- United States

- /

- Oil and Gas

- /

- NYSE:TPL

If EPS Growth Is Important To You, Texas Pacific Land (NYSE:TPL) Presents An Opportunity

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Texas Pacific Land (NYSE:TPL). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Our analysis indicates that TPL is potentially overvalued!

Texas Pacific Land's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. We can see that in the last three years Texas Pacific Land grew its EPS by 8.0% per year. That growth rate is fairly good, assuming the company can keep it up.

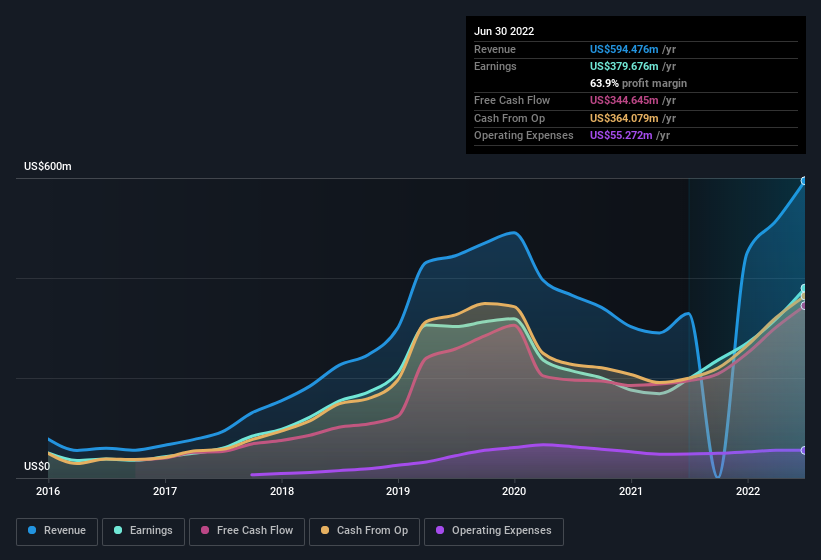

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. On the revenue front, Texas Pacific Land has done well over the past year, growing revenue by 81% to US$594m but EBIT margin figures were less stellar, seeing a decline over the last 12 months. If EBIT margins are able to stay balanced and this revenue growth continues, then we should see brighter days ahead.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Texas Pacific Land.

Are Texas Pacific Land Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

While Texas Pacific Land insiders did net US$1.3m selling stock over the last year, they invested US$1.9m, a much higher figure. You could argue that level of buying implies genuine confidence in the business. It is also worth noting that it was Independent Trustee Murray Stahl who made the biggest single purchase, worth US$20k, paying US$2,001 per share.

The good news, alongside the insider buying, for Texas Pacific Land bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have US$25m worth of shares. This considerable investment should help drive long-term value in the business. While their ownership only accounts for 0.1%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. That's because on our analysis the CEO, Tyler Glover, is paid less than the median for similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like Texas Pacific Land, with market caps over US$8.0b, is about US$13m.

The Texas Pacific Land CEO received total compensation of just US$5.0m in the year to December 2021. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Does Texas Pacific Land Deserve A Spot On Your Watchlist?

One positive for Texas Pacific Land is that it is growing EPS. That's nice to see. In addition, insiders have been busy adding to their sizeable holdings in the company. That makes the company a prime candidate for your watchlist - and arguably a research priority. Now, you could try to make up your mind on Texas Pacific Land by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

The good news is that Texas Pacific Land is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Texas Pacific Land might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:TPL

Texas Pacific Land

Engages in the land and resource management, and water services and operations businesses.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives