- United States

- /

- Electrical

- /

- NYSE:GEV

3 US Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As the Nasdaq Composite hits record highs and the Dow Jones Industrial Average experiences its eighth consecutive day of decline, investors are closely watching market movements ahead of the Federal Reserve's interest rate decision. In this fluctuating environment, identifying stocks that may be trading below their estimated value can offer opportunities for those looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| UMB Financial (NasdaqGS:UMBF) | $123.38 | $244.22 | 49.5% |

| Business First Bancshares (NasdaqGS:BFST) | $27.78 | $54.95 | 49.4% |

| Sensus Healthcare (NasdaqCM:SRTS) | $7.97 | $15.58 | 48.9% |

| West Bancorporation (NasdaqGS:WTBA) | $23.63 | $46.43 | 49.1% |

| Equity Bancshares (NYSE:EQBK) | $46.66 | $92.69 | 49.7% |

| U.S. Physical Therapy (NYSE:USPH) | $95.56 | $187.03 | 48.9% |

| Constellium (NYSE:CSTM) | $11.01 | $21.77 | 49.4% |

| Privia Health Group (NasdaqGS:PRVA) | $21.87 | $43.17 | 49.3% |

| Equifax (NYSE:EFX) | $273.50 | $534.38 | 48.8% |

| Vertex Pharmaceuticals (NasdaqGS:VRTX) | $468.09 | $913.78 | 48.8% |

Here we highlight a subset of our preferred stocks from the screener.

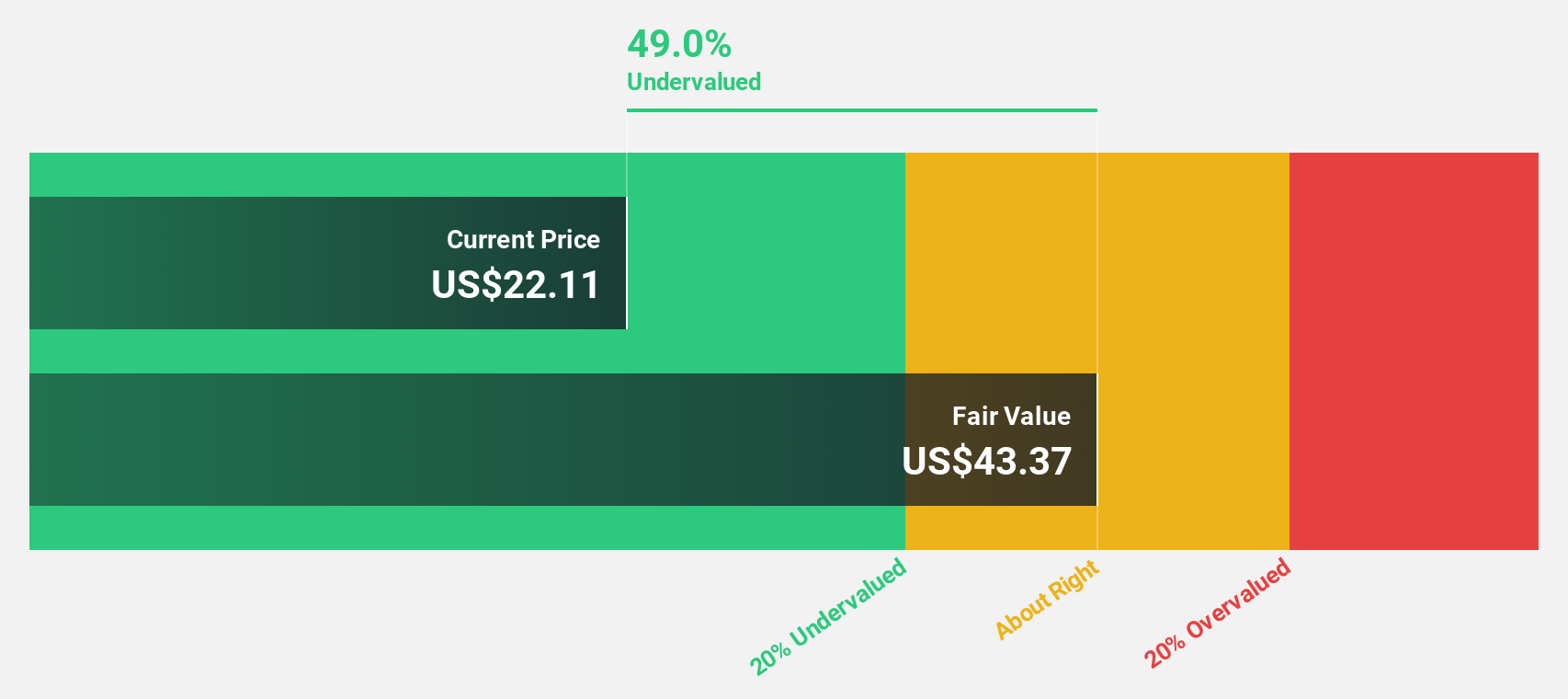

Privia Health Group (NasdaqGS:PRVA)

Overview: Privia Health Group, Inc. is a national physician-enablement company operating in the United States with a market cap of $2.52 billion.

Operations: Privia Health Group generates revenue primarily from its Healthcare Facilities & Services segment, totaling $1.72 billion.

Estimated Discount To Fair Value: 49.3%

Privia Health Group is trading at US$21.87, significantly below its estimated fair value of US$43.17, suggesting it may be undervalued based on cash flows. Despite a recent decline in net income and profit margins, the company forecasts strong earnings growth of 39% per year, outpacing the broader U.S. market's expected growth rate. Additionally, Privia has raised its full-year revenue guidance and filed a significant shelf registration for future offerings.

- Our earnings growth report unveils the potential for significant increases in Privia Health Group's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Privia Health Group.

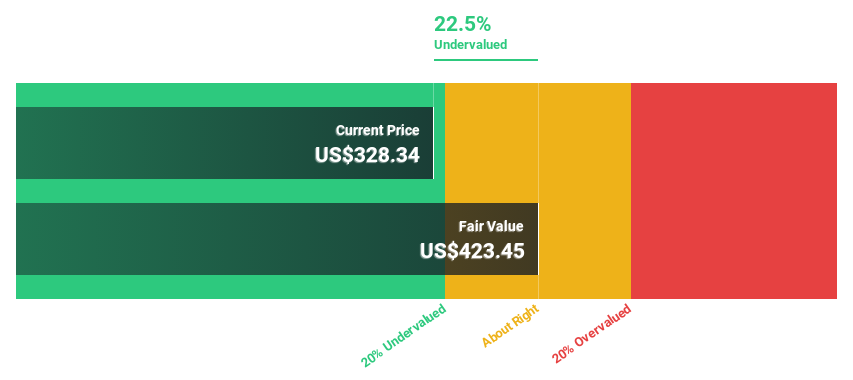

GE Vernova (NYSE:GEV)

Overview: GE Vernova Inc. is an energy company that provides products and services for generating, transferring, orchestrating, converting, and storing electricity across multiple regions including the United States, Europe, Asia, the Americas, the Middle East, and Africa with a market cap of $91.52 billion.

Operations: The company's revenue segments include Wind at $9.18 billion, Power at $18.29 billion, and Electrification at $7.34 billion.

Estimated Discount To Fair Value: 20.3%

GE Vernova is trading at US$337.71, below its estimated fair value of US$423.54, indicating potential undervaluation based on cash flows. The company has become profitable this year and forecasts earnings growth of 27.75% annually, surpassing the U.S. market's growth rate. Recent strategic moves include a share repurchase program worth up to $6 billion and involvement in innovative projects like the Whyalla hydrogen power plant, enhancing its investment appeal despite slower revenue growth projections compared to the market.

- Our growth report here indicates GE Vernova may be poised for an improving outlook.

- Take a closer look at GE Vernova's balance sheet health here in our report.

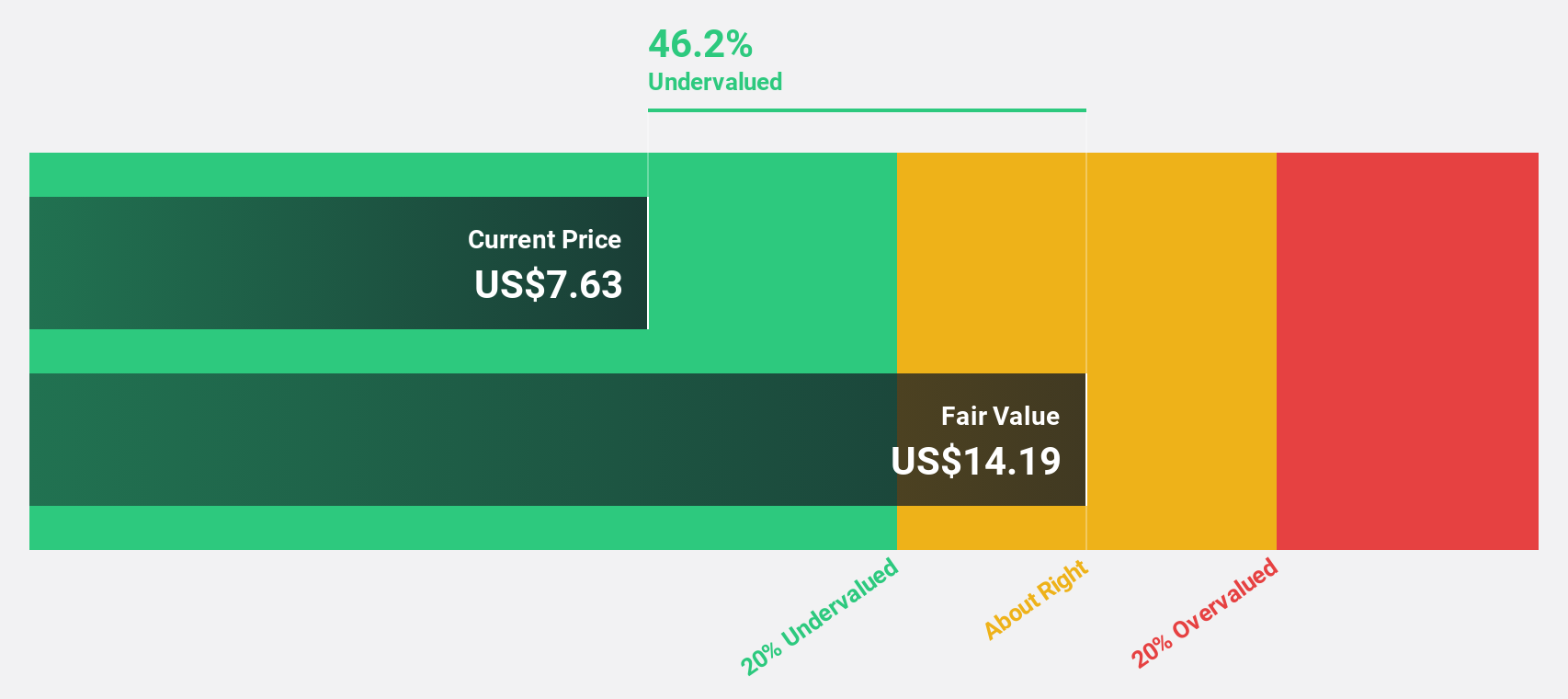

Similarweb (NYSE:SMWB)

Overview: Similarweb Ltd. offers cloud-based digital intelligence solutions across various regions, including the United States, Europe, and Asia Pacific, with a market cap of approximately $1.04 billion.

Operations: The company's revenue segment includes online financial information providers, generating $241.08 million.

Estimated Discount To Fair Value: 27.4%

Similarweb Ltd. is trading at US$13.15, below its estimated fair value of US$18.12, suggesting undervaluation based on cash flows. The company reported Q3 2024 sales of US$64.71 million, up from the previous year, and reduced net loss to US$2.57 million from US$4.84 million a year ago. With an expected annual profit growth rate of 126.3% and forecasted profitability within three years, Similarweb's revenue growth outpaces the U.S market average despite recent shareholder dilution.

- According our earnings growth report, there's an indication that Similarweb might be ready to expand.

- Dive into the specifics of Similarweb here with our thorough financial health report.

Next Steps

- Unlock more gems! Our Undervalued US Stocks Based On Cash Flows screener has unearthed 185 more companies for you to explore.Click here to unveil our expertly curated list of 188 Undervalued US Stocks Based On Cash Flows.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GEV

GE Vernova

An energy company, engages in the provision of various products and services that generate, transfer, orchestrate, convert, and store electricity in the United States, Europe, Asia, the Americas, the Middle East, and Africa.

Flawless balance sheet with reasonable growth potential.