- United States

- /

- Auto

- /

- NasdaqGS:LI

December 2024 US Stocks Possibly Priced Below Intrinsic Value

Reviewed by Simply Wall St

As the United States stock market navigates a challenging landscape marked by recent losses despite encouraging inflation data, investors are keenly observing potential opportunities amid fluctuating indices. In this environment, identifying stocks that might be priced below their intrinsic value becomes crucial, as these stocks could offer long-term growth potential once market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Clear Secure (NYSE:YOU) | $26.66 | $53.14 | 49.8% |

| Oddity Tech (NasdaqGM:ODD) | $43.76 | $84.55 | 48.2% |

| Western Alliance Bancorporation (NYSE:WAL) | $84.62 | $165.22 | 48.8% |

| HealthEquity (NasdaqGS:HQY) | $94.95 | $189.22 | 49.8% |

| Advanced Energy Industries (NasdaqGS:AEIS) | $113.00 | $219.00 | 48.4% |

| WEX (NYSE:WEX) | $169.39 | $332.05 | 49% |

| LifeMD (NasdaqGM:LFMD) | $5.04 | $9.79 | 48.5% |

| South Atlantic Bancshares (OTCPK:SABK) | $15.02 | $29.98 | 49.9% |

| Freshpet (NasdaqGM:FRPT) | $143.71 | $283.12 | 49.2% |

| Progress Software (NasdaqGS:PRGS) | $66.38 | $129.52 | 48.7% |

Underneath we present a selection of stocks filtered out by our screen.

Airbnb (NasdaqGS:ABNB)

Overview: Airbnb, Inc., along with its subsidiaries, operates a global platform facilitating hosts in offering stays and experiences to guests, with a market capitalization of approximately $83.85 billion.

Operations: The company generates revenue of $10.84 billion from its Internet Information Providers segment, which supports its global platform for hosts and guests.

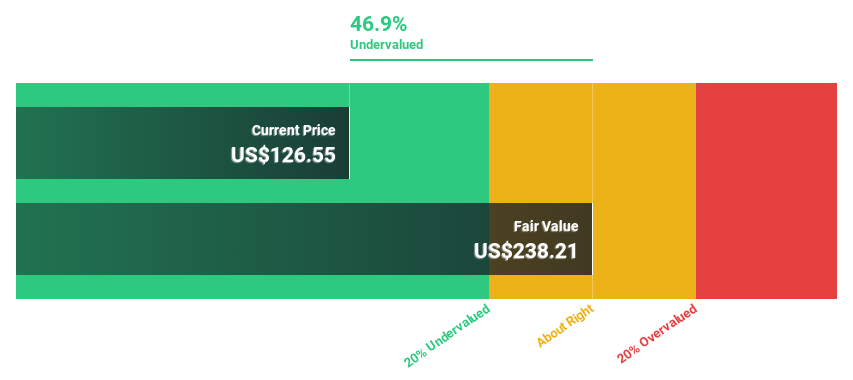

Estimated Discount To Fair Value: 42.6%

Airbnb is trading over 20% below its estimated fair value of US$233.63, suggesting it may be undervalued based on cash flows despite recent challenges. The company reported a significant drop in net income for Q3 2024 compared to the previous year, yet earnings are forecast to grow at 17.7% annually, outpacing the US market's growth rate. Additionally, Airbnb's recent share buyback indicates confidence in its valuation and future prospects amidst slower revenue growth forecasts.

- The growth report we've compiled suggests that Airbnb's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Airbnb's balance sheet health report.

DexCom (NasdaqGS:DXCM)

Overview: DexCom, Inc. is a medical device company specializing in the design, development, and commercialization of continuous glucose monitoring systems globally, with a market cap of approximately $31.26 billion.

Operations: The company's revenue primarily comes from its Patient Monitoring Equipment segment, which generated $3.95 billion.

