Stock Analysis

- United States

- /

- Telecom Services and Carriers

- /

- NYSE:LUMN

Exploring Undervalued Small Caps With Insider Actions In July 2024

Reviewed by Simply Wall St

Amidst a backdrop of mixed global market performances and shifting economic indicators, small-cap stocks have shown resilience, with the Russell 2000 Index registering a notable uptick. This dynamic environment presents a fertile ground for identifying undervalued small-cap companies that may be poised for growth.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Thryv Holdings | NA | 0.8x | 24.30% | ★★★★★☆ |

| Guardian Capital Group | 10.4x | 4.0x | 31.36% | ★★★★☆☆ |

| Papa John's International | 18.1x | 0.6x | 40.68% | ★★★★☆☆ |

| Franklin Financial Services | 9.9x | 2.0x | 30.45% | ★★★★☆☆ |

| CVS Group | 22.4x | 1.2x | 38.69% | ★★★★☆☆ |

| Columbus McKinnon | 24.4x | 1.1x | 42.67% | ★★★★☆☆ |

| Citizens & Northern | 14.4x | 3.2x | 31.43% | ★★★☆☆☆ |

| Studsvik | 20.9x | 1.3x | 34.15% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -142.93% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

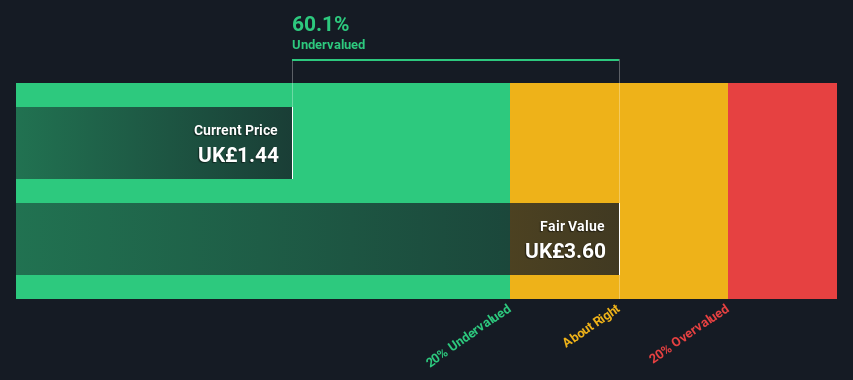

Aston Martin Lagonda Global Holdings (LSE:AML)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Aston Martin Lagonda Global Holdings is a luxury automotive manufacturer known for its high-performance cars, with a market capitalization of approximately £1.56 billion.

Operations: Automotive sales generated £1.56 billion in revenue, with a gross profit margin of 40.80%. The cost of goods sold was £922.60 million, impacting the net income which stood at -£293.30 million for the period.

PE: -4.6x

Aston Martin Lagonda Global Holdings, amid executive transitions and a challenging financial landscape, recently spotlighted insider confidence with significant share purchases. Despite reporting a net loss increase in the first half of 2024 to £207.8 million from the previous year, they project revenues to hit £2.5 billion by 2027-28. This projection alongside recent insider investments suggests a potential rebound as new leadership under CEO Adrian Hallmark commences in September 2024, aiming to steer the company towards these ambitious targets.

- Unlock comprehensive insights into our analysis of Aston Martin Lagonda Global Holdings stock in this valuation report.

Understand Aston Martin Lagonda Global Holdings' track record by examining our Past report.

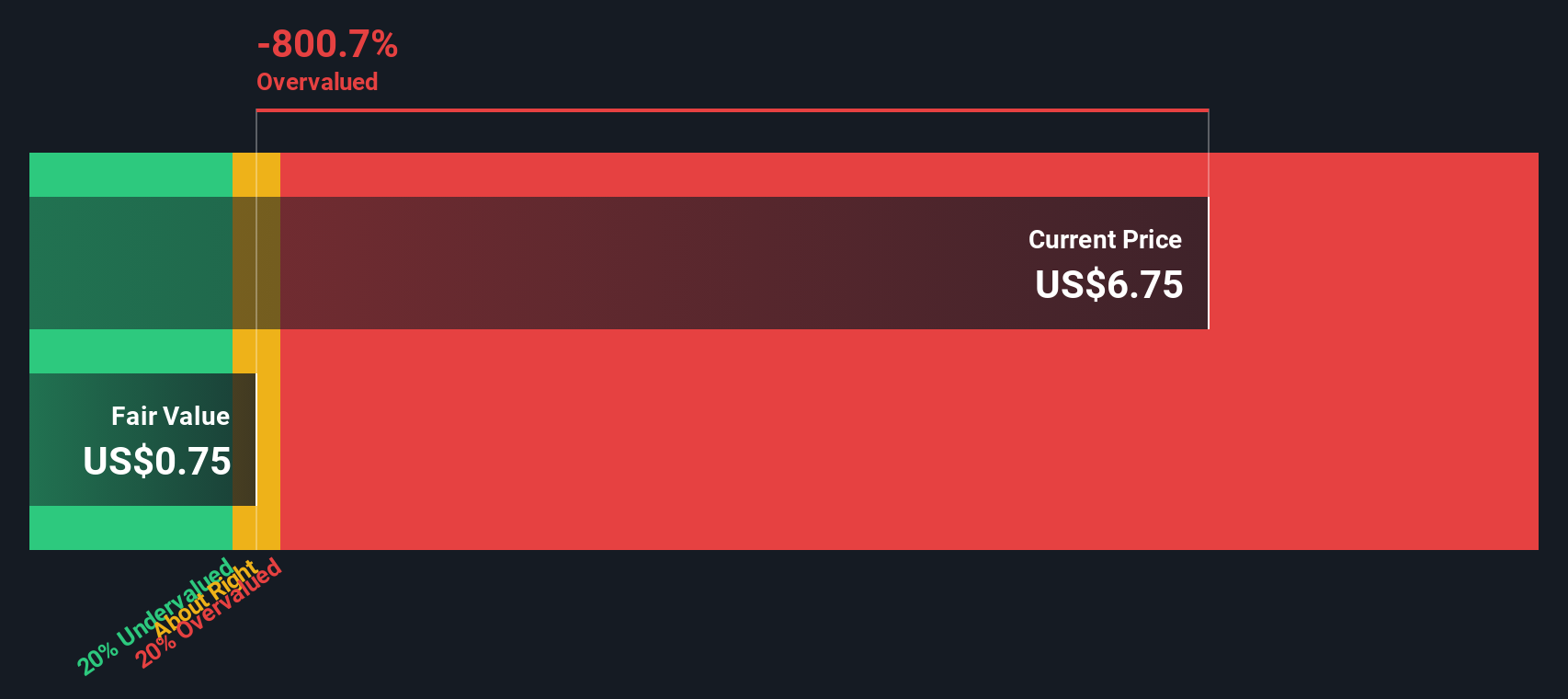

Delek US Holdings (NYSE:DK)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Delek US Holdings is an integrated energy company primarily engaged in petroleum refining, with additional operations in retail fuel and logistics, boasting a market capitalization of approximately $1.07 billion.

Operations: Refining constitutes the primary revenue source at $15.72 billion, followed by logistics and retail sectors generating $1.03 billion and $871.20 million respectively. The company's gross profit margin has seen fluctuations, recently recorded at 5.79% in the latest quarter of 2024, down from earlier figures such as 13.06% in early 2019, reflecting varying operational efficiencies over time.

PE: -19.9x

Recently included in multiple Russell indexes, Delek US Holdings reflects a strategic position in the market. Despite a challenging first quarter with a reported net loss of US$32.6 million, compared to last year's net income, the company shows resilience by increasing its quarterly dividend. Highlighting insider confidence, significant shares were repurchased under an ongoing buyback program, reinforcing belief in the company's potential rebound and growth prospects amidst financial headwinds.

Lumen Technologies (NYSE:LUMN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Lumen Technologies is a telecommunications company with operations primarily in business and mass market segments, boasting a market cap of approximately $10.24 billion.

Operations: In 2023, the company generated $14.84 billion in revenue with a gross profit of $7.61 billion, reflecting a gross profit margin of approximately 51.23%. Over the year, operating expenses amounted to $5.87 billion.

PE: -0.2x

Lumen Technologies, a company often perceived as undervalued, has recently shown promising signs of growth and strategic alignment with industry leaders. With earnings projected to surge by 114% annually, the firm's financial trajectory appears robust. Insider confidence is evident from recent share purchases, signaling strong belief in the company's future prospects. Furthermore, a transformative partnership with Microsoft to enhance digital capabilities and network infrastructure underpins potential for substantial operational efficiencies and improved cash flows exceeding US$20 million over the next year. This collaboration not only boosts Lumen's technological edge but also solidifies its position in a competitive market.

- Navigate through the intricacies of Lumen Technologies with our comprehensive valuation report here.

Turning Ideas Into Actions

- Discover the full array of 217 Undervalued Small Caps With Insider Buying right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LUMN

Lumen Technologies

A facilities-based technology and communications company, provides various integrated products and services to business and residential customers in the United States and internationally.

Undervalued with moderate growth potential.