- United States

- /

- Energy Services

- /

- NYSE:RNGR

Discovering US Undiscovered Gems for October 2025

Reviewed by Simply Wall St

As the U.S. stock market faces volatility with regional bank shares under pressure and bond yields hitting lows not seen since April, investors are seeking stability amid economic uncertainty. In this environment, small-cap stocks can offer unique opportunities for growth, as they often remain overlooked in broader market turbulence. Identifying these undiscovered gems requires a keen understanding of their potential to thrive despite current challenges, making them attractive prospects for those looking to diversify their portfolios.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tri-County Financial Group | 82.51% | 3.15% | -17.04% | ★★★★★★ |

| Sound Financial Bancorp | 34.70% | 2.11% | -11.08% | ★★★★★★ |

| Oakworth Capital | 87.50% | 15.82% | 9.79% | ★★★★★★ |

| SUI Group Holdings | NA | 16.40% | -30.66% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| First Northern Community Bancorp | NA | 8.05% | 12.27% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| Valhi | 44.30% | 1.10% | -1.40% | ★★★★★☆ |

| FRMO | 0.10% | 41.35% | 45.95% | ★★★★★☆ |

| Gulf Island Fabrication | 20.48% | 3.25% | 43.31% | ★★★★★☆ |

Underneath we present a selection of stocks filtered out by our screen.

Crawford (CRD.B)

Simply Wall St Value Rating: ★★★★★☆

Overview: Crawford & Company offers claims management and outsourcing solutions to carriers, brokers, and corporations across various regions including the United States, the United Kingdom, Europe, Canada, Australia, Asia, and Latin America, with a market cap of approximately $522.75 million.

Operations: With a market cap of approximately $522.75 million, Crawford & Company generates revenue from four key segments: Broadspire ($393.69 million), Platform Solutions ($169.70 million), International Operations ($431.70 million), and North America Loss Adjusting ($316.58 million).

Crawford is making strides in the insurtech arena, aiming to boost efficiency and cut costs in claims management. Recent earnings show a mixed picture, with second-quarter revenue at US$334.6 million, up from US$326.85 million the previous year, though net income dipped to US$7.78 million from US$8.58 million. Over six months, revenue rose to US$657.93 million compared to last year's US$639.93 million, while net income increased to US$14.47 million from US$11.42 million previously reported for the same period last year.. The company has repurchased 5,910,191 shares worth about $46.41M since November 2021 but none in the latest quarter ending June 2025.. Analysts expect annual revenue growth of 6% over three years with profit margins potentially rising from 1% to 7%.

Global Ship Lease (GSL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Global Ship Lease, Inc. operates by owning and chartering containerships under fixed-rate charters to container shipping companies globally, with a market capitalization of approximately $1.02 billion.

Operations: GSL generates revenue primarily through its transportation shipping segment, amounting to $730.28 million. The company benefits from fixed-rate charters, providing a predictable revenue stream.

Global Ship Lease, a player in the container shipping sector, has shown robust financial health with a net debt to equity ratio of 6.5%, significantly reduced from 194.9% five years ago. The company’s earnings grew by 18.8% last year, outpacing the industry average of -2%. Despite forecasts of an average annual earnings decline of 12.7% over the next three years, GSL continues to trade at 70.8% below its estimated fair value. Recent moves like a $150 million equity offering and strong interest coverage at 23.2x EBIT demonstrate strategic positioning amid market challenges.

Ranger Energy Services (RNGR)

Simply Wall St Value Rating: ★★★★★★

Overview: Ranger Energy Services, Inc. offers onshore high specification well service rigs, wireline services, and complementary services to exploration and production companies in the United States with a market capitalization of approximately $278.72 million.

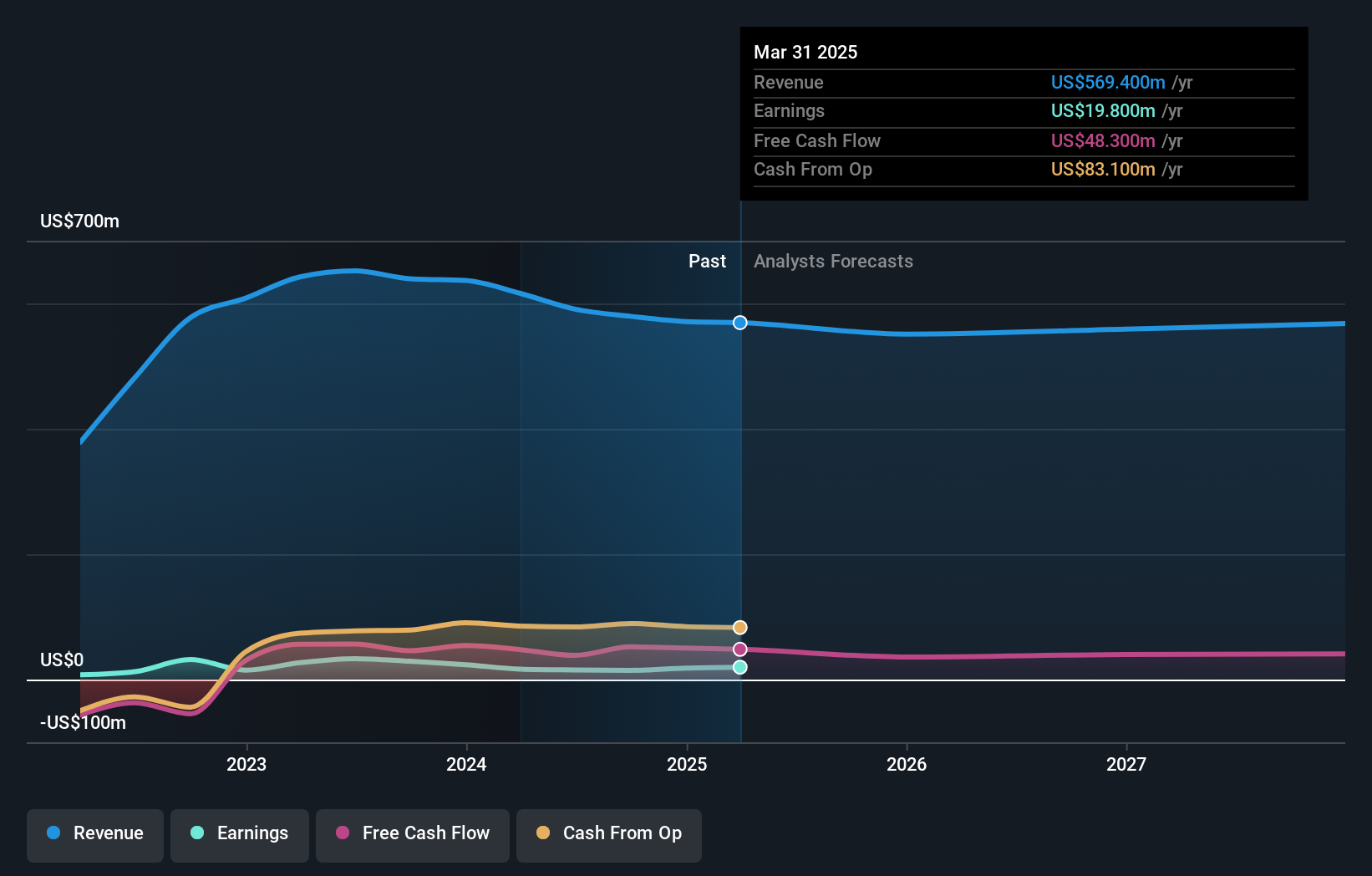

Operations: Ranger Energy Services generates revenue through three primary segments: high specification rigs ($347.50 million), wireline services ($92.20 million), and processing solutions and ancillary services ($132.20 million). The high specification rigs segment is the largest contributor to its revenue stream.

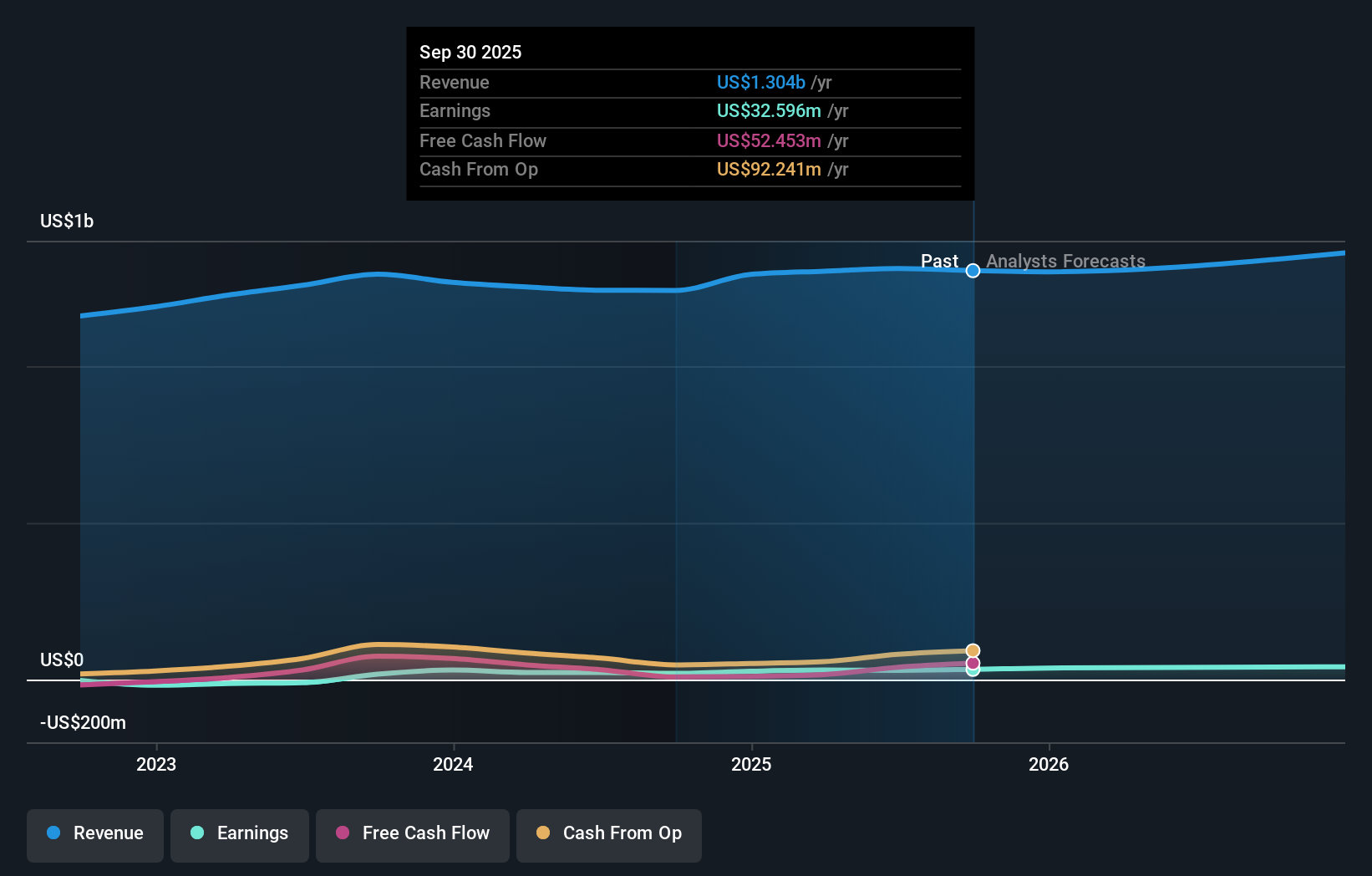

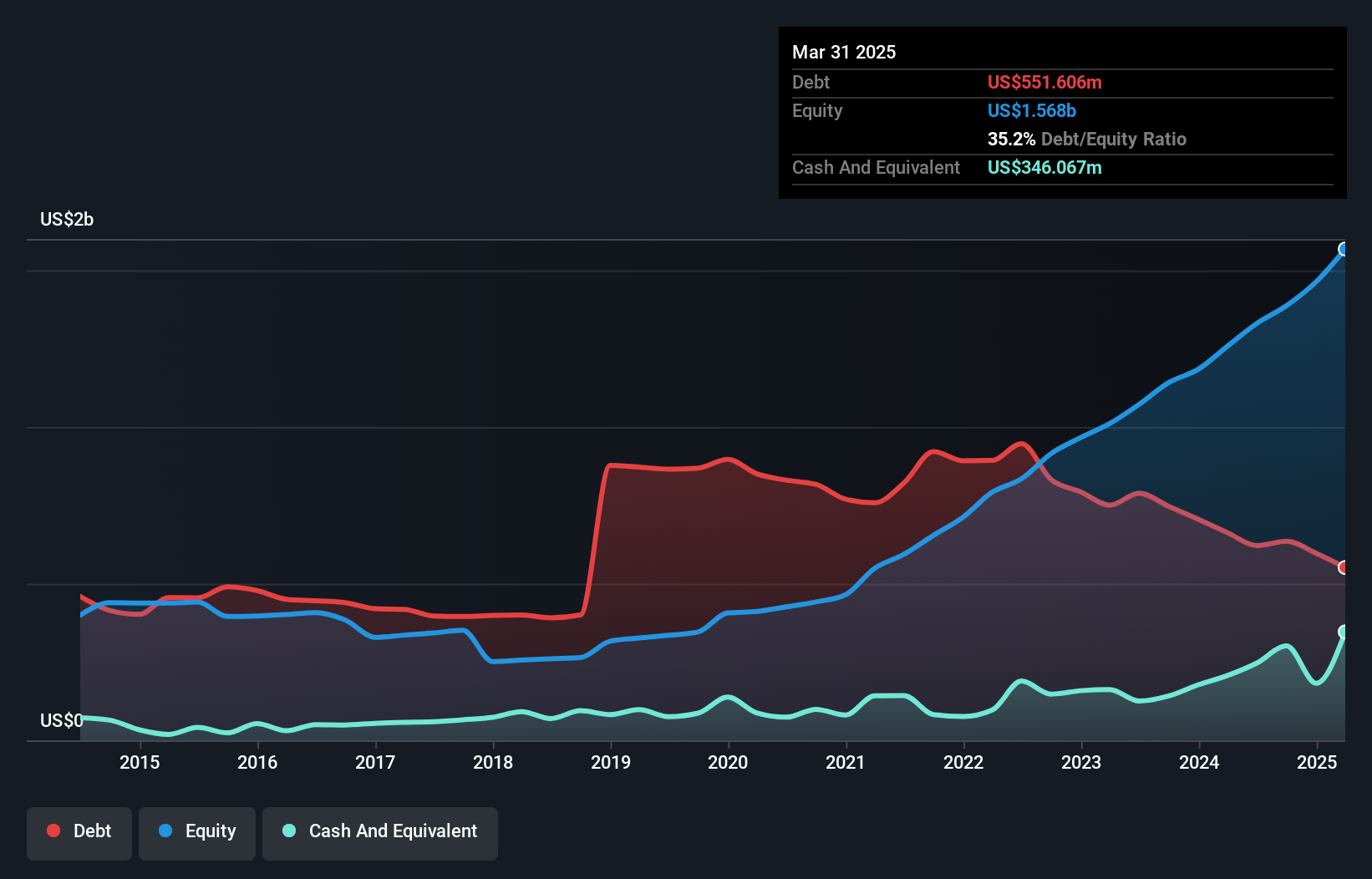

Ranger Energy Services, a nimble player in the energy sector, has been making waves with its innovative approach and robust financial health. Over the past year, earnings surged by 45.5%, outpacing the broader industry’s -4.3%. The company is debt-free now, a stark contrast to five years ago when it had a debt-to-equity ratio of 13.7%. Trading at nearly 69% below its estimated fair value suggests potential upside for investors. Recent developments include launching two Hybrid Double Electric Workover Rigs and repurchasing over 3 million shares for $35 million, indicating strong cash flow management and shareholder focus.

- Click here to discover the nuances of Ranger Energy Services with our detailed analytical health report.

Understand Ranger Energy Services' track record by examining our Past report.

Taking Advantage

- Unlock our comprehensive list of 293 US Undiscovered Gems With Strong Fundamentals by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RNGR

Ranger Energy Services

Provides onshore high specification well service rigs, wireline services, and complementary services to exploration and production companies in the United States.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion