- United States

- /

- Health Care REITs

- /

- NYSE:SILA

3 Top Dividend Stocks Yielding Up To 6.1%

Reviewed by Simply Wall St

The market has shown positive momentum recently, with a 2.9% increase over the last week and a 12% rise over the past year, while earnings are expected to grow by 14% annually. In this environment, identifying strong dividend stocks can be crucial as they offer potential income and stability amid market growth.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.76% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 6.81% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 6.19% | ★★★★★★ |

| Ennis (NYSE:EBF) | 5.13% | ★★★★★★ |

| Chevron (NYSE:CVX) | 4.81% | ★★★★★★ |

| Credicorp (NYSE:BAP) | 5.25% | ★★★★★☆ |

| Valley National Bancorp (NasdaqGS:VLY) | 4.80% | ★★★★★☆ |

| Douglas Dynamics (NYSE:PLOW) | 4.09% | ★★★★★☆ |

| Huntington Bancshares (NasdaqGS:HBAN) | 3.83% | ★★★★★☆ |

| Carter's (NYSE:CRI) | 8.63% | ★★★★★☆ |

Click here to see the full list of 141 stocks from our Top US Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Fresh Del Monte Produce (NYSE:FDP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fresh Del Monte Produce Inc., with a market cap of $1.60 billion, operates globally through its subsidiaries to produce, market, and distribute fresh and fresh-cut fruits and vegetables across various regions including North America, Central America, South America, Europe, the Middle East, Africa, Asia, and beyond.

Operations: Fresh Del Monte Produce Inc.'s revenue is primarily derived from its Fresh and Value-Added Products segment, which accounts for $2.61 billion, followed by the Banana segment at $1.46 billion, and Other Products and Services contributing $197.20 million.

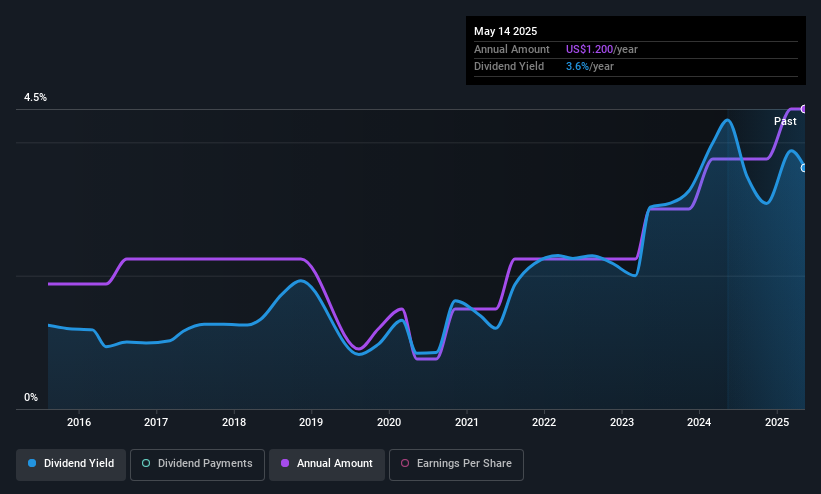

Dividend Yield: 3.6%

Fresh Del Monte Produce's dividend history shows volatility, with recent increases to US$0.30 per share, signaling growth despite past unreliability. The payout is sustainable with a low earnings and cash flow coverage ratio of 34.2% and 35.7%, respectively. However, its yield of 3.59% lags behind top-tier U.S. dividend stocks at 4.66%. Recent buybacks totaling US$7.61 million suggest confidence in value, with shares trading significantly below estimated fair value by over half (50%).

- Delve into the full analysis dividend report here for a deeper understanding of Fresh Del Monte Produce.

- Our valuation report here indicates Fresh Del Monte Produce may be undervalued.

Sila Realty Trust (NYSE:SILA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sila Realty Trust, Inc., based in Tampa, Florida, is a net lease real estate investment trust specializing in the healthcare sector, with a market cap of approximately $1.44 billion.

Operations: Sila Realty Trust generates its revenue primarily from commercial real estate investments in the healthcare sector, amounting to $184.47 million.

