- United States

- /

- Capital Markets

- /

- NYSEAM:CET

3 High-Quality Dividend Stocks Yielding Up To 4.8%

Reviewed by Simply Wall St

Over the last 7 days, the United States market has dropped 1.1%, yet it remains up by 9.1% over the past year with earnings forecasted to grow by 14% annually. In this dynamic environment, high-quality dividend stocks can offer investors a combination of income and potential for growth, making them an attractive option for those seeking stability amidst fluctuating market conditions.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 6.08% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 7.11% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 6.43% | ★★★★★★ |

| Ennis (NYSE:EBF) | 5.29% | ★★★★★★ |

| Chevron (NYSE:CVX) | 5.05% | ★★★★★★ |

| Credicorp (NYSE:BAP) | 5.42% | ★★★★★☆ |

| Valley National Bancorp (NasdaqGS:VLY) | 5.10% | ★★★★★☆ |

| Southside Bancshares (NYSE:SBSI) | 5.02% | ★★★★★☆ |

| Huntington Bancshares (NasdaqGS:HBAN) | 4.05% | ★★★★★☆ |

| Carter's (NYSE:CRI) | 9.96% | ★★★★★☆ |

Click here to see the full list of 148 stocks from our Top US Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

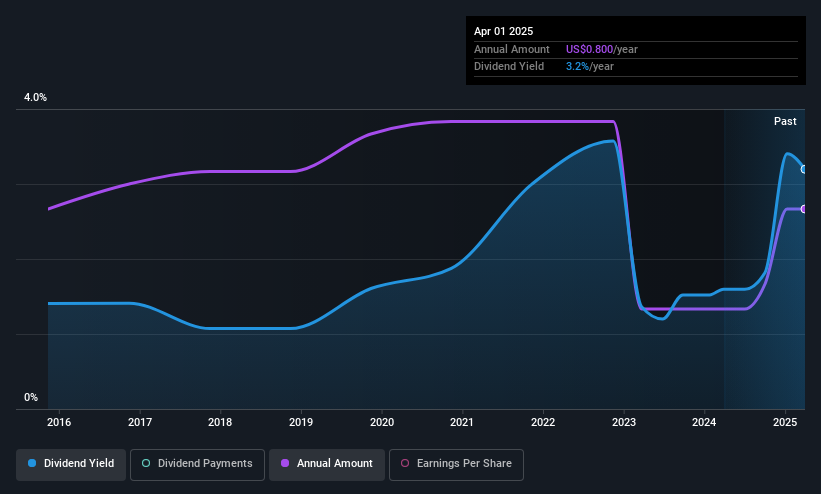

Calavo Growers (NasdaqGS:CVGW)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Calavo Growers, Inc. is involved in marketing and distributing avocados, prepared avocados, and other perishable foods to a variety of customers globally, with a market cap of $479.45 million.

Operations: Calavo Growers, Inc. generates its revenue through two main segments: Fresh, which accounts for $624.39 million, and Prepared, contributing $63.93 million.

Dividend Yield: 3%

Calavo Growers recently declared a quarterly dividend of US$0.20 per share, supported by a payout ratio of 77.5%, indicating coverage by earnings and cash flows. Despite an impressive earnings turnaround, with net income reaching US$4.42 million in the latest quarter, the dividend yield remains low compared to top-tier payers in the U.S., and past payments have been volatile. The company also announced a US$25 million share repurchase program valid until 2027, potentially enhancing shareholder value.

- Click here and access our complete dividend analysis report to understand the dynamics of Calavo Growers.

- Upon reviewing our latest valuation report, Calavo Growers' share price might be too optimistic.

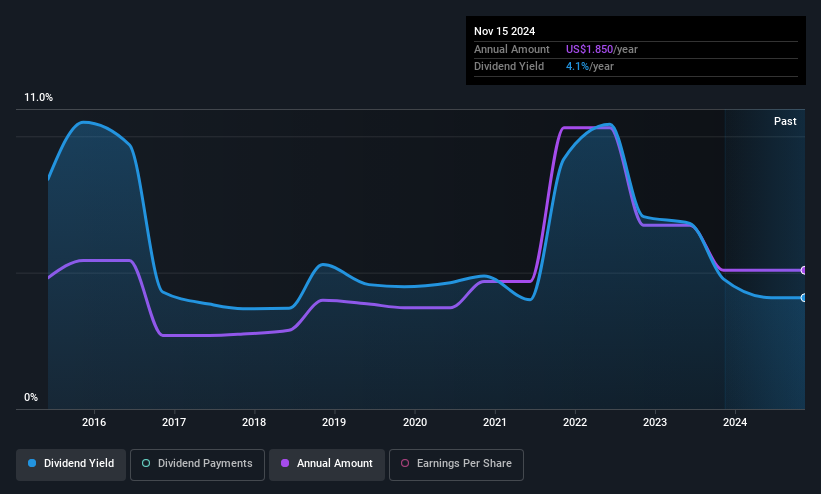

Central Securities (NYSEAM:CET)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Central Securities Corp. is a publicly owned investment manager with a market cap of approximately $1.35 billion.

Operations: Central Securities Corp. generates revenue primarily through its financial services segment, specifically from closed-end funds, amounting to approximately $23.70 million.

Dividend Yield: 4.8%

Central Securities offers a dividend yield of 4.84%, placing it among the top 25% of U.S. dividend payers, though its dividends are not well covered by free cash flows, with a high cash payout ratio of 174.7%. Despite earnings growth of 28.8% over the past year and trading at a significant discount to estimated fair value, its dividend payments have been volatile and unreliable over the past decade.

- Click to explore a detailed breakdown of our findings in Central Securities' dividend report.

- Our expertly prepared valuation report Central Securities implies its share price may be lower than expected.

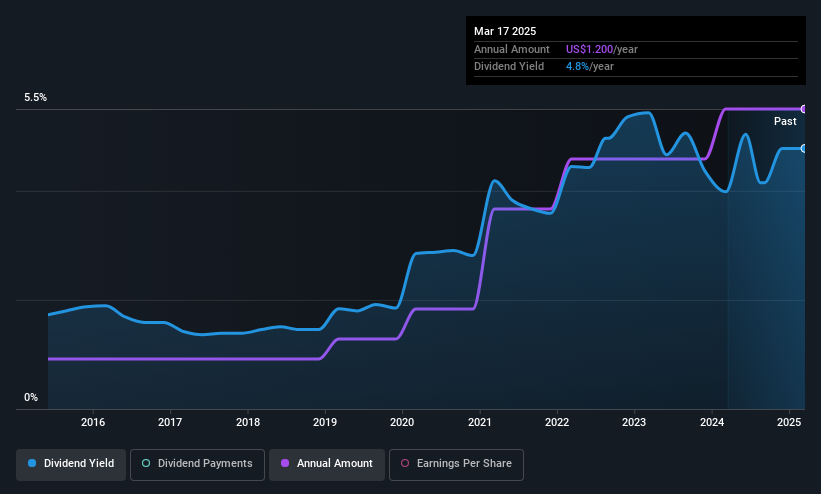

CompX International (NYSEAM:CIX)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: CompX International Inc. manufactures and sells security products and recreational marine components primarily in North America, with a market cap of approximately $308.33 million.

Operations: CompX International Inc.'s revenue is derived from two main segments: Security Products, contributing $115.59 million, and Marine Components, generating $32.66 million.

Dividend Yield: 4.6%

CompX International maintains a stable dividend history, recently affirming its quarterly dividend of US$0.30 per share, supported by a cash payout ratio of 77.1% and an earnings payout ratio of 82.3%. The company's dividends have shown consistent growth over the past decade without volatility. Despite trading at 34.3% below estimated fair value, its current yield of 4.62% is slightly below the top quartile in the U.S., but remains reliable and sustainable given current financial metrics.

- Navigate through the intricacies of CompX International with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that CompX International is trading behind its estimated value.

Where To Now?

- Unlock more gems! Our Top US Dividend Stocks screener has unearthed 145 more companies for you to explore.Click here to unveil our expertly curated list of 148 Top US Dividend Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Central Securities, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:CET

Central Securities

Central Securities Corp. is a publicly owned investment manager.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives