- United States

- /

- Biotech

- /

- NasdaqGS:NTRA

High Growth Tech Stocks to Watch in February 2025

Reviewed by Simply Wall St

In the last week, the United States market has stayed flat, but over the past 12 months, it has risen by an impressive 23%, with earnings forecasted to grow by 15% annually. In this context of robust growth and stability, identifying high-growth tech stocks involves looking for companies that demonstrate strong innovation potential and adaptability to maintain momentum in a dynamic market environment.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.36% | 24.28% | ★★★★★★ |

| Ardelyx | 21.09% | 55.29% | ★★★★★★ |

| AsiaFIN Holdings | 51.75% | 82.69% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| TG Therapeutics | 29.48% | 43.58% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.62% | 56.70% | ★★★★★★ |

| Blueprint Medicines | 23.57% | 55.74% | ★★★★★★ |

| Travere Therapeutics | 30.46% | 62.05% | ★★★★★★ |

Click here to see the full list of 232 stocks from our US High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Natera (NasdaqGS:NTRA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Natera, Inc. is a diagnostics company that focuses on the development and commercialization of molecular testing services globally, with a market capitalization of approximately $23.36 billion.

Operations: The company generates revenue primarily from the development and commercialization of molecular testing services, amounting to $1.53 billion.

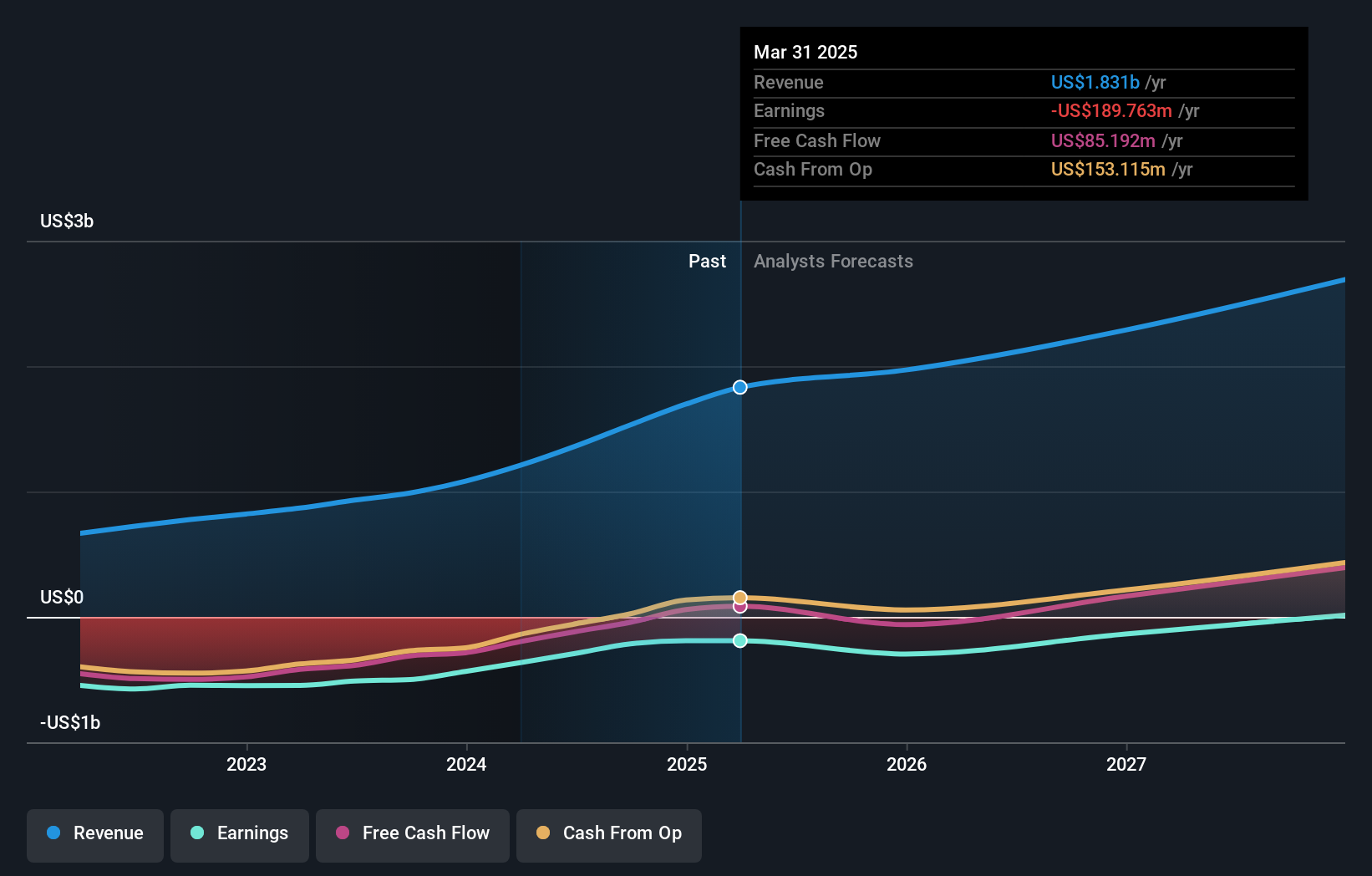

Natera, Inc.'s recent advancements in oncology diagnostics underscore its potential within high-growth sectors, despite current unprofitability. The company's revenue is projected to grow at 12.7% annually, outpacing the US market average of 8.8%. Particularly noteworthy is the expected earnings growth rate of 70.36% per year, signaling a robust upward trajectory as it moves towards profitability in three years. Recent clinical studies like CALGB/SWOG 80702 have demonstrated the efficacy of Natera's Signatera test in improving disease-free survival rates by tailoring cancer treatments more precisely, which could significantly enhance patient outcomes and reduce healthcare costs over time. This blend of innovative product development and strong future growth prospects positions Natera intriguingly in the biotech landscape.

- Delve into the full analysis health report here for a deeper understanding of Natera.

Review our historical performance report to gain insights into Natera's's past performance.

Waystar Holding (NasdaqGS:WAY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Waystar Holding Corp. specializes in developing a cloud-based software solution for healthcare payments and has a market capitalization of $6.92 billion.

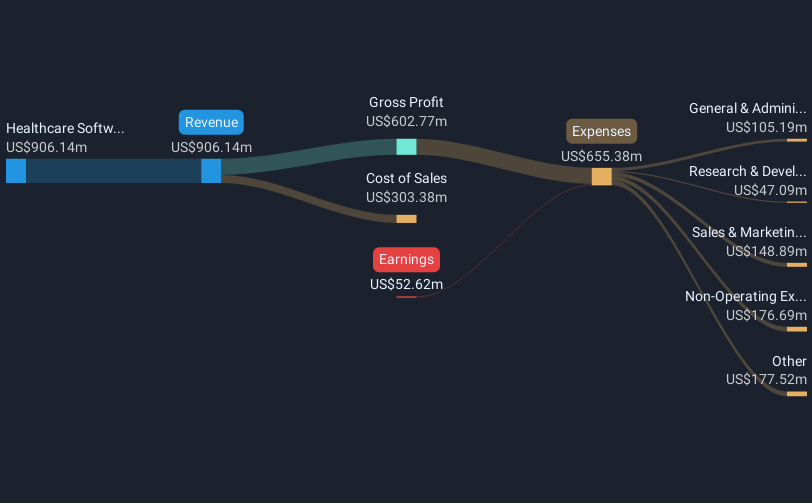

Operations: The company generates revenue primarily from its healthcare software segment, which brought in $906.14 million. With a market capitalization of approximately $6.92 billion, it focuses on providing cloud-based solutions for healthcare payments.

Waystar Holding's recent introduction of AltitudeAI™, including AltitudeCreate™, showcases its innovative approach to tackling the $20 billion annual challenge of denied healthcare claims. By leveraging generative AI to autonomously generate appeal letters, Waystar not only aims to streamline operations but also enhance provider-payer interactions, which could substantially reduce the U.S. healthcare system's $350 billion in administrative losses annually. This strategic move aligns with broader industry trends towards AI integration to boost efficiency and accuracy in healthcare payments. With a robust growth in revenue by 18.2% over the past year and an anticipated profitability within three years, Waystar is positioning itself as a transformative force in healthcare technology amidst rising operational costs and increasing denial rates across the industry.

- Click here to discover the nuances of Waystar Holding with our detailed analytical health report.

Understand Waystar Holding's track record by examining our Past report.

Snap (NYSE:SNAP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Snap Inc. is a technology company that operates in North America, Europe, and internationally, with a market cap of $18.94 billion.

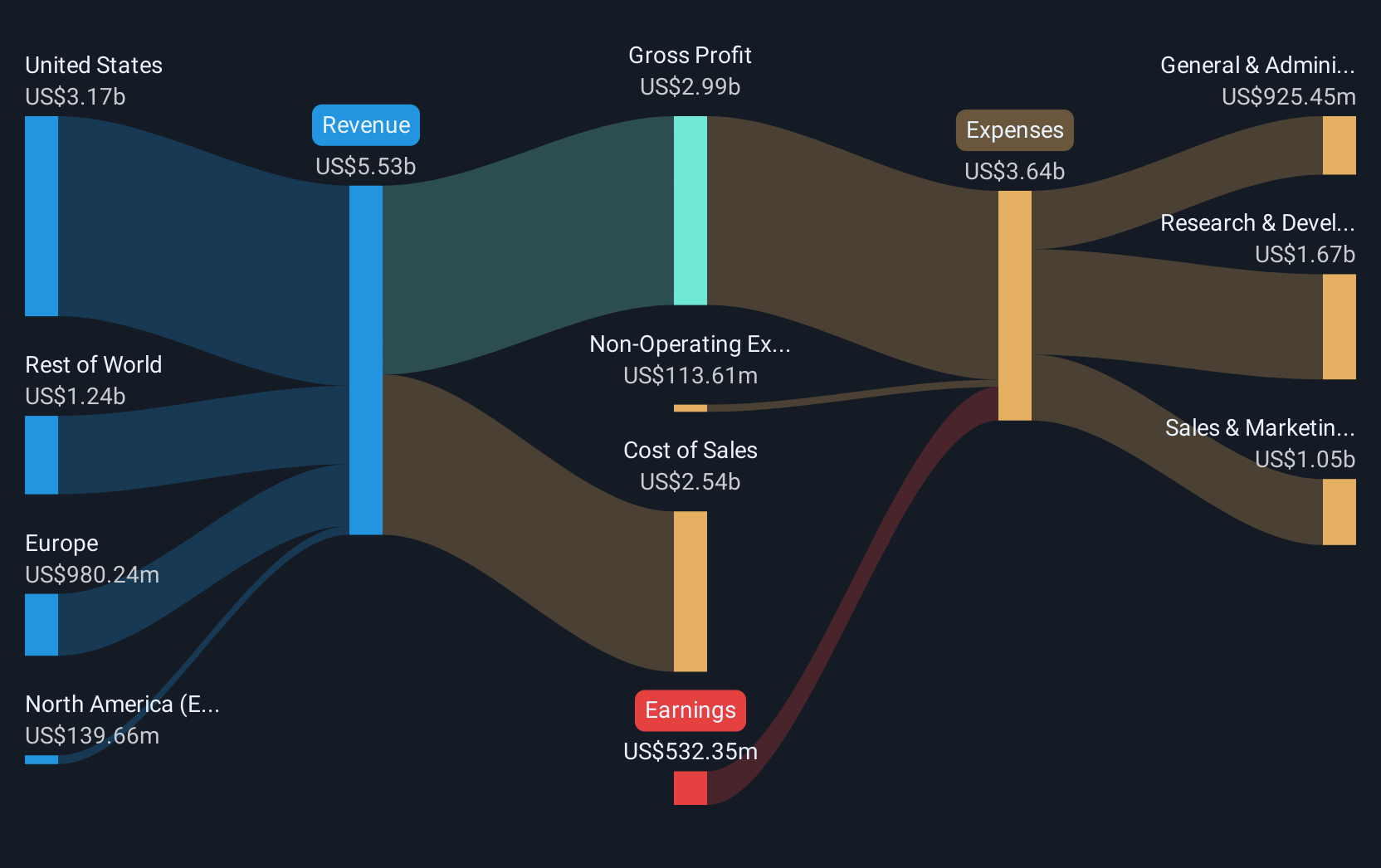

Operations: Snap Inc. generates revenue primarily through its Software & Programming segment, amounting to $5.17 billion. The company operates across various regions, including North America and Europe, contributing to its diverse market presence.

Snap's trajectory in the high-growth tech landscape is marked by its robust revenue growth forecast at 11% annually, outpacing the US market average of 8.8%. Despite current unprofitability, Snap is poised for a significant turnaround with earnings expected to surge by 58.84% per year, positioning it for profitability within three years. This potential is underscored by recent strategic hires, such as Ankit Goyle from Apple, aimed at bolstering its marketing efforts in key markets like India. However, the company faces challenges from recent lawsuits alleging that social media platforms have contributed to a public health crisis among youth—an issue that could impact brand reputation and user engagement moving forward.

- Click to explore a detailed breakdown of our findings in Snap's health report.

Evaluate Snap's historical performance by accessing our past performance report.

Summing It All Up

- Unlock our comprehensive list of 232 US High Growth Tech and AI Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Natera might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTRA

Natera

A diagnostics company, develops and commercializes molecular testing services worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives