- United States

- /

- Beverage

- /

- NasdaqGS:COKE

Coca-Cola Consolidated (COKE) Reports Q2 Sales Increase To US$1.86 Billion

Reviewed by Simply Wall St

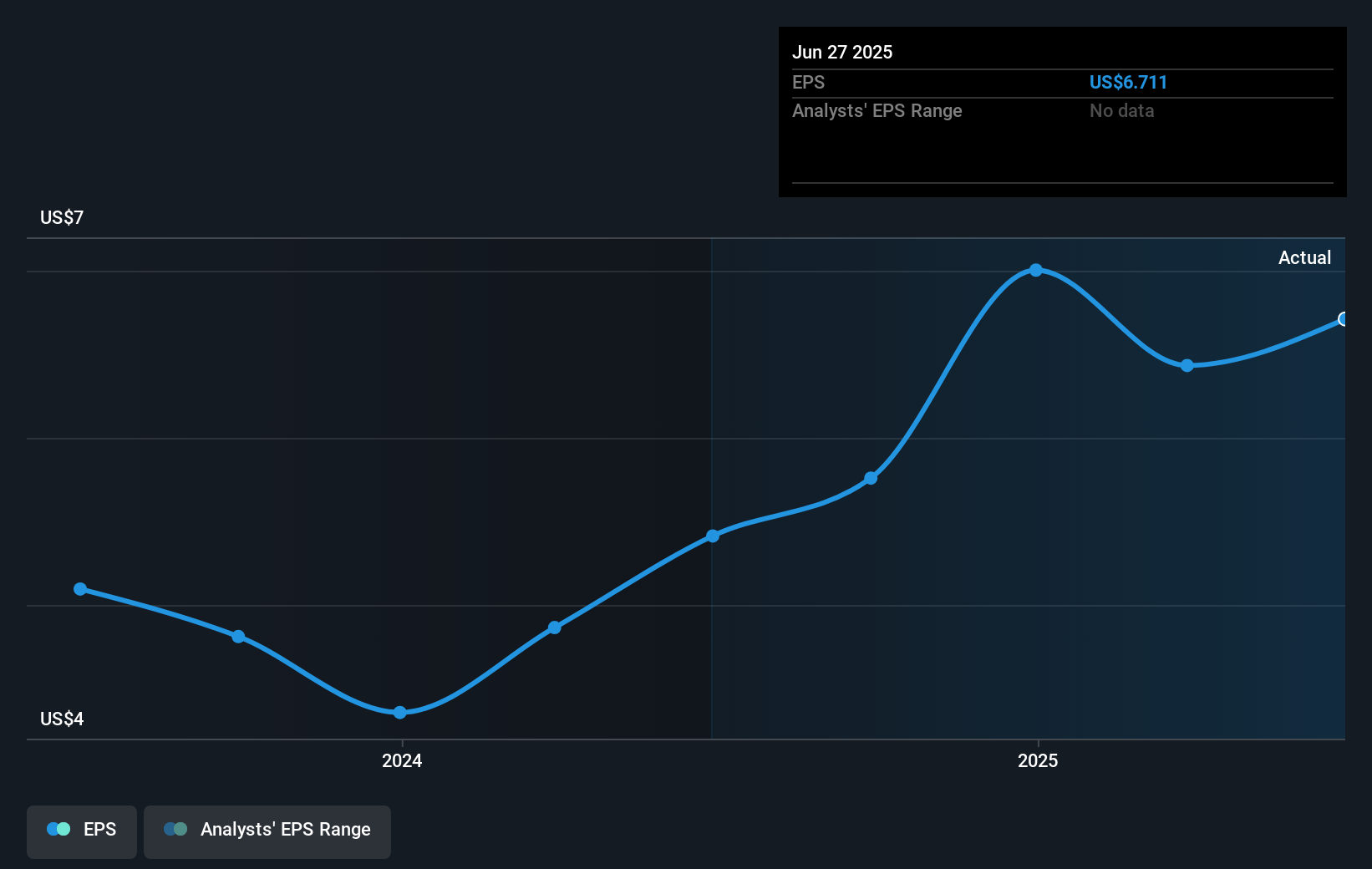

Coca-Cola Consolidated (COKE) reported a strong increase in quarterly sales and net income for the second quarter, although its six-month net income declined compared to the previous year. Over the past month, the company's share price moved up 2%, reflecting broader market trends where major indexes hit record highs, boosted by robust corporate earnings. The announcement of a $0.25 per share dividend and the company's inclusion in several growth benchmarks could have added a positive sentiment. This slight rise aligns generally with market performance trends, suggesting company-specific factors supported rather than diverged from market conditions.

Over the past five years, Coca-Cola Consolidated's (COKE) total return, which includes both share price appreciation and dividends, reached 414.44%. This performance contextually reflects the company's resilience and ability to deliver shareholder value consistently. Despite a slightly lower six-month net income recently, the firm's historically robust growth in earnings and revenue continues to underpin investor confidence.

While COKE surpassed the US Beverage industry over the past year, its 1-year return did not match the broader US market's 18% gain. The company's sustained focus on dividend distributions and the execution of a stock split exemplifies its commitment to enhancing shareholder returns. Additionally, inclusion in major indices suggests exposure to a broader investor base, which might support future share price dynamics.

The recent 2% share price uptick amid a positive quarterly earnings report and dividend announcement positions the company well relative to analyst consensus targets, albeit these targets need further analysis for precise comparison. Nevertheless, the effective execution of dividend policies and strategic inclusion in growth benchmarks could favorably influence revenue and earnings forecasts moving forward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COKE

Coca-Cola Consolidated

Manufactures, markets, and distributes nonalcoholic beverages primarily products of The Coca-Cola Company in the United States.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Cheap if able to sustain revenue, and a potential bargain if able to turn store openings into revenue growth

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)