- United States

- /

- Hospitality

- /

- NasdaqGS:ABNB

3 US Stocks Estimated To Be Trading Below Their Intrinsic Value In January 2025

Reviewed by Simply Wall St

As the United States stock market shows signs of optimism with futures indicating a positive open and recent gains, investors are closely watching the impact of new economic policies under President Trump's administration. In this environment, identifying stocks that may be trading below their intrinsic value can offer potential opportunities for those looking to capitalize on market fluctuations and strategic fiscal changes.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Flushing Financial (NasdaqGS:FFIC) | $14.76 | $28.24 | 47.7% |

| Atlantic Union Bankshares (NYSE:AUB) | $37.87 | $75.59 | 49.9% |

| German American Bancorp (NasdaqGS:GABC) | $39.75 | $78.06 | 49.1% |

| Old National Bancorp (NasdaqGS:ONB) | $22.93 | $43.88 | 47.7% |

| Heartland Financial USA (NasdaqGS:HTLF) | $65.78 | $130.19 | 49.5% |

| CI&T (NYSE:CINT) | $6.38 | $12.41 | 48.6% |

| Afya (NasdaqGS:AFYA) | $15.74 | $30.49 | 48.4% |

| Eli Lilly (NYSE:LLY) | $725.72 | $1419.49 | 48.9% |

| Equity Bancshares (NYSE:EQBK) | $43.13 | $86.04 | 49.9% |

| LifeMD (NasdaqGM:LFMD) | $4.90 | $9.77 | 49.8% |

Let's explore several standout options from the results in the screener.

Airbnb (NasdaqGS:ABNB)

Overview: Airbnb, Inc., along with its subsidiaries, operates a global platform that allows hosts to provide accommodations and experiences to guests, with a market cap of approximately $84.42 billion.

Operations: The company generates revenue of $10.84 billion from its Internet Information Providers segment.

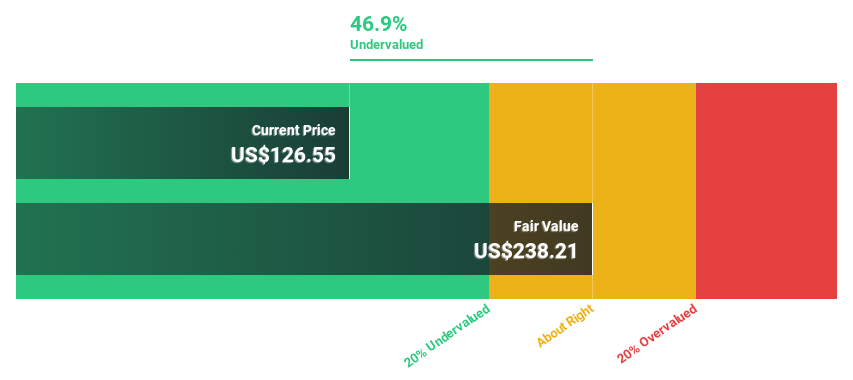

Estimated Discount To Fair Value: 37.9%

Airbnb is trading at US$135.12, significantly below its estimated fair value of US$217.47, suggesting it might be undervalued based on cash flows. Despite a forecasted earnings growth of 16.6% per year outpacing the US market's 14.9%, recent results show a decline in net income and profit margins compared to last year. The company completed a share buyback worth US$1.84 billion, which could indicate confidence in its valuation and future prospects.

- According our earnings growth report, there's an indication that Airbnb might be ready to expand.

- Take a closer look at Airbnb's balance sheet health here in our report.

DexCom (NasdaqGS:DXCM)

Overview: DexCom, Inc. is a medical device company that specializes in the design, development, and commercialization of continuous glucose monitoring systems both in the United States and internationally, with a market cap of approximately $32.96 billion.

Operations: The company's revenue primarily comes from its patient monitoring equipment segment, generating $3.95 billion.

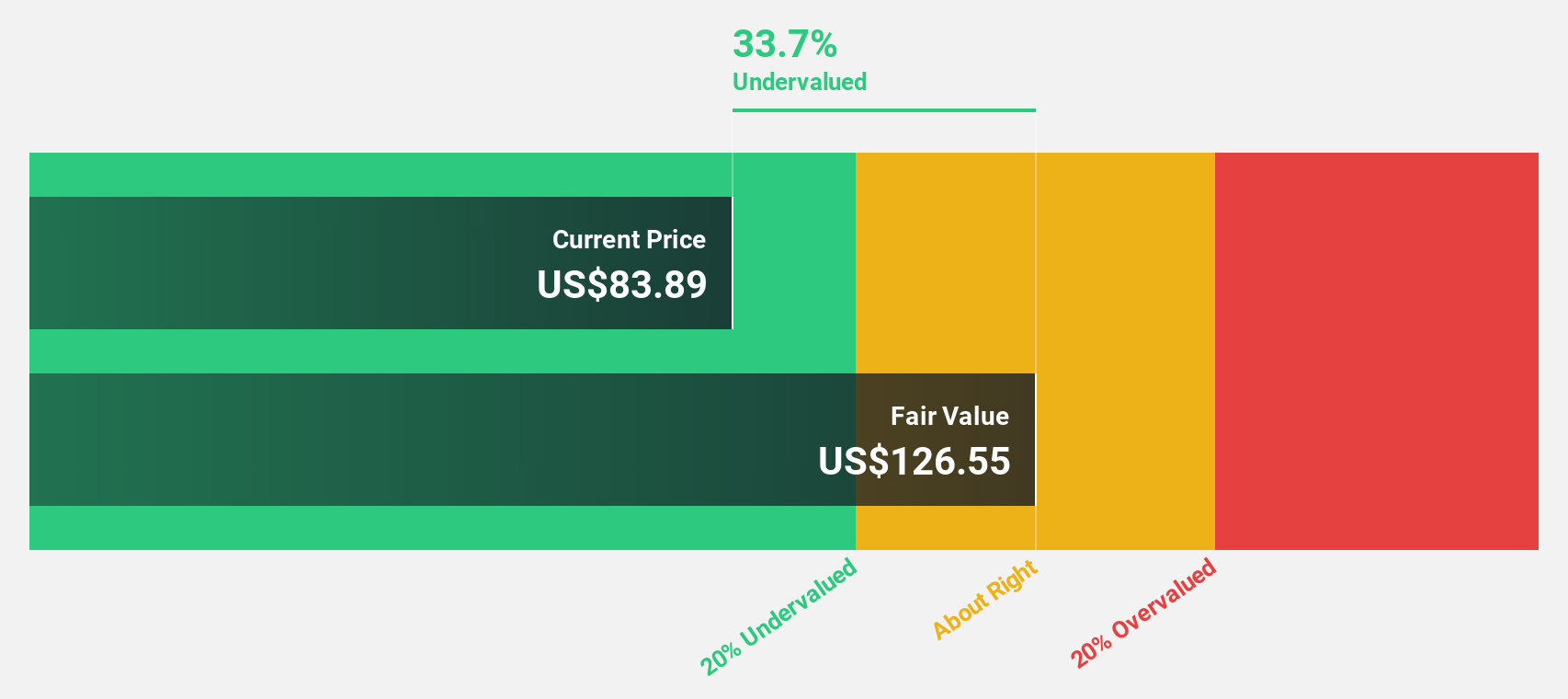

Estimated Discount To Fair Value: 34%

DexCom is trading at US$84.38, well below its estimated fair value of US$127.85, highlighting potential undervaluation based on cash flows. The company's earnings grew by a substantial 80.6% over the past year and are expected to grow 16.1% annually, outpacing the broader US market's growth forecast of 14.9%. Recent strategic moves include a partnership with OURA and a share buyback program worth US$750 million, reflecting strong financial positioning and growth prospects.

- Our expertly prepared growth report on DexCom implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of DexCom stock in this financial health report.

Li Auto (NasdaqGS:LI)

Overview: Li Auto Inc. operates in the energy vehicle market in the People’s Republic of China with a market cap of approximately $22.53 billion.

Operations: The company's revenue primarily comes from its Auto Manufacturers segment, generating CN¥141.92 billion.

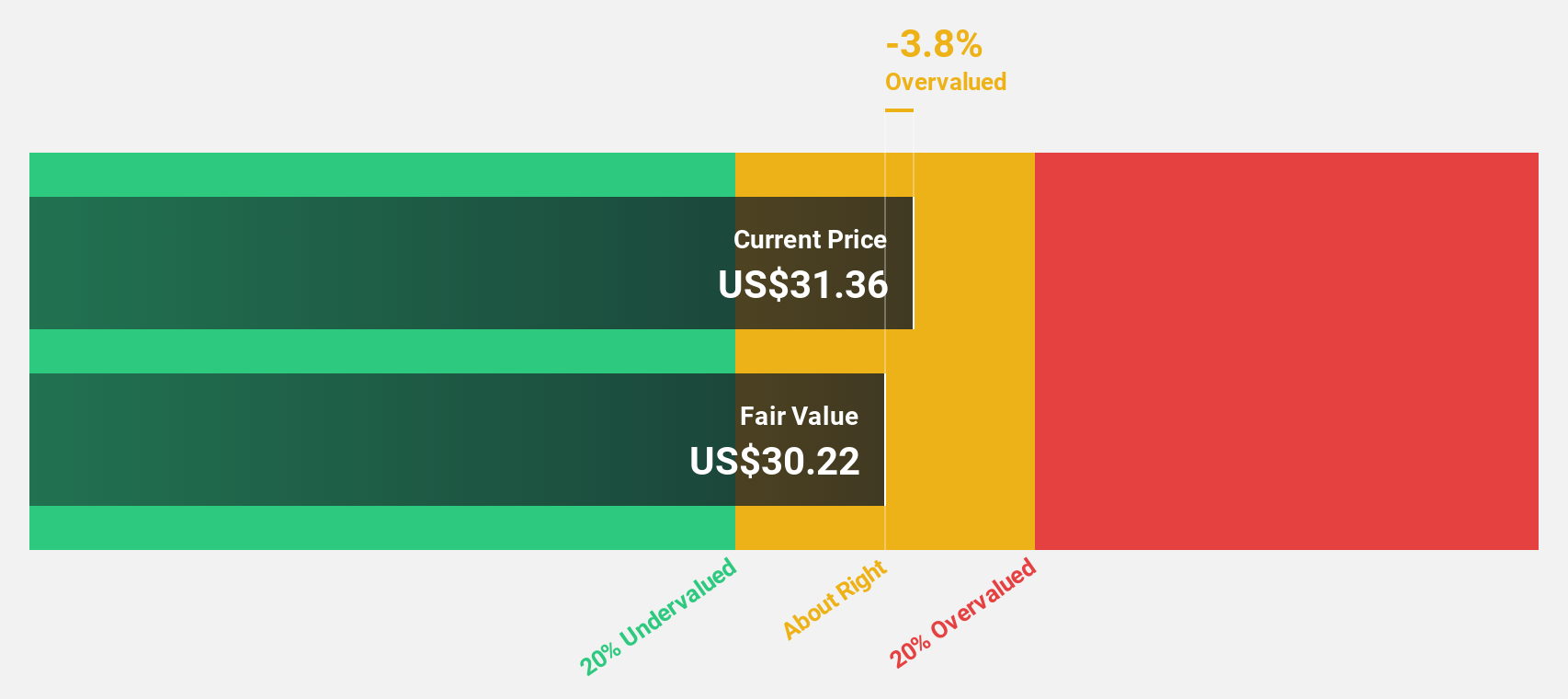

Estimated Discount To Fair Value: 12%

Li Auto is trading at US$22.59, slightly below its estimated fair value of US$25.67, suggesting it could be undervalued based on cash flows. The company reported a robust 61.3% earnings growth over the past year and forecasts a significant annual profit growth of 21.6%, surpassing the broader US market's expectations. Despite this, revenue growth is projected to be moderate at 17.5% annually, with recent vehicle deliveries showing consistent year-over-year increases.

- Insights from our recent growth report point to a promising forecast for Li Auto's business outlook.

- Dive into the specifics of Li Auto here with our thorough financial health report.

Turning Ideas Into Actions

- Gain an insight into the universe of 163 Undervalued US Stocks Based On Cash Flows by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ABNB

Airbnb

Operates a platform that enables hosts to offer stays and experiences to guests worldwide.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives