- United States

- /

- Hospitality

- /

- NYSE:LTH

October 2025's Noteworthy Stocks Estimated Below Their Intrinsic Value

Reviewed by Simply Wall St

As the U.S. stock market concludes a volatile week with major indices posting gains, investors are navigating through concerns about banking sector health and trade tensions with China. In this environment, identifying stocks that are potentially undervalued can offer opportunities for those looking to capitalize on discrepancies between market prices and intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wix.com (WIX) | $130.82 | $258.91 | 49.5% |

| Trade Desk (TTD) | $49.98 | $96.49 | 48.2% |

| Rush Street Interactive (RSI) | $17.30 | $33.40 | 48.2% |

| Phibro Animal Health (PAHC) | $39.72 | $77.67 | 48.9% |

| Old National Bancorp (ONB) | $19.85 | $37.97 | 47.7% |

| NeuroPace (NPCE) | $10.41 | $20.08 | 48.2% |

| Midland States Bancorp (MSBI) | $15.83 | $30.62 | 48.3% |

| First Advantage (FA) | $14.01 | $27.13 | 48.4% |

| Corpay (CPAY) | $285.46 | $549.18 | 48% |

| ChoiceOne Financial Services (COFS) | $26.36 | $51.63 | 48.9% |

We're going to check out a few of the best picks from our screener tool.

Roku (ROKU)

Overview: Roku, Inc. operates a TV streaming platform both in the United States and internationally, with a market cap of approximately $13.88 billion.

Operations: The company's revenue is primarily derived from its Platform segment, which generated $3.80 billion, and its Devices segment, which contributed $595.16 million.

Estimated Discount To Fair Value: 35.3%

Roku, trading at US$94.21, is considered undervalued based on cash flow analysis, with a fair value estimate of US$145.54. Recent strategic expansions like the FreeWheel partnership enhance monetization and scale, potentially boosting cash flows. Despite legal setbacks in patent disputes, Roku's forecasted profitability growth over the next three years and revenue growth of 10.1% per year underscore its potential as an attractive investment opportunity amidst its current valuation gap.

- In light of our recent growth report, it seems possible that Roku's financial performance will exceed current levels.

- Navigate through the intricacies of Roku with our comprehensive financial health report here.

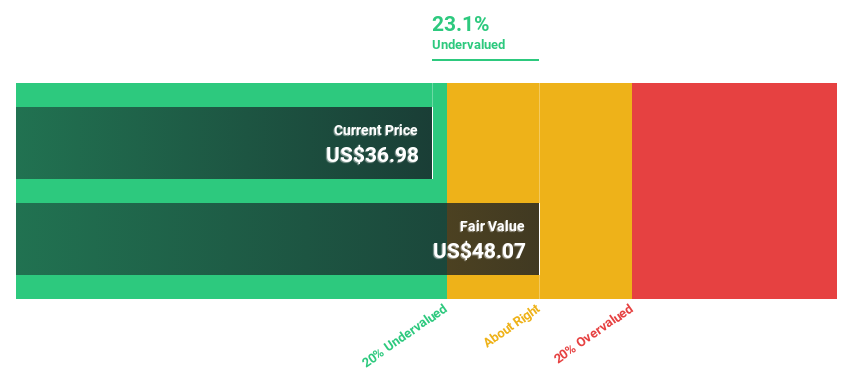

Waystar Holding (WAY)

Overview: Waystar Holding Corp. develops a cloud-based software solution for healthcare payments and has a market cap of approximately $7.06 billion.

Operations: The company generates revenue of $1.01 billion from its healthcare software segment.

Estimated Discount To Fair Value: 45.9%

Waystar Holding, trading at US$36.98, is significantly undervalued with a fair value estimate of US$68.36. Its earnings are projected to grow substantially at 31.9% annually, surpassing the broader market's growth rate. Recent strategic initiatives include a US$250 million debt financing to support acquisitions and innovations in AI-powered healthcare solutions, potentially enhancing cash flow generation despite a forecasted low return on equity of 9.8% in three years.

- Insights from our recent growth report point to a promising forecast for Waystar Holding's business outlook.

- Click to explore a detailed breakdown of our findings in Waystar Holding's balance sheet health report.

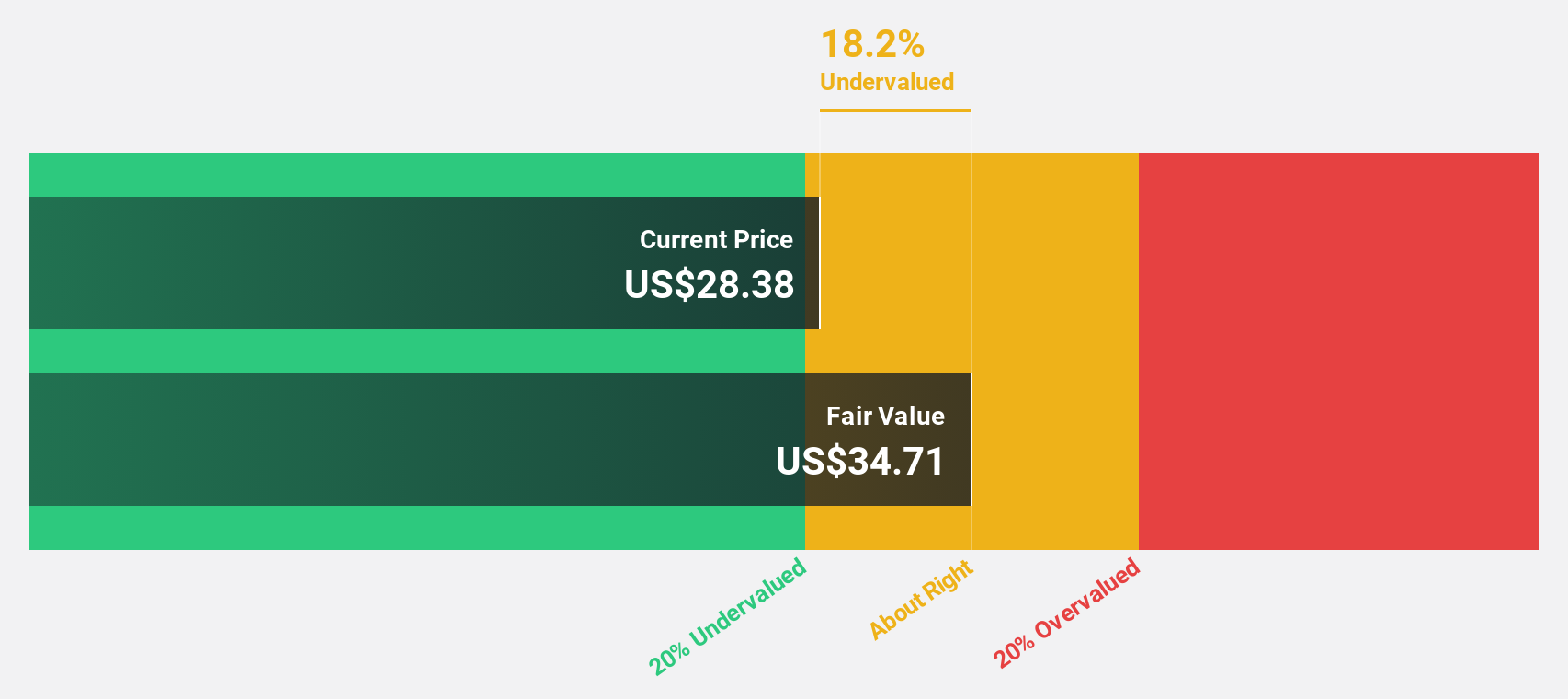

Life Time Group Holdings (LTH)

Overview: Life Time Group Holdings, Inc. operates health, fitness, and wellness centers for individual members in the United States and Canada, with a market cap of $5.65 billion.

Operations: The company generates revenue from its health, fitness, and wellness services with a segment total of $2.82 billion.

Estimated Discount To Fair Value: 24.7%

Life Time Group Holdings, trading at US$25.70, is undervalued with a fair value estimate of US$34.12. The company is expanding its footprint with new locations like the Life Time Prudential Center in Boston and strategic alliances such as the partnership with Aion. Despite high debt levels, earnings are expected to grow significantly at 22.4% annually over the next three years, outpacing market growth and enhancing cash flow potential amidst ongoing business expansions and product innovations.

- The analysis detailed in our Life Time Group Holdings growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Life Time Group Holdings stock in this financial health report.

Turning Ideas Into Actions

- Explore the 176 names from our Undervalued US Stocks Based On Cash Flows screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LTH

Life Time Group Holdings

Provides health, fitness, and wellness experiences to a community of individual members in the United States and Canada.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives