- United States

- /

- Food

- /

- NasdaqGM:FRPT

Verra Mobility And Two Other US Stocks Estimated To Be Trading Below Intrinsic Value

Reviewed by Simply Wall St

As the S&P 500 reaches new heights and major indices hover near record levels, investors are keenly observing market movements to identify potential opportunities. In this environment, identifying stocks trading below their intrinsic value can be a strategic move for those looking to capitalize on undervalued assets; Verra Mobility and two other U.S. stocks stand out as candidates potentially offering such value amidst these conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | $18.66 | $36.99 | 49.6% |

| CareTrust REIT (NYSE:CTRE) | $25.97 | $50.31 | 48.4% |

| Smurfit Westrock (NYSE:SW) | $55.30 | $109.74 | 49.6% |

| Sandy Spring Bancorp (NasdaqGS:SASR) | $33.88 | $64.49 | 47.5% |

| Incyte (NasdaqGS:INCY) | $71.27 | $134.85 | 47.1% |

| Array Technologies (NasdaqGM:ARRY) | $6.86 | $13.52 | 49.3% |

| Constellium (NYSE:CSTM) | $9.24 | $18.27 | 49.4% |

| First Advantage (NasdaqGS:FA) | $19.58 | $38.12 | 48.6% |

| Open Lending (NasdaqGM:LPRO) | $5.48 | $10.38 | 47.2% |

| Kyndryl Holdings (NYSE:KD) | $41.87 | $82.10 | 49% |

Let's explore several standout options from the results in the screener.

Verra Mobility (NasdaqCM:VRRM)

Overview: Verra Mobility Corporation offers smart mobility technology solutions and services across the United States, Australia, Canada, and Europe with a market cap of approximately $4.34 billion.

Operations: The company's revenue is primarily derived from its Commercial Services segment at $403.56 million, followed by Government Solutions at $381.71 million, and Parking Solutions contributing $83.45 million.

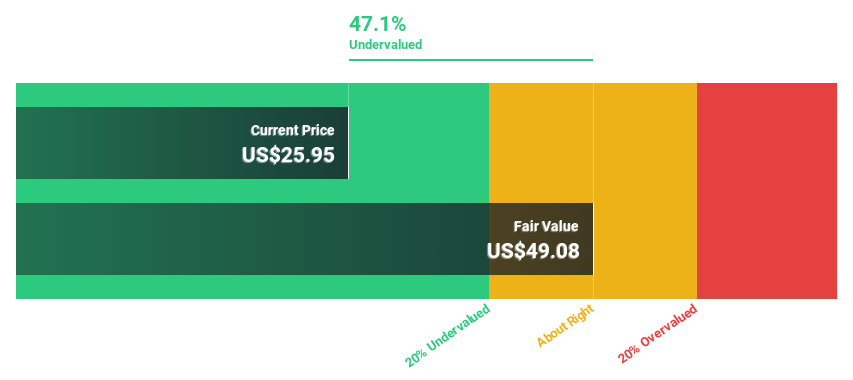

Estimated Discount To Fair Value: 45.8%

Verra Mobility appears undervalued based on cash flows, trading at US$26.55 against a fair value estimate of US$48.97, suggesting a significant discount. Despite slower revenue growth projections of 6.5% annually compared to the broader market, its earnings are forecasted to grow significantly at 23.1% per year, outpacing the market average of 14.5%. Recent enhancements in its buyback plan by an additional US$100 million underscore management's confidence in its financial health and future prospects.

- Our comprehensive growth report raises the possibility that Verra Mobility is poised for substantial financial growth.

- Get an in-depth perspective on Verra Mobility's balance sheet by reading our health report here.

Freshpet (NasdaqGM:FRPT)

Overview: Freshpet, Inc. manufactures, distributes, and markets natural fresh meals and treats for dogs and cats across the United States, Canada, and Europe with a market cap of approximately $6.29 billion.

Operations: The company generates revenue of $927.89 million from its pet food and pet treats segment for dogs and cats.

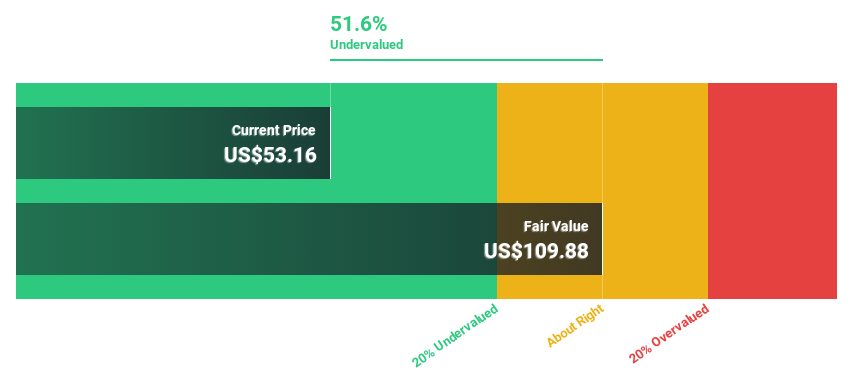

Estimated Discount To Fair Value: 24.7%

Freshpet, trading at US$131.99, is undervalued based on discounted cash flow analysis with a fair value estimate of US$175.21, reflecting a 24.7% discount. Its revenue growth forecast of 17.7% per year surpasses the US market average of 8.9%, while earnings are expected to grow significantly at 29.8% annually over the next three years, outpacing market expectations despite recent one-off financial impacts and low future return on equity projections (9.5%).

- Our earnings growth report unveils the potential for significant increases in Freshpet's future results.

- Unlock comprehensive insights into our analysis of Freshpet stock in this financial health report.

Smurfit Westrock (NYSE:SW)

Overview: Smurfit Westrock Plc, along with its subsidiaries, is engaged in the manufacturing, distribution, and sale of containerboard, corrugated containers, and other paper-based packaging products both in Ireland and globally, with a market capitalization of approximately $27.81 billion.

Operations: The company's revenue is primarily derived from three segments: North America with $9.58 billion, Latin America with $1.71 billion, and Europe, the Middle East and Africa, and Asia-Pacific collectively contributing $10.09 billion.

Estimated Discount To Fair Value: 49.6%

Smurfit Westrock, trading at US$55.30, is significantly undervalued with a fair value estimate of US$109.74. Despite a low return on equity forecast (11.4%) and substantial insider selling, its earnings are projected to grow 26.3% annually, outpacing the US market's 14.5%. Recent earnings showed strong sales growth from US$2.86 billion to US$7.54 billion year-over-year, alongside strategic plans for disciplined M&A to enhance shareholder value creation and returns.

- According our earnings growth report, there's an indication that Smurfit Westrock might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Smurfit Westrock.

Taking Advantage

- Delve into our full catalog of 162 Undervalued US Stocks Based On Cash Flows here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Freshpet, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FRPT

Freshpet

Manufactures, distributes, and markets natural fresh meals and treats for dogs and cats in the United States, Canada, and Europe.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives