- United States

- /

- Oil and Gas

- /

- NYSE:NOG

Earnings Troubles May Signal Larger Issues for Northern Oil and Gas (NYSE:NOG) Shareholders

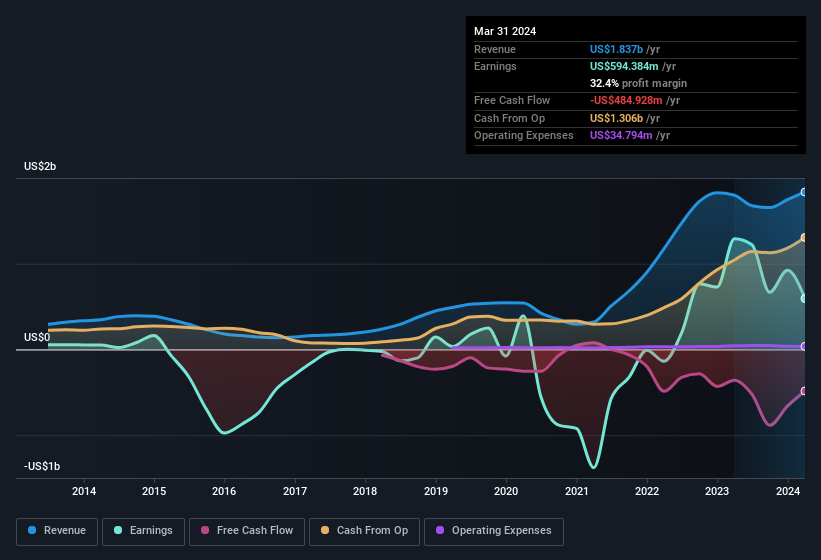

Last week's earnings announcement from Northern Oil and Gas, Inc. (NYSE:NOG) was disappointing to investors, with a sluggish profit figure. Our analysis has found some reasons to be concerned, beyond the weak headline numbers.

See our latest analysis for Northern Oil and Gas

A Closer Look At Northern Oil and Gas' Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

For the year to March 2024, Northern Oil and Gas had an accrual ratio of 0.32. Unfortunately, that means its free cash flow was a lot less than its statutory profit, which makes us doubt the utility of profit as a guide. Over the last year it actually had negative free cash flow of US$485m, in contrast to the aforementioned profit of US$594.4m. We also note that Northern Oil and Gas' free cash flow was actually negative last year as well, so we could understand if shareholders were bothered by its outflow of US$485m. Unfortunately for shareholders, the company has also been issuing new shares, diluting their share of future earnings.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. As it happens, Northern Oil and Gas issued 18% more new shares over the last year. That means its earnings are split among a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. Check out Northern Oil and Gas' historical EPS growth by clicking on this link.

A Look At The Impact Of Northern Oil and Gas' Dilution On Its Earnings Per Share (EPS)

Northern Oil and Gas was losing money three years ago. And even focusing only on the last twelve months, we see profit is down 54%. Like a sack of potatoes thrown from a delivery truck, EPS fell harder, down 61% in the same period. Therefore, the dilution is having a noteworthy influence on shareholder returns.

In the long term, if Northern Oil and Gas' earnings per share can increase, then the share price should too. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Our Take On Northern Oil and Gas' Profit Performance

As it turns out, Northern Oil and Gas couldn't match its profit with cashflow and its dilution means that shareholders own less of the company than the did before (unless they bought more shares). Considering all this we'd argue Northern Oil and Gas' profits probably give an overly generous impression of its sustainable level of profitability. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. Every company has risks, and we've spotted 6 warning signs for Northern Oil and Gas (of which 2 shouldn't be ignored!) you should know about.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if Northern Oil and Gas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:NOG

Northern Oil and Gas

An independent energy company, engages in the acquisition, exploration, exploitation, development, and production of crude oil and natural gas properties in the United States.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives