- United States

- /

- Entertainment

- /

- NYSE:SKLZ

US Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

As the U.S. equities market stumbles toward the end of 2024, with the Dow and S&P 500 on track to post monthly losses, investors are increasingly looking for opportunities beyond large-cap stocks. Penny stocks, a term that may seem outdated but remains relevant, represent smaller or less-established companies that can offer significant value potential. By focusing on those with robust financials and growth potential, investors might uncover promising opportunities in these overlooked segments of the market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.8301 | $6.25M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.19 | $1.87B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $104.78M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.285 | $9.2M | ★★★★★★ |

| Tantech Holdings (NasdaqCM:TANH) | $0.23 | $1.59M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $3.07 | $87.96M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.50 | $44.07M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.39 | $25.72M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.08 | $96.23M | ★★★★★☆ |

Click here to see the full list of 737 stocks from our US Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Art's-Way Manufacturing (NasdaqCM:ARTW)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Art's-Way Manufacturing Co., Inc. is a company that produces and sells agricultural equipment and specialized modular science and agricultural buildings both in the United States and internationally, with a market cap of $12.28 million.

Operations: The company generates revenue from two main segments: $8.28 million from modular buildings and $16.90 million from agricultural products.

Market Cap: $12.28M

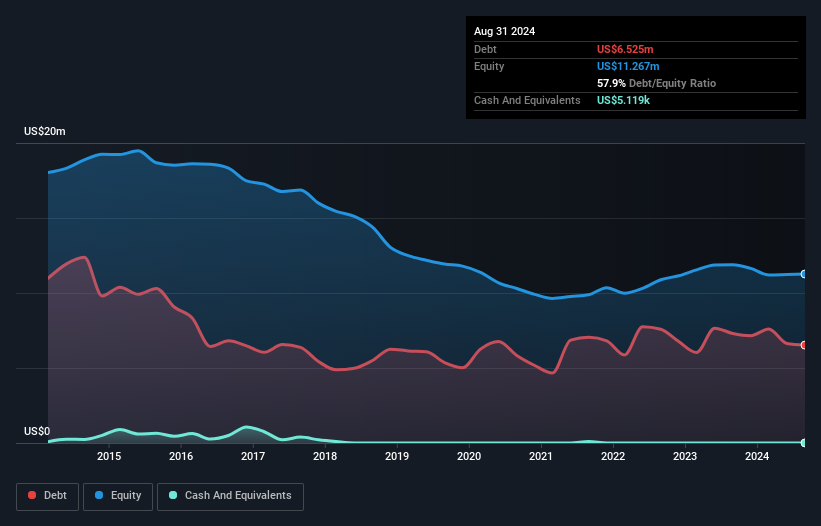

Art's-Way Manufacturing faces challenges as a penny stock with declining sales, reporting US$18.33 million for the first nine months of 2024, down from US$23.43 million the previous year. Despite being unprofitable, it has managed to reduce losses over five years and maintains a positive free cash flow with sufficient cash runway for over three years. The company's short-term assets exceed its liabilities, though its net debt to equity ratio is high at 57.9%. Recent leadership changes see Marc McConnell stepping in as CEO, potentially impacting future strategic direction and operational efficiency.

- Unlock comprehensive insights into our analysis of Art's-Way Manufacturing stock in this financial health report.

- Examine Art's-Way Manufacturing's past performance report to understand how it has performed in prior years.

VYNE Therapeutics (NasdaqCM:VYNE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: VYNE Therapeutics Inc. is a clinical-stage biopharmaceutical company that develops proprietary therapeutics for immuno-inflammatory conditions, with a market cap of $46.76 million.

Operations: The company generates revenue from the development and commercialization of foam-based formulations, amounting to $0.49 million.

Market Cap: $46.76M

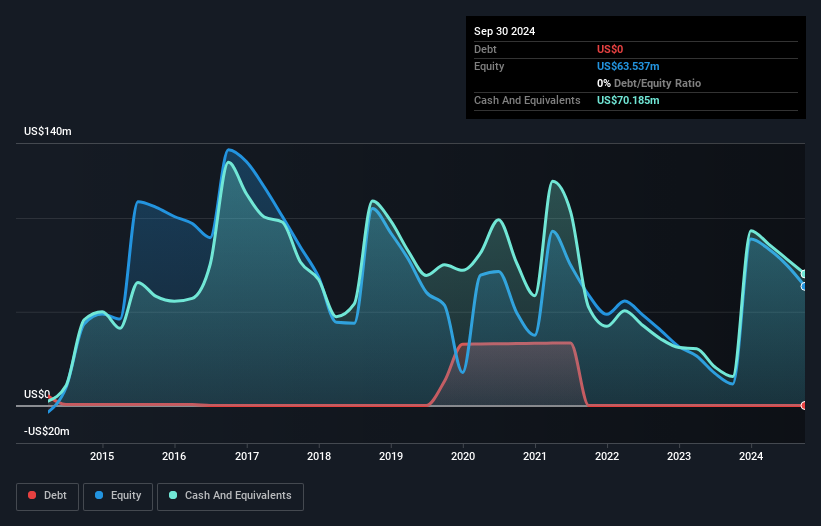

VYNE Therapeutics, a clinical-stage biopharmaceutical company, remains pre-revenue with US$0.49 million in revenue and a market cap of US$46.76 million. The company is debt-free and has sufficient cash runway for over a year despite recent shareholder dilution. VYNE's management team is experienced, averaging 4.8 years in tenure, which may aid strategic execution amidst its unprofitability and forecasted earnings decline of 18.2% annually over the next three years. Recent positive Phase 1a trial results for VYN202 highlight potential future growth avenues; however, ongoing losses underscore the high-risk nature typical of penny stocks in this sector.

- Click here and access our complete financial health analysis report to understand the dynamics of VYNE Therapeutics.

- Explore VYNE Therapeutics' analyst forecasts in our growth report.

Skillz (NYSE:SKLZ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Skillz Inc. operates a mobile game platform across various countries, including the United States, Israel, China, and Malta, with a market cap of approximately $93.09 million.

Operations: The company generates revenue primarily from the United States, accounting for $93.25 million, with additional income of $2.16 million from other countries.

Market Cap: $93.09M

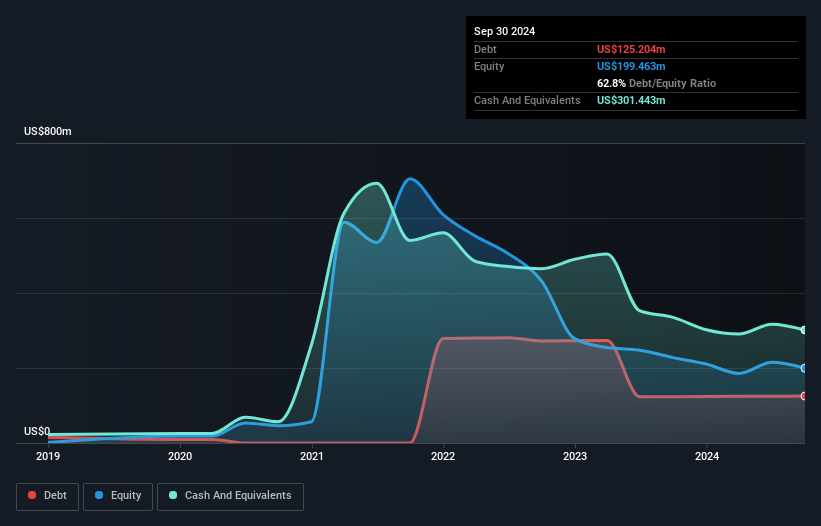

Skillz Inc., with a market cap of US$93.09 million, faces challenges typical of penny stocks, including unprofitability and declining earnings forecasts. Despite this, the company maintains a strong cash position with short-term assets exceeding both its short and long-term liabilities significantly. Recent strategic moves include a share repurchase program totaling US$41.1 million, funded by existing cash reserves, which may reflect management's confidence in the company's valuation. However, the management team is relatively inexperienced with an average tenure of one year, potentially impacting strategic execution as they navigate ongoing financial losses and industry competition.

- Click to explore a detailed breakdown of our findings in Skillz's financial health report.

- Gain insights into Skillz's outlook and expected performance with our report on the company's earnings estimates.

Key Takeaways

- Get an in-depth perspective on all 737 US Penny Stocks by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SKLZ

Skillz

Operates a mobile game platform in the United States, Israel, China, Malta, and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives