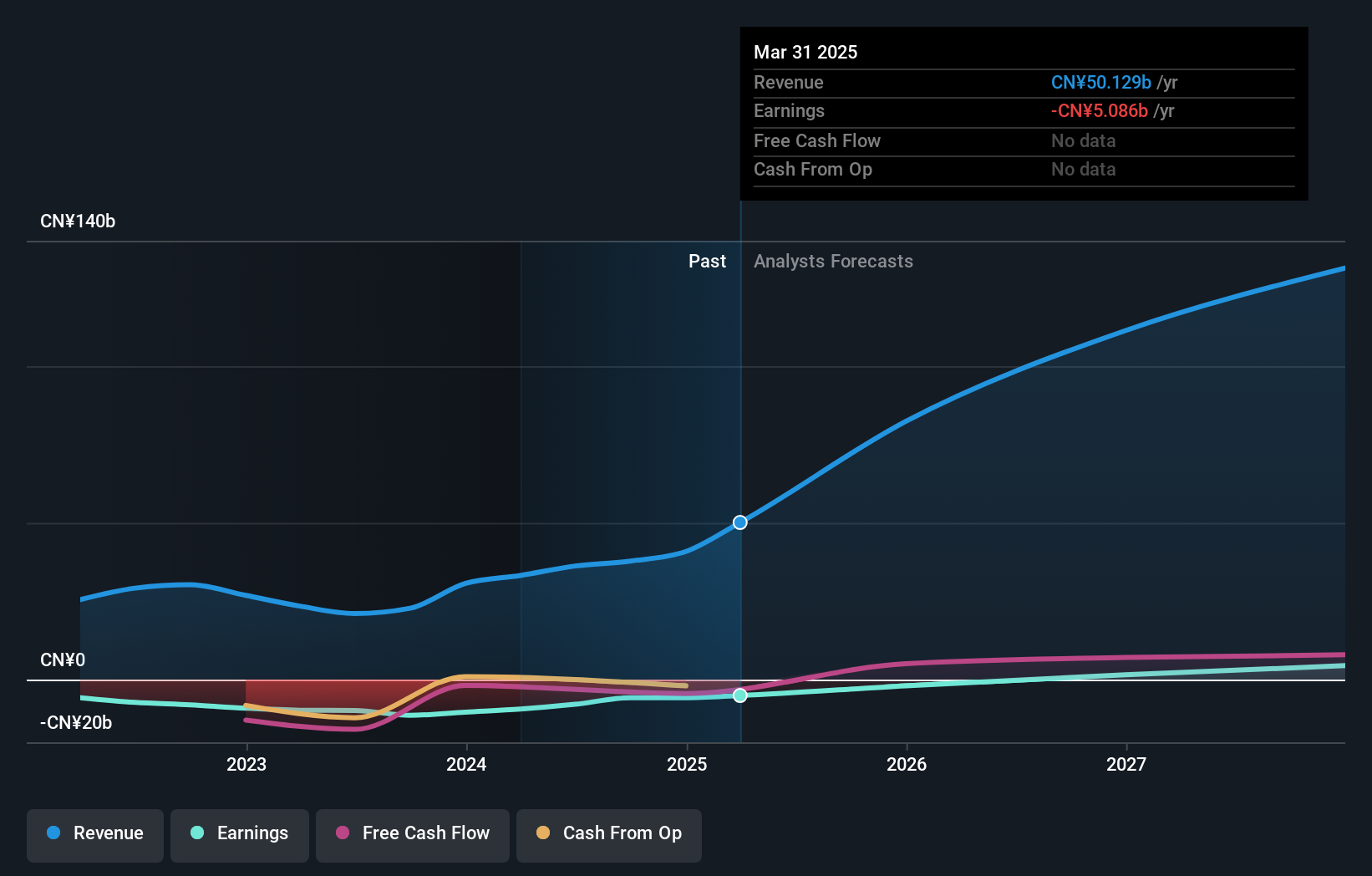

XPeng (NYSE:XPEV)

Simply Wall St Growth Rating: ★★★★★☆

Overview: XPeng Inc. is a company that designs, develops, manufactures, and markets smart electric vehicles in the People’s Republic of China, with a market cap of approximately $19.74 billion.

Operations: The company's revenue primarily comes from its Auto Manufacturers segment, totaling CN¥40.87 billion.

Insider Ownership: 20.7%

XPeng is expanding rapidly, with recent announcements highlighting its innovative AI-driven EVs and entry into new markets like Poland. The company plans an IPO for its flying car unit, signaling ambitious growth strategies. XPeng's vehicle deliveries surged significantly year-over-year, reflecting strong market demand. Although insider trading activity is not substantial recently, the company's revenue is forecast to grow at 25.9% annually, outpacing the US market average. However, its return on equity remains modest at 13.8%.

- Click here to discover the nuances of XPeng with our detailed analytical future growth report.

- Our expertly prepared valuation report XPeng implies its share price may be too high.

Taking Advantage

- Gain an insight into the universe of 195 Fast Growing US Companies With High Insider Ownership by clicking here.

- Want To Explore Some Alternatives? Uncover 16 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XPEV

XPeng

Designs, develops, manufactures, and markets smart electric vehicles (EVs) in the People’s Republic of China.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives