- United States

- /

- Auto Components

- /

- NasdaqGS:KNDI

3 US Penny Stocks With Market Caps Over $80M To Watch

Reviewed by Simply Wall St

As the U.S. stock market concludes a strong year on a weak note, with major indices like the Dow experiencing significant monthly losses, investors are reflecting on opportunities within various sectors. Penny stocks, often associated with smaller or newer companies, remain an intriguing area for those seeking potential growth despite their somewhat outdated label. By focusing on companies that exhibit solid financial health and promising prospects, investors can uncover potential value in this niche segment of the market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.77 | $6.03M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.22 | $1.84B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $111.43M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.30 | $9.9M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.29 | $10.49M | ★★★★★★ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.94 | $97.13M | ★★★★★☆ |

| Imperial Petroleum (NasdaqCM:IMPP) | $3.01 | $93.12M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.47 | $43.38M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.31 | $24.65M | ★★★★★☆ |

Click here to see the full list of 733 stocks from our US Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Aldeyra Therapeutics (NasdaqCM:ALDX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Aldeyra Therapeutics, Inc. is a biotechnology company focused on developing and commercializing medicines for immune-mediated diseases, with a market cap of $298.94 million.

Operations: Aldeyra Therapeutics, Inc. does not currently report any revenue segments.

Market Cap: $298.94M

Aldeyra Therapeutics, Inc., a biotechnology company with a market cap of US$298.94 million, is pre-revenue and currently unprofitable but has made strides in reducing losses over the past five years. The company's management and board are experienced, with an average tenure of 3.9 and 11.3 years respectively. Aldeyra's short-term assets significantly exceed its liabilities, providing financial stability despite ongoing losses. Recent developments include the resubmission of a New Drug Application for reproxalap to the FDA after positive Phase 3 trial results for dry eye disease treatment, which could potentially impact future revenue streams if approved.

- Navigate through the intricacies of Aldeyra Therapeutics with our comprehensive balance sheet health report here.

- Learn about Aldeyra Therapeutics' future growth trajectory here.

Adlai Nortye (NasdaqGM:ANL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Adlai Nortye Ltd. is a clinical-stage biotechnology company dedicated to discovering and developing cancer therapies in the United States and Mainland China, with a market cap of $85.24 million.

Operations: Adlai Nortye Ltd. has not reported any revenue segments.

Market Cap: $85.24M

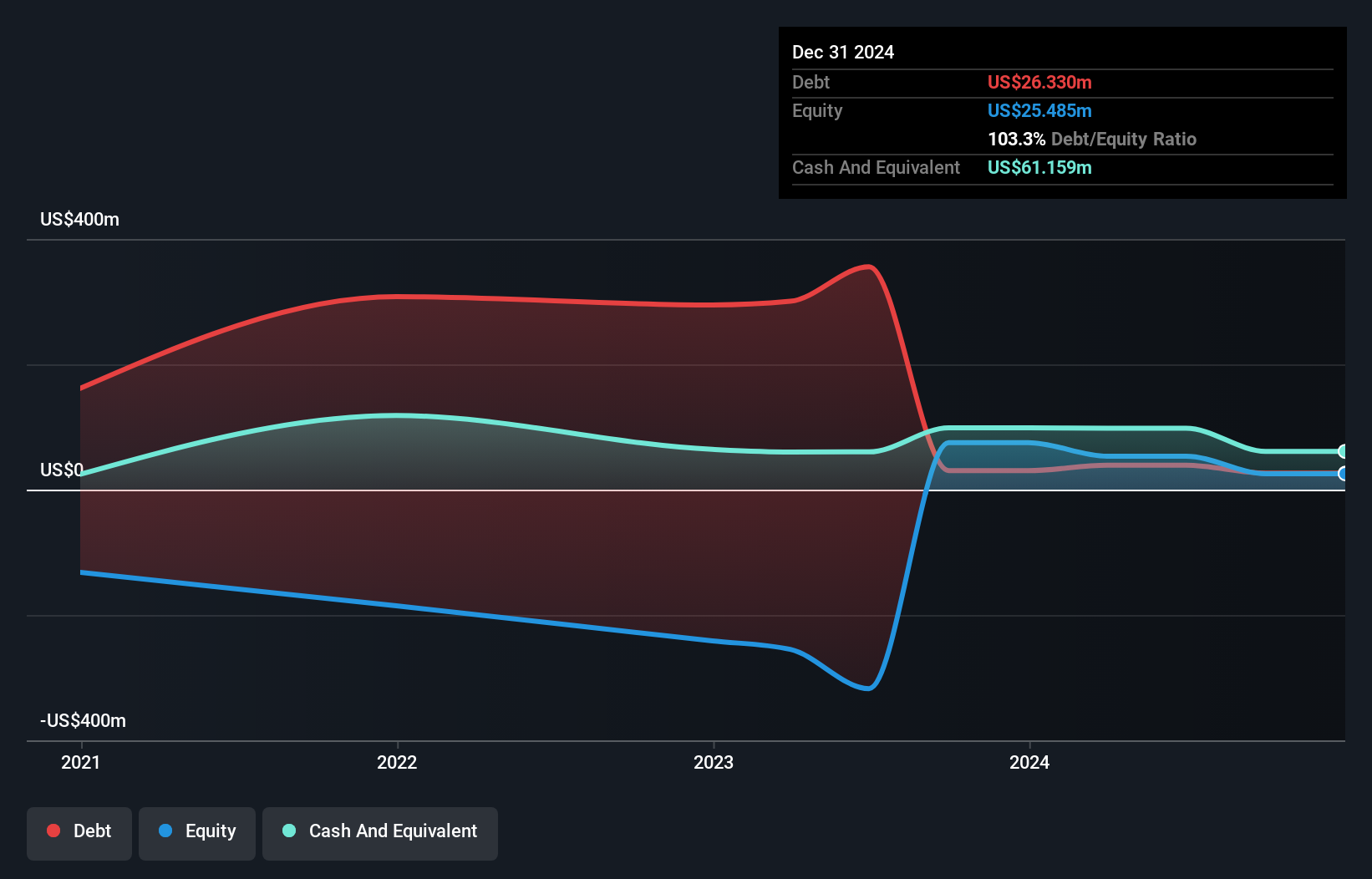

Adlai Nortye Ltd., with a market cap of US$85.24 million, is a pre-revenue biotechnology company focused on cancer therapies. The company has not reported significant revenue and remains unprofitable, with losses increasing at an annual rate of 12.7% over the past five years. Despite this, Adlai Nortye's financial position shows more cash than total debt and short-term assets exceeding liabilities by US$45.98 million, suggesting some level of financial stability. However, high share price volatility and an inexperienced management team may pose challenges to investor confidence in the near term.

- Click here and access our complete financial health analysis report to understand the dynamics of Adlai Nortye.

- Review our growth performance report to gain insights into Adlai Nortye's future.

Kandi Technologies Group (NasdaqGS:KNDI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Kandi Technologies Group, Inc. designs, develops, manufactures, and commercializes electric vehicle products and parts in China and the United States with a market cap of approximately $81.49 million.

Operations: The company generates revenue primarily from its Auto Manufacturers segment, amounting to $118.13 million.

Market Cap: $81.49M

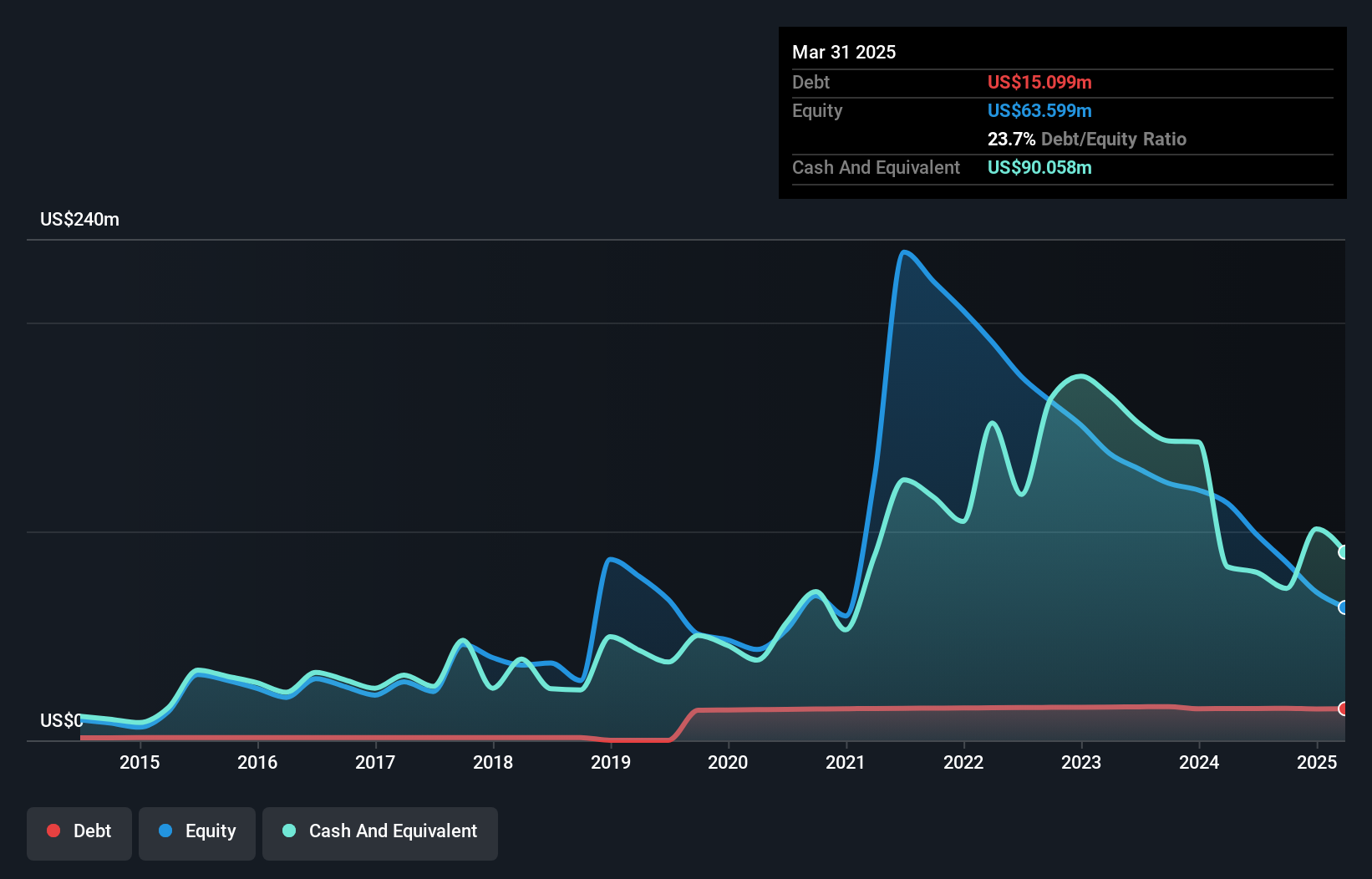

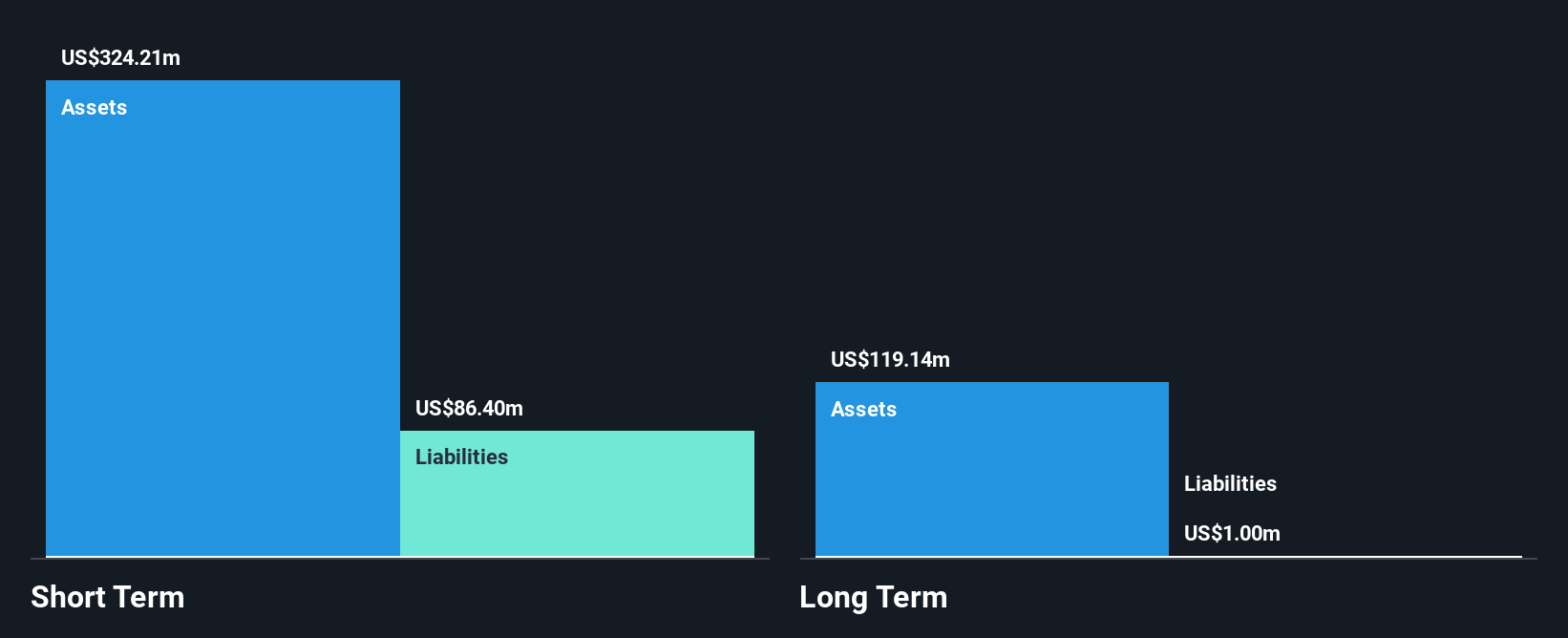

Kandi Technologies Group, with a market cap of US$81.49 million, focuses on electric vehicle products and parts. Despite being unprofitable, the company maintains financial stability with short-term assets of US$396.7 million surpassing liabilities and more cash than total debt. Recent earnings showed a net loss of US$4.11 million for Q3 2024, reflecting challenges in profitability compared to the previous year’s net income. The company plans significant U.S.-based expansions in lithium battery manufacturing and all-terrain vehicles production, potentially enhancing revenue streams but also indicating substantial capital investment requirements amidst high share price volatility.

- Jump into the full analysis health report here for a deeper understanding of Kandi Technologies Group.

- Evaluate Kandi Technologies Group's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Access the full spectrum of 733 US Penny Stocks by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kandi Technologies Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KNDI

Kandi Technologies Group

Engages in designing, developing, manufacturing, and commercializing electric vehicle (EV) products and parts in the People’s Republic of China and the United States.

Adequate balance sheet low.