- United States

- /

- Oil and Gas

- /

- NYSE:PSX

Phillips 66 (NYSE:PSX) Elects New Directors at Annual Shareholder Meeting

Reviewed by Simply Wall St

Phillips 66 (NYSE:PSX) recently held its Annual Meeting of Shareholders, resulting in the election of A. Nigel Hearne and nominees from Elliott Management to the board, while certain proposals, such as declassifying the board, were not approved. Over the past month, Phillips 66's stock rose by 6.61%, a movement aligned with the broader market trends characterized by mixed trading sessions and notable macroeconomic influences, including strong tech sector performance and changes in trade policy. These governance updates would have likely added weight to the company's stock performance overall during this period.

Phillips 66 has 4 possible red flags (and 1 which is concerning) we think you should know about.

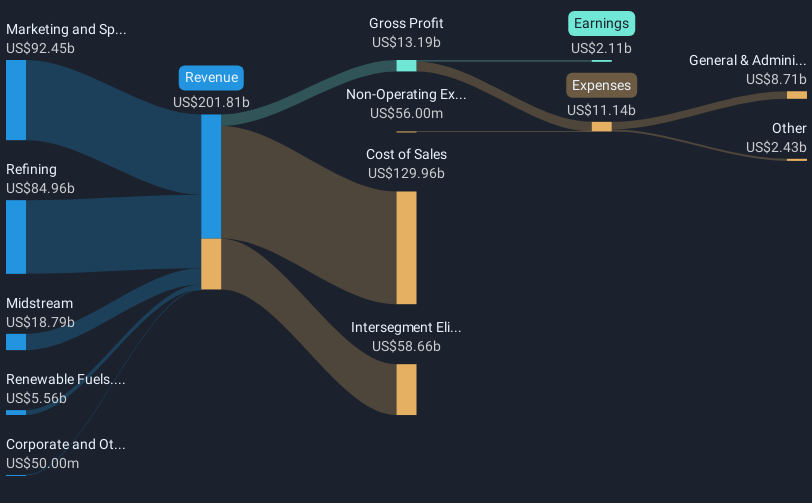

The recent governance changes at Phillips 66, including the election of A. Nigel Hearne and Elliott Management nominees to the board, could potentially influence the company's strategic focus on transformational growth in its NGL, Midstream, and Refining segments. This, in turn, may impact the company's revenue and earnings forecasts as it aims to boost earnings stability and margins through acquisitions and refining enhancements. The proposed but unapproved changes such as declassifying the board might have restrained potential shifts in governance dynamics that could have otherwise influenced decision-making processes.

Over the past five years, Phillips 66's total shareholder return, including dividends, was 65.61%. In contrast, the company's one-year performance lagged behind both the US Oil and Gas industry and the broader US market. Within the last year, the stock underperformed the US market's 11.5% return and the US Oil and Gas industry's negative return of 6.1%. This demonstrates a disconnect between long-term sustained growth and recent market challenges.

The company's stock is currently trading at a discount to the consensus price target of $128.97, with the current share price at $105.39. This indicates an 18.3% potential upside, reflecting differing analyst opinions on Phillips 66's future earnings growth and revenue expectations. While some analysts anticipate a significant increase in earnings to $4.9 billion by 2028, the challenging macro environment in refining and renewables introduces risks that could pressure revenue and margins. These factors highlight the importance of board composition and strategic direction in shaping the company's future financial performance.

Evaluate Phillips 66's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSX

Phillips 66

Operates as an energy manufacturing and logistics company in the United States, the United Kingdom, Germany, and internationally.

Average dividend payer slight.

Similar Companies

Market Insights

Community Narratives