- United States

- /

- Oil and Gas

- /

- NYSE:TPL

We Ran A Stock Scan For Earnings Growth And Texas Pacific Land (NYSE:TPL) Passed With Ease

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Texas Pacific Land (NYSE:TPL). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Texas Pacific Land

How Quickly Is Texas Pacific Land Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. We can see that in the last three years Texas Pacific Land grew its EPS by 11% per year. That's a good rate of growth, if it can be sustained.

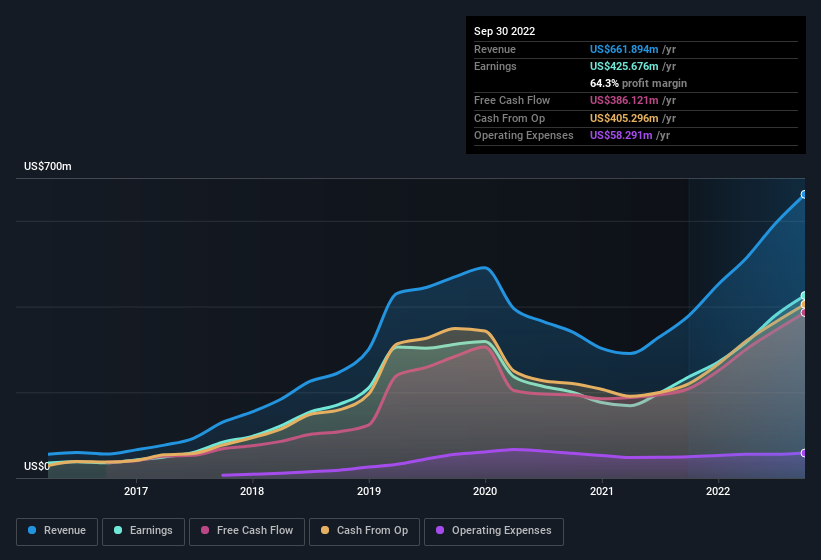

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The music to the ears of Texas Pacific Land shareholders is that EBIT margins have grown from 79% to 85% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Texas Pacific Land's future profits.

Are Texas Pacific Land Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The US$1.3m worth of shares that insiders sold during the last 12 months pales in comparison to the US$2.2m they spent on acquiring shares in the company. This adds to the interest in Texas Pacific Land because it suggests that those who understand the company best, are optimistic. Zooming in, we can see that the biggest insider purchase was by Independent Trustee Murray Stahl for US$26k worth of shares, at about US$2,618 per share.

Along with the insider buying, another encouraging sign for Texas Pacific Land is that insiders, as a group, have a considerable shareholding. Indeed, they hold US$21m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Even though that's only about 0.1% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Tyler Glover, is paid less than the median for similar sized companies. The median total compensation for CEOs of companies similar in size to Texas Pacific Land, with market caps over US$8.0b, is around US$13m.

The Texas Pacific Land CEO received total compensation of just US$5.0m in the year to December 2021. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Is Texas Pacific Land Worth Keeping An Eye On?

As previously touched on, Texas Pacific Land is a growing business, which is encouraging. In addition, insiders have been busy adding to their sizeable holdings in the company. That makes the company a prime candidate for your watchlist - and arguably a research priority. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Texas Pacific Land is trading on a high P/E or a low P/E, relative to its industry.

Keen growth investors love to see insider buying. Thankfully, Texas Pacific Land isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Texas Pacific Land might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:TPL

Texas Pacific Land

Engages in the land and resource management, and water services and operations businesses.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives