- United States

- /

- Energy Services

- /

- NYSE:OIS

Here's Why Shareholders May Want To Be Cautious With Increasing Oil States International, Inc.'s (NYSE:OIS) CEO Pay Packet

Key Insights

- Oil States International's Annual General Meeting to take place on 7th of May

- Salary of US$925.0k is part of CEO Cindy Taylor's total remuneration

- The overall pay is 106% above the industry average

- Oil States International's EPS grew by 96% over the past three years while total shareholder loss over the past three years was 33%

Shareholders of Oil States International, Inc. (NYSE:OIS) will have been dismayed by the negative share price return over the last three years. However, what is unusual is that EPS growth has been positive, suggesting that the share price has diverged from fundamentals. These are some of the concerns that shareholders may want to bring up at the next AGM held on 7th of May. They could also try to influence management and firm direction through voting on resolutions such as executive remuneration and other company matters. Here's our take on why we think shareholders may want to be cautious of approving a raise for the CEO at the moment.

See our latest analysis for Oil States International

How Does Total Compensation For Cindy Taylor Compare With Other Companies In The Industry?

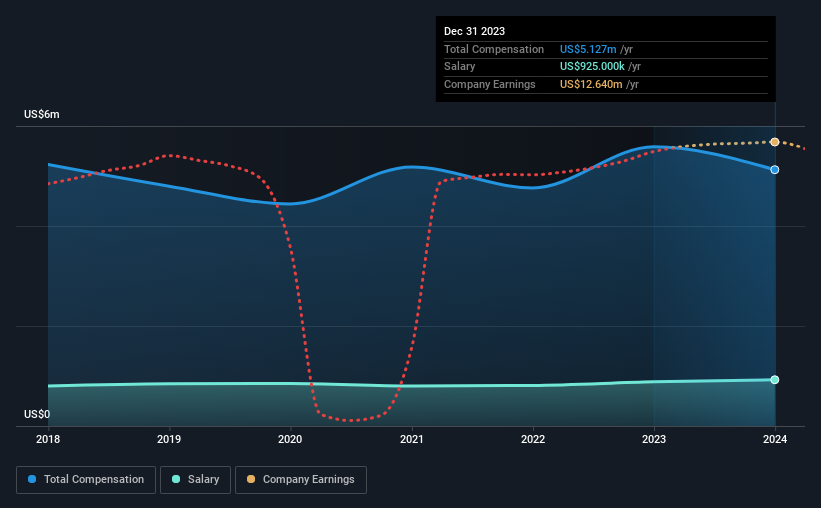

At the time of writing, our data shows that Oil States International, Inc. has a market capitalization of US$256m, and reported total annual CEO compensation of US$5.1m for the year to December 2023. Notably, that's a decrease of 8.2% over the year before. While we always look at total compensation first, our analysis shows that the salary component is less, at US$925k.

In comparison with other companies in the American Energy Services industry with market capitalizations ranging from US$100m to US$400m, the reported median CEO total compensation was US$2.5m. Hence, we can conclude that Cindy Taylor is remunerated higher than the industry median. Furthermore, Cindy Taylor directly owns US$7.1m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$925k | US$885k | 18% |

| Other | US$4.2m | US$4.7m | 82% |

| Total Compensation | US$5.1m | US$5.6m | 100% |

On an industry level, around 15% of total compensation represents salary and 85% is other remuneration. Oil States International is paying a higher share of its remuneration through a salary in comparison to the overall industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Oil States International, Inc.'s Growth

Oil States International, Inc. has seen its earnings per share (EPS) increase by 96% a year over the past three years. Its revenue is down 2.1% over the previous year.

Shareholders would be glad to know that the company has improved itself over the last few years. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Oil States International, Inc. Been A Good Investment?

The return of -33% over three years would not have pleased Oil States International, Inc. shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

The fact that shareholders are sitting on a loss on the value of their shares in the past few years is certainly disconcerting. The fact that the stock price hasn't grown along with earnings may indicate that other issues may be affecting that stock. Shareholders would be keen to know what's holding the stock back when earnings have grown. The upcoming AGM will be a chance for shareholders to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

If you think CEO compensation levels are interesting you will probably really like this free visualization of insider trading at Oil States International.

Important note: Oil States International is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:OIS

Oil States International

Through its subsidiaries, provides engineered capital equipment and consumable products for energy, industrial, and military sectors worldwide.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives