- United States

- /

- Energy Services

- /

- NYSE:XPRO

Expro Group Holdings (NYSE:XPRO): Evaluating Valuation After Record-Setting Offshore Engineering Milestone

Reviewed by Simply Wall St

Expro Group Holdings (NYSE:XPRO) just made headlines by setting a new world record for the heaviest casing string ever deployed offshore. By leveraging its advanced Blackhawk Gen III Wireless Top Drive Cement Head with SKYHOOK technology in a challenging Gulf of America project for a super major, Expro’s team pulled off a feat that even industry veterans are calling a milestone. This kind of technical edge, especially in demanding offshore environments, puts Expro’s name front and center for investors eyeing innovation and operational excellence in the oilfield services space.

Shareholders may be wondering how this engineering win fits into Expro’s broader story, especially with the share price rising 21% in the past month but still down 32% over the year. Momentum appears to be building again, following a period where market perception had clearly shifted. The company’s annual revenue and net income have both grown over the past year, hinting at operational improvements even as the longer-term stock trend remains under pressure.

So with Expro’s share price rebounding and its engineering credentials shining, is the stock now offering real value, or are investors already pricing in future growth from these accomplishments?

Most Popular Narrative: 3% Undervalued

According to the most widely followed narrative, Expro Group Holdings appears slightly undervalued compared to analyst estimates, with a small discount to its fair value.

Accelerated development and deployment of advanced digital and automation technologies, such as remote operations and AI-driven tools, are enhancing operational efficiency and margin expansion. This is creating potential for further net margin and earnings improvements as adoption grows.

Curious about the strategy that puts Expro’s fair value above its current price? The narrative hinges on projections of rising margins, future earnings growth, and a premium profit multiple rarely seen in this sector. Want to uncover which forecasted financial leaps and industry bets are shaping this bullish outlook? There is more behind the scenes. Find out what could propel Expro’s valuation to new heights.

Result: Fair Value of $12.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, if oilfield spending slows or regulatory shifts accelerate, Expro’s long-term demand and earnings power could encounter significant challenges.

Find out about the key risks to this Expro Group Holdings narrative.Another View: Comparing to the Market

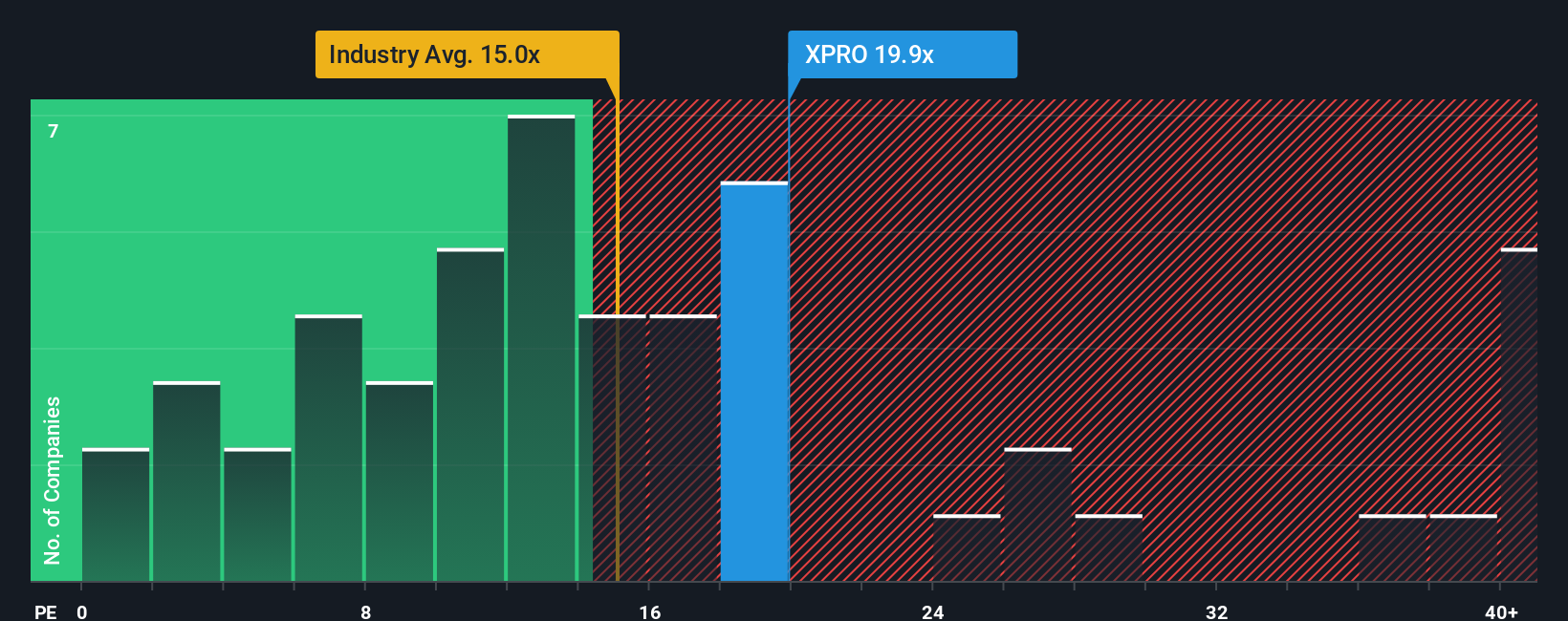

While the previous valuation suggests Expro is slightly undervalued, a look at how shares are trading versus the broader US industry standard paints a less optimistic picture. This indicates the stock may actually be expensive. Which benchmark tells the true story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Expro Group Holdings Narrative

If you have a different perspective or want to investigate the data personally, you can craft your own take in just a few minutes: Do it your way.

A great starting point for your Expro Group Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep an eye out for the next big opportunity. The Simply Wall Street Screener is your shortcut to finding them fast. Don’t let these handpicked ideas pass you by, especially if you want to sharpen your edge and beat the market this year.

- Spot tomorrow’s technology leaders by checking out AI penny stocks, which are transforming industries with breakthrough artificial intelligence and automation.

- Collect reliable income and consistent growth by searching for dividend stocks with yields > 3% that excel in delivering strong dividend yields above 3%.

- Jump on the deals that value investors crave by using undervalued stocks based on cash flows to unearth stocks currently trading at a bargain based on projected cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Expro Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:XPRO

Expro Group Holdings

Provides energy services in North and Latin America, Europe and Sub-Saharan Africa, the Middle East and North Africa, and the Asia-Pacific.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026