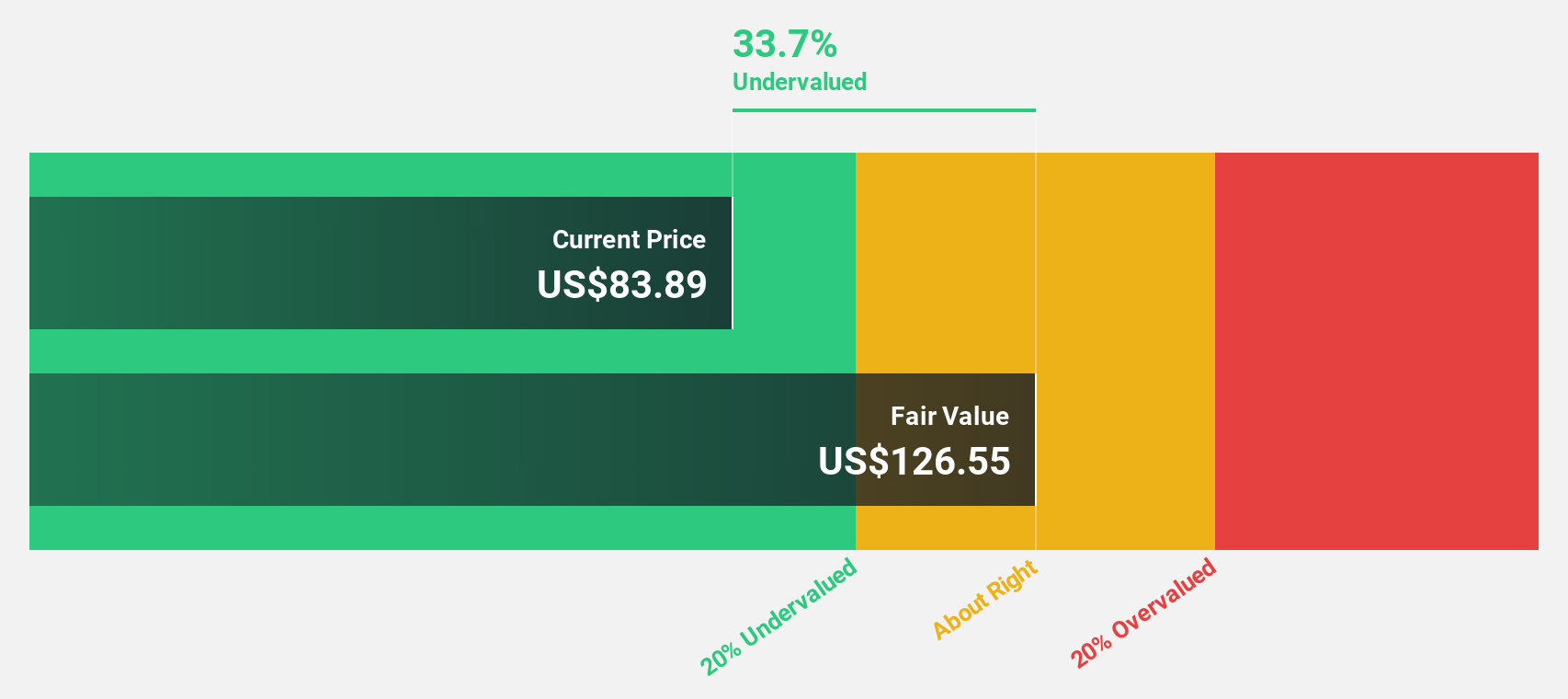

Estimated Discount To Fair Value: 35.5%

DexCom is trading at US$80.04, considerably below its estimated fair value of US$124.15, highlighting potential undervaluation based on cash flows. Despite slower revenue growth forecasts of 11-13% for 2024, earnings are projected to increase by 16.6% annually, surpassing the broader market's growth rate. A recent strategic partnership with OURA and a completed share buyback worth $750 million underscore confidence in DexCom's future prospects despite ongoing legal challenges and executive changes.

- According our earnings growth report, there's an indication that DexCom might be ready to expand.

- Click here to discover the nuances of DexCom with our detailed financial health report.

Li Auto (NasdaqGS:LI)

Overview: Li Auto Inc. operates in the energy vehicle market in the People’s Republic of China with a market cap of approximately $23.50 billion.

Operations: The company's revenue is primarily derived from its Auto Manufacturers segment, generating CN¥141.92 billion.

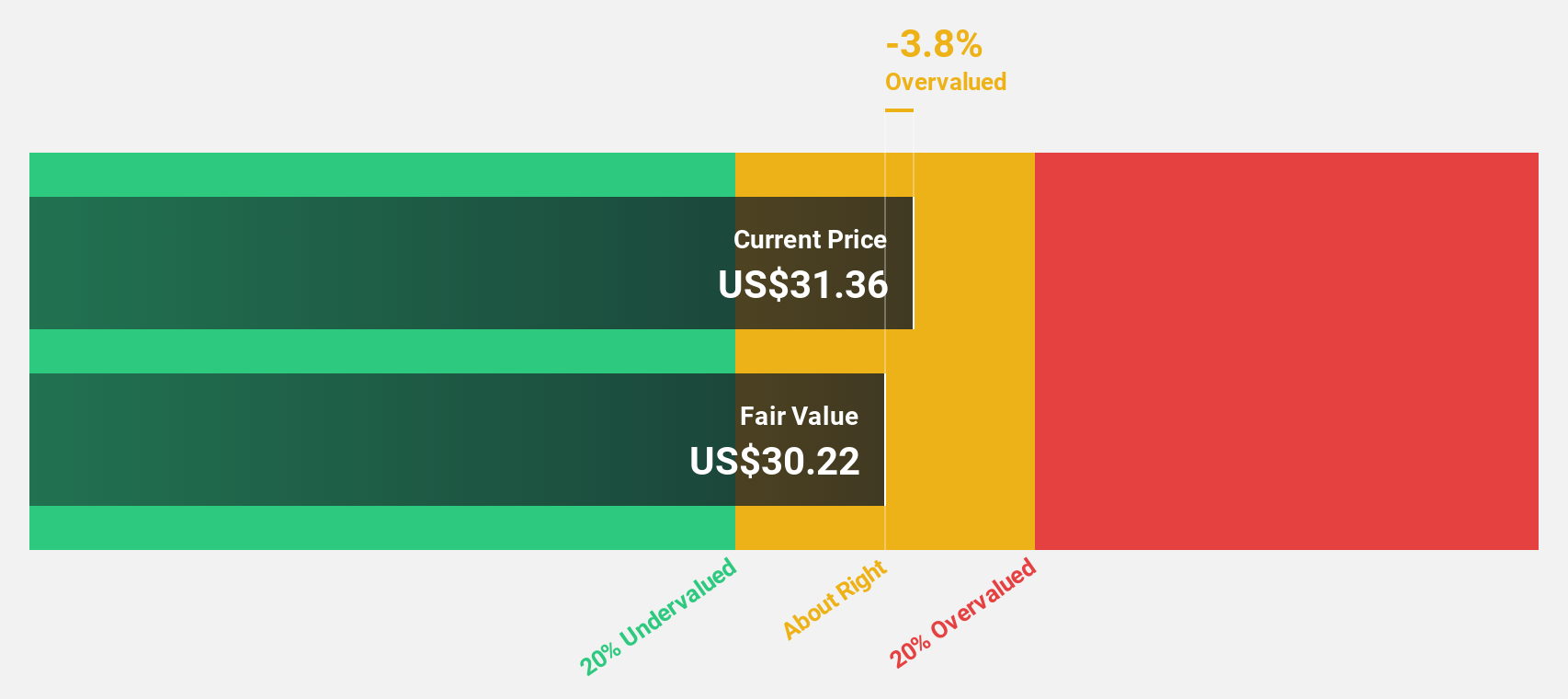

Estimated Discount To Fair Value: 22.5%

Li Auto, trading at US$23.56, is significantly undervalued with an estimated fair value of US$30.4. The company's earnings are expected to grow substantially at 25% annually, outpacing the broader U.S. market's growth rate of 15.2%. Recent delivery figures show a robust increase in vehicle sales year-over-year, supporting revenue growth forecasts of 19.7% per year despite low return on equity projections and a slight dip in quarterly net income.

- Our comprehensive growth report raises the possibility that Li Auto is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Li Auto.

Turning Ideas Into Actions

- Gain an insight into the universe of 179 Undervalued US Stocks Based On Cash Flows by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LI

Li Auto

Operates in the energy vehicle market in the People’s Republic of China.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives