- United States

- /

- Banks

- /

- NasdaqGM:USCB

Insider Buying Highlights 3 Undervalued Small Caps In US

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it has seen a remarkable 31% increase over the past year with earnings projected to grow by 15% per annum in the coming years. In this context, identifying stocks that are potentially undervalued and have insider buying can be a strategic approach for investors looking to capitalize on opportunities within small-cap companies.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| ProPetro Holding | NA | 0.6x | 45.84% | ★★★★★★ |

| Capital Bancorp | 15.2x | 3.1x | 43.75% | ★★★★☆☆ |

| Hanover Bancorp | 13.7x | 2.8x | 34.11% | ★★★★☆☆ |

| German American Bancorp | 16.2x | 5.4x | 43.55% | ★★★☆☆☆ |

| USCB Financial Holdings | 18.7x | 5.3x | 49.57% | ★★★☆☆☆ |

| First United | 14.4x | 3.3x | 44.31% | ★★★☆☆☆ |

| Orion Group Holdings | NA | 0.4x | -228.66% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -74.22% | ★★★☆☆☆ |

| Sabre | NA | 0.5x | -82.93% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

USCB Financial Holdings (NasdaqGM:USCB)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: USCB Financial Holdings operates primarily in the banking sector, with a focus on providing financial services, and has a market capitalization of approximately $0.24 billion.

Operations: The company generates its revenue primarily from banking services, with recent figures showing $71.79 million in revenue. Operating expenses, including general and administrative costs, have been increasing over time, reaching $43.13 million recently. Despite fluctuations in net income margin, the gross profit margin remains consistently at 100%.

PE: 18.7x

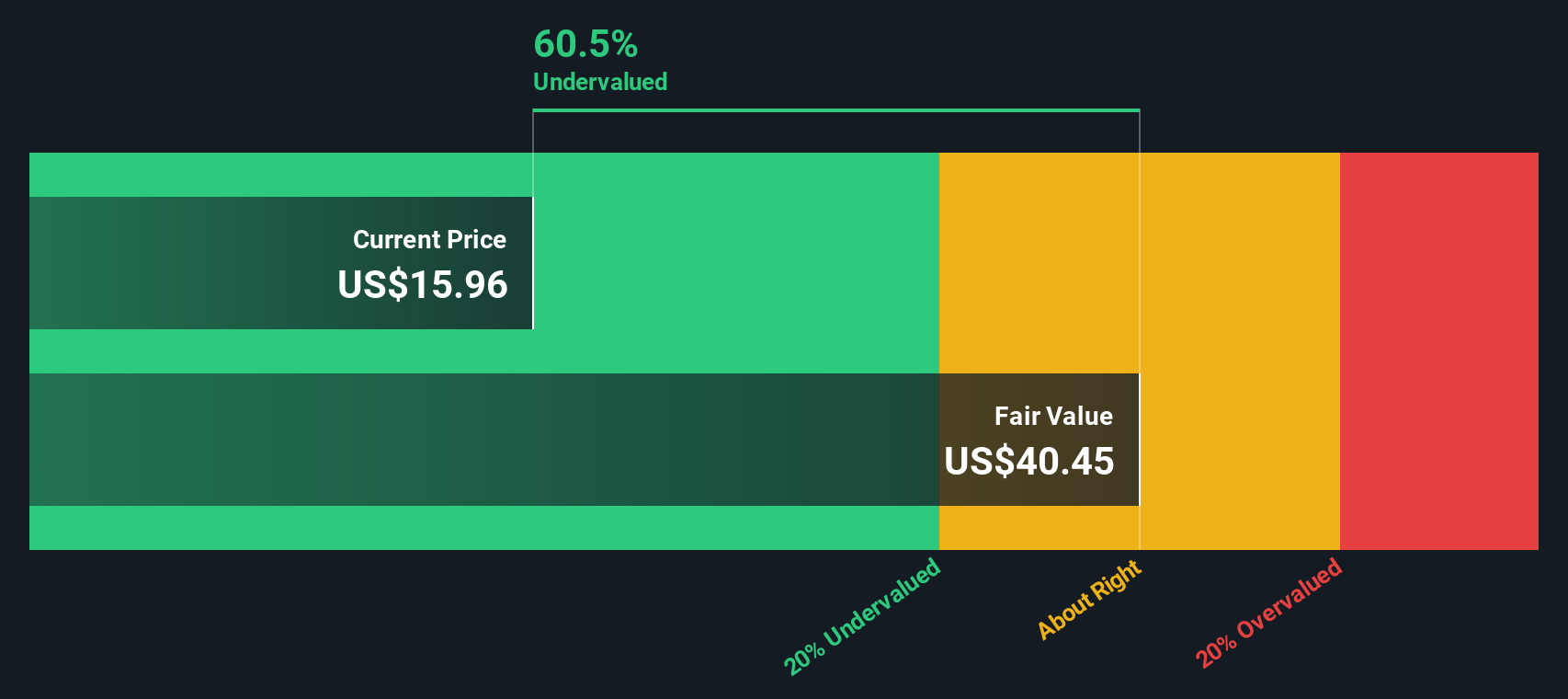

USCB Financial Holdings, a smaller company in the market, recently reported strong third-quarter results with net interest income growing to US$18.11 million from US$14.02 million last year and net income rising to US$6.95 million from US$3.82 million. The company completed a share buyback of 10,000 shares for US$0.12 million by September 2024 and declared a quarterly dividend of $0.05 per share payable in December 2024, reflecting strategic financial management and potential for future growth as earnings are projected to grow annually by around 19%.

- Get an in-depth perspective on USCB Financial Holdings' performance by reading our valuation report here.

Understand USCB Financial Holdings' track record by examining our Past report.

Delek US Holdings (NYSE:DK)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Delek US Holdings operates primarily in the refining and logistics sectors, with a market capitalization of approximately $1.46 billion.

Operations: The company's primary revenue streams are derived from its refining and logistics segments, with the refining segment contributing significantly more. Over recent periods, the net income margin has shown variability, ranging from positive to negative figures. The gross profit margin also fluctuated, reaching a high of 13.48% in mid-2019 before declining to lower percentages in subsequent years. Operating expenses include significant general and administrative costs alongside depreciation and amortization expenses.

PE: -3.0x

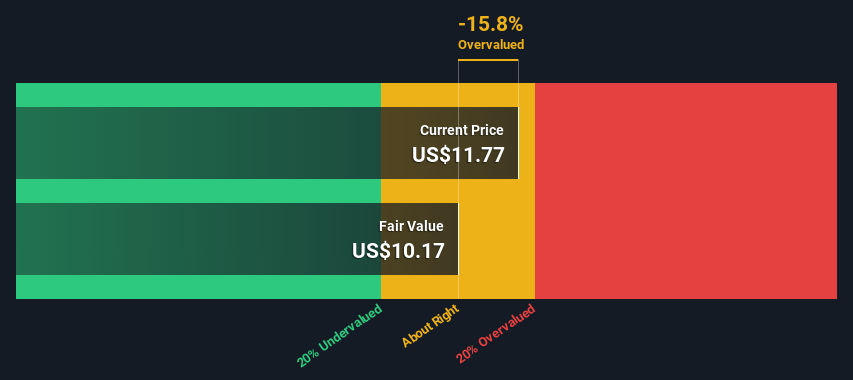

Delek US Holdings, a smaller player in the U.S. market, has been navigating financial challenges with mixed results. Recent earnings showed a decrease in sales to US$3.04 billion for Q3 2024 from US$4.63 billion the previous year, alongside a net loss of US$76.8 million compared to last year's profit of US$128.7 million. Despite these setbacks, the company repurchased 942,329 shares for US$20 million between July and September 2024, signaling potential insider confidence in its future prospects amidst ongoing dividend payouts of $0.255 per share approved by their board.

- Unlock comprehensive insights into our analysis of Delek US Holdings stock in this valuation report.

Examine Delek US Holdings' past performance report to understand how it has performed in the past.

Manitowoc Company (NYSE:MTW)

Simply Wall St Value Rating: ★★★★★☆

Overview: Manitowoc Company is a leading global manufacturer of cranes and lifting solutions, with operations spanning the Americas, Europe and Africa, and the Middle East and Asia Pacific regions.

Operations: The company's revenue streams are primarily derived from the Americas, Europe and Africa, and the Middle East and Asia Pacific regions. Over recent periods, gross profit margin has shown fluctuations, reaching 19.64% in September 2023 before decreasing to 17.40% by December 2024. Operating expenses have consistently impacted profitability, with general and administrative expenses being a significant component of these costs.

PE: -40.7x

Manitowoc, a smaller U.S. company, recently reported a net loss of US$7 million for Q3 2024 despite sales rising slightly to US$524.8 million from the previous year. The company's financial strategy includes issuing US$300 million in high-interest notes due 2031 to manage existing debt, indicating reliance on external funding sources. While no insider buying was noted recently, the company repurchased shares worth US$5.64 million under its buyback program announced last year, reflecting some confidence in its value proposition amidst challenging earnings performance and limited cash runway.

- Dive into the specifics of Manitowoc Company here with our thorough valuation report.

Gain insights into Manitowoc Company's past trends and performance with our Past report.

Where To Now?

- Unlock our comprehensive list of 46 Undervalued US Small Caps With Insider Buying by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:USCB

Flawless balance sheet with solid track record.

Market Insights

Community Narratives