- United States

- /

- Beverage

- /

- NasdaqGS:KDP

Will Disney Collaboration and Mixed Reality Tie-Ins Change Keurig Dr Pepper's (KDP) Brand Narrative?

Reviewed by Simply Wall St

- Disney Advertising recently announced a strategic collaboration with Keurig Dr Pepper to deliver personalized consumer experiences, including innovative integrations of Dr Pepper® during college football broadcasts and new documentary-style social content.

- This partnership will debut mixed reality features in live sports broadcasts, blending brand storytelling with fan engagement on an unprecedented scale.

- We'll assess how the planned use of augmented and mixed reality activations could reshape Keurig Dr Pepper's long-term investment outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Keurig Dr Pepper Investment Narrative Recap

To own shares of Keurig Dr Pepper, investors need confidence in the company’s ability to grow its core beverage brands while managing pressures in its coffee business. The Disney Advertising partnership introduces new fan-engagement tools through mixed and augmented reality, but it does not directly address the most immediate short-term risk: ongoing headwinds in the U.S. Coffee segment from inflation and competitive pricing, which continue to weigh on margins. Among recent announcements, the company’s reaffirmation of full-year earnings guidance after its July 2025 results stands out. That confirmation, despite a challenging coffee segment, signals management’s focus on revenue growth and cost control as near-term catalysts, even as cost pressures and tariff risks remain central issues in the months ahead. Yet, in contrast to these efforts to boost branded beverage growth, investors should be aware that continued margin pressure from inflation and pricing competition in coffee could...

Read the full narrative on Keurig Dr Pepper (it's free!)

Keurig Dr Pepper is projected to reach $21.1 billion in revenue and $3.2 billion in earnings by 2028. This outlook assumes annual revenue growth of 10.2% and an increase in earnings of $1.7 billion from the current $1.5 billion.

Uncover how Keurig Dr Pepper's forecasts yield a $37.89 fair value, a 31% upside to its current price.

Exploring Other Perspectives

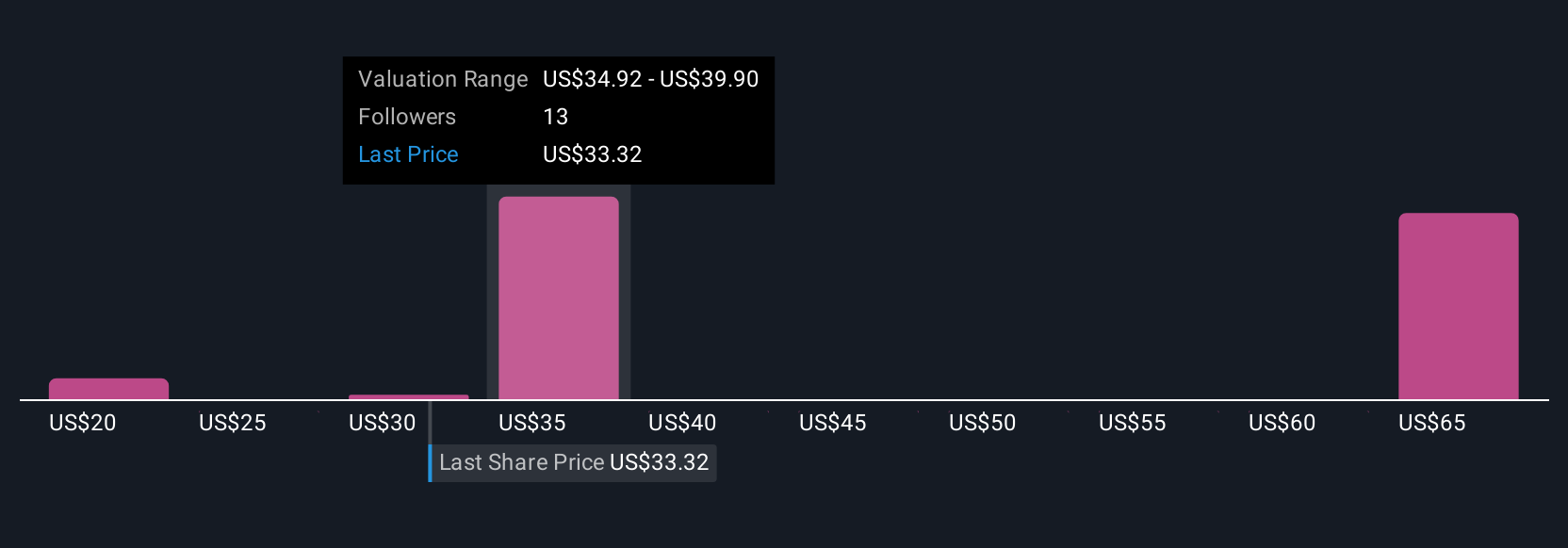

Six private investors in the Simply Wall St Community valued KDP between US$20 and US$64.93 per share, reflecting a broad spectrum of expectations. While some see brand growth as a catalyst for upside, others point to margin risks that could affect future earnings, highlighting the importance of considering multiple viewpoints before making decisions.

Explore 6 other fair value estimates on Keurig Dr Pepper - why the stock might be worth 31% less than the current price!

Build Your Own Keurig Dr Pepper Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Keurig Dr Pepper research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Keurig Dr Pepper research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Keurig Dr Pepper's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Keurig Dr Pepper might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KDP

Keurig Dr Pepper

Owns, manufactures, and distributors beverages and single serve brewing systems in the United States and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)