- United States

- /

- Food

- /

- NasdaqGM:LWAY

Undiscovered Gems in the United States for February 2025

Reviewed by Simply Wall St

In the last week, the United States market has been flat, yet it has experienced a notable 21% rise over the past year with earnings projected to grow by 14% annually. In this dynamic environment, identifying stocks that are undervalued or overlooked can provide unique opportunities for investors seeking to capitalize on potential growth.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 9.72% | 4.93% | 6.51% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Cashmere Valley Bank | 15.51% | 5.80% | 3.51% | ★★★★★★ |

| Oakworth Capital | 31.49% | 14.78% | 4.46% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Lifeway Foods (NasdaqGM:LWAY)

Simply Wall St Value Rating: ★★★★★★

Overview: Lifeway Foods, Inc. is a company that produces and markets probiotic-based products both in the United States and internationally, with a market cap of $329.15 million.

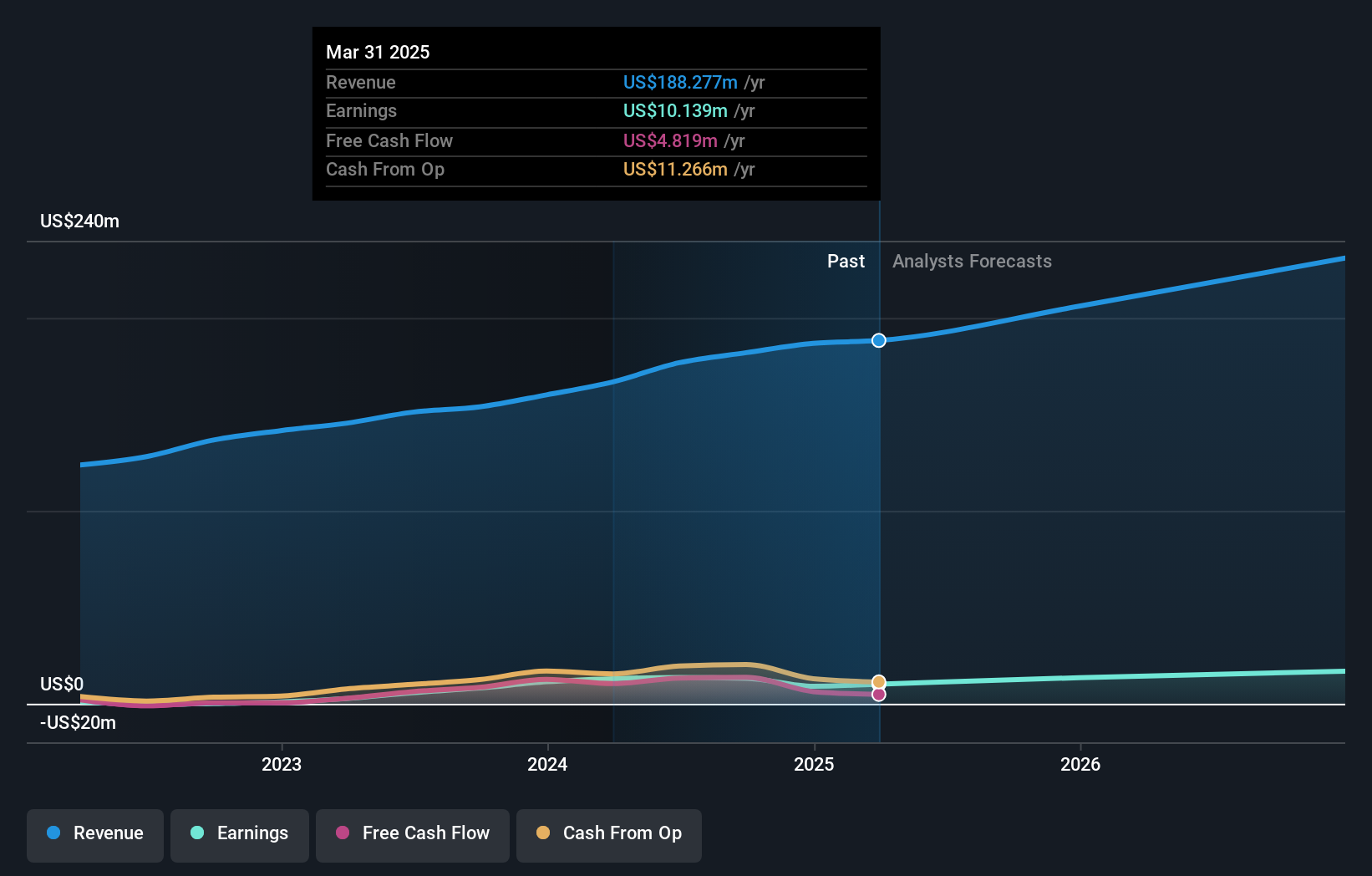

Operations: Lifeway Foods generates revenue primarily from its cultured dairy products, amounting to $181.98 million.

Lifeway Foods, a notable player in the probiotic foods sector, is making strides with its recent distribution of Farmer Cheese to 1,400 Albertsons stores across the U.S., reflecting its commitment to expanding product reach. The company's earnings growth of 62.1% last year significantly outpaced the food industry's average of 0.9%, highlighting robust performance. Lifeway remains debt-free and trades at 73% below its estimated fair value, indicating potential undervaluation. Despite facing market execution challenges and competitive pressures, Lifeway's strategic expansion into international markets like South Africa and UAE positions it well for future growth opportunities.

Calavo Growers (NasdaqGS:CVGW)

Simply Wall St Value Rating: ★★★★★★

Overview: Calavo Growers, Inc. is a company that markets and distributes avocados and other perishable foods to various retail and wholesale customers globally, with a market cap of $422.57 million.

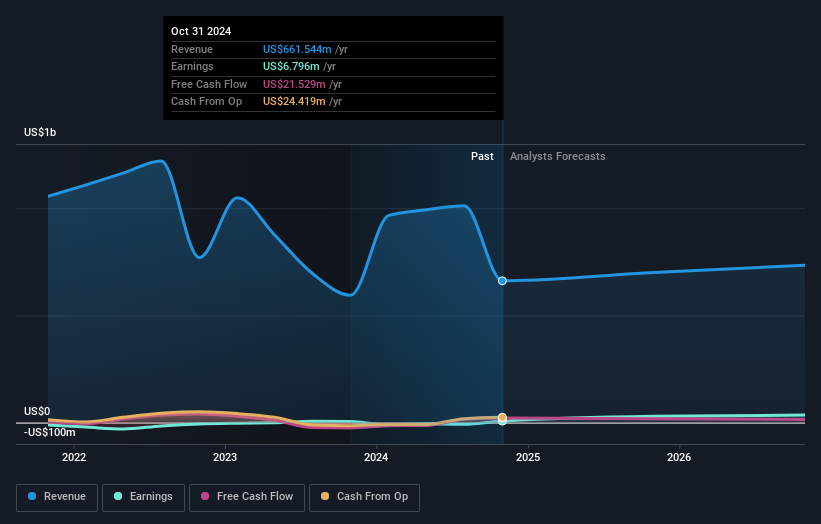

Operations: Calavo Growers generates revenue primarily from two segments: Grown products, which contribute $597.62 million, and Prepared products, adding $63.92 million.

Calavo Growers, a nimble player in the food industry, has shown impressive financial resilience. Over the past year, earnings surged 45.3%, outpacing the industry’s modest 0.9% growth. The company remains debt-free and boasts high-quality earnings, underscoring its solid financial footing. Recent leadership changes saw Farha Aslam appointed as Chair of the Board, bringing extensive experience from Crescent House Capital and other notable firms. For fiscal 2024, sales reached US$661 million with a net loss narrowing to US$1 million from US$8 million previously; basic EPS improved to US$0.38 from US$0.26 last year for continuing operations.

- Click to explore a detailed breakdown of our findings in Calavo Growers' health report.

Review our historical performance report to gain insights into Calavo Growers''s past performance.

Global Industrial (NYSE:GIC)

Simply Wall St Value Rating: ★★★★★★

Overview: Global Industrial Company is an industrial distributor specializing in a wide range of MRO products across North America, with a market capitalization of approximately $937.41 million.

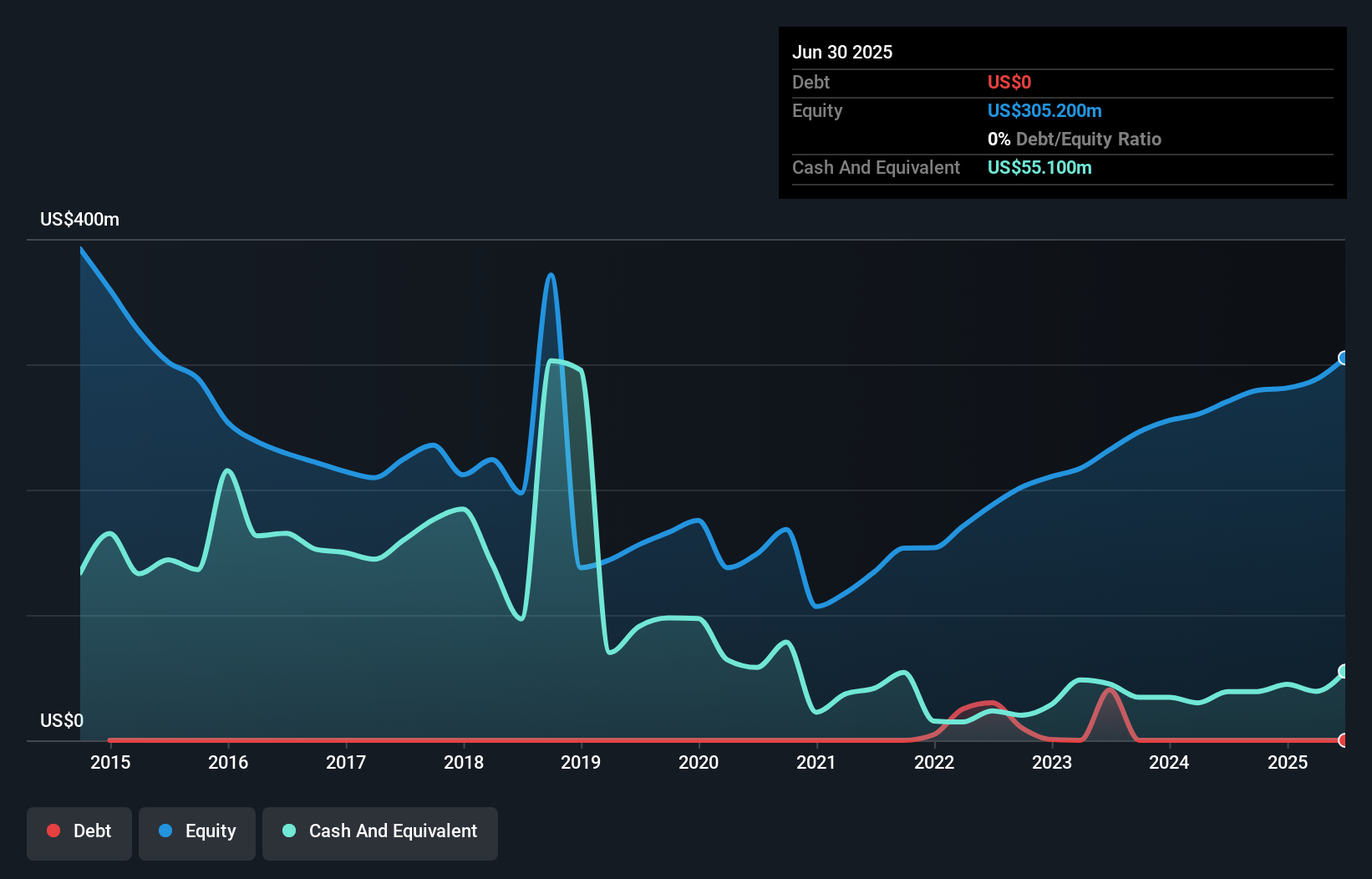

Operations: Global Industrial generates revenue primarily through its Industrial Products Group, which reported $1.33 billion in sales. The company's gross profit margin was 35.2%, reflecting its pricing strategy and cost management within the competitive industrial distribution sector.

Global Industrial, a promising player in the industrial sector, is making strategic moves to boost its growth trajectory. The company is debt-free and trades at 71.3% below its estimated fair value, suggesting potential for significant appreciation. Despite a recent earnings dip of 5.4%, it outperforms the industry average decline of 6.9%. With no debt over the past five years and positive free cash flow, Global Industrial seems well-positioned financially. The appointment of Anesa Chaibi as CEO could bring fresh leadership insights to further enhance customer engagement and operational efficiency through tools like Salesforce, aiming for improved profit margins from 4.9% to 6.3%.

Seize The Opportunity

- Embark on your investment journey to our 284 US Undiscovered Gems With Strong Fundamentals selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LWAY

Lifeway Foods

Produces and markets probiotic-based products in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives