- United States

- /

- Healthcare Services

- /

- NasdaqGS:HQY

Three Stocks That May Be Priced Below Their Intrinsic Estimates In March 2025

Reviewed by Simply Wall St

As the major U.S. stock indexes show signs of recovery following a recent selloff, investors are closely watching the Federal Reserve's decisions for clues about future economic conditions and interest rates. In this environment, identifying stocks that may be priced below their intrinsic value can offer potential opportunities for those looking to navigate market uncertainties effectively.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Dime Community Bancshares (NasdaqGS:DCOM) | $28.21 | $56.29 | 49.9% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | $30.92 | $61.31 | 49.6% |

| Semrush Holdings (NYSE:SEMR) | $9.64 | $18.99 | 49.2% |

| MINISO Group Holding (NYSE:MNSO) | $21.01 | $41.33 | 49.2% |

| Associated Banc-Corp (NYSE:ASB) | $22.44 | $44.84 | 50% |

| Pure Storage (NYSE:PSTG) | $49.87 | $99.55 | 49.9% |

| Smurfit Westrock (NYSE:SW) | $45.07 | $90.05 | 50% |

| KBR (NYSE:KBR) | $50.92 | $101.62 | 49.9% |

| Advanced Micro Devices (NasdaqGS:AMD) | $103.51 | $204.16 | 49.3% |

| Mobileye Global (NasdaqGS:MBLY) | $14.44 | $28.77 | 49.8% |

Let's explore several standout options from the results in the screener.

Celsius Holdings (NasdaqCM:CELH)

Overview: Celsius Holdings, Inc. is engaged in the development, processing, manufacturing, marketing, selling, and distribution of functional energy drinks across the United States and internationally with a market cap of approximately $7.04 billion.

Operations: The company's revenue segment is primarily derived from non-alcoholic beverages, totaling $1.36 billion.

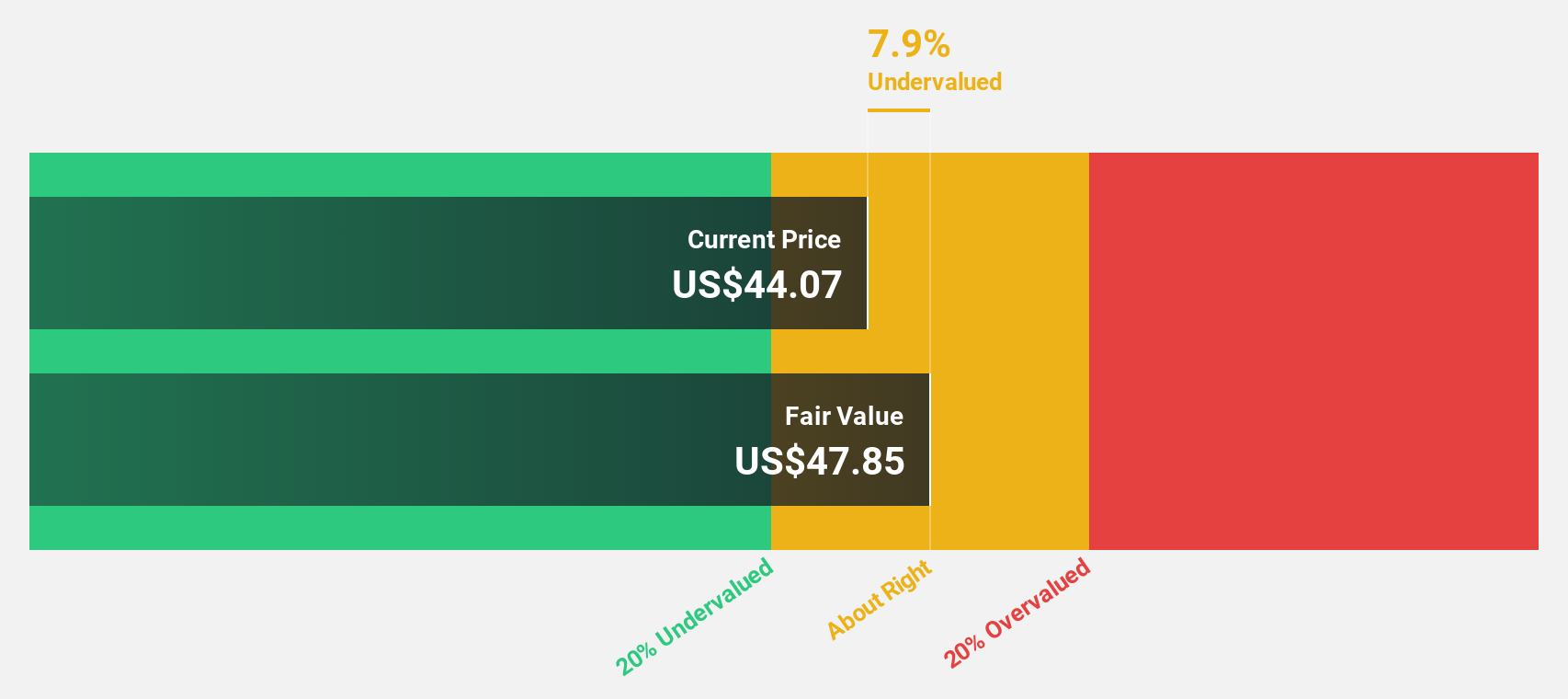

Estimated Discount To Fair Value: 45.7%

Celsius Holdings, trading at US$30.37, is significantly undervalued based on discounted cash flows with an estimated fair value of US$55.92. Despite a recent dip in profit margins to 7.9%, earnings are expected to grow significantly at 25.1% annually, outpacing the broader U.S. market growth rate of 13.9%. The appointment of Eric Hanson as President and COO aims to enhance strategic partnerships and drive future growth in the functional beverage sector.

- The analysis detailed in our Celsius Holdings growth report hints at robust future financial performance.

- Navigate through the intricacies of Celsius Holdings with our comprehensive financial health report here.

Duolingo (NasdaqGS:DUOL)

Overview: Duolingo, Inc. operates as a mobile learning platform in the United States, the United Kingdom, and internationally with a market cap of approximately $13.31 billion.

Operations: The company generates revenue primarily through its educational software segment, which amounted to $748.02 million.

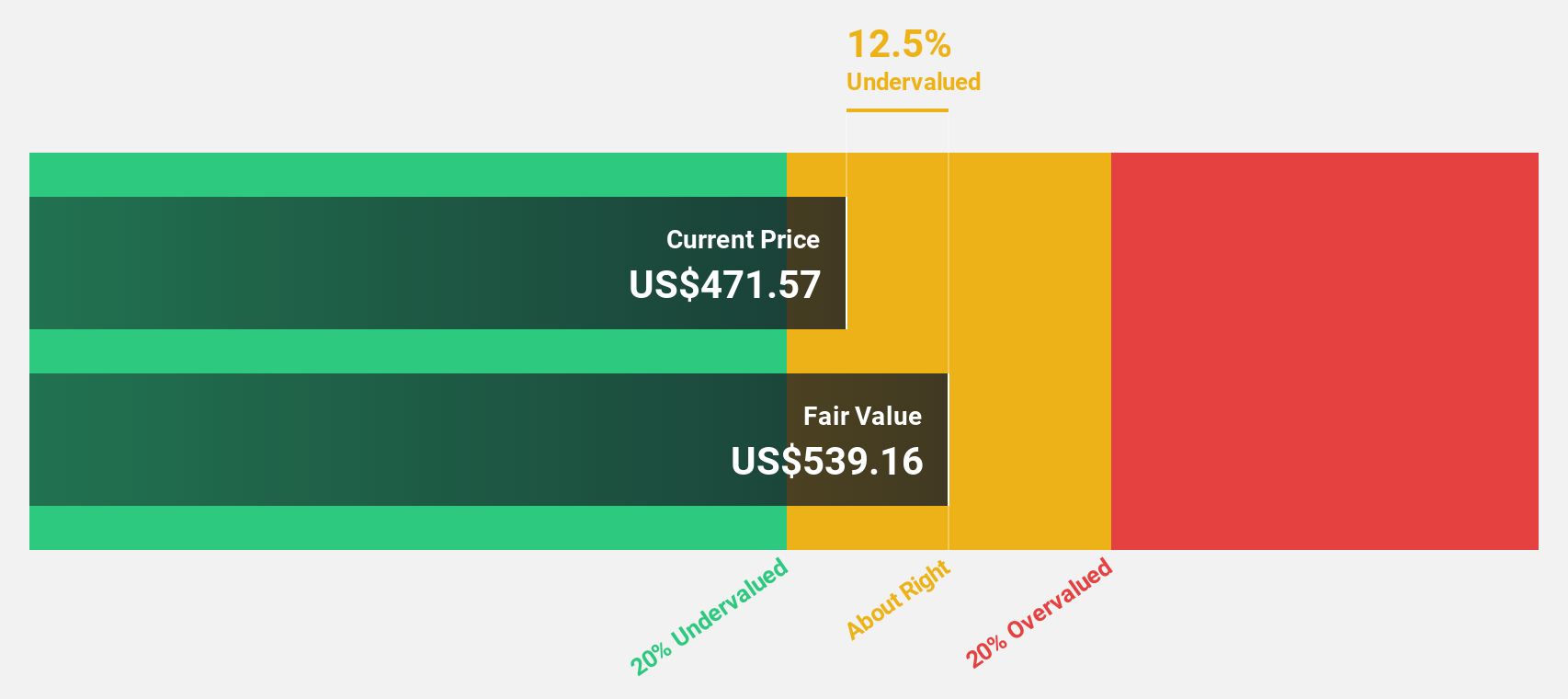

Estimated Discount To Fair Value: 33.1%

Duolingo, currently trading at US$288.81, appears undervalued with a fair value estimate of US$431.9 based on discounted cash flows. Despite significant insider selling recently, the company reported robust financials for 2024 with annual earnings surging to US$88.57 million from US$16.07 million in 2023 and expects further revenue growth between US$962.5 million and US$978.5 million in 2025, outpacing the broader U.S. market's growth rate significantly over the next three years.

- In light of our recent growth report, it seems possible that Duolingo's financial performance will exceed current levels.

- Click here to discover the nuances of Duolingo with our detailed financial health report.

HealthEquity (NasdaqGS:HQY)

Overview: HealthEquity, Inc. offers technology-enabled services platforms for consumers and employers in the United States, with a market cap of approximately $8.73 billion.

Operations: The company generates revenue from its Pharmacy Services segment, which amounted to $1.15 billion.

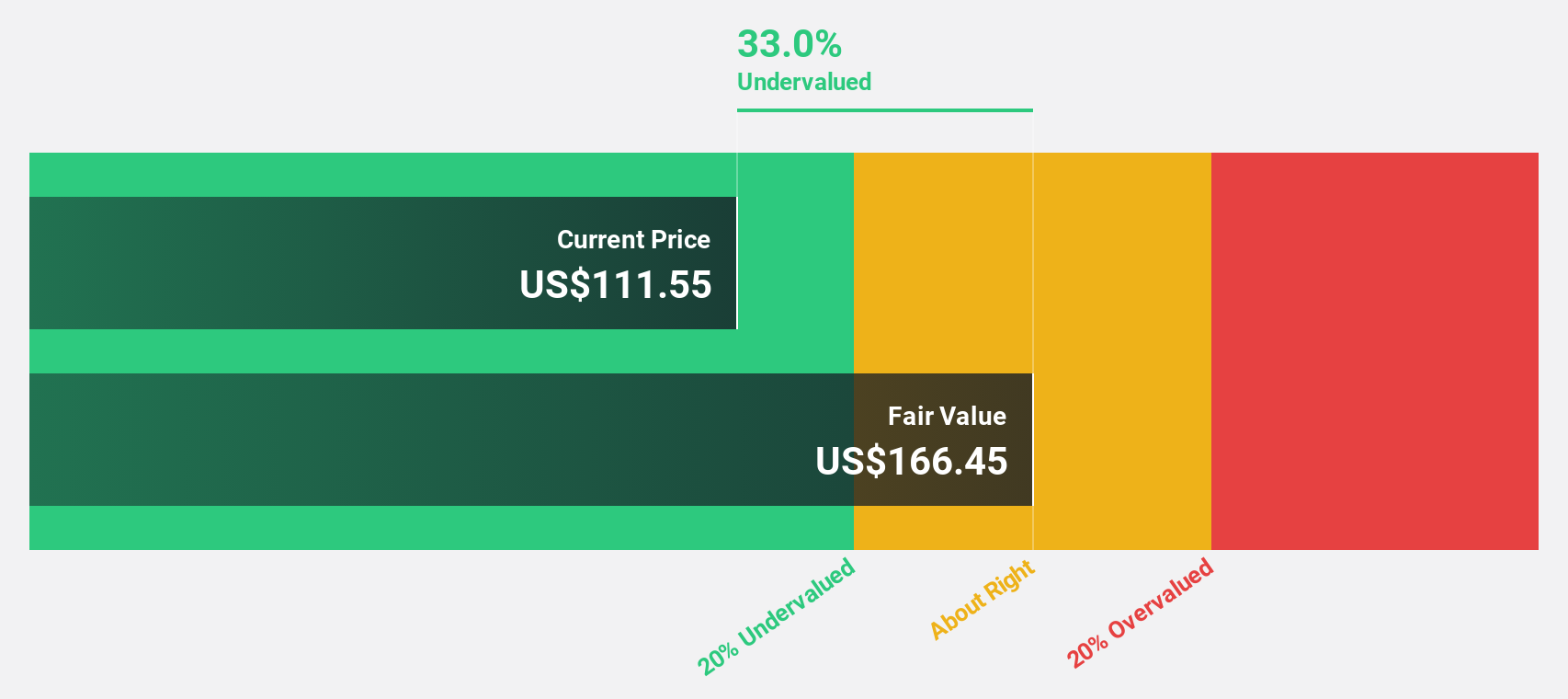

Estimated Discount To Fair Value: 43.1%

HealthEquity, trading at US$101.67, is undervalued with a fair value estimate of US$178.8 from discounted cash flow analysis. Despite revenue growth forecasts of 10.3% annually, below the 20% threshold but above the U.S. market's average, its earnings are expected to grow significantly by 42.5% per year over three years. Recent guidance projects revenues up to US$1.305 billion and net income between US$164 million and US$179 million for fiscal year ending January 2026.

- Our earnings growth report unveils the potential for significant increases in HealthEquity's future results.

- Dive into the specifics of HealthEquity here with our thorough financial health report.

Seize The Opportunity

- Click here to access our complete index of 194 Undervalued US Stocks Based On Cash Flows.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade HealthEquity, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if HealthEquity might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HQY

HealthEquity

Provides technology-enabled services platforms to consumers and employers in the United States.

Excellent balance sheet with reasonable growth potential.