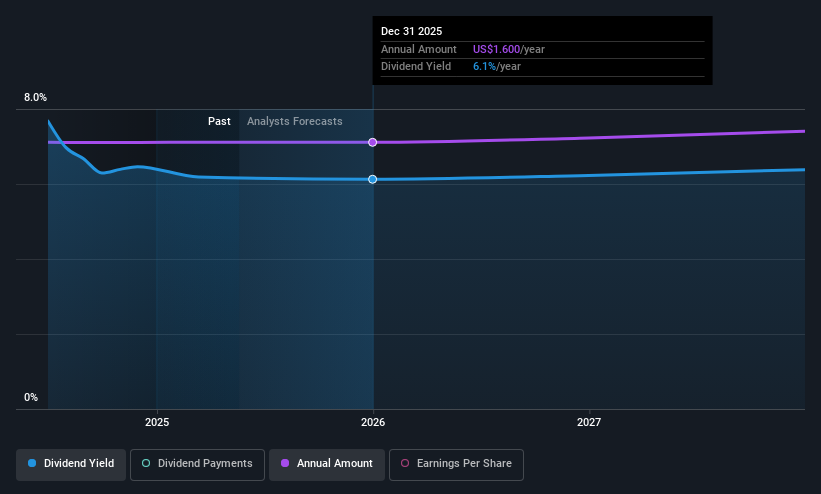

Dividend Yield: 6.1%

Sila Realty Trust's dividend yield of 6.14% ranks in the top 25% of U.S. dividend payers, though payments have been volatile over its four-year history. The dividends are covered by earnings and cash flows with payout ratios of 75.9% and 73.3%, respectively, indicating sustainability despite recent declines in net income to US$7.1 million for Q1 2025 from US$14.98 million a year ago, amid a strategic acquisition worth US$35.12 million enhancing growth prospects.

- Unlock comprehensive insights into our analysis of Sila Realty Trust stock in this dividend report.

- Upon reviewing our latest valuation report, Sila Realty Trust's share price might be too optimistic.

VICI Properties (NYSE:VICI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: VICI Properties Inc. is an S&P 500 experiential real estate investment trust specializing in gaming, hospitality, and entertainment destinations, with a market cap of approximately $33.92 billion.

Operations: VICI Properties Inc. generates revenue primarily through its Real Property and Real Estate Lending Activities, totaling approximately $3.88 billion.

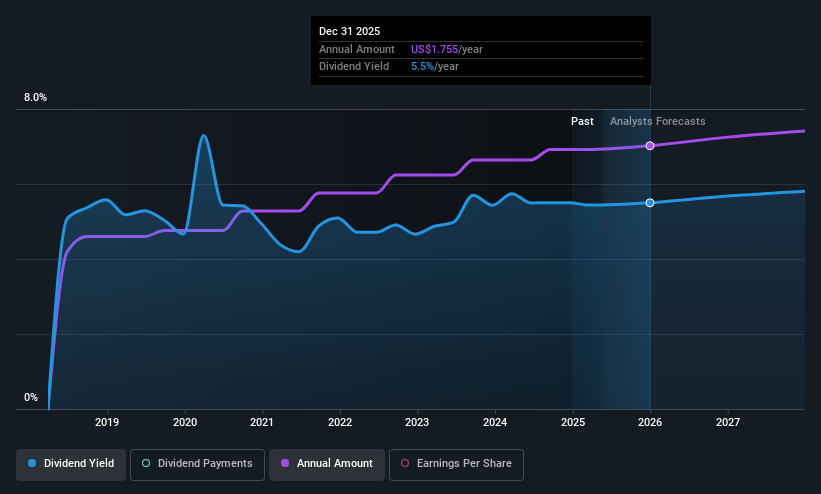

Dividend Yield: 5.4%

VICI Properties offers a compelling dividend profile, with its yield in the top 25% of U.S. payers and dividends covered by earnings and cash flows at payout ratios of 67.5% and 75.2%, respectively. However, the company has only a seven-year history of dividend payments. Recent earnings showed slight revenue growth to US$984.2 million but a decline in net income to US$543.61 million for Q1 2025, reflecting financial challenges amidst strategic debt refinancing efforts totaling $1.3 billion.

- Get an in-depth perspective on VICI Properties' performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that VICI Properties is trading behind its estimated value.

Make It Happen

- Explore the 141 names from our Top US Dividend Stocks screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Sila Realty Trust, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SILA

Sila Realty Trust

Sila Realty Trust, Inc., headquartered in Tampa, Florida, is a net lease real estate investment trust with a strategic focus on investing in the growing and resilient healthcare sector.

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives