- United States

- /

- Healthtech

- /

- NasdaqGS:SLP

US Growth Companies With High Insider Ownership In January 2025

Reviewed by Simply Wall St

As the U.S. stock market grapples with a tech slump and rising bond yields, investors are closely monitoring economic indicators and Federal Reserve actions for signs of stability. In this environment, growth companies with high insider ownership can offer potential resilience, as they often reflect strong internal confidence and alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.6% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.2% | 66.3% |

| EHang Holdings (NasdaqGM:EH) | 31.4% | 79.6% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 48% |

| BBB Foods (NYSE:TBBB) | 22.9% | 40.7% |

| Smith Micro Software (NasdaqCM:SMSI) | 23.1% | 85.4% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| XPeng (NYSE:XPEV) | 20.7% | 55.8% |

Here we highlight a subset of our preferred stocks from the screener.

Lifeway Foods (NasdaqGM:LWAY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lifeway Foods, Inc. is a company that produces and markets probiotic-based products both in the United States and internationally, with a market cap of approximately $332.63 million.

Operations: The company generates revenue primarily from its Cultured Dairy Products segment, which accounts for $181.98 million.

Insider Ownership: 40%

Lifeway Foods, a leading U.S. supplier of kefir products, forecasts revenue growth at 11.4% annually, outpacing the broader U.S. market's 9%. Despite recent insider selling, Lifeway's earnings are projected to grow significantly at 24.3% per year. The company rejected Danone's acquisition offer for undervaluing its potential amidst ongoing investor activism and management disputes. Lifeway continues to innovate with new product lines and expand distribution internationally, supporting sustained growth prospects under CEO Julie Smolyansky’s leadership.

- Unlock comprehensive insights into our analysis of Lifeway Foods stock in this growth report.

- Insights from our recent valuation report point to the potential undervaluation of Lifeway Foods shares in the market.

Simulations Plus (NasdaqGS:SLP)

Simply Wall St Growth Rating: ★★★★☆☆

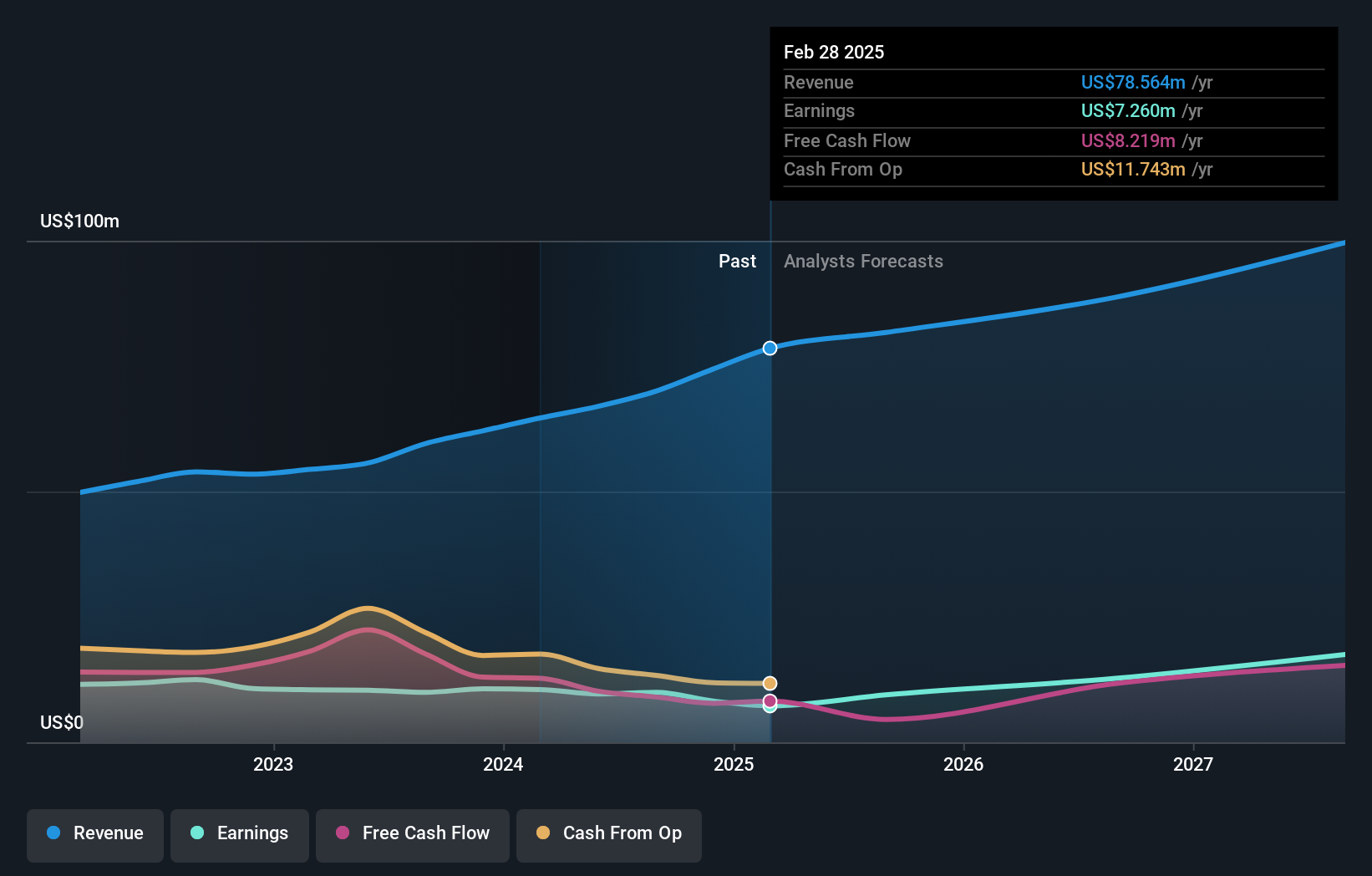

Overview: Simulations Plus, Inc. develops software for drug discovery and development that utilizes artificial intelligence and machine learning for modeling, simulation, and prediction of molecular properties worldwide, with a market cap of $567.61 million.

Operations: The company's revenue is derived from two main segments: Services, contributing $30.29 million, and Software, generating $44.15 million.

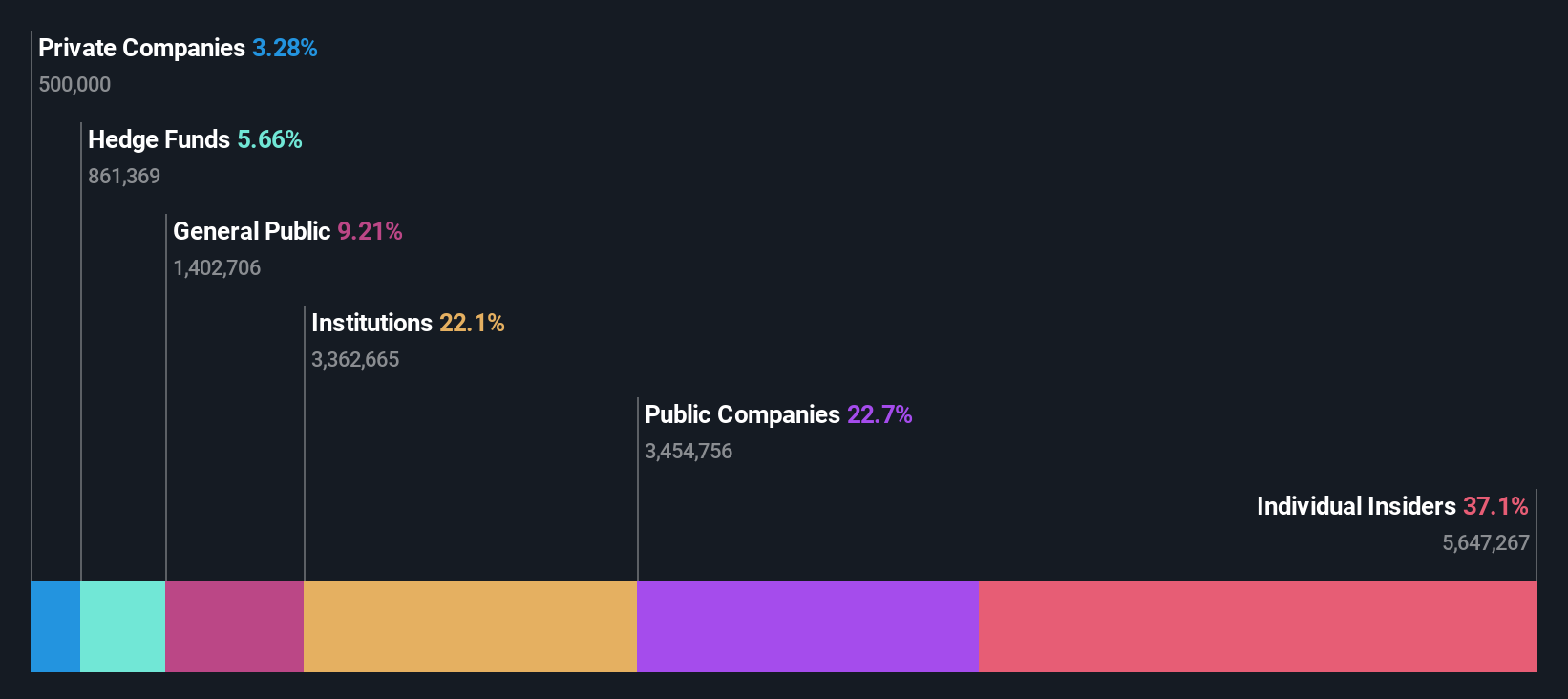

Insider Ownership: 17.9%

Simulations Plus anticipates revenue growth between US$90 million and US$93 million for fiscal 2025, supported by a recent FDA grant to advance its GastroPlus platform. Despite lower profit margins compared to last year, earnings are forecasted to grow significantly at 32.18% annually, outpacing the U.S. market's average. The company is actively pursuing acquisitions to complement organic growth, though insider trading activity has been minimal recently.

- Dive into the specifics of Simulations Plus here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Simulations Plus is priced higher than what may be justified by its financials.

Dingdong (Cayman) (NYSE:DDL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dingdong (Cayman) Limited is an e-commerce company operating in China with a market cap of approximately $695.42 million.

Operations: The company's revenue is primarily derived from its online retail operations, amounting to CN¥22.15 billion.

Insider Ownership: 28.2%

Dingdong (Cayman) Limited has demonstrated significant growth, with third-quarter revenue rising to CNY 6.54 billion and net income reaching CNY 133.41 million, a substantial increase from the previous year. The company has raised its financial guidance for the fourth quarter and full year of 2024, expecting GAAP profits. Despite high share price volatility, Dingdong's earnings are forecasted to grow significantly at 44.2% annually, though revenue growth lags behind the U.S. market average.

- Take a closer look at Dingdong (Cayman)'s potential here in our earnings growth report.

- Our valuation report unveils the possibility Dingdong (Cayman)'s shares may be trading at a discount.

Summing It All Up

- Take a closer look at our Fast Growing US Companies With High Insider Ownership list of 205 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SLP

Simulations Plus

Develops drug discovery and development software for modeling and simulation, and prediction of molecular properties utilizing artificial intelligence and machine learning based technology worldwide.

Flawless balance sheet with reasonable growth potential.