Quote of the Week: “China’s import of chips—$260 billion in 2017, the year of Xi’s Davos debut—was far larger than Saudi Arabia’s export of oil or Germany’s export of cars. China spends more money buying chips each year than the entire global trade in aircraft. No product is more central to international trade than semiconductors.” ― Excerpt from Chip War: The Fight for the World's Most Critical Technology by Chris Miller

Over the last few weeks, we covered the three types of semiconductor chips, namely memory, logic and analog chips. This week we are taking a look at the companies that play a role in manufacturing those chips.

Manufacturing integrated circuits has been described as the most complex process on Earth and there are literally hundreds of companies that play a role in this process.

These companies may not produce the eye-watering returns that the chipmakers themselves occasionally do, but there are more companies in this space, and they can make compelling long-term investments.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify, Apple podcasts or Youtube !

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

-

💰 CrowdStrike’s T&Cs Entitle Most To Refunds Rather Than Damages Compensation ( Business Insider )

- What’s our take?

- CrowdStrike is in crisis management mode, trying its best to restore both customer and investor confidence. Most customers with standard contracts will be entitled to refunds of their subscriptions, while larger customers with custom contracts might be entitled to more compensation.

- CrowdStrike will likely be dealing with the fallout of this event for quite some time in the form of scrutiny from the SEC, shareholders and customers. However, it’s hard to say just how much this has impacted the business’ future prospects.

- On the bullish side, it’s the industry leader, its product is valuable and enterprises are adverse to change given the high switching costs for software like this, so it may just be a short-term challenge.

- On the bearish side, it’s potentially lost brand value, new customers may be reluctant to join, and custom contracts may demand lower prices given the stain on their reputation, so this could reduce future revenue growth.

- The dust is yet to settle, but check out these 3 different narratives on CrowdStrike , on the stock’s company report.

- What’s our take?

-

📈 Rising expectations of rate cuts and a Trump victory boost smaller US stocks ( Sherwood )

- What’s our take?

- Investors like small caps again, for now at least. This was driven by the high likelihood of a rate cut in September, softer than-expected June inflation report and the increased chance of a Republican victory at the election after the assassination attempt on Donald Trump.

- Smaller cap companies typically have floating rate debt, so rate cuts help them. They’re also more domestic and less global, so trade wars and tariffs impact them less. Also, they typically pay higher taxes than their global peers, so Donald Trump’s proposed tax cuts would also help them greatly.

- While these are all macro factors, they should not be relied upon for simply allocating to small caps. Small caps provide great opportunities, but you need to do your homework to find the high-quality stocks, so leverage our company report analysis for help with that.

- What’s our take?

-

💸 Alphabet AI spending continues to rise ( Barrons )

-

What’s our take?

- Alphabet managed to top revenue and EPS estimates but YouTube’s revenue disappointed investors. An interesting detail in this earnings report was the amount Google is spending on its datacenter infrastructure.

- Capital expenditure for the second quarter was 91% higher than the same quarter last year. It was however just 9% higher than the first quarter. If Alphabet’s Capex is anything to go by, AI investments continue to rise, but momentum has certainly slowed.

- This week we will see how Capex spend is trending at four more of the AI/datacenter giants.

-

-

🇮🇳 India is catching up with China’s position in the MSCI Emerging Markets Index ( FT )

-

What’s our take?

- The MSCI EM Index is the most closely tracked index for emerging market investors. India with a 19.5% weighting is on the verge of overtaking Taiwan to take the second spot, behind China which accounts for 25% of the index.

- Interestingly, India is far less accessible to global investors. There are 229 China-based companies listed on US exchanges compared to just 11 companies based in India. Global investors can only access the Indian market via ETFs and mutual funds, or by navigating a lot of bureaucracy to invest directly.

- If more listed companies in India become accessible to foreign investors, it’s plausible that India would overtake China quite quickly.

- As India’s weighting in the index rises, it's becoming more important to emerging market investors. On the other hand, valuations are elevated, while China’s are much lower.

-

-

🏦 ECB opts for wait and see approach on rate cuts ( S&P Global )

- What’s our take?

- The ECB doesn’t have enough data yet to make a strong convection call on either holding rates where they are or cutting them. They don’t want to cut too aggressively, because that could leave inflation at uncomfortably high levels, and they don’t want to cut too late given the economy has struggled in recent months and that might cause unnecessary pain.

- The EU’s modest growth outlook and falling inflation mean rate cuts are still on the table, but again it’s not worth trying to predict where they’re going because we all saw how that went in 2023.

- For investors in Europe, the fact that local rates might stay higher for longer means that companies with excessive leverage should be approached with caution, discount rates will likely remain higher, and fixed-income instruments remain relatively appealing.

- What’s our take?

-

Iron ore prices slide on weaker fundamentals ( S&P Global )

- What’s our take?

- When it says “fundamentals” it means demand from China and its steel market. Most fluctuations in the price of iron ore occur based on news out of China, given it consumes 75% of the world's seaborne iron ore. In this case, the price has slipped because of oversupply in China, seasonally stronger export growth from iron ore-producing countries, and the lack of any concrete stimulus measures from China’s Third Plenum last week.

- The price of iron ore is closely tied to global economic growth, but particularly in China. If you’re investing in iron ore, stay up to date on China’s steel market.

- What’s our take?

🏗️ Microchip Manufacturing - and the Companies Involved

The science of designing and manufacturing semiconductor chips and devices is probably the most complex process on earth. The process also relies on a long list of companies, most of which are publicly listed.

The companies that contribute to this process are interesting from an investor’s point of view - and this is for a few reasons:

- Many supply the entire industry, which means there’s less of a ‘winner takes all’ factor at play.

- These companies can also specialize in a specific niche, and build an enduring moat.

- They are also less dependent on current end-user demand, which makes them less cyclical.

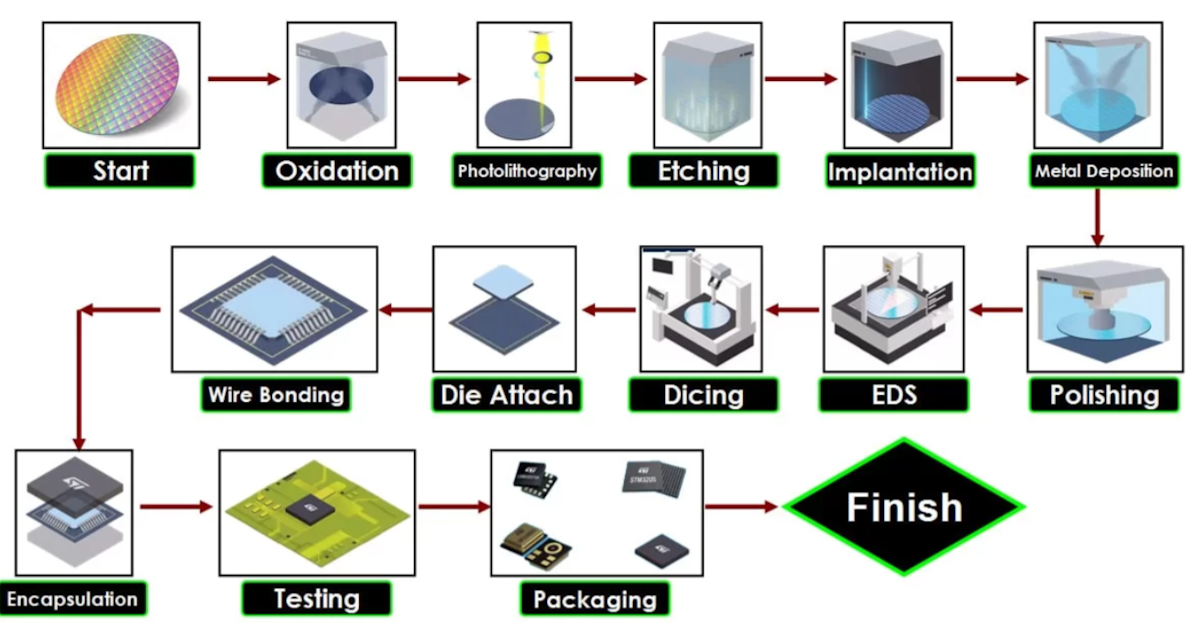

📐 📦 The Process: Design to Packaging

The following is a simplified explanation of the process of manufacturing a microchip. This article provides a more detailed explanation.

📏 Design

- Designing microchips with billions of transistors requires some of the most advanced software around. Electronic design automation (EDA) software is used to design the layout of chips and to simulate how they will work in the real world.

🧇 Silicon wafers

- Silicon wafers form the substrate on which an IC is created. Cylindrical ingots (known as boules) of crystalline silicon are grown using a chemical process. These boules are then sliced into wafers.

Before the fabrication process begins, the wafers are polished to remove imperfections and oxidized to make the silicon conductive.

The diameter of wafers ranges from 25 to 300mm. Numerous ICs are printed on each wafer, so there’s an incentive to make larger wafers.

🖨️ Photolithography and Etching

- Lithography is the process by which circuits are ‘printed’ onto a silicon wafer. A layer of photoresist is first applied to the silicon. Next, a photomask that contains the circuit pattern is placed on top of the photoresist. The wafer is then exposed to light with a specific wavelength, which changes the properties of the photoresist where it’s exposed by the mask.

The pattern is then transferred to the substrate through a process of etching (to remove excess material), chemical deposition and ion implantation. Metal film is also applied, to provide the wiring by which current reaches the circuit.

The above processes are repeated multiple times to produce a 3-dimensional structure so that the resulting circuits resemble a miniature city, rather than a 2-dimensional map.

🧪 Testing

- At this point, a wafer theoretically contains thousands of individual circuits, but many can be defective. EDS (energy dispersive spectroscopy) is the process used to inspect the wafer to see which chips are flawless and usable.

After inspection, the wafer is cut into individual ‘chips’, each containing a circuit, and defective chips are discarded.

📦 Packaging and Assembly

- The individual circuits produced during the above process form the heart of a microchip, but there are still a few steps to produce a finished product. During the packaging process, contact pins are added, and the chip is encapsulated in a protective, non-conductive material. Other components may also be added during the packaging process, or multiple ICs may be combined as a single product.

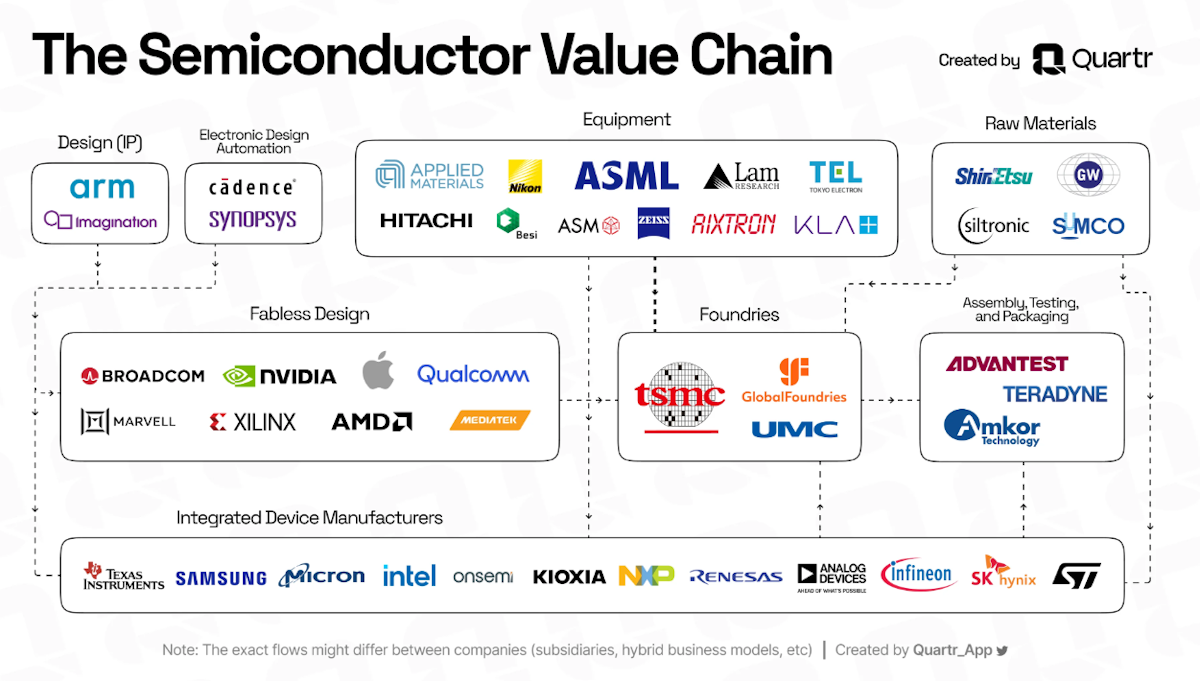

🔑 Key Companies in the Semiconductor Supply Chain

The process described above requires input from numerous companies. These can be categorised as follows:

- Foundry or fabrication companies own and operate the factories (fabs) where chips are manufactured.

- Software companies provide the EDA and simulation software used to design the circuits.

- Equipment manufacturers design and manufacture the machines used throughout the process.

- Materials companies provide the silicon wafers, gasses, chemicals and other materials used throughout the process.

- OSATs (Outsourced semiconductor assembly and test) assemble chips on behalf of foundries and chipmakers.

🏭 Foundries

Historically, chips were manufactured by the companies that designed them. There are actually hundreds of fabs operated by dozens of companies scattered around the world. Most of these fabs produce chips that are fairly simple compared to the ones used in data centres and high-end PCs.

As the process became more complex, companies chose to specialise, and the industry split into three groups:

- Fabless chipmakers focus only on design. This group includes Nvidia , AMD and the big tech companies now designing their own chips.

- IDMs design and manufacture chips. This group includes Intel, Micron, Infineon. While these companies do manufacture their own chips, they have been increasingly outsourcing the fabrication of the most advanced chips to foundries.

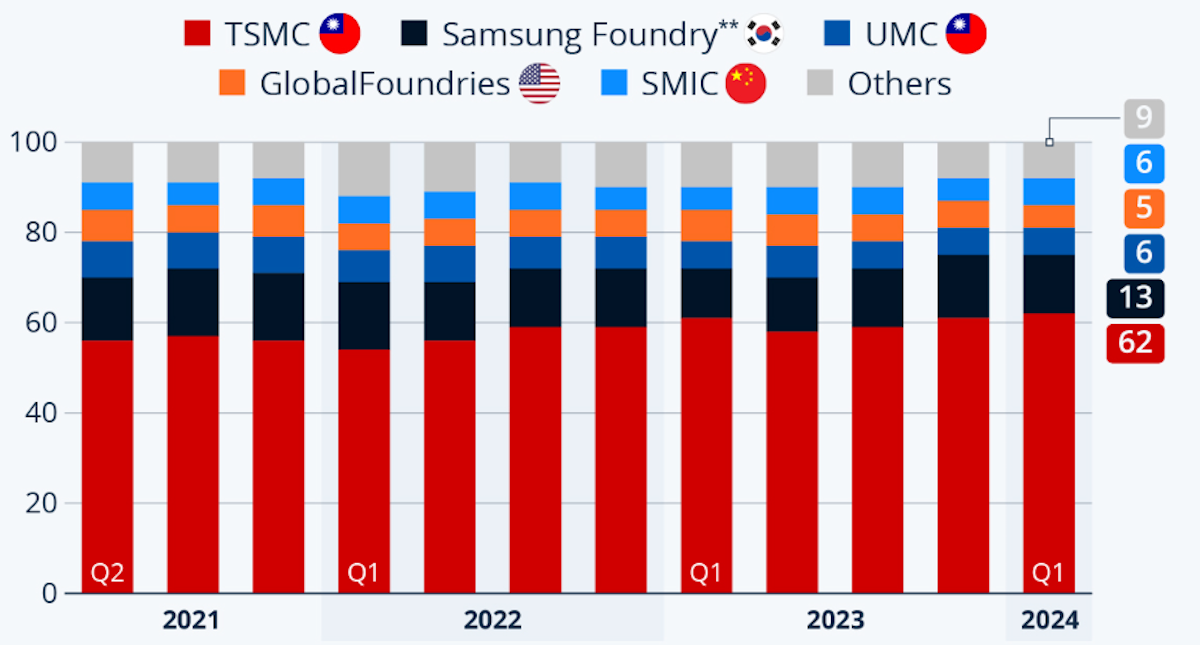

- Foundries focus on fabrication only. This list is short, with TSMC and Samsung accounting for 75% of the market, with other names like GlobalFoundries and UMC in there as well.

Samsung is an anomaly, as it is both an IDM and the second-largest foundry company. Intel is aiming to emulate its success by rebuilding its foundry business.

Foundry Market Share by Quarter - Statista

While there are five large specialized fabs, TSMC and Samsung are way ahead when it comes to the advanced process nodes, with Intel a little way behind them. SMI , Global Foundries and United Microelectronics tends to focus on less advanced processes.

There are only two small, independent foundry companies. Tower Semiconductor in Israel manufactures analog and mixed-signal chips. X-FAB in Germany produces mixed-signal chips and silicon carbide products for the auto industry.

Policymakers are making large investments to increase advanced fabrication in the US and Europe. There are currently over 70 fabs being constructed or expanded in the US, with more being built in Europe and Israel. This will change the geography of this industry, but it's likely to be a long time before the list of companies changes meaningfully.

🧑💻 EDA Software

Synopsys and Cadence are the two well-known EDA providers, but there are a few smaller companies, including Altium based in Australia and Zuken in Japan. Another, Mentor Graphics was acquired by Siemens in 2017 and is now known as Siemens EDA.

Ansys provides engineering simulation software to numerous industries. This software is widely used in the chipmaking industry to test circuit designs before they go into production.

🪨 Materials

The raw ingredients used to produce microchips are Silicon, Germanium, Gallium and other rare and not-so-rare materials. Dozens of chemicals and gasses are also used during the process. Many of these are provided by the world’s largest chemical and gas companies, like Linde.

Shin-Etsu Chemical in Japan is a key supplier of photoresist and photomask materials and wafer substrates. Siltronic in Germany and Elkem in Norway produces silicon wafers and other materials. Entegris Inc is a leading supplier of chemicals used in precision manufacturing processes.

Experiments with new materials suggest the use of rare earth materials could increase. This theme is closely tied to advances in battery technology. Albemarle, Wolfspeed and MP Materials operate in this space.

✨ Note: Most of the EDA software and materials companies are categorized under software and materials, rather than the semiconductor industries.

⚙️ Equipment Manufacturers

The fabrication procedure involves numerous processes, each requiring specialized (and expensive) machinery. This wouldn’t be possible without equipment developed over decades by several companies.

ASML stands out as the most valuable of the equipment makers. And, at $380 million a pop, it probably sells the most expensive machines in the world. Tiny transistors require light with a tiny wavelength for the lithography process. For the most advanced process nodes (under 5nm) this can only be achieved with extreme ultraviolet light (EUV).

So far, ASML is the only company that’s figured out how to produce EUV light - something that was once thought impossible. For an idea of what this involves, here’s a description from ASML’s website:

“In our laser-produced plasma (LPP) source, molten tin droplets of around 25 microns in diameter are ejected from a generator at 70 meters per second. As they fall, the droplets are hit first by a low-intensity laser pulse that flattens them into a pancake shape. Then a more powerful laser pulse vaporizes the flattened droplet to create a plasma that emits EUV light. To produce enough light to manufacture microchips, this process is repeated 50,000 times every second.”

How’s that for a feat of engineering?

ASML also sells other types of lithography systems, but it has a monopoly when it comes to EUV, hence the $400 billion valuation. Just how long it maintains that monopoly remains to be seen.

Applied Materials is the second-largest equipment supplier but covers a wider range of production processes. It’s valued at less than half of ASML, despite earning just about the same revenue and net income.

Applied Materials supplies equipment used for oxidation, deposition, etching, polishing and inspection of wafers. The company recently pioneered a process that allows copper wire to be used for 2 nm process nodes.

The remaining giants in the equipment space are Lam Research, KLA Corp and Tokyo Electron . Lam Research and Tokyo Electron provide equipment used for etching and deposition. KLA Corp sells equipment used for testing and assembly.

Numerous smaller companies provide other essential equipment to the industry. The table below lists the 15 largest equipment providers by market cap and the solutions they offer to foundries.

📦 Packaging, Testing and Assembly

The final stages of the process are often outsourced to specialized firms, known as OSATs, which stands for Outsourced Semiconductor Assembly and Test.

These companies play an important role, although this role may be diminished with some of the latest manufacturing techniques. The increased production of the system-on-a-chip (SoC) means various types of ICs are created during the initial process. This happens at the foundry, leaving less to do later. Nevertheless, OSATs will continue to play a role in the production of more basic ICs.

The largest of these companies are ASE Technology in Taiwan, AMKOR Technology in the US and JCET Group in China.

💡 The Insight: Finding Value All Along The Semiconductor Supply Chain

Designing and manufacturing chips is both capital-intensive and risky, meaning the leading companies have to be very big. The supply chain is one area where smaller companies can focus on a niche and still thrive.

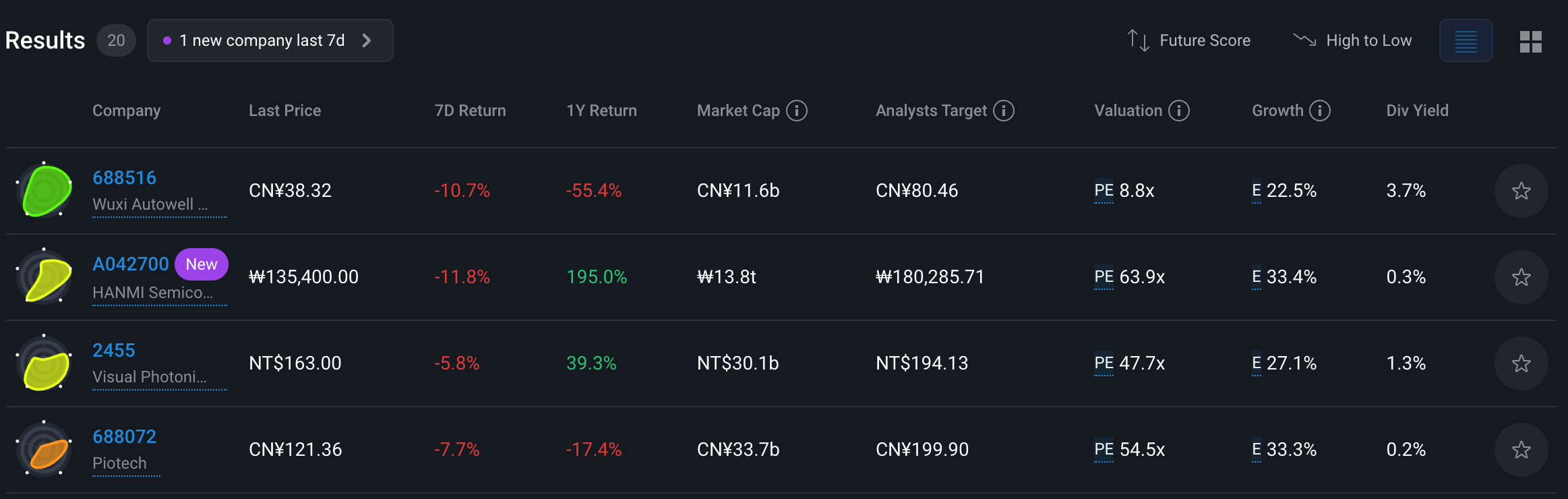

Here are a few examples of smaller companies (market caps in brackets) operating in very narrow niches in the industry.

- Ultra Clean ($2.2 B) sells equipment used to prevent contamination in the ‘clean room’ environments of foundries.

- Ichor Holdings ($1.2 B) manufactures equipment used for fluid and gas delivery during the etching process.

- Aehr Test Systems ($520 M) sells equipment used to test wafers up to 300mm.

- Photronics ($1.6 B) manufactures photomask material.

The Simply Wall St stock Screener lists 389 companies that supply equipment to the industry, so there could be a few opportunities amongst that list. To find them, you can get creative with the stock screener.

As an example, the screen in the image below looks for companies with:

- A market cap of $300 million to $10 billion.

- At least five analysts covering the company.

- Interesting companies are likely to have more coverage and forecasts will have some validity.

- A future score of 4/6 or higher.

- We are looking for companies that are expected to grow.

- A health score of 3/6 or higher.

- We want to avoid companies that might run out of cash.

This screen ignores the value, past and dividend scores. At this stage, we are looking for interesting companies, not assessing their investment potential. Once you have a handful of companies, then you can start assessing their potential as investments.

The semiconductor sector has had a strong run over the last year, so it’s entirely possible that you’ll think the companies you come up with are overvalued. That’s fine, you can add them to a watchlist, do your research, estimate a fair value for them and wait for a better opportunity to buy beneath your estimate of fair value.

There are lots of ways to get creative with the screener. You could take an entirely different approach to find overlooked opportunities by looking for companies with little or no analyst coverage, and then ranking them by ROE.

Key Events During the Next Week

It’s a big week for data and earnings, with the FOMC meeting and four ‘big tech’ companies reporting second-quarter results.

Tuesday

- 🇫🇷 🇩🇪Quarterly GDP data is due to be released in France and Germany. Economists expect France's economy to have grown at 0.8% in Q2, down from 1.1% in the first quarter. Germany’s economy is forecast to have grown by 0.4%, compared to a 0.2% contraction during the first quarter

- 🇩🇪 Germany’s inflation rate is also due, and expected to remain at 2.2%.

- 🇺🇸 The US JOLTs job openings report is forecast to show a slight increase in job openings.

Wednesday

- 🇦🇺Australia’s inflation rate will be published. Economists expect the year-on-year rate to decline to 3.7% from 4%.

- 🇯🇵The Bank of Japan is expected to keep the benchmark interest rate at 0.1%.

- 🇫🇷 France’s inflation rate is forecast to fall from 2.2% to 1.7%.

- 🇺🇸The US ADP employment report is expected to show 140K new private sector jobs down from 150K.

- 🇺🇸 The US Fed is expected to keep the Fed Funds Rate at 5.5%.

Thursday

- 🇬🇧 The Bank of England’s MPC will meet and is expected to cut the benchmark rate by 0.25% to 5%. This would be the BOE’s first rate cut in four years.

Friday

- 🇬🇧 US employment data will be released. The unemployment rate is forecast to remain at 4.1%, while non-farm payrolls are expected to be up 190K compared to 206K last month.

It’s the biggest week of earnings season, with four big tech companies and leading chipmakers, energy, and pharma companies reporting. The largest companies due to report second quarter earnings include:

- Apple

- Microsoft

- Amazon

- Meta

- Intel

- AMD

- Qualcomm

- Arm Holdings

- Lam Research

- ON Semiconductor

- Exxon

- Chevron

- Mastercard

- S&P Global

- Boeing

- Procter and Gamble

- Merck

- Pfizer

- McDonald’s

Simply Wall St analyst Richard Bowman holds positions in LRCX, CDNS and INTC. Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.