Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Phillips 66 (NYSE:PSX). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Phillips 66

How Fast Is Phillips 66 Growing Its Earnings Per Share?

Over the last three years, Phillips 66 has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. Impressively, Phillips 66's EPS catapulted from US$11.95 to US$24.53, over the last year. It's not often a company can achieve year-on-year growth of 105%.

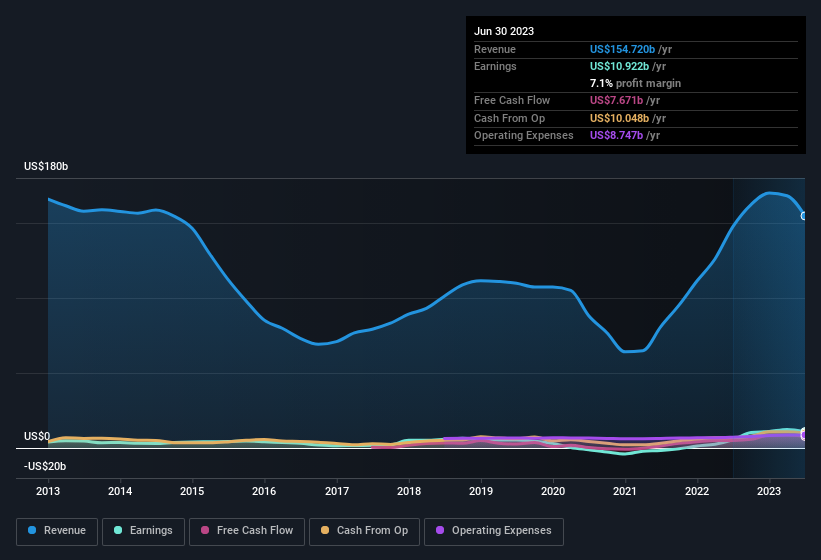

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that Phillips 66 is growing revenues, and EBIT margins improved by 2.6 percentage points to 6.3%, over the last year. Both of which are great metrics to check off for potential growth.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Phillips 66.

Are Phillips 66 Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

It's worth noting that there was some insider selling of Phillips 66 shares last year, worth US$819k. But that doesn't beat the large US$1.0m share acquisition by company insider Gregory Hayes. So, on balance, that's positive.

On top of the insider buying, it's good to see that Phillips 66 insiders have a valuable investment in the business. Notably, they have an enviable stake in the company, worth US$112m. This comes in at 0.2% of shares in the company, which is a fair amount of a business of this size. So despite their percentage holding being low, company management still have plenty of reasons to deliver the best outcomes for investors.

Does Phillips 66 Deserve A Spot On Your Watchlist?

Phillips 66's earnings have taken off in quite an impressive fashion. The icing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Phillips 66 deserves timely attention. It's still necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Phillips 66 (at least 1 which is a bit concerning) , and understanding them should be part of your investment process.

The good news is that Phillips 66 is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:PSX

Phillips 66

Operates as an energy manufacturing and logistics company in the United States, the United Kingdom, Germany, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives