- United States

- /

- Beverage

- /

- NYSE:KO

Coca-Cola (NYSE:KO) Eyes Growth with OREO Partnership Amid Market Challenges

Coca-Cola (NYSE:KO) is navigating a dynamic landscape marked by both opportunities and challenges. Recent innovations and strategic collaborations, such as the partnership with OREO, highlight the company's drive for market expansion and consumer engagement. However, financial pressures and competitive threats necessitate a closer examination of its operational strategies and market positioning. In the discussion that follows, we delve into Coca-Cola's strengths, weaknesses, opportunities, and threats to provide a comprehensive analysis of its current and future prospects.

Click here to discover the nuances of Coca-Cola with our detailed analytical report.

Strengths: Core Advantages Driving Sustained Success For Coca-Cola

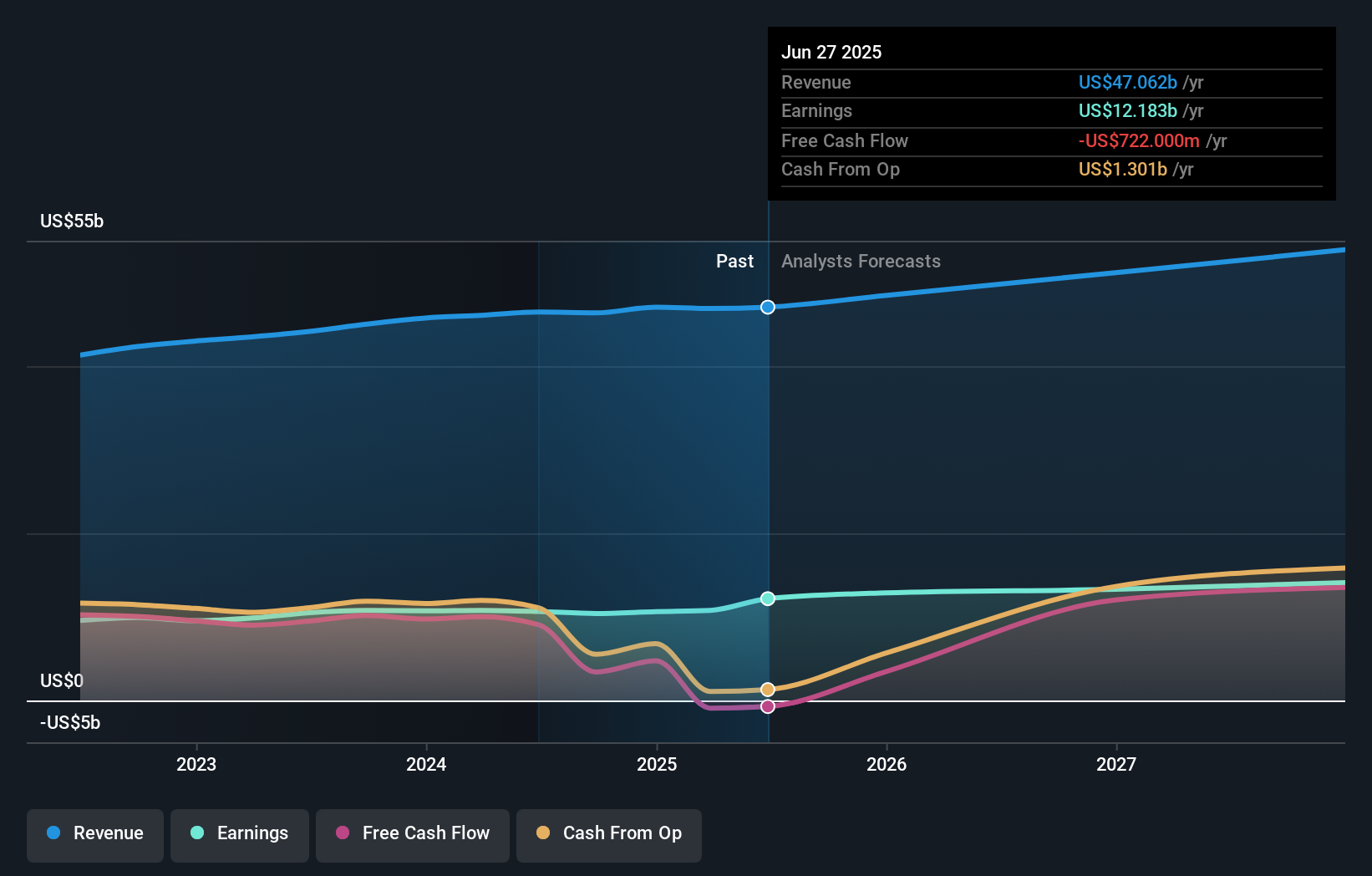

Coca-Cola's financial health is robust, demonstrated by a strong balance sheet and a net debt leverage of 1.5x EBITDA, well below their targeted range of 2 to 2.5x, as highlighted by CFO John Murphy in the latest earnings call. The company has also shown consistent profitability, with earnings growing at an average of 6.6% per year over the past five years. Leadership under CEO James Quincey has been pivotal, driving innovation and market expansion. For instance, Coca-Cola's marketing and innovation transformation journey led to Trademark Coke winning Creative Brand of the Year at the Cannes Lions.

Weaknesses: Critical Issues Affecting Coca-Cola's Performance and Areas For Growth

Despite its strengths, Coca-Cola faces significant financial challenges. The company is considered expensive based on its Price-To-Earnings Ratio (28.9x), higher than both the peer average (23.8x) and the Global Beverage industry average (18.4x). Furthermore, its current net profit margins of 22.9% are lower than last year's 23.8%, indicating a slight decline in profitability. Performance issues in key markets like North America, where volume decline was driven by softness in away-from-home channels, and in China, where consumer confidence remains subdued, also pose challenges. Additionally, free cash flow was approximately $3.3 billion, down $700 million from the previous year due to higher tax payments and increased capital expenditures.

To dive deeper into how Coca-Cola's valuation metrics are shaping its market position, check out our detailed Valuation Report for IMB.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

Coca-Cola has several strategic opportunities to enhance its market position. The company is well-positioned to capture vast opportunities, as noted by CEO James Quincey, particularly through AI-driven initiatives to push personalized messages to retailers. The recent collaboration with the OREO brand to create limited-edition products like the OREO® Coca-Cola™ Sandwich Cookie and Coca-Cola® OREO™ Zero Sugar Limited Edition exemplifies innovative product strategies that can drive consumer engagement and sales. Coca-Cola's expansion into emerging markets, such as India and Africa, where it has seen significant volume growth, also presents substantial growth potential. Increasing investments behind cold drink equipment to win share of visible inventory is another strategic move to drive consumer demand. To understand how these initiatives could build on previous efforts, visit the IMB’s Past Performance Report.

Threats: Key Risks and Challenges That Could Impact Coca-Cola's Success

Coca-Cola faces several external threats that could impact its growth and market share. Geopolitical tensions and economic uncertainty continue to be significant challenges, as noted by CEO James Quincey. Regulatory issues, such as the ongoing IRS tax case, pose additional risks. The company's high level of debt, which skews its Return on Equity (38.87%), is another concern. Furthermore, competition in the beverage industry, particularly in the energy category, remains intense. Operational risks, such as the events affecting the relationship between unit cases and concentrate, as mentioned by CFO John Murphy, also present challenges.

Conclusion

In conclusion, Coca-Cola's strong financial health, demonstrated by a robust balance sheet and consistent profitability, provides a solid foundation for sustained success. However, the company's high Price-To-Earnings Ratio of 28.9x, which exceeds both the peer average and the Global Beverage industry average, suggests that investors are paying a premium for its shares, potentially reflecting high expectations for future growth. While the company faces challenges such as declining net profit margins and performance issues in key markets, its strategic initiatives, including AI-driven marketing and expansion into emerging markets, offer significant growth potential. Nonetheless, external threats like geopolitical tensions and regulatory issues could impact its future performance, necessitating careful navigation by management.

Already own Coca-Cola? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NYSE:KO

Coca-Cola

A beverage company, manufactures and sells various nonalcoholic beverages in the United States and internationally.

Solid track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026