Quote of the Week: “ Some people can do one thing magnificently, like Michelangelo, and others make things like semiconductors or build 747 aeroplanes -- that type of work requires legions of people. In order to do things well, that can't be done by one person, you must find extraordinary people.” - Steve Jobs

This week we are continuing our series on semiconductor chips, AKA integrated circuits (ICs).

We previously covered logic and memory ICs, and today we turn to their analog cousins.

These chips don’t grab the headlines like the latest AI accelerators do, but they are actually far more common. Devices like mobile phones can contain dozens of them, and estimates of the number sold each year run into the hundreds of billions.

We’ll wrap this week’s insights up with a look at capital allocation, which, as you may know, is an important factor for companies that spend billions on R&D and equipment each year.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify, Apple podcasts or Youtube !

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

-

📉 Big Banks Earnings Show Signs of Consumer Slowdown ( AP News )

- What’s our take?

- After 2 years of banks benefiting from higher interest rates, we’re starting to see that consumers are reaching their limits in this environment. Provisions for bad loans, rising delinquencies, reduction in loan growth, sluggish growth on credit card spending and adjusted profits falling are all signs that consumers are reducing their spending, or struggling with their repayments.

- Chris Stanley, a banking industry practice lead at Moody’s said: “ Higher-for-longer interest rates, persistently high housing prices, softening used vehicle values, and signs of a cooling labour market merit focused scrutiny from the banking sector .”

- While interest rate cuts may be on the horizon (which we’ll cover in a second), that may not be enough to encourage consumer confidence or help their financial situations, especially since banks typically don’t pass on the cuts to consumers immediately.

- What’s our take?

-

✂️ Slowing US Inflation Boosts Chances of Rate Cuts ( S&P Global )

- What’s our take?

- The market is placing high odds on a rate cut in September, thanks to inflation heading in the right direction. Inflation for the year to June 2024 came in at 3%, the lowest annual level since March 2021.

- This, combined with the weakness in the labour market we mentioned last week, provides the Federal Reserve with enough justification to start cutting rates.

- According to the CME Fedwatch tool, the odds of 3 rate cuts by year-end were sitting at 50% on July 11th. Analysts believe that we will likely only see one cut in September, and probably none at the November and December meetings because they’re around the election and employment data hasn’t broken into “recession territory” yet.

- What’s our take?

-

⌚ Revenue From AI Investments May Not Arrive Soon ( Axios )

- What’s our take?

- The promise of increased revenues from all this AI investment may take longer to arrive than the market expects. Reports from Goldman Sachs, Barclays and Sequoia Capital have cautioned investors on their current optimism by running some numbers.

- While companies, in aggregate, are investing hundreds of billions of dollars in AI infrastructure, the segment's biggest revenue generator is from OpenAI, and they’re only generating $3.4bn annually. David Cahn from Sequoia believes that in order to cover their cost of energy and their margins, companies will need to generate four times in revenue what they’ve spent on Nvidia data centres - which seems incredibly difficult, at least in the medium term.

- Axios argues the situation we may have here could be similar to the 2000-2002 period where telecom capacity was overbuilt, lots of investors were then wiped out, but within a few years, that capacity, and more were all used. Investors seem split on this, and your opinion will dictate whether you think today’s valuations are justified.

- What’s our take?

-

👊 Chip Stocks Take A Beating After Comments From Biden Administration And Trump ( Reuters )

- What’s our take?

- The semiconductor industry suffered a triple whammy last week. First, ASML delivered strong results, but the guidance wasn’t good enough for the market. It was then reported that the Biden administration is considering another round of restrictions on exports of advanced technology to China. Finally, Donald Trump suggested that Taiwan should pay the US for defence.

- Given all those comments and the fact that ‘big tech’ reports next week, it isn’t too surprising that investors decided to take profits off the table.

- As US electioneering heats up there’s likely to be a lot more rhetoric. Some of it may eventually find its way into policy - but it's mostly just talk.

- What matters for the semiconductor industry is the underlying business fundamentals and trends. This type of rhetoric has been going on for a long time and there are already export curbs in place - and last time we checked the chipmakers were doing okay.

- What’s our take?

-

💰 Google Wants To Acquire Cybersecurity Company Wiz for $23bn ( Business Standard )

- What’s our take?

- A better cybersecurity offering may help set Google apart from Azure and AWS. Intelligence analysts have said that there is a hot market for cloud security, given large organisations are a big target for hackers.

- Global dealmaking in the first 6 months of 2024 for cybersecurity businesses has picked up significantly, reaching 137 deals worth $12.4bn in total, compared to 124 deals worth $4.8bn over the whole of 2023.

- The cloud security industry is reportedly the most important and fastest-growing part of cybersecurity, and there’s plenty of revenue to gain from it.

- The likes of Crowdstrike, Palo Alto Networks, Zscaler, Fortinet, others and now possibly Google (if the regulators let this acquisition go ahead of course), are well-positioned to benefit from this trend.

- What’s our take?

-

🇨🇳 China: CCP’s Third Plenum Could Bring More Reforms ( Reuters )

- What’s our take?

- Expect to see policy changes and reforms that aim to tackle short-term challenges while driving long-term plans. Policy advisers have said that this third plenum will outline efforts to promote advanced manufacturing, revise the tax system to curb debt risks, manage a vast property crisis, boost domestic consumption and revitalise the private sector.

- A policy adviser noted that while reforms are clearly needed, they will be complicated to implement, because an ageing population, property bubbles, local government debt risks and financial risks require conflicting actions.

- While the meeting might end with a long list of reforms, some economists believe that the post-plenum statement will likely be light on in regards to implementation and prioritisation or how tensions between reforms will be addressed.

- What’s our take?

-

🇬🇧 UK Not Planning To Follow EU With Tariffs on China Imports ( FT )

- What’s our take?

- The British car industry seems content with the state of the local UK car market competition, at least for now.

- In order for the UK government to launch a probe and potentially introduce tariffs, as the Europeans have, they’d need the British car sector to formally ask the Trade Remedies Authority to launch an investigation - But they haven’t yet. That’s not to say they never will.

- The UK exported 700,000 cars in 2023 from brands like Jaguar Land Rover, Mini and Nissan and only 7% of them went to China while 60% went to Europe. This suggests that if the UK did impose tariffs on Chinese-made EVs, they’d be less exposed to retaliation from Beijing than their European counterparts, like Germany, who export a greater portion of their vehicles to China.

- For now, it seems like the UK’s domestic EV market will continue to be dominated by brands that manufacture in China, like Tesla, BMW and MG, but the UK will quote “ remain vigilant ”.

- What’s our take?

📻 The Importance of Analog and Power Semiconductors

The types of integrated circuits that broadly fall within the ‘analog’ category act as a link between the real world and the digital world. Where digital signals are binary and must have a value of 1 or 0, analog signals are continuous and can have any value between a minimum and maximum. Analog signals represent the ‘level’ of things like voltage, temperature, sound, and radio wave frequencies.

Memory and logic chips process digital signals, or data. Analog ICs collect, process, amplify, convert, filter and transmit analog signals. This category can be further divided into the following:

- 🎤 General Analog ICs:

- These include sensors and chips that amplify or transmit signals. These are found in older microphones and audio speakers. The 555 timer IC is said to be the most common chip in the world, with over a billion being sold each year.

- 📱 Power ICs:

- These are used to manage power in systems ranging from mobile phones to the most advanced AI accelerators.

- 🛜 Mixed-signal ICs:

- These process analog and digital signals, typically by converting one to the other. Many of the communication ICs we mentioned last week are actually mixed-signal chips. Communication protocols like 5G, WiFi and Bluetooth rely on these chips.

The companies that make these products generally have a large catalogue of products that they sell to numerous industries. Unlike the logic market, quite a few analog companies manufacture their own chips.

Some analog ICs are very advanced, while others are made using quite dated technology and are relatively inexpensive. However, 10s of billions of these chips are used to manufacture billions of devices, appliances, vehicles and machines each year.

🧮 What Analog Semiconductor Companies Sell

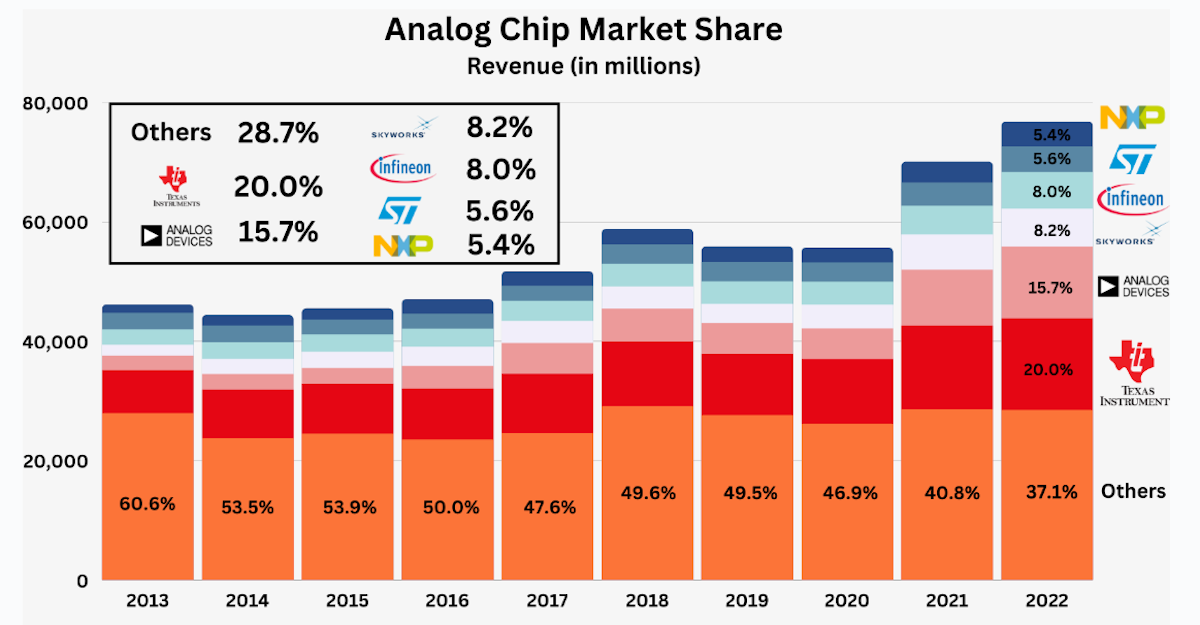

Texas Instruments and Analog Devices are the largest suppliers of analog chips and together account for nearly 40% of the market. Numerous other companies specialize in one or two niche areas of the market.

Texas Instruments is arguably the world’s first chipmaker and was responsible for the first integrated circuit and the first handheld calculator. The company has also been credited with major innovations in computer vision and audio processing.

TI sells a vast array of sensors, analog and power management chips, and microcontrollers. Their products are used by just about every industry, and chances are you are surrounded by them right now.

The company Analog Devices is notable for some of the most advanced mixed-signal chips, including those used for image stabilization in cameras and touch-screen controls. The company differentiates itself by selling complete systems rather than individual components. One interesting thing to note is that ADI’s chips are widely used in healthcare technology.

Some of the other notable analog companies are Himax and Universal Display , which design and manufacture display driver ICs and display screen technology.

Infineon , ST Microelectronics and Microchip Technology which we mentioned last week also sell analog and power ICs alongside their processors and microcontrollers. Skyworks Solutions and Qorvo also supply mixed-signal ICs to the wireless communication industry.

The table below includes the largest analog, mixed-signal and power IC companies, as measured by 2023 revenue.

🔌 Analog Power Chips Help Us Push The Limits Of Innovation

Power management has been a crucial ingredient in the evolution of smartphones and notebook computers.

✨ Without power management ICs we wouldn’t have devices that get more powerful and smaller each year.

Power ICs have also played a key role in cloud computing, AI, electric vehicles and the electrification of the economy. The following companies operate in this space:

- 📱 NXP Semiconductors

- This company has managed to entrench itself in several industries, from autos to mobile technology and security systems. NXP supplies the NFC chips that allow mobile phone card payments. The company is also a major supplier of power control and management systems used in vehicles, appliances,

- 💽 Monolithic Power Systems

- Monolithic provides power conversion and management components used in datacenters, telecom infrastructure and vehicles. The company has been a major beneficiary of the growth in datacenter capacity. As a result, Monolithic has recorded the highest revenue growth (46%/year) amongst analog chipmakers over the past five years.

- 🚙 ON Semi

- ON Semi is a leading supplier to the EV industry. It’s a leader in its silicon carbide semiconductors, which improves charging times and range for. The company benefited from the growth in EV sales from 2020 to 2023, but lost momentum when EV sales slowed.

💡 The Insight: Wise Capital Allocation Compounds Earnings

Everyone loves a bit of profit, and profit margins are the most commonly cited profitability metrics for companies.

The gross, operating and net margins reflect the percentage of revenue that makes it to each stage of the income statement. These margins are important, but they don’t tell us the full story.

Investors also need to know how effectively a company is deploying its resources.

A company can spend its cash reserves and retained earnings in numerous ways. It can:

- 🏭 Reinvest in the business if there are appealing opportunities.

- This includes capital expenditure, R&D and marketing efforts. The business would ideally pick these options if it has investment opportunities that will generate a return above the cost of that capital.

- 💰Pay down existing obligations

- If the company has a high level of debt, it might be wise to reduce its amount of leverage by paying off some of its debt.

- 💸 Reward shareholders by returning capital to them

- This involves paying dividends or share buybacks when the company has enough capital for all of its internal needs, or there aren’t any appealing internal reinvestment opportunities for the company.

These actions also apply to any new capital raised via debt or share sales.

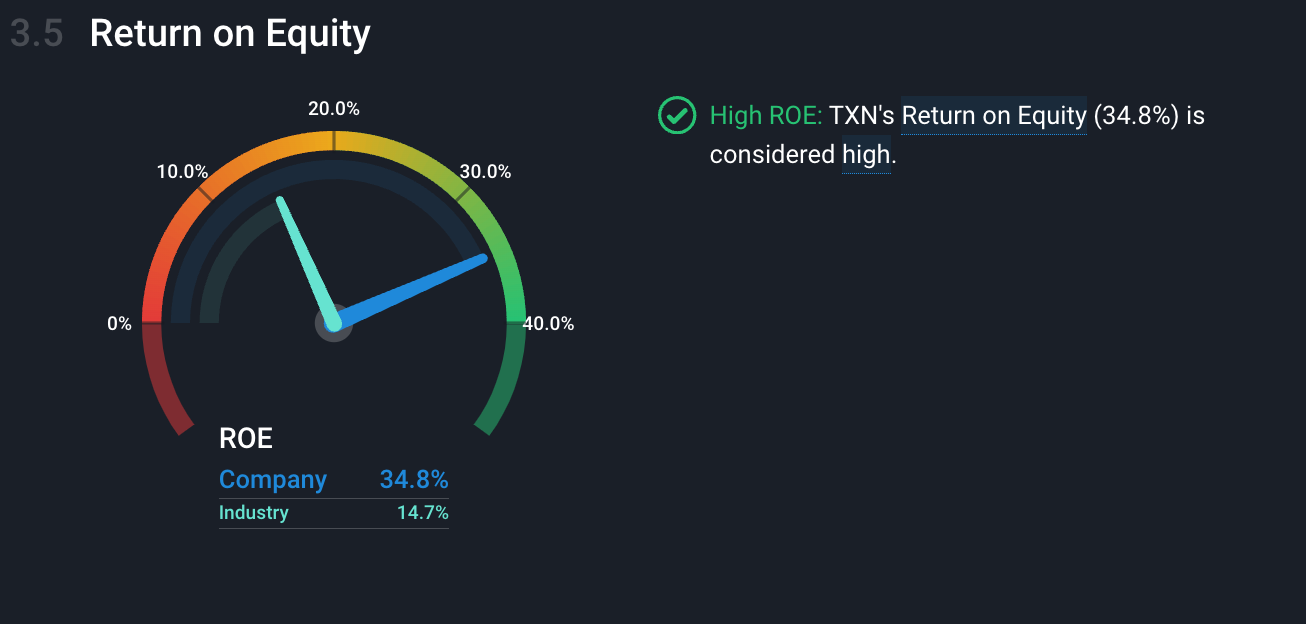

This is where ratios like return on equity (ROE) come in. ROE and similar ratios reflect the performance of the underlying business and how good the leadership is at deciding where to allocate capital.

If capital is invested wisely, it generates a profit that can be reinvested to generate more profits. This is how successful businesses compound earnings over time.

If a company can’t earn a decent return on new investments, shareholders are better off having the capital returned to them in the form of dividends - or share buybacks if they make sense in that market.

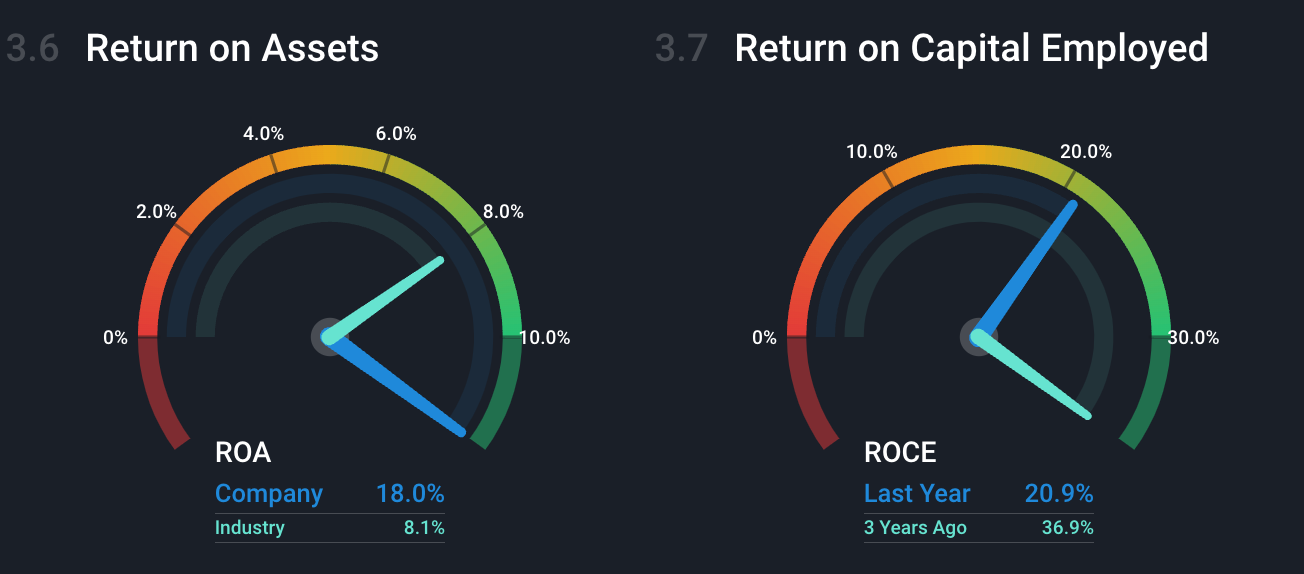

Simply Wall St’s company reports include the ROE (return on equity) in Section 3 , which covers Past Performance. The ROA (return on assets) and ROCE (return on capital employed) are also shown to provide further context.

The image above reflects these ratios for Texas Instruments over the last 12 months.

- Return on Equity = Net Income/Shareholders Equity

- The ROE tells us how much profit is generated as a percentage of equity. Equity in turn is equal to assets - liabilities. This is a good general indicator but doesn’t tell us how much leverage the company is using to generate that return.

- Return on Assets = (Net Income - Net Interest Expense) / Total Assets

- ROA considers the return on the company's assets. This is useful when comparing similar companies, as it strips out the effect of leverage. By comparing the ROA and ROE, you can see how much the ROE benefits from the use of debt.

- Return on Capital Employed = EBIT / (Total Assets - Current Liabilities)

- ROCE considers EBIT or operating profit as a percentage of capital employed. Capital employed is calculated by subtracting current liabilities, which are typically related to operating expenses, from total assets. This ratio tells us how much operating profit the company is earning for every dollar of capital invested.

These ratios change over time, and the more cyclical a business is, the more they are likely to change. To get an idea of how well a company uses its resources over the long term, you can look at a ten-year average, which includes several cycles.

The table below reflects the average ROA and ROE for leading chipmakers over the last ten years:

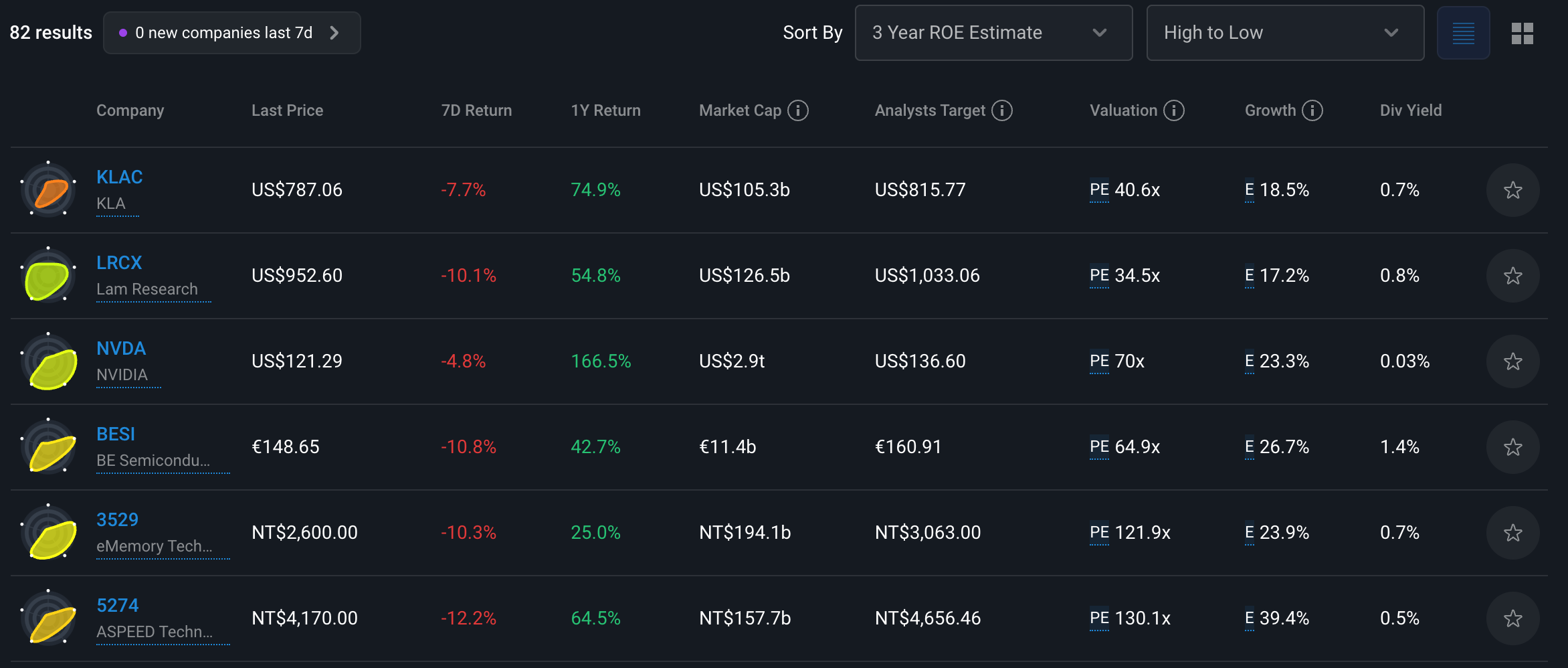

The company report for each company also includes the estimated ROE in three years time in section 2 (Future Growth). This is an estimate based on the average analyst earnings forecast.

When you use the stock Screener, you can rank the results according to these future ROE estimates, which can give a very different perspective on a company’s valuation and expected growth rates. Here’s a preprepared screener to filter for global semiconductor stocks with good ROE, ordered by 3-year ROE estimate.

You’ll notice that some of these companies aren’t chipmakers, but the companies that supply equipment to the industry. In fact, 6 of the top 10 are companies that supply equipment to the industry.

We will be covering those companies next week, so keep an eye out for next week’s Market Insight.

Key Events During the Next Week

Wednesday

- 🇨🇦 The Bank of Canada will announce its interest rate decision and is expected to keep rates at 4.75%.

Thursday

- 🇺🇸 US GDP estimates for the second quarter will be released. This is the first estimate and is forecast to be 2.5%, up from 1.4% in the first quarter.

- 🇺🇸 US Durable Goods Orders are forecast to have been 2.1% higher in June, compared to a 0.1% increase in May.

Friday

- 🇺🇸 US Core PCE Price and personal spending data will be published. The price index is forecast to be 2.6% higher over the last 12 months and 0.2% higher month-on-month.

- 🇺🇸 The University of Michigan Consumer Sentiment Index is expected to show sentiment falling from 68.2 to 66.

It’s a big week for earnings season as three of the magnificent 7 report second-quarter earnings, with another three reporting next week. The largest companies reporting include:

- Alphabet

- Tesla

- Visa

- Abbvie

- Qualcomm

- Thermo Fisher

- Danaher

- Texas Instruments

- Verizon

- IBM

- GE

- Cadence Design Systems

- NXP Semiconductors

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.