- United States

- /

- Energy Services

- /

- NYSE:RIG

Is Transocean a Bargain After Recent Share Price Volatility and Mixed Valuation Signals?

Reviewed by Bailey Pemberton

- If you have ever wondered whether Transocean at around $4.28 is a bargain or a value trap, you are exactly who this breakdown is for.

- The stock is up 8.4% year to date and 8.6% over the last 12 months, but that ride has been choppy, with a 3.4% dip in the last week and only a modest 1.2% gain over the past month, which tells you sentiment is still undecided.

- Recent moves have been driven less by company specific headlines and more by shifting expectations around offshore drilling demand, day-rate trends and oil price volatility. As investors rotate in and out of energy names, Transocean keeps getting repriced as the market rethinks how durable offshore spending really is.

- On our valuation checks, Transocean scores just 2/6, suggesting the market might be baking in a lot of optimism in some areas while overlooking value in others. Next we will walk through different valuation approaches, then finish with a more complete way to think about what this stock is really worth.

Transocean scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Transocean Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model takes estimates of how much cash a business will generate in the future, then discounts those cash flows back into today’s dollars to arrive at an intrinsic value per share.

For Transocean, the latest twelve month Free Cash Flow is about $141.5 million, and analysts expect this to rise meaningfully as offshore activity improves. By 2027, Free Cash Flow is projected to reach roughly $716.3 million, with Simply Wall St extrapolating modest growth beyond the analyst window through 2035. These future cash flows are discounted using a 2 Stage Free Cash Flow to Equity model to capture both a near term ramp up and a steadier long term phase.

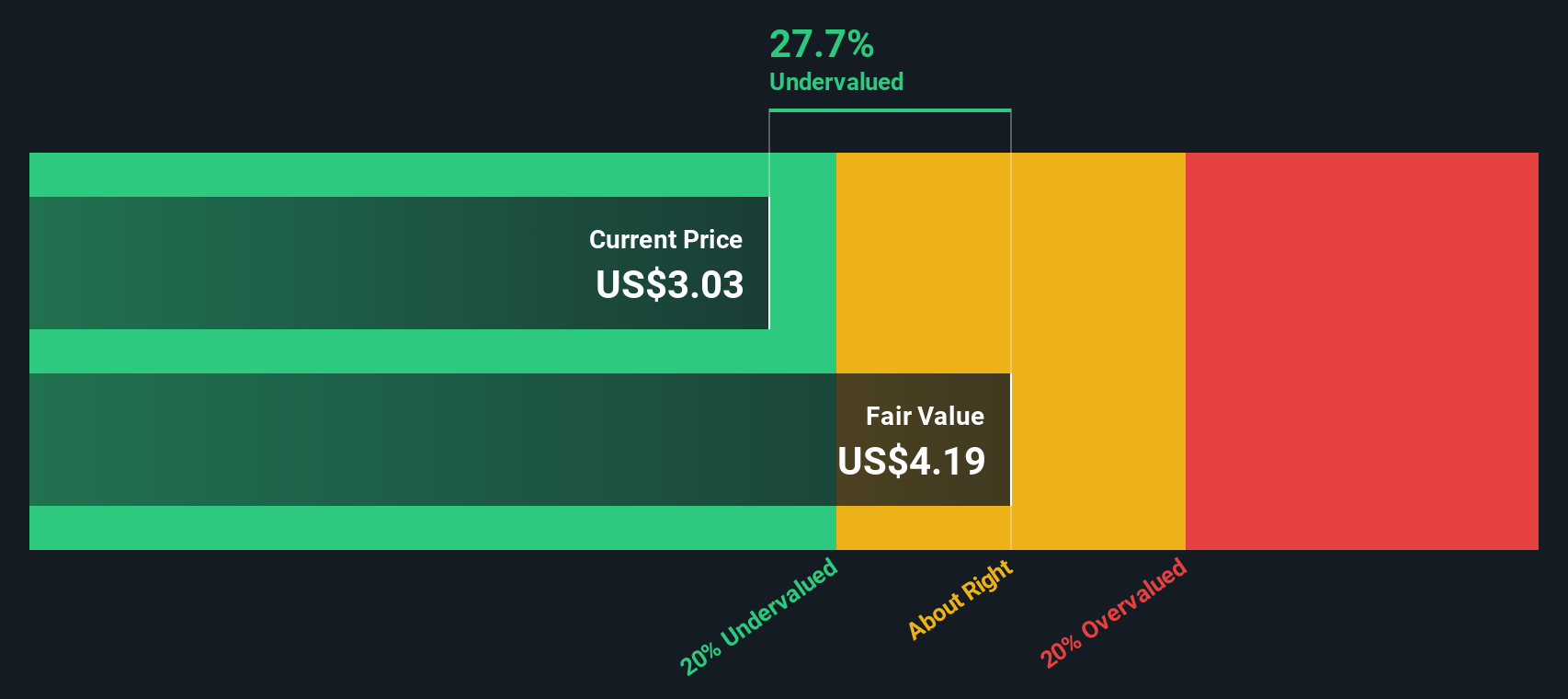

On this basis, the DCF model arrives at an intrinsic value of about $10.59 per share, versus a current price around $4.28. That implies Transocean is trading at roughly a 59.6% discount to its estimated fair value, and this suggests the market is heavily discounting the durability of future cash flows.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Transocean is undervalued by 59.6%. Track this in your watchlist or portfolio, or discover 905 more undervalued stocks based on cash flows.

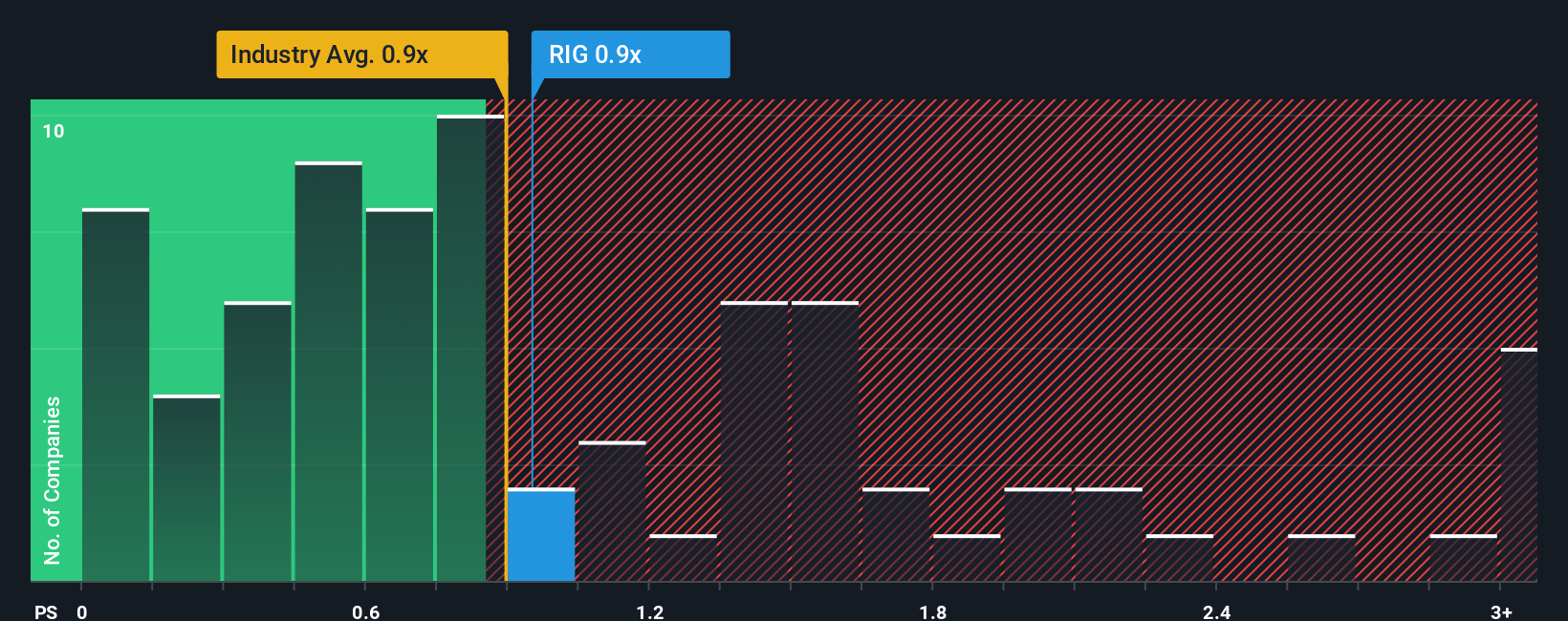

Approach 2: Transocean Price vs Sales

For companies like Transocean that are still normalizing profitability after a downturn, the Price to Sales multiple is a useful way to value the business, because revenue tends to be more stable and less affected by short term swings in margins than earnings.

In general, higher growth and lower risk justify a higher sales multiple, while slower growth, cyclicality or balance sheet risk usually mean investors should demand a lower, more conservative ratio. So what looks fair for an offshore driller will typically sit below a fast growing software stock, but should still reflect the recovery potential in day rates and utilization.

Transocean currently trades around 1.22x sales, slightly above the Energy Services industry average of roughly 1.16x and also above the peer group average of about 1.12x. Simply Wall St’s Fair Ratio for Transocean is 1.02x, which is a proprietary estimate of what the Price to Sales multiple should be after adjusting for its growth outlook, profitability, risk profile, industry position and market cap. Because this Fair Ratio is tailored to the company’s fundamentals, it is more informative than simple comparisons to peers or the sector alone. With the actual multiple sitting modestly above the Fair Ratio, the stock screens as mildly expensive on this measure.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1445 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Transocean Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simple, structured stories that connect your view of a company to concrete forecasts for its future revenue, earnings and margins, and then to a fair value estimate you can compare with today’s share price.

On Simply Wall St’s Community page, Narratives are an easy tool used by millions of investors to spell out why they think a stock will perform a certain way, linking the business story to a financial model that updates dynamically as new information, such as earnings results or contract news, comes in.

With Narratives, you can quickly see whether your fair value for Transocean is above or below the current price, helping you decide if it is a buy, hold or sell. You can also understand why other investors disagree. For example, one Narrative assumes Transocean is worth closer to $5.50 on the back of tightening rig markets and high margin contracts. Another, more cautious, Narrative sees fair value nearer $2.50 because of debt, volatile dayrates and long term energy transition risks.

Do you think there's more to the story for Transocean? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Transocean might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RIG

Transocean

Provides offshore contract drilling services for oil and gas wells in Switzerland and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026