- United States

- /

- Medical Equipment

- /

- NasdaqGM:CERS

Cerus And 2 Other Promising Penny Stocks To Watch

Reviewed by Simply Wall St

The U.S. stock market recently experienced a pullback, with major indexes ending lower for two consecutive sessions, as tech giants faced declines while the energy sector outperformed. In such fluctuating market conditions, investors often seek opportunities in various corners of the market, including penny stocks. Despite their vintage name, penny stocks can offer intriguing prospects for growth and value when backed by strong financials and fundamentals. In this article, we explore several promising penny stocks that stand out for their potential to deliver impressive returns over time.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.09 | $435.04M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.95 | $694.39M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $1.22 | $206.93M | ✅ 4 ⚠️ 2 View Analysis > |

| Puma Biotechnology (PBYI) | $4.72 | $237.25M | ✅ 3 ⚠️ 2 View Analysis > |

| Sensus Healthcare (SRTS) | $3.16 | $51.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Performance Shipping (PSHG) | $2.05 | $23.25M | ✅ 4 ⚠️ 2 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| Table Trac (TBTC) | $4.70 | $20.88M | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (BABB) | $1.00 | $7.09M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.84 | $86.32M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 372 stocks from our US Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Cerus (CERS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cerus Corporation is a biomedical products company with a market cap of $306.72 million.

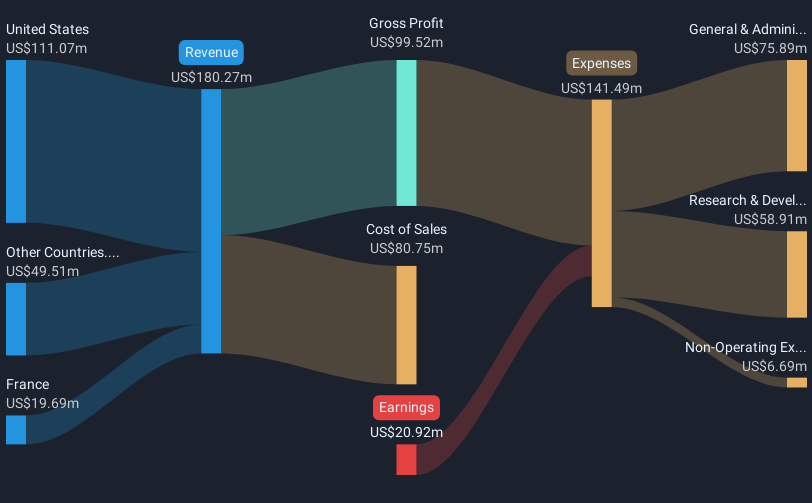

Operations: The company generated $192.51 million in revenue from its Blood Safety segment.

Market Cap: $306.72M

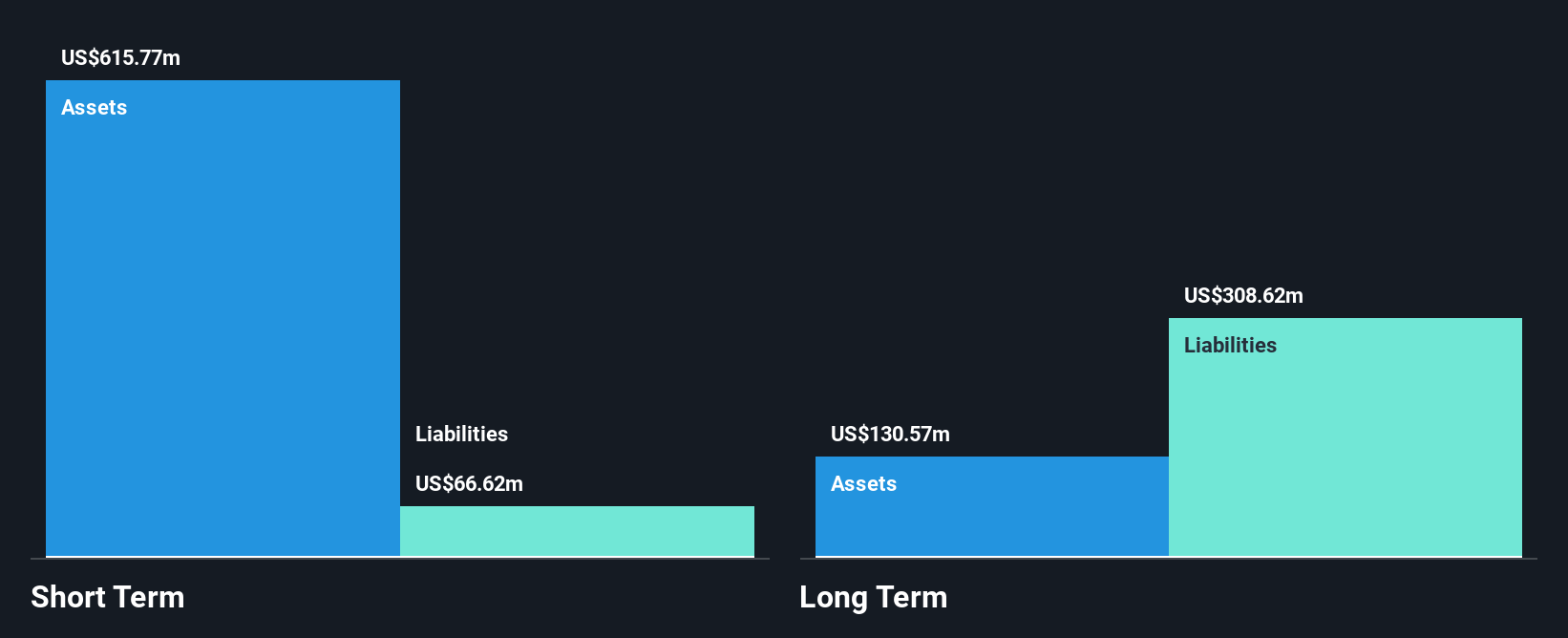

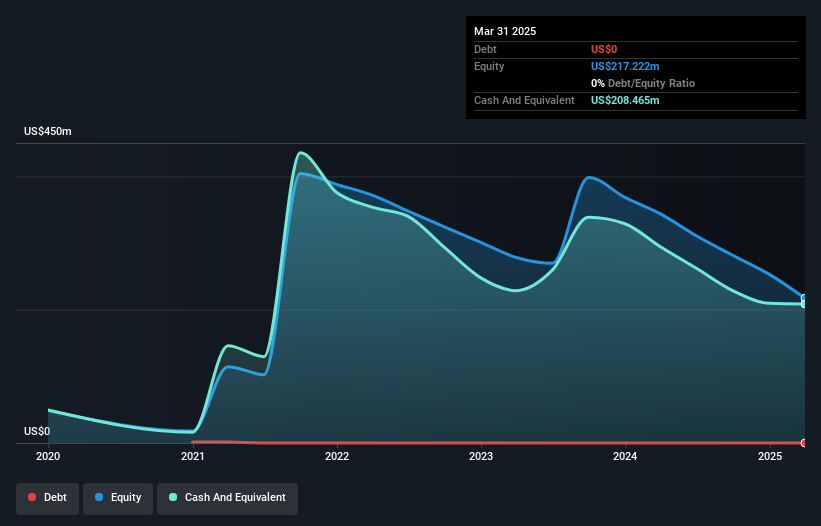

Cerus Corporation, with a market cap of US$306.72 million, is navigating its unprofitable status by reducing losses at 22.3% annually over the past five years. Despite this, it maintains a satisfactory net debt to equity ratio of 12.2% and has sufficient cash runway for over three years due to positive free cash flow growth of 28.7% per year. Recent developments include an increased full-year revenue forecast to US$200-203 million and a significant contract amendment from the U.S. Department of Defense worth US$7.2 million for trauma treatment research, indicating strong potential in its Blood Safety segment expansion efforts.

- Dive into the specifics of Cerus here with our thorough balance sheet health report.

- Gain insights into Cerus' outlook and expected performance with our report on the company's earnings estimates.

Autolus Therapeutics (AUTL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Autolus Therapeutics plc is a clinical-stage biopharmaceutical company that develops T cell therapies for cancer and autoimmune diseases, with a market cap of $359.29 million.

Operations: The company generates revenue of $29.93 million from its segment focused on developing and commercializing CAR-T therapies.

Market Cap: $359.29M

Autolus Therapeutics, with a market cap of US$359.29 million, remains unprofitable but shows potential through its CAR-T therapy developments. The company reported US$29.91 million in revenue for the first half of 2025, with a net loss reduction from the previous year. Recent European Commission approval for AUCATZYL® in treating relapsed B-cell acute lymphoblastic leukemia marks significant progress, alongside promising initial findings from the CARLYSLE study on systemic lupus erythematosus. Autolus has robust short-term assets exceeding liabilities and maintains adequate cash runway despite increased debt levels over five years.

- Take a closer look at Autolus Therapeutics' potential here in our financial health report.

- Review our growth performance report to gain insights into Autolus Therapeutics' future.

Caribou Biosciences (CRBU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Caribou Biosciences, Inc. is a clinical-stage biopharmaceutical company focused on developing genome-edited allogeneic cell therapies for hematologic malignancies and autoimmune diseases, with a market cap of approximately $173.21 million.

Operations: Caribou Biosciences generates revenue primarily from developing a pipeline of allogeneic CAR-T and CAR-NK cell therapies, amounting to $9.12 million.

Market Cap: $173.21M

Caribou Biosciences, with a market cap of US$173.21 million, is focused on developing genome-edited therapies but remains unprofitable. The company reported a net loss of US$54.1 million for Q2 2025, up from US$37.7 million the previous year, with revenue at US$9.12 million primarily from its cell therapy pipeline. Despite no debt and sufficient short-term assets exceeding liabilities, Caribou's cash runway is limited to just over a year if current cash flow trends persist. Recent conference presentations highlight ongoing developments in CAR-T and CAR-NK therapies as the company seeks growth opportunities amidst high share price volatility.

- Navigate through the intricacies of Caribou Biosciences with our comprehensive balance sheet health report here.

- Evaluate Caribou Biosciences' prospects by accessing our earnings growth report.

Summing It All Up

- Navigate through the entire inventory of 372 US Penny Stocks here.

- Want To Explore Some Alternatives? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CERS

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives