- United States

- /

- Medical Equipment

- /

- NasdaqGM:PRCT

PROCEPT BioRobotics (PRCT): Reassessing Valuation After BofA Downgrade and Slower Aquablation Growth Concerns

Reviewed by Simply Wall St

BofA Securities just cooled on PROCEPT BioRobotics (PRCT), downgrading the stock to neutral after flagging slower utilization of its aquablation systems and softer system sales as hospital capital budgets tighten.

See our latest analysis for PROCEPT BioRobotics.

Investors have already been wrestling with this shift in sentiment, with a 1 month share price return of 13.94 percent offering only a brief rebound against a year to date share price loss of 57.06 percent and a 1 year total shareholder return of negative 60.24 percent, suggesting momentum has clearly faded despite the long run opportunity narrative.

If this cautious mood around hospital capital spending has you reassessing your exposure in healthcare, it could be a good moment to explore other healthcare stocks that might offer a more balanced mix of growth and resilience.

With shares still trading almost 40 percent below the average analyst price target but growth clearly decelerating, is PROCEPT BioRobotics now an undervalued growth story in a temporary pause, or is the market rightly pricing in a slower trajectory?

Most Popular Narrative: 31.5% Undervalued

With PROCEPT BioRobotics last closing at $35.71 against a narrative fair value of $52.10, the spread suggests investors may be overlooking embedded growth expectations.

The ongoing expansion of HYDROS robotic system placements into both high volume and mid/lower volume hospitals, in conjunction with rising utilization by a growing base of engaged surgeons, indicates significant untapped market potential driving recurring consumables revenue growth and eventual expansion in gross and operating margins.

Curious how ambitious revenue ramps, rising margins and a rich future earnings multiple can still point to upside from here? The narrative unpacks a high growth runway, bold profitability assumptions and a valuation framework usually reserved for category leaders. Want to see the exact combination of growth, margins and multiples that supports that fair value target? Dive in to see what is really built into this optimistic roadmap.

Result: Fair Value of $52.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained operating losses and slower than expected Aquablation adoption could undermine the bullish growth narrative and force a rethink on valuation assumptions.

Find out about the key risks to this PROCEPT BioRobotics narrative.

Another Lens on Valuation

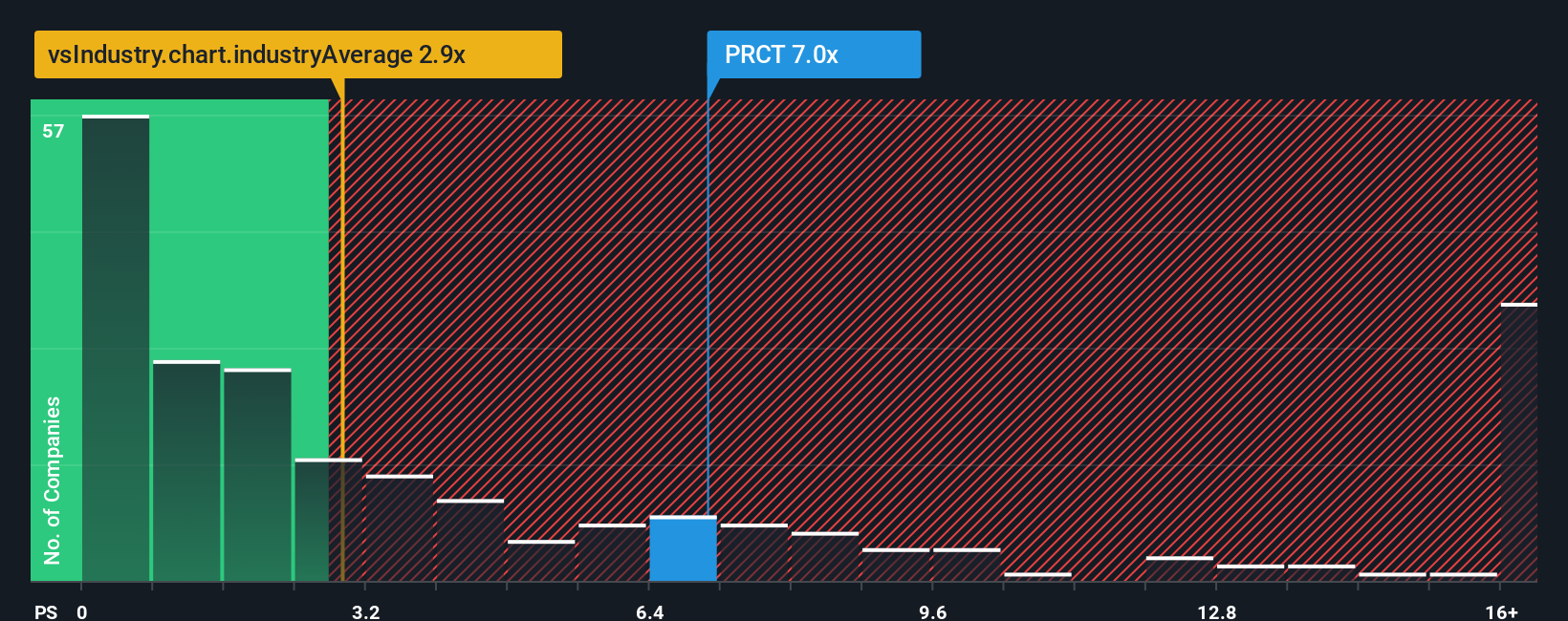

Price targets hint at upside, but the current price to sales ratio of 6.7 times versus a fair ratio of 4 times and a Medical Equipment industry average of 3.4 times paints PROCEPT BioRobotics as plainly expensive. Is the market overpaying for growth that may already be priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own PROCEPT BioRobotics Narrative

If you would rather dig into the numbers yourself and challenge these assumptions, you can build a personalized view in just minutes: Do it your way.

A great starting point for your PROCEPT BioRobotics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider your next potential opportunity by scanning fresh ideas from our screeners built to highlight resilient businesses.

- Review these 3602 penny stocks with strong financials that already show healthier fundamentals than the typical speculative name.

- Explore these 26 AI penny stocks positioned at the intersection of innovation and accelerating enterprise demand.

- Evaluate these 12 dividend stocks with yields > 3% that focus on income while maintaining quality balance sheets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:PRCT

PROCEPT BioRobotics

A surgical robotics company, focuses on developing transformative solutions in urology in the United States and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026