- United States

- /

- Consumer Durables

- /

- NasdaqGS:LCUT

3 Dividend Stocks To Consider With Yields Up To 5%

Reviewed by Simply Wall St

As the U.S. stock market experiences a pause in its recent rally, with major indices like the S&P 500 and Nasdaq Composite facing declines, investors are closely watching economic indicators and Federal Reserve communications for guidance. In such uncertain times, dividend stocks can offer a measure of stability and income potential, making them an attractive consideration for those looking to navigate volatile markets.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.82% | ★★★★★★ |

| Douglas Dynamics (NYSE:PLOW) | 4.89% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.97% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 7.17% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 6.63% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.35% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.93% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 6.52% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.48% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 4.80% | ★★★★★★ |

Click here to see the full list of 156 stocks from our Top US Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Calavo Growers (NasdaqGS:CVGW)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Calavo Growers, Inc. is engaged in marketing and distributing avocados and other perishable foods to various retail and wholesale customers globally, with a market cap of approximately $425.04 million.

Operations: Calavo Growers, Inc. generates revenue through its Fresh segment, which accounts for $624.39 million, and its Prepared segment, contributing $63.93 million.

Dividend Yield: 3.4%

Calavo Growers, Inc. recently announced a share repurchase program worth US$25 million, valid until 2027, which can support stock price stability. The company declared a quarterly dividend of $0.20 per share payable in April 2025. Despite past volatility and an unstable dividend track record, current dividends are covered by earnings (77.5% payout ratio) and cash flows (80.2% cash payout ratio). However, its 3.39% yield is below the top tier of U.S. dividend payers.

- Delve into the full analysis dividend report here for a deeper understanding of Calavo Growers.

- Upon reviewing our latest valuation report, Calavo Growers' share price might be too pessimistic.

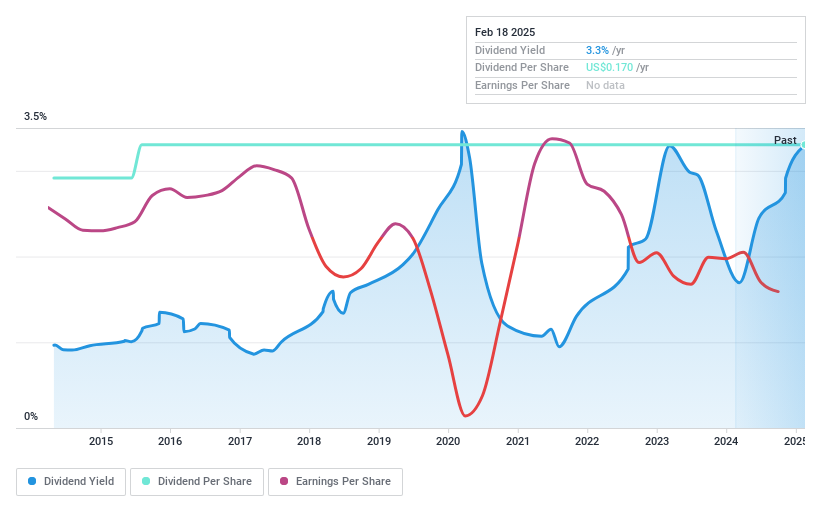

Lifetime Brands (NasdaqGS:LCUT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lifetime Brands, Inc. is a company that designs, sources, and sells branded kitchenware and tableware for home use both in the United States and internationally, with a market cap of $111.48 million.

Operations: Lifetime Brands generates revenue from its international operations amounting to $55.75 million and from U.S. (including retail direct) activities totaling $627.20 million.

Dividend Yield: 3.1%

Lifetime Brands' dividend yield of 3.13% is below the top tier in the U.S. market, and while dividends have been stable and growing over the past decade, they are not well covered by earnings due to unprofitability. However, a low cash payout ratio indicates coverage by cash flows. Recent financial results show improved quarterly earnings but an annual net loss. The company is seeking acquisitions and expanding infrastructure with a new distribution center to support future growth strategies.

- Click here and access our complete dividend analysis report to understand the dynamics of Lifetime Brands.

- Our valuation report here indicates Lifetime Brands may be undervalued.

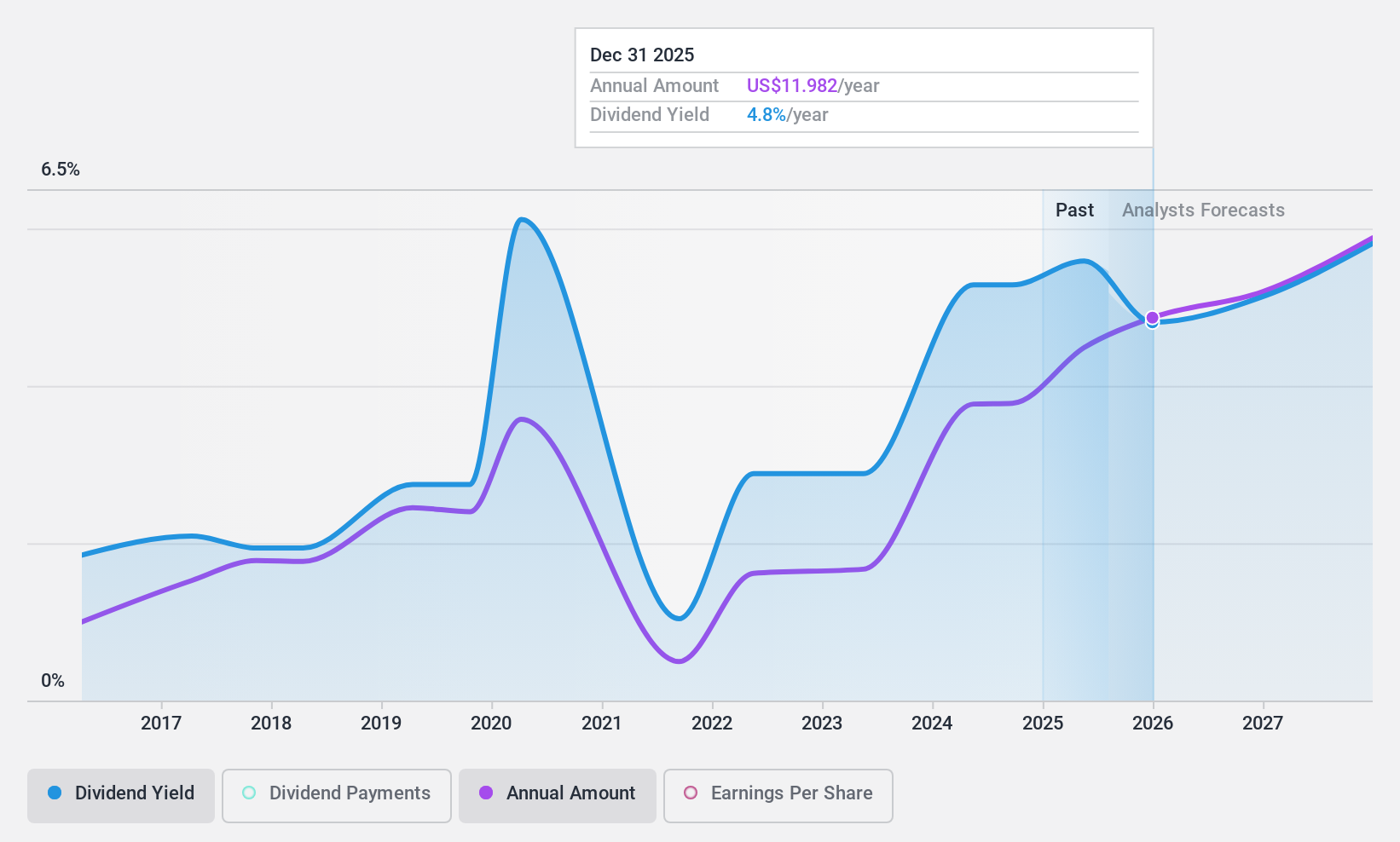

Credicorp (NYSE:BAP)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Credicorp Ltd. offers a range of financial, insurance, and health services primarily in Peru and internationally, with a market cap of $15.16 billion.

Operations: Credicorp Ltd.'s revenue segments include Universal Banking through Banco De Crédito Del Perú at PEN 12.82 billion and Banco De Crédito De Bolivia at PEN 433 million, Microfinance via Mibanco at PEN 1.52 billion and Mibanco Colombia (including Edyficar S.A.S.) at PEN 268 million, Insurance and Pension Funds through Pacífico Seguros and Subsidiaries at PEN 1.23 billion and Prima AFP at PEN 381 million, as well as Investment Management and Advisory services generating PEN 951 million.

Dividend Yield: 5%

Credicorp offers a 5.03% dividend yield, placing it in the top 25% of U.S. dividend payers, with dividends covered by earnings at a 53.3% payout ratio and forecasted to remain sustainable at 48.7%. Despite growth in earnings and net income, its dividend history is marked by volatility and unreliability over the past decade. Trading below estimated fair value suggests potential investment appeal, though high non-performing loans (5.3%) present risks.

- Unlock comprehensive insights into our analysis of Credicorp stock in this dividend report.

- In light of our recent valuation report, it seems possible that Credicorp is trading behind its estimated value.

Make It Happen

- Click here to access our complete index of 156 Top US Dividend Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LCUT

Lifetime Brands

Designs, sources, and sells branded kitchenware, tableware, and other products for use in the home in the United States and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives