- United States

- /

- Medical Equipment

- /

- NasdaqGS:TMCI

Talkspace Leads These 3 Promising Penny Stocks

Reviewed by Simply Wall St

The U.S. stock market has been experiencing mixed movements, with the Dow Jones Industrial Average recently setting a new all-time high while the Nasdaq and S&P 500 have pulled back due to concerns over tech stocks. Despite these fluctuations, certain investment opportunities continue to capture attention, particularly in areas that offer affordability and potential growth. Penny stocks, though an outdated term, still represent smaller or newer companies that can provide significant value when backed by strong financials and clear growth paths.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.10 | $435.04M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.75 | $614.83M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.8895 | $151.06M | ✅ 4 ⚠️ 2 View Analysis > |

| LexinFintech Holdings (LX) | $3.235 | $545.17M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.28 | $1.39B | ✅ 5 ⚠️ 1 View Analysis > |

| CI&T (CINT) | $4.52 | $588.07M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 1 ⚠️ 5 View Analysis > |

| VAALCO Energy (EGY) | $3.54 | $369.07M | ✅ 2 ⚠️ 3 View Analysis > |

| BAB (BABB) | $0.8886 | $6.25M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.42 | $104.67M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 342 stocks from our US Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Talkspace (TALK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Talkspace, Inc. is a virtual behavioral healthcare company that connects patients with licensed mental health providers in the United States, with a market cap of approximately $536.73 million.

Operations: The company's revenue is generated from its Healthcare Facilities & Services segment, which amounted to $214.59 million.

Market Cap: $536.73M

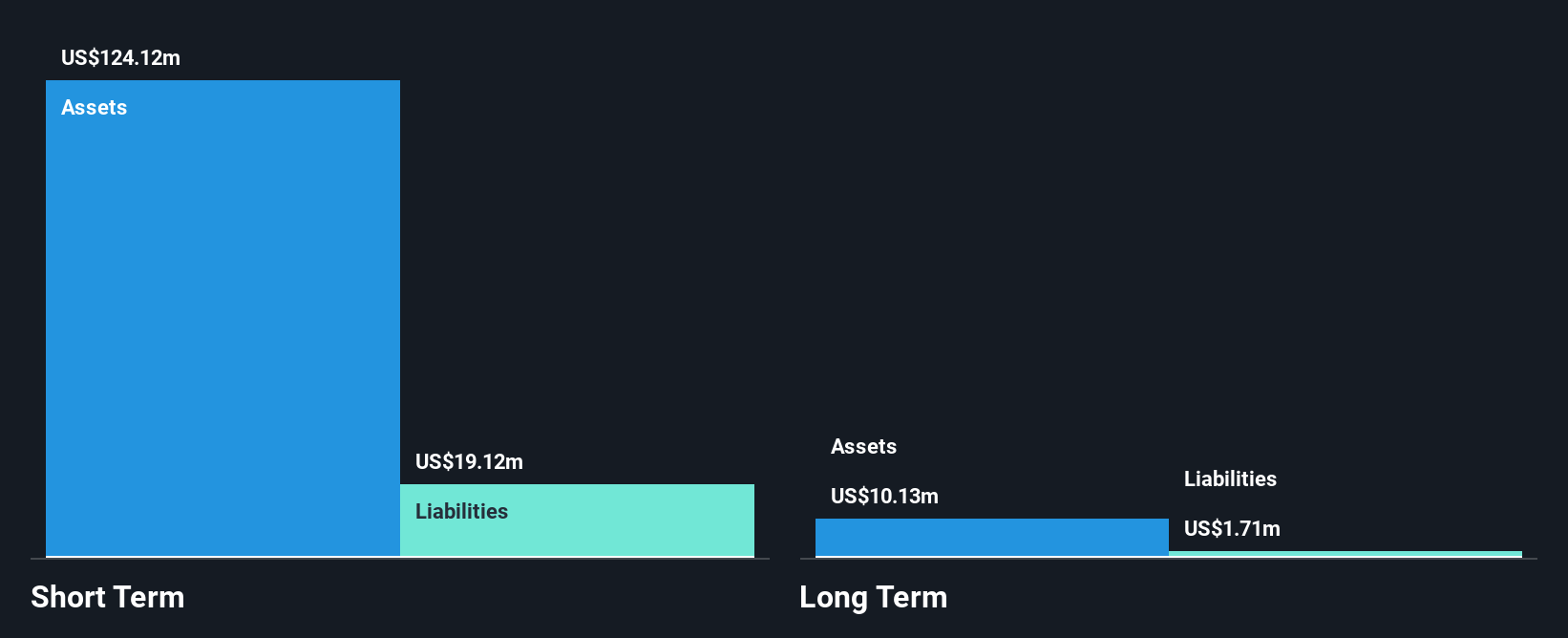

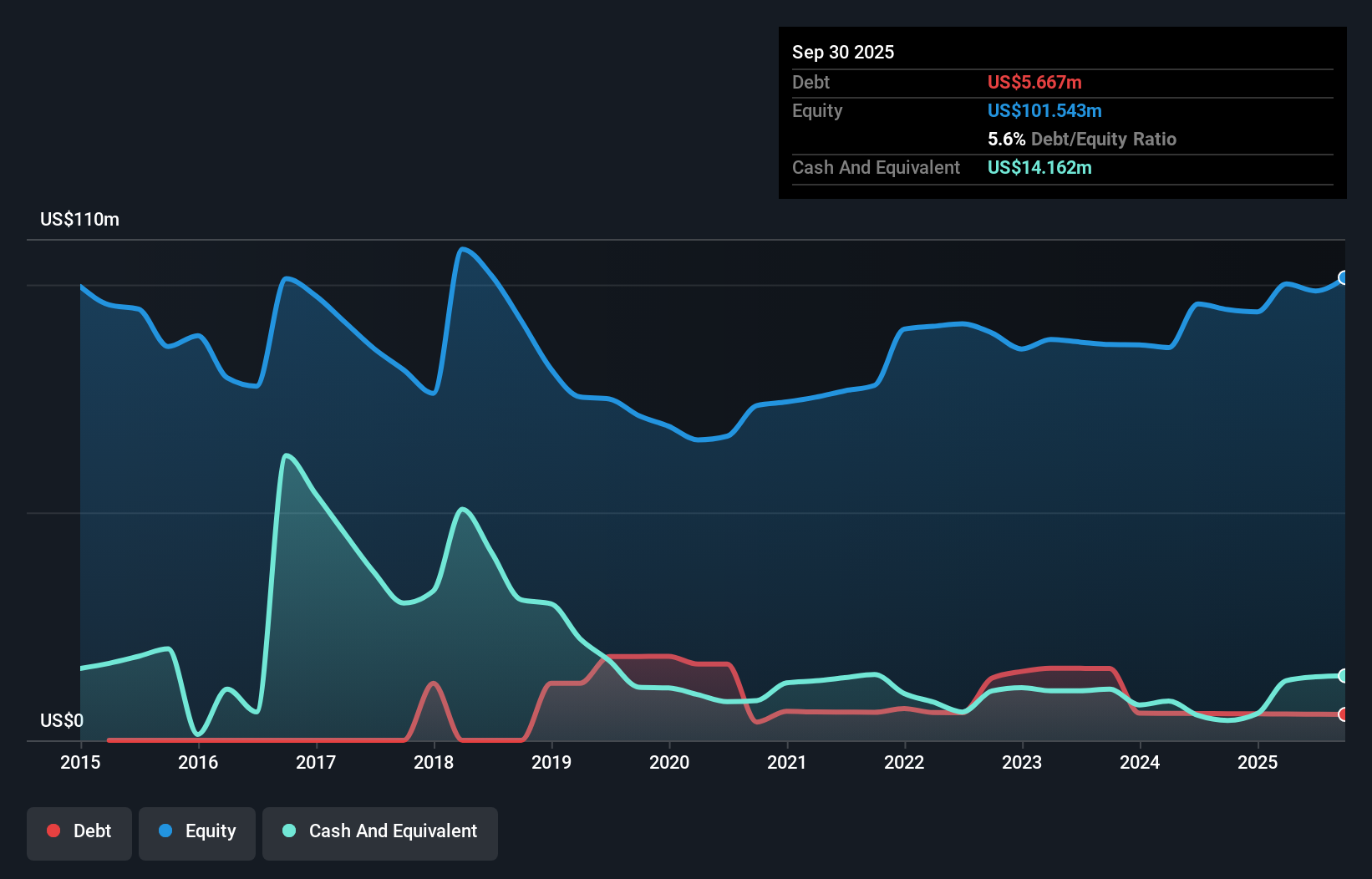

Talkspace, Inc. has shown resilience in the penny stock landscape with a market cap of approximately US$536.73 million and recent profitability. The company's short-term assets significantly exceed its liabilities, providing a strong financial footing without debt concerns. With earnings recently turning positive, Talkspace's revenue for Q3 2025 reached US$59.38 million, reflecting growth from the previous year. Notably, Talkspace secured a Sourcewell contract to expand its services across North America and launched "Chapters," targeting women's mental health needs through tailored care pathways—demonstrating strategic initiatives to drive future revenue streams and enhance service offerings in underserved markets.

- Jump into the full analysis health report here for a deeper understanding of Talkspace.

- Gain insights into Talkspace's outlook and expected performance with our report on the company's earnings estimates.

Gaia (GAIA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Gaia, Inc. operates a digital video subscription service and online community catering to an underserved member base in the United States, Canada, Australia, and internationally, with a market cap of $93.42 million.

Operations: The company generates a total revenue of $98.62 million from its digital video subscription service and online community across the United States, Canada, Australia, and other international markets.

Market Cap: $93.42M

Gaia, Inc., with a market cap of US$93.42 million, operates in the digital video subscription space and has recently reported Q3 2025 sales of US$24.98 million, an increase from the previous year. Despite being unprofitable, Gaia maintains a positive cash flow with sufficient runway for over three years and no significant shareholder dilution. The company has faced challenges with short-term liabilities exceeding assets but possesses more cash than total debt. Recent executive changes aim to strengthen leadership as Gaia forecasts low double-digit revenue growth for 2026 amidst ongoing volatility in its stock price and market positioning efforts through new product launches like Igniton™ supplements.

- Get an in-depth perspective on Gaia's performance by reading our balance sheet health report here.

- Explore Gaia's analyst forecasts in our growth report.

Treace Medical Concepts (TMCI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Treace Medical Concepts, Inc. is a medical technology company that designs, manufactures, and markets medical devices in the United States with a market cap of approximately $182.23 million.

Operations: The company generates $218.88 million in revenue from its operations focused on the design, manufacture, and marketing of medical devices.

Market Cap: $182.23M

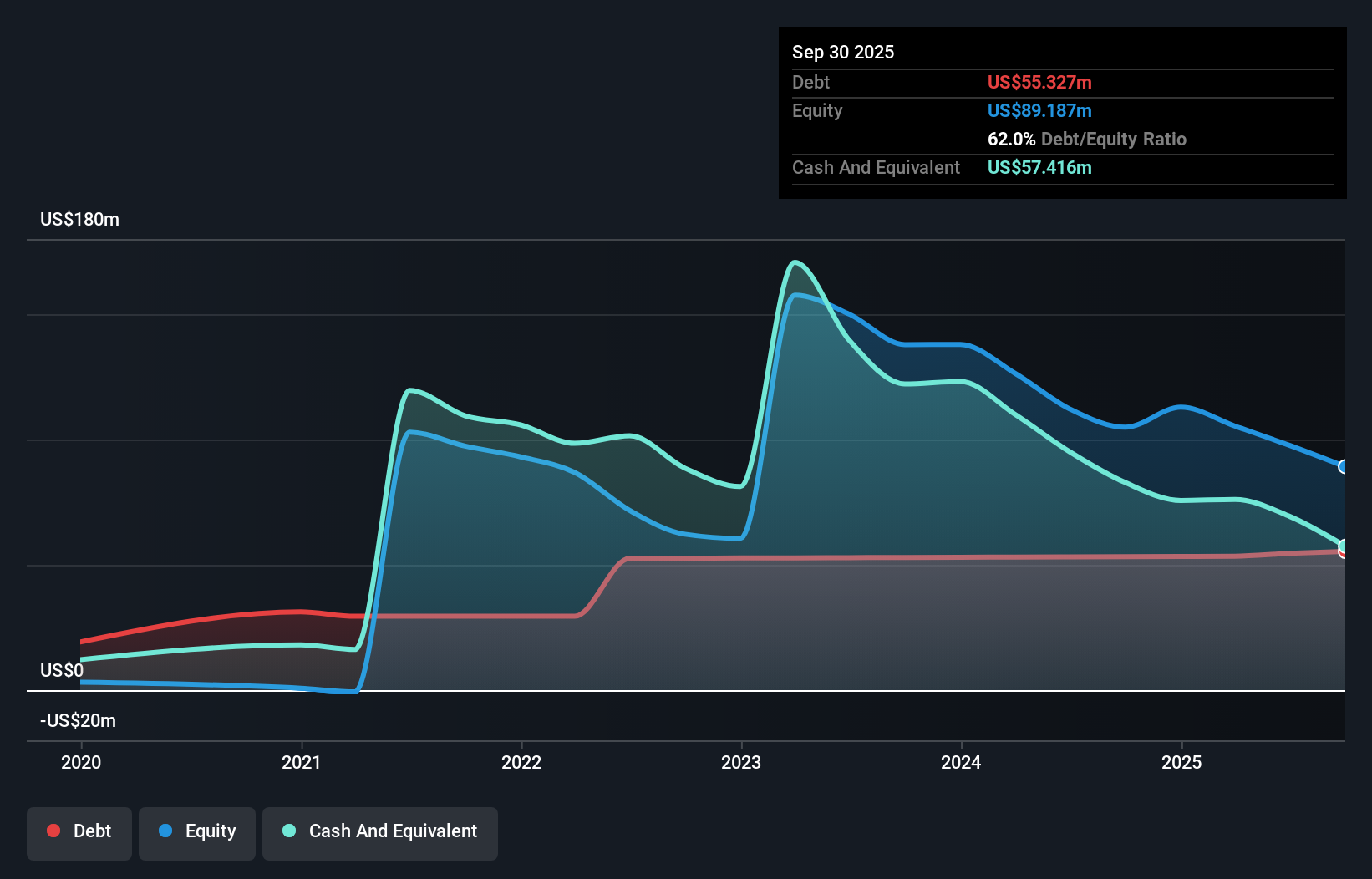

Treace Medical Concepts, Inc. has a market cap of US$182.23 million and reported Q3 2025 sales of US$50.21 million, up from the previous year, though it remains unprofitable with a net loss of US$16.29 million for the quarter. The company revised its 2025 revenue guidance downward to US$211-213 million due to slower growth expectations. Despite volatility in its share price and negative return on equity, Treace benefits from an experienced management team and board, more cash than debt, and sufficient short-term assets to cover liabilities while maintaining a cash runway exceeding one year even if free cash flow declines continue.

- Navigate through the intricacies of Treace Medical Concepts with our comprehensive balance sheet health report here.

- Assess Treace Medical Concepts' future earnings estimates with our detailed growth reports.

Turning Ideas Into Actions

- Dive into all 342 of the US Penny Stocks we have identified here.

- Contemplating Other Strategies? Uncover 10 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Treace Medical Concepts might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TMCI

Treace Medical Concepts

A medical technology company, designs, manufactures, and markets medical devices in the United States.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)