- United States

- /

- Interactive Media and Services

- /

- NYSE:SSTK

Top 3 Undervalued Small Caps With Insider Buys To Watch In July 2024

Reviewed by Simply Wall St

Over the last 7 days, the United States market has dropped 2.3%, but it remains up 17% over the past year with earnings forecast to grow by 15% annually. In this context, identifying small-cap stocks that are undervalued and have insider buying can offer promising opportunities for investors looking to capitalize on potential growth.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Hanover Bancorp | 9.0x | 2.1x | 44.48% | ★★★★★☆ |

| Franklin Financial Services | 10.2x | 2.0x | 29.46% | ★★★★☆☆ |

| Columbus McKinnon | 24.3x | 1.1x | 42.94% | ★★★★☆☆ |

| Titan Machinery | 4.3x | 0.1x | 18.57% | ★★★★☆☆ |

| Chatham Lodging Trust | NA | 1.4x | 13.25% | ★★★★☆☆ |

| Citizens & Northern | 13.6x | 3.0x | 34.31% | ★★★☆☆☆ |

| Scholastic | 71.7x | 0.5x | 31.52% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Alta Equipment Group | NA | 0.2x | -227.32% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -142.62% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

Delek US Holdings (NYSE:DK)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Delek US Holdings operates in the energy sector with activities spanning refining, logistics, and retail, and has a market cap of approximately $1.82 billion.

Operations: Delek US Holdings generates revenue primarily from its refining, retail, and logistics segments. The refining segment contributes the largest share at $15.72 billion, while retail and logistics add $871.2 million and $1.03 billion respectively. Net profit margin has shown variability over the periods analyzed, with a high of 5.26% in Q1 2019 and a low of -8.37% in Q4 2020.

PE: -19.9x

Delek US Holdings, a small-cap stock, was recently added to multiple Russell indexes as of July 1, 2024. The company reported first-quarter sales of US$3.23 billion but faced a net loss of US$32.6 million compared to last year’s profit. Insider confidence is evident with significant share repurchases totaling 15.32 million shares since November 2018. Additionally, they increased their quarterly dividend to US$0.25 per share in May 2024, reflecting a commitment to returning value to shareholders despite financial challenges and reliance on external borrowing for funding.

- Take a closer look at Delek US Holdings' potential here in our valuation report.

Explore historical data to track Delek US Holdings' performance over time in our Past section.

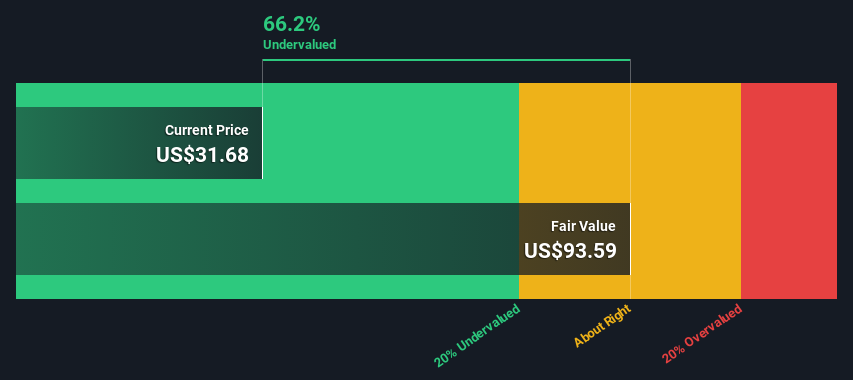

Leggett & Platt (NYSE:LEG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Leggett & Platt is a diversified manufacturer that designs and produces engineered components and products for various industries, with operations in bedding products, specialized products, and furniture, flooring & textile products, holding a market cap of approximately $4.69 billion.

Operations: The company generates revenue primarily from Bedding Products ($1.91 billion), Specialized Products ($1.28 billion), and Furniture, Flooring & Textile Products ($1.46 billion). The net income margin has shown variability, reaching a high of 9.78% in Q4 2016 and recently dropping to -3.44% in Q2 2024, with notable fluctuations over the periods analyzed.

PE: -11.4x

Leggett & Platt, a company with a market cap under US$5 billion, has recently experienced significant insider confidence with purchases in the past six months. Despite being dropped from the S&P 400 and added to the S&P 600 on June 9, 2024, it remains focused on strategic acquisitions and debt reduction. Recent leadership changes saw Karl Glassman return as CEO. First-quarter earnings reported sales of US$1.1 billion and net income of US$31.6 million, reflecting ongoing financial challenges but also potential for future growth through strategic initiatives.

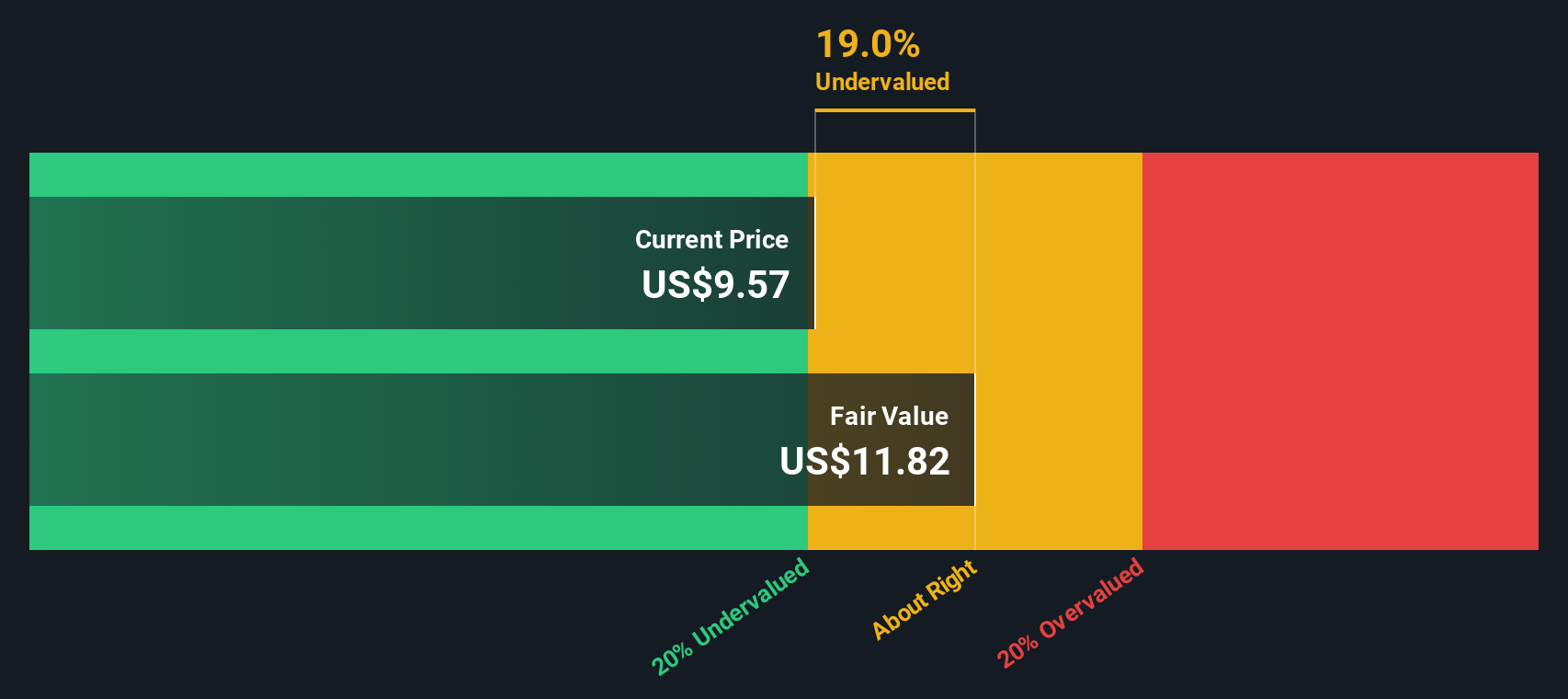

Shutterstock (NYSE:SSTK)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shutterstock is a global provider of high-quality licensed photographs, vectors, illustrations, videos, and music to businesses and individuals.

Operations: The company generates revenue primarily from its Internet Information Providers segment, amounting to $873.62 million. Over the observed periods, gross profit margins have shown variability, with a recent figure of 58.98%. Operating expenses include significant allocations towards Sales & Marketing and R&D.

PE: 16.7x

Shutterstock, known for its expansive content library, recently launched a generative 3D API built on NVIDIA Edify AI architecture, enhancing enterprise capabilities in creating realistic 3D models. Insider confidence is evident with recent share purchases by executives. The company also secured a $125 million term loan and $250 million revolving credit facility to support growth initiatives. Additionally, Shutterstock's inclusion in multiple Russell indices underscores its market relevance. With strategic board appointments and a focus on ethical AI solutions, the company is well-positioned for future expansion.

Summing It All Up

- Get an in-depth perspective on all 64 Undervalued US Small Caps With Insider Buying by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Shutterstock, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SSTK

Shutterstock

Provides platform to connect brands and businesses to high quality content in North America, Europe, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives