- United States

- /

- Beverage

- /

- NasdaqGS:KDP

We Ran A Stock Scan For Earnings Growth And Keurig Dr Pepper (NASDAQ:KDP) Passed With Ease

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Keurig Dr Pepper (NASDAQ:KDP). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Keurig Dr Pepper

Keurig Dr Pepper's Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. Over the last three years, Keurig Dr Pepper has grown EPS by 11% per year. That's a good rate of growth, if it can be sustained.

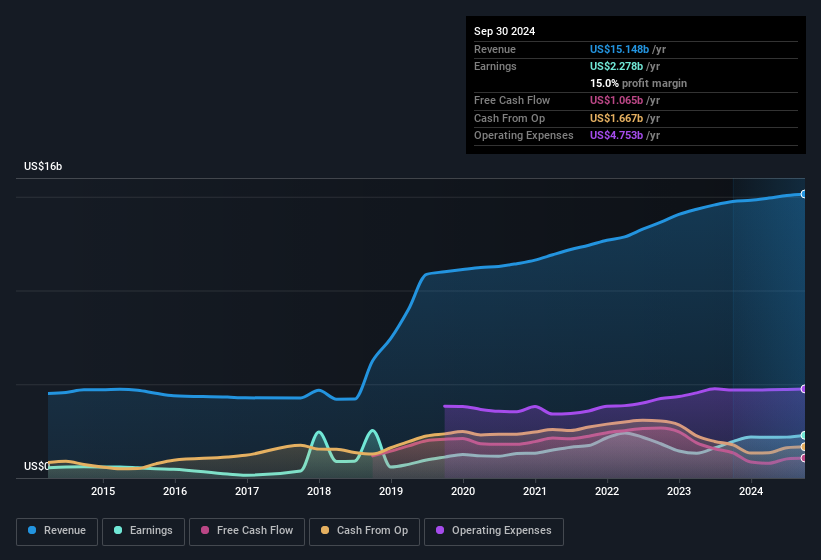

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The good news is that Keurig Dr Pepper is growing revenues, and EBIT margins improved by 2.1 percentage points to 23%, over the last year. Both of which are great metrics to check off for potential growth.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Keurig Dr Pepper's forecast profits?

Are Keurig Dr Pepper Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The US$3.0m worth of shares that insiders sold during the last 12 months pales in comparison to the US$18m they spent on acquiring shares in the company. We find this encouraging because it suggests they are optimistic about Keurig Dr Pepper'sfuture. Zooming in, we can see that the biggest insider purchase was by company insider G. Harf for US$5.0m worth of shares, at about US$29.10 per share.

The good news, alongside the insider buying, for Keurig Dr Pepper bulls is that insiders (collectively) have a meaningful investment in the stock. We note that their impressive stake in the company is worth US$449m. This suggests that leadership will be very mindful of shareholders' interests when making decisions!

Does Keurig Dr Pepper Deserve A Spot On Your Watchlist?

One positive for Keurig Dr Pepper is that it is growing EPS. That's nice to see. Better yet, insiders are significant shareholders, and have been buying more shares. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. We should say that we've discovered 2 warning signs for Keurig Dr Pepper (1 shouldn't be ignored!) that you should be aware of before investing here.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Keurig Dr Pepper, you'll probably love this curated collection of companies in the US that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Keurig Dr Pepper might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:KDP

Keurig Dr Pepper

Owns, manufactures, and distributors beverages and single serve brewing systems in the United States and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives