- United States

- /

- Software

- /

- NasdaqGS:EXFY

Discovering Opportunities: AlloVir And 2 Other US Penny Stocks

Reviewed by Simply Wall St

As the U.S. stock market navigates a landscape shaped by mixed economic data and ongoing corporate earnings reports, investors are keenly observing potential opportunities across various sectors. Penny stocks, a term that may seem outdated, still capture the essence of investing in smaller or emerging companies with potential for growth. By focusing on those with strong financials and clear growth prospects, investors can uncover hidden gems amidst these lesser-known equities.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.7921 | $5.74M | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.25 | $544.21M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.67 | $2.16B | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.54 | $51.81M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.28 | $10.13M | ★★★★★★ |

| Better Choice (NYSEAM:BTTR) | $1.70 | $2.86M | ★★★★★★ |

| ARC Document Solutions (NYSE:ARC) | $3.42 | $147.91M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.57 | $136.12M | ★★★★★☆ |

| So-Young International (NasdaqGM:SY) | $1.25 | $99.97M | ★★★★☆☆ |

Click here to see the full list of 756 stocks from our US Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

AlloVir (NasdaqCM:ALVR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: AlloVir, Inc. is a clinical-stage cell therapy company focused on developing allogeneic, off-the-shelf multi-virus specific T cell therapies to address viral-associated diseases, with a market cap of $97.49 million.

Operations: Currently, there are no reported revenue segments for this clinical-stage cell therapy company.

Market Cap: $97.49M

AlloVir, Inc., a clinical-stage cell therapy company with a market cap of US$97.49 million, is pre-revenue and currently unprofitable. Despite having no debt and sufficient cash runway for over a year based on current free cash flow, the company has experienced shareholder dilution in the past year. The management team is seasoned with an average tenure of 5.8 years, providing stability amidst financial challenges. Recently, AlloVir was removed from the S&P Global BMI Index and reported significant reductions in net losses for Q2 2024 compared to the previous year, indicating some improvement in financial management despite ongoing challenges.

- Click here to discover the nuances of AlloVir with our detailed analytical financial health report.

- Understand AlloVir's earnings outlook by examining our growth report.

Cerus (NasdaqGM:CERS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cerus Corporation is a biomedical products company with a market cap of $318.71 million.

Operations: The company's revenue from the Blood Safety segment is $169.98 million.

Market Cap: $318.71M

Cerus Corporation, with a market cap of US$318.71 million, has shown steady revenue growth from its Blood Safety segment, reaching US$169.98 million. Despite being unprofitable and having a negative return on equity, Cerus has reduced losses over the past five years by 15.1% annually and forecasts further revenue growth of 10.96% per year. The company recently secured a significant six-year agreement with BARDA worth up to $248 million to advance its INTERCEPT RBC system in the U.S., which could bolster future prospects if regulatory milestones are achieved successfully. However, shareholders have faced dilution and increased debt levels recently.

- Jump into the full analysis health report here for a deeper understanding of Cerus.

- Examine Cerus' earnings growth report to understand how analysts expect it to perform.

Expensify (NasdaqGS:EXFY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Expensify, Inc. offers a cloud-based expense management software platform catering to individuals, corporations, small and midsized businesses, and enterprises globally, with a market cap of approximately $161.74 million.

Operations: The company's revenue is primarily generated from its Internet Software & Services segment, totaling $138.53 million.

Market Cap: $161.74M

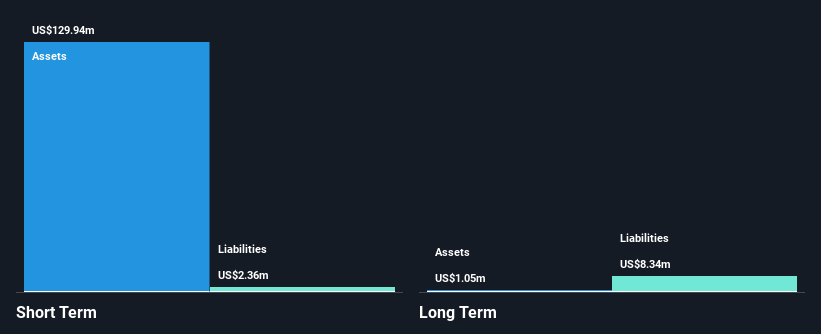

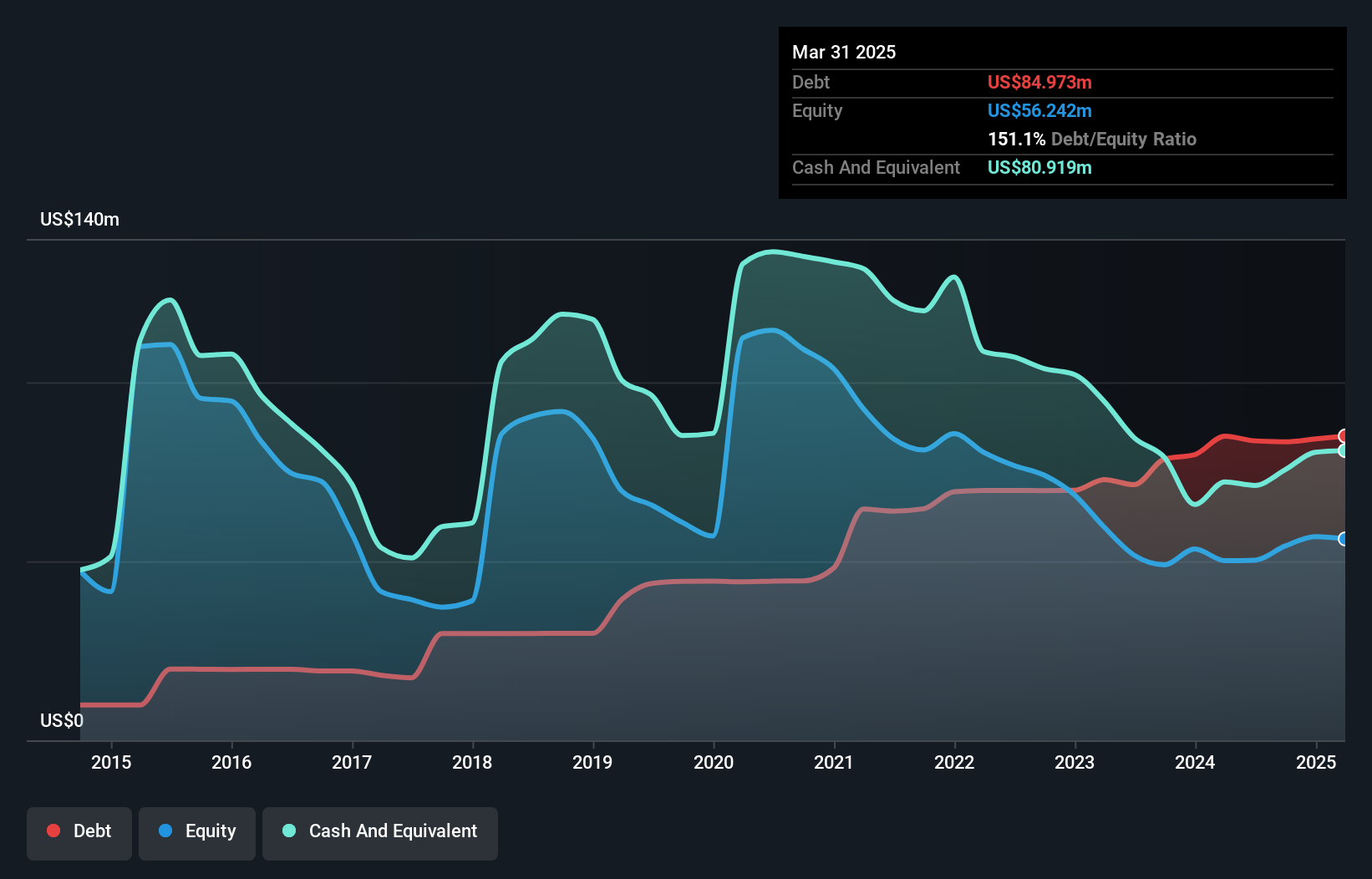

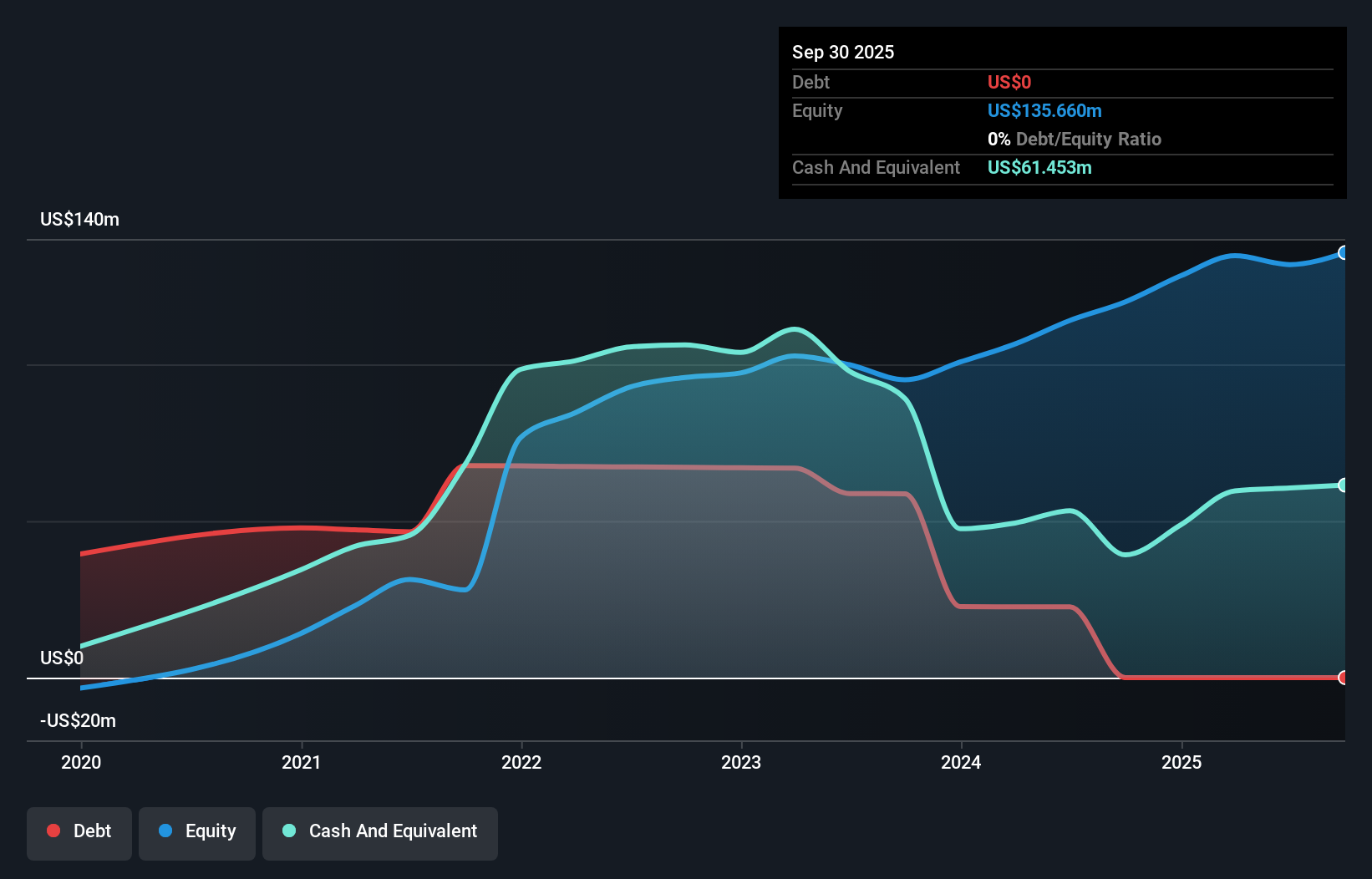

Expensify, Inc., with a market cap of US$161.74 million, operates in the cloud-based expense management sector and faces challenges typical of penny stocks. The company reported declining sales for the first half of 2024 at US$66.82 million, down from US$78.99 million the previous year, alongside a reduced net loss of US$6.55 million compared to US$17.25 million last year. Despite being unprofitable and experiencing shareholder dilution by 6.1%, Expensify maintains a strong cash position exceeding its total debt and short-term liabilities, providing a cash runway for over three years amidst significant insider selling recently noted.

- Take a closer look at Expensify's potential here in our financial health report.

- Assess Expensify's future earnings estimates with our detailed growth reports.

Where To Now?

- Take a closer look at our US Penny Stocks list of 756 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Expensify might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXFY

Expensify

Provides a cloud-based expense management software platform to individuals and corporations, small and midsized businesses, and enterprises in the United States and internationally.

Flawless balance sheet slight.