- United States

- /

- Software

- /

- NasdaqGS:MNDY

3 Undervalued US Stocks Estimated To Be Up To 30.8% Below Intrinsic Value

Reviewed by Simply Wall St

As the U.S. stock market wraps up a strong year with a slight downturn, major indices like the Dow Jones Industrial Average and S&P 500 have experienced notable monthly losses despite impressive annual gains. In this context of fluctuating performance, identifying undervalued stocks becomes crucial for investors aiming to capitalize on potential market inefficiencies and intrinsic value discrepancies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| First Solar (NasdaqGS:FSLR) | $176.24 | $350.71 | 49.7% |

| Camden National (NasdaqGS:CAC) | $42.74 | $84.45 | 49.4% |

| Ally Financial (NYSE:ALLY) | $36.01 | $71.71 | 49.8% |

| HealthEquity (NasdaqGS:HQY) | $95.95 | $189.22 | 49.3% |

| Kanzhun (NasdaqGS:BZ) | $13.80 | $26.99 | 48.9% |

| LifeMD (NasdaqGM:LFMD) | $4.95 | $9.82 | 49.6% |

| Mr. Cooper Group (NasdaqCM:COOP) | $96.01 | $188.12 | 49% |

| Progress Software (NasdaqGS:PRGS) | $65.15 | $129.60 | 49.7% |

| South Atlantic Bancshares (OTCPK:SABK) | $15.94 | $30.95 | 48.5% |

| Repligen (NasdaqGS:RGEN) | $143.94 | $280.90 | 48.8% |

Here's a peek at a few of the choices from the screener.

CyberArk Software (NasdaqGS:CYBR)

Overview: CyberArk Software Ltd. develops, markets, and sells software-based identity security solutions and services globally, with a market cap of approximately $13.93 billion.

Operations: The company generates revenue from its Security Software & Services segment, amounting to $909.46 million.

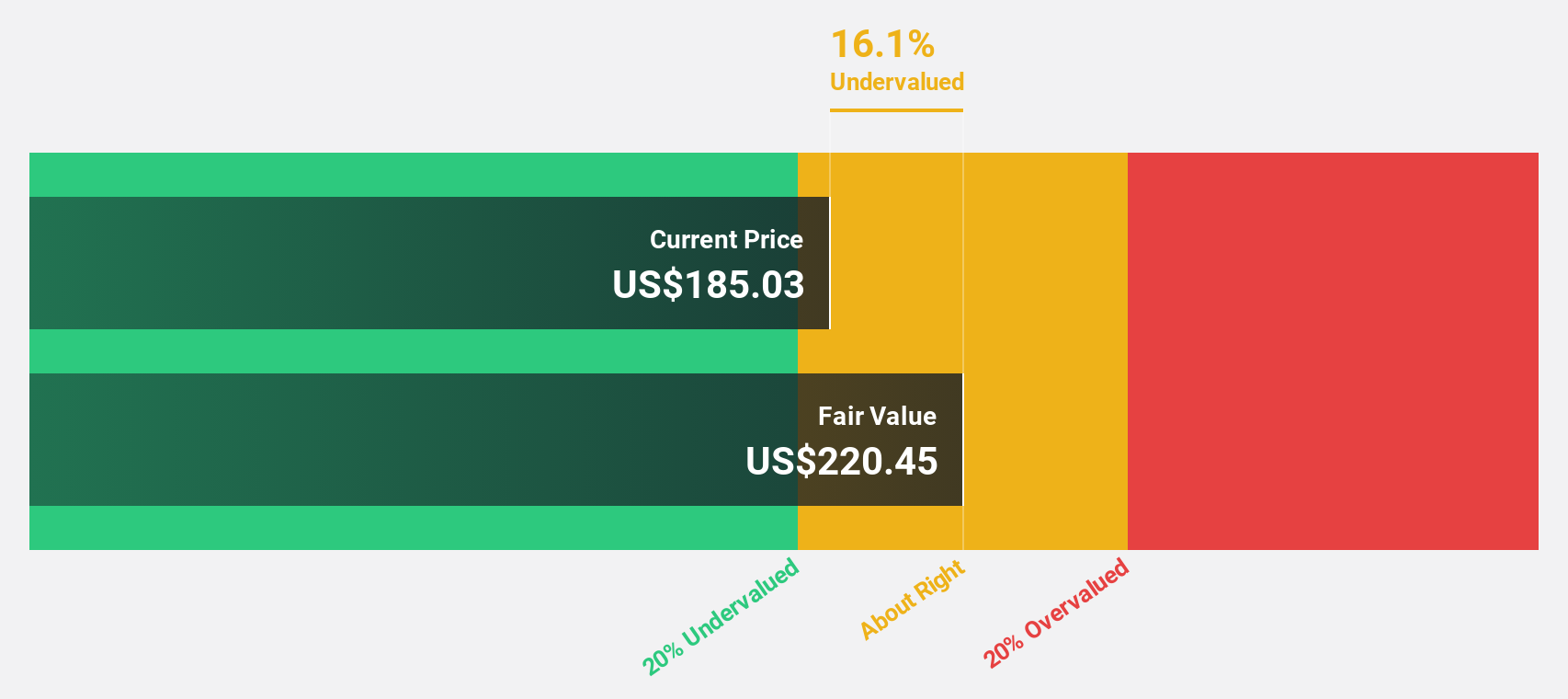

Estimated Discount To Fair Value: 29.8%

CyberArk Software is trading at US$333.15, significantly below its estimated fair value of US$474.53, suggesting it may be undervalued based on cash flows. The company's earnings and revenue are projected to grow faster than the US market, with earnings expected to increase by 32.3% annually. Recent product innovations like FuzzyAI and strategic partnerships enhance its growth potential despite a recent follow-on equity offering that could dilute shares further.

- Upon reviewing our latest growth report, CyberArk Software's projected financial performance appears quite optimistic.

- Take a closer look at CyberArk Software's balance sheet health here in our report.

iRhythm Technologies (NasdaqGS:IRTC)

Overview: iRhythm Technologies, Inc. is a digital healthcare company that designs, develops, and commercializes device-based technology for ambulatory cardiac monitoring services to diagnose arrhythmias in the United States, with a market cap of approximately $2.72 billion.

Operations: The company's revenue is primarily generated from its Medical Labs & Research segment, which amounts to $560.03 million.

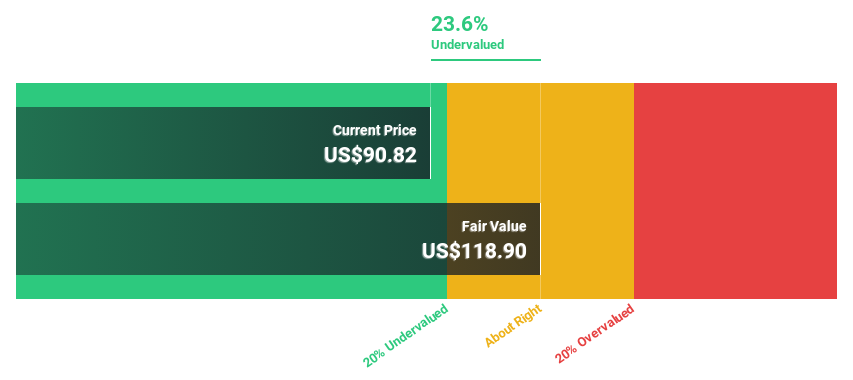

Estimated Discount To Fair Value: 24.1%

iRhythm Technologies is trading at US$90.17, below its estimated fair value of US$118.81, indicating potential undervaluation based on cash flows. Despite recent insider selling and shareholder dilution, the company forecasts revenue growth of 15.1% annually, surpassing the broader US market's growth rate. The FDA clearance for enhancements to its Zio AT device could bolster future performance as iRhythm aims for profitability within three years amidst strong product compliance and physician agreement metrics.

- The growth report we've compiled suggests that iRhythm Technologies' future prospects could be on the up.

- Unlock comprehensive insights into our analysis of iRhythm Technologies stock in this financial health report.

monday.com (NasdaqGS:MNDY)

Overview: monday.com Ltd. develops software applications globally, including in the United States, Europe, the Middle East, Africa, and the United Kingdom, with a market cap of approximately $11.73 billion.

Operations: The company generates revenue of $906.59 million from its Internet Software & Services segment.

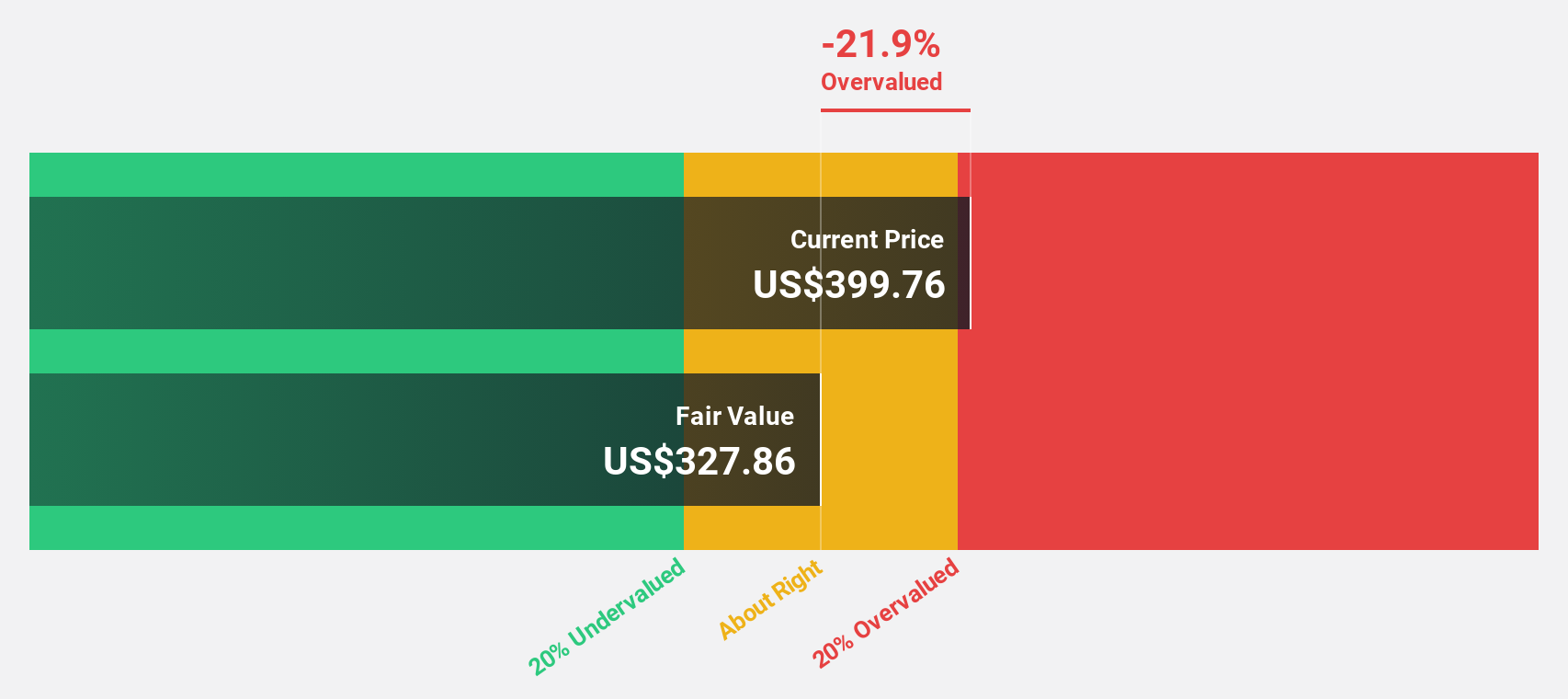

Estimated Discount To Fair Value: 30.8%

monday.com, trading at US$235.44, is undervalued by over 30% based on cash flow estimates with a fair value of US$340.01. Despite past shareholder dilution and a recent net loss of US$12.03 million in Q3 2024, its revenue grew to US$251 million from the previous year and is forecasted to grow significantly faster than the market at over 20% annually, driven by strategic expansions and potential M&A activities.

- The analysis detailed in our monday.com growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of monday.com.

Seize The Opportunity

- Get an in-depth perspective on all 174 Undervalued US Stocks Based On Cash Flows by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MNDY

monday.com

Develops software applications in the United States, Europe, the Middle East, Africa, the United Kingdom, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives