- United States

- /

- Healthtech

- /

- NasdaqGS:SLP

3 Intriguing Stocks Estimated At Up To 42.7% Below Intrinsic Value

Reviewed by Simply Wall St

As the United States market grapples with renewed trade tensions and fluctuating indices, investors are keenly observing the impact on economic growth and corporate profits. In such a volatile environment, identifying stocks trading below their intrinsic value can present unique opportunities for those looking to capitalize on potential mispricings.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Berkshire Hills Bancorp (NYSE:BHLB) | $25.09 | $50.02 | 49.8% |

| UMH Properties (NYSE:UMH) | $16.38 | $32.38 | 49.4% |

| Super Group (SGHC) (NYSE:SGHC) | $8.37 | $16.54 | 49.4% |

| Burke & Herbert Financial Services (NasdaqCM:BHRB) | $55.59 | $108.72 | 48.9% |

| Advanced Flower Capital (NasdaqGM:AFCG) | $4.83 | $9.39 | 48.6% |

| Hims & Hers Health (NYSE:HIMS) | $53.52 | $106.29 | 49.6% |

| Finward Bancorp (NasdaqCM:FNWD) | $30.00 | $59.39 | 49.5% |

| TXO Partners (NYSE:TXO) | $15.30 | $29.97 | 49% |

| ZEEKR Intelligent Technology Holding (NYSE:ZK) | $29.40 | $57.19 | 48.6% |

| Agora (NasdaqGS:API) | $3.68 | $7.25 | 49.2% |

Underneath we present a selection of stocks filtered out by our screen.

Simulations Plus (NasdaqGS:SLP)

Overview: Simulations Plus, Inc. develops drug discovery and development software that leverages artificial intelligence and machine learning for modeling, simulation, and molecular property prediction globally, with a market cap of $637.52 million.

Operations: The company's revenue is derived from two main segments: Services, which generated $32.54 million, and Software, contributing $46.02 million.

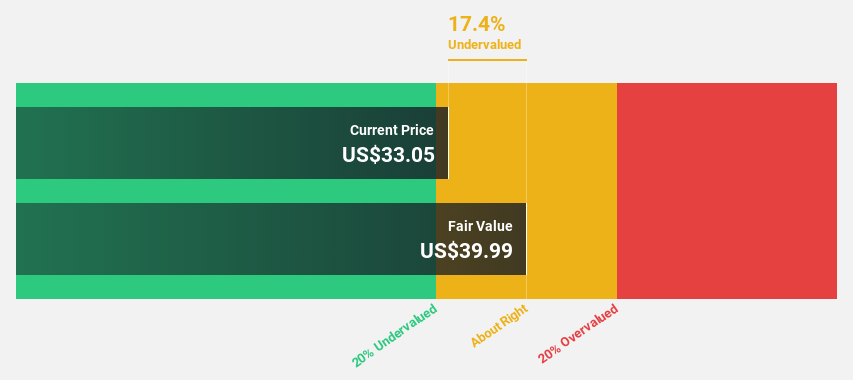

Estimated Discount To Fair Value: 18.9%

Simulations Plus is trading at US$32.49, approximately 18.9% below its estimated fair value of US$40.08, indicating potential undervaluation based on cash flows. Despite a decline in profit margins from 16.3% to 9.2%, the company expects revenue growth between US$90 million and US$93 million for 2025, supported by new product releases like DILIsym 11 and alignment with FDA initiatives to reduce animal testing, potentially driving future earnings growth significantly above market rates.

- Our expertly prepared growth report on Simulations Plus implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Simulations Plus.

Sportradar Group (NasdaqGS:SRAD)

Overview: Sportradar Group AG, along with its subsidiaries, offers sports data services to the sports betting and media industries across various global regions, with a market cap of approximately $6.97 billion.

Operations: The company generates revenue primarily from its Data Processing segment, which amounts to €1.15 billion.

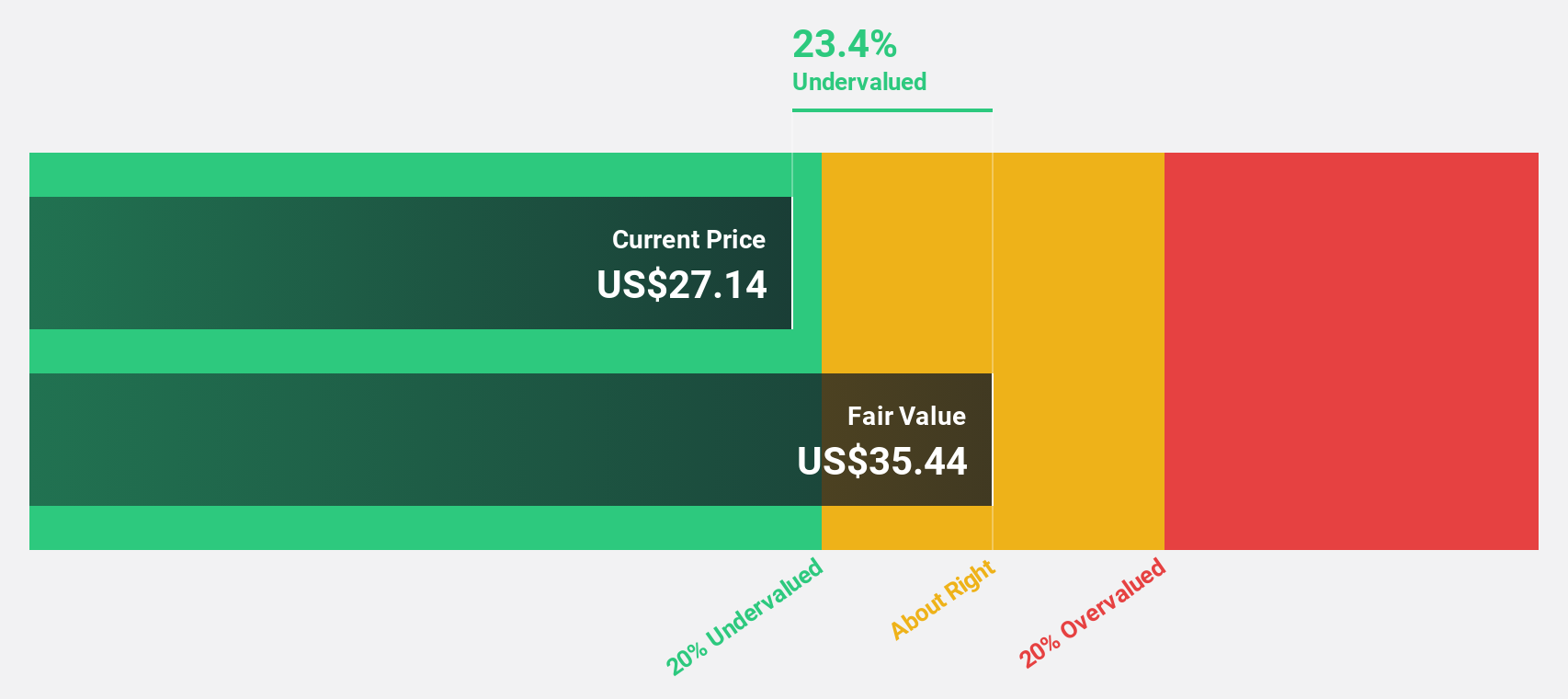

Estimated Discount To Fair Value: 32.9%

Sportradar Group, trading at $23.71, is valued 32.9% below its estimated fair value of $35.32, highlighting potential undervaluation based on cash flows. The company reported a significant turnaround with net income of €24.21 million in Q1 2025 compared to a loss the previous year and expects revenue growth of at least 15% for fiscal 2025. Despite low forecasted return on equity, earnings are projected to grow significantly faster than the US market average over the next three years.

- Insights from our recent growth report point to a promising forecast for Sportradar Group's business outlook.

- Unlock comprehensive insights into our analysis of Sportradar Group stock in this financial health report.

Fiverr International (NYSE:FVRR)

Overview: Fiverr International Ltd. operates a global online marketplace and has a market cap of approximately $1.16 billion.

Operations: The company's revenue is primarily generated from its Internet Software & Services segment, totaling $405.14 million.

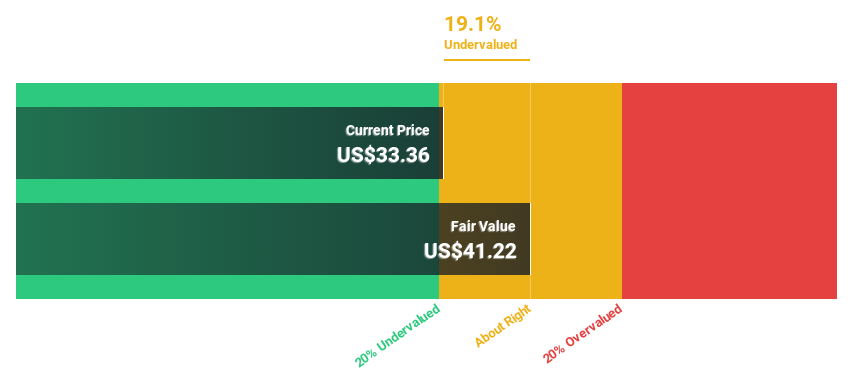

Estimated Discount To Fair Value: 42.7%

Fiverr International, trading at US$33.15, is considered undervalued with a fair value estimate of US$57.86. The company raised its 2025 revenue guidance to between US$425 million and US$438 million, reflecting growth expectations of 9% to 12%. Earnings are expected to grow significantly at 38.4% annually over the next three years, outpacing the broader market's growth rate. A share repurchase program worth up to $100 million further underscores potential shareholder value enhancement.

- According our earnings growth report, there's an indication that Fiverr International might be ready to expand.

- Click to explore a detailed breakdown of our findings in Fiverr International's balance sheet health report.

Taking Advantage

- Take a closer look at our Undervalued US Stocks Based On Cash Flows list of 169 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Simulations Plus, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SLP

Simulations Plus

Develops drug discovery and development software for modeling and simulation, and prediction of molecular properties utilizing artificial intelligence and machine learning based technology worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives