- United States

- /

- Healthcare Services

- /

- NasdaqGS:CLOV

US Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As the U.S. stock market wraps up a strong year with some recent turbulence, major indices like the Nasdaq Composite and S&P 500 have still managed to post impressive gains, highlighting a period of robust growth despite recent setbacks. In this environment, identifying growth companies with high insider ownership can be particularly appealing to investors seeking alignment between management and shareholder interests, as these firms often demonstrate confidence in their long-term potential amidst fluctuating market conditions.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| BBB Foods (NYSE:TBBB) | 22.9% | 41% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.3% | 66.3% |

| Credit Acceptance (NasdaqGS:CACC) | 14.0% | 49% |

| Ryan Specialty Holdings (NYSE:RYAN) | 16.8% | 36.6% |

| Similarweb (NYSE:SMWB) | 25.4% | 126.3% |

| CarGurus (NasdaqGS:CARG) | 17% | 42.4% |

Let's take a closer look at a couple of our picks from the screened companies.

California BanCorp (NasdaqCM:BCAL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: California BanCorp operates as the bank holding company for California Bank of Commerce, N.A., with a market cap of $535.87 million.

Operations: California BanCorp generates revenue primarily from its Commercial Banking segment, which amounts to $78.31 million.

Insider Ownership: 17.1%

California BanCorp is forecast to grow revenue at 33.7% annually, outpacing the US market's 9.2%. Analysts agree the stock is undervalued by 14.3%, with a projected price increase of 24.9%. Despite substantial shareholder dilution over the past year and reported net losses, BCAL aims for profitability within three years, exceeding average market growth rates. Recent leadership changes include Jerry Legg's appointment as Senior VP in public sector banking, enhancing strategic direction.

- Take a closer look at California BanCorp's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, California BanCorp's share price might be too pessimistic.

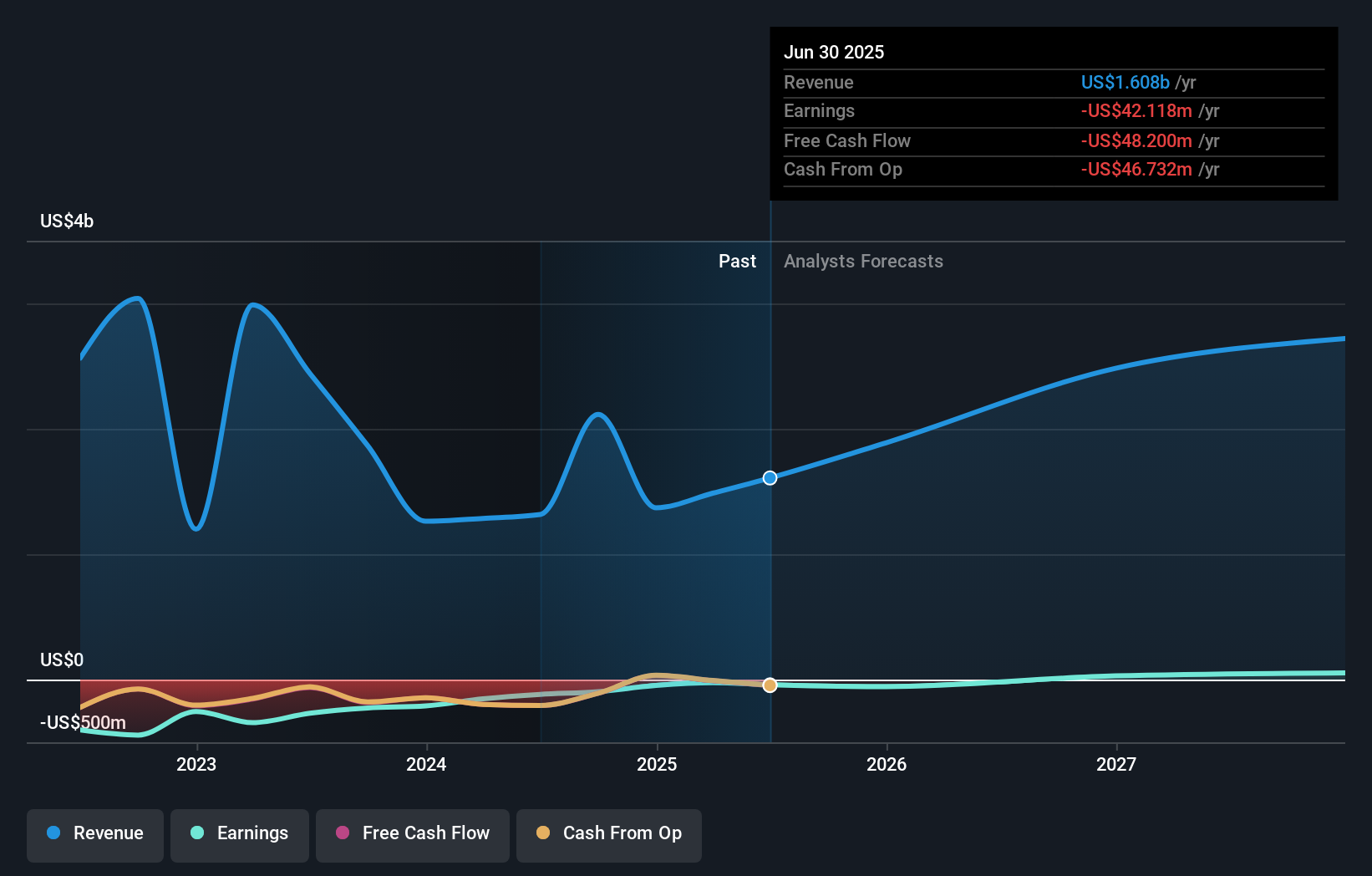

Clover Health Investments (NasdaqGS:CLOV)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Clover Health Investments Corp. provides Medicare Advantage plans in the United States and has a market cap of approximately $1.60 billion.

Operations: Clover Health generates revenue primarily through its Medicare Advantage plans offered in the United States.

Insider Ownership: 20.9%

Clover Health Investments is forecast to achieve profitability within three years, surpassing average market growth. Despite recent shareholder dilution and a volatile share price, the company trades at 78.7% below estimated fair value. Revenue is expected to grow at 10.4% annually, faster than the US market's 9%. Recent earnings show reduced net losses, with a Q3 loss of US$9.16 million compared to US$41.47 million a year ago, indicating financial improvement.

- Click here to discover the nuances of Clover Health Investments with our detailed analytical future growth report.

- According our valuation report, there's an indication that Clover Health Investments' share price might be on the cheaper side.

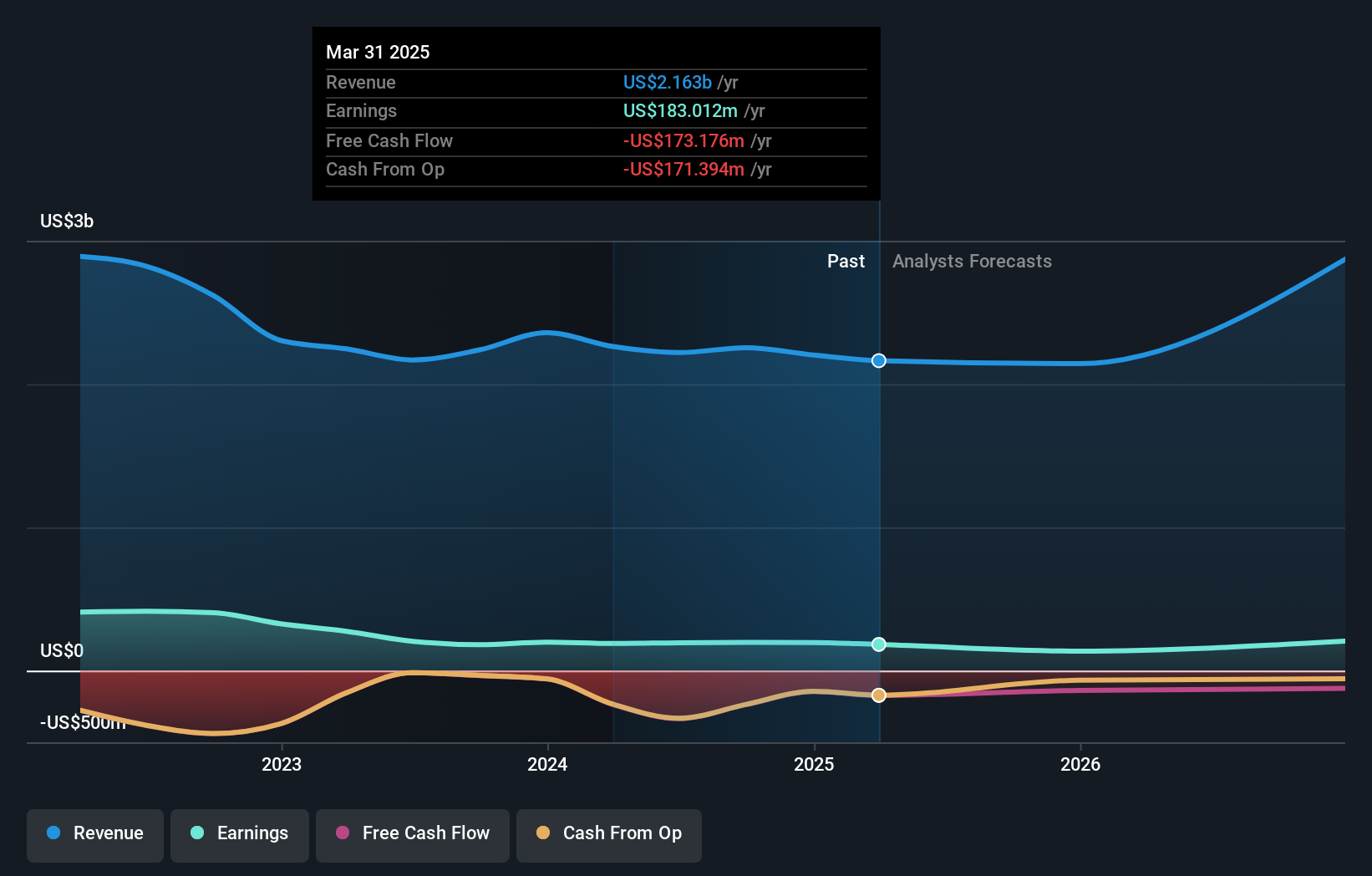

LGI Homes (NasdaqGS:LGIH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: LGI Homes, Inc. designs, constructs, and sells homes with a market capitalization of approximately $2.09 billion.

Operations: The company's revenue is primarily generated from its homebuilding business, amounting to $2.25 billion.

Insider Ownership: 12.4%

LGI Homes is experiencing robust earnings growth, projected at 21.1% annually, outpacing the US market average. The company maintains a competitive price-to-earnings ratio of 10.7x, below the market average of 18.2x, suggesting potential value for investors. Recent developments include new community openings in Nash County and Waynesboro, enhancing its portfolio with modern homes and strategic locations. However, debt coverage remains a concern as it's not well-supported by operating cash flow despite no recent insider trading activity reported.

- Click to explore a detailed breakdown of our findings in LGI Homes' earnings growth report.

- In light of our recent valuation report, it seems possible that LGI Homes is trading beyond its estimated value.

Make It Happen

- Take a closer look at our Fast Growing US Companies With High Insider Ownership list of 200 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CLOV

Clover Health Investments

Provides medicare advantage plans in the United States.

Flawless balance sheet and fair